South America Naval System Surveillance Radar Market Forecast to 2028– COVID-19 Impact and Regional Analysis– by Type (X-band and Ku-band, L-Band and S-band, and Others) and Application (Weapon Guidance System and Surveillance)

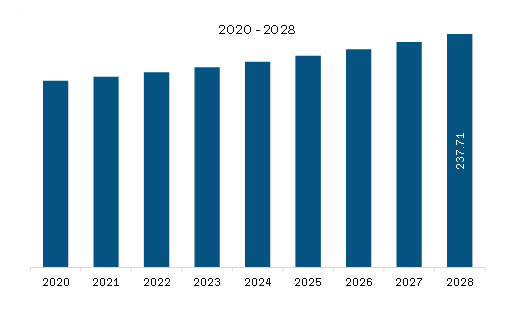

The naval system surveillance radar market in South America is expected to grow from US$ 198.69 million in 2022 to US$ 237.71 million by 2028. It is estimated to grow at a CAGR of 3.0% from 2022 to 2028.

Modernization of Conventional Naval System Surveillance Radar

The demand for conventional naval equipment to be modernized is increasing as warfare and submarine management are changing. Modernization in radar is necessary to keep pace with technological progress during warfare. Thus, the demand to upgrade the system is driving the growth of the South America naval system surveillance radar market. Modernization aims to enhance technology and provide high reliability and cost-effective surveillance system solutions. Many developing countries are focusing on upgrading their naval system surveillance radar. However, radar is still lacking the motivation to develop technically advanced and modernized equipment such as navigational aids (Navaids), maritime communication systems, naval gun mounts, ship engines, and gas turbines. Naval drones fired from the deck, artificial intelligence in a naval battle, space surveillance, and a secure private 5G network for machine-to-machine communication are other possibilities that the Navy has considered. Hence, the demand for conventional naval system surveillance radar across the naval forces will create opportunities for the market.

Market Overview

Brazil and the Rest of South America are the key contributors to the naval system surveillance radar market in the South America. The growth in the overall military expenditure among South American countries is driving the demand for naval system surveillance radar. According to data published by SIPRI in 2021, the military spending in Central America and the Caribbean was US$ 11 billion, and the total military spending in South America was US$ 45.3 billion. Countries in this region utilize this budget to strengthen their military, navy, and air force activities. A significant amount of the defense budget is allotted for the new naval equipment procurement, thus promoting the growth of the SAM naval system surveillance radar market in South America. Strengthening the overall defense activities includes acquiring new and advanced naval technologies, including advanced surveillance and radar system. Various governments in South America such as Brazil, Peru, Chile, Colombia, and Argentina, are investing the additional budget in defense to strengthen the navy and safeguard their nations from any external threat such as war, national security, and border disputes. Thus, the rise in the investments by the South American countries to adopt new and advanced naval technologies is contributing to the growth of the naval system surveillance market in the region.

South America Naval System Surveillance Radar Market Revenue and Forecast to 2028 (US$ Million)

South America Naval System Surveillance Radar Market Segmentation

The South America naval system surveillance radar market is segmented into type, application, and country.

- Based on type, the market is segmented into x-band and ku-band, l-band and s-band, and others. The x-band and ku-band segment registered the largest market share in 2022.

- Based on application, the market is bifurcated into weapon guidance system and surveillance. The surveillance segment held a larger market share in 2022.

- Based on country, the market is bifurcated into Brazil and Rest of SAM. Brazil dominated the market share in 2022.

Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; Saab AB; Thales Group; BAE Systems; Israel Aerospace Industries Ltd; Leonardo S.p.a; Ultra; and HENSOLDT. are the leading companies operating in the South America naval system surveillance radar market in the region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Naval System Surveillance Radar Market Landscape

4.1 Market Overview

4.2 Porter’s Five Force Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

5. SAM Naval System Surveillance Radar Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Importance of Naval Surveillance Systems

5.1.2 Rise in Procurement of Naval System Surveillance Radar

5.2 Market Restraints

5.2.1 Design Constraints and Component Failure Due to Environment Conditions

5.3 Market Opportunities

5.3.1 Modernization of Conventional Naval System Surveillance Radar

5.4 Trends

5.4.1 Integration of Advanced Technology with Naval Radars

5.5 Impact Analysis of Drivers and Restraints

6. Naval System Surveillance Radar Market –SAM Market Analysis

6.1 Naval System Surveillance Radar Market Forecast and Analysis

7. SAM Naval System Surveillance Radar Market Analysis – by Type

7.1 Overview

7.2 Naval System Surveillance Radar Market, By Type (2021 and 2028)

7.3 X-band and Ku-band

7.3.1 Overview

7.3.2 X-Band and Ku-Band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

7.4 L-band and S-band

7.4.1 Overview

7.4.2 L-band and S-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

8. SAM Naval System Surveillance Radar Market Analysis – by Application

8.1 Overview

8.2 Naval System Surveillance Radar Market, By Application (2021 and 2028)

8.3 Weapon Guidance System

8.3.1 Overview

8.3.2 Weapon Guidance System: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Surveillance

8.4.1 Overview

8.4.2 Surveillance: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9. SAM Naval System Surveillance Radar Market – Country Analysis

9.1 SAM: Naval System Surveillance Radar Market

9.1.1 SAM: Naval System Surveillance Radar Market, by Key Country

9.1.2 SAM: Naval System Surveillance Radar Market, by Key Country

9.1.2.1 Brazil: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.1.1 Brazil: Naval System Surveillance Radar Market, by Type

9.1.2.1.2 Brazil: Naval System Surveillance Radar Market, by Application

9.1.2.2 Rest of SAM: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.2.1 Rest of SAM: Naval System Surveillance Radar Market, by Type

9.1.2.2.2 Rest of SAM: Naval System Surveillance Radar Market, by Application

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 New Product Development

11. Company Profiles

11.1 Lockheed Martin Corporation

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Northrop Grumman Corporation

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Raytheon Technologies Corporation

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Saab AB

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Thales Group

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 BAE Systems

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Israel Aerospace Industries Ltd.

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Leonardo S.p.A.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Ultra

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 HENSOLDT

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. SAM Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. Brazil: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil: Naval System Surveillance Radar Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 4. Rest of SAM: Naval System Surveillance Radar Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 5. Rest of SAM: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 6. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Naval System Surveillance Radar Market Segmentation

Figure 2. SAM Naval System Surveillance Radar Segmentation, By Country

Figure 3. SAM Naval System Surveillance Radar Market Overview

Figure 4. SAM Naval System Surveillance Radar Market, By Type

Figure 5. SAM Naval System Surveillance Radar Market, By Application

Figure 6. SAM Naval System Surveillance Radar Market, By Country

Figure 7. SAM Naval System Surveillance Radar Market: Porter’s Five Forces Analysis

Figure 8. SAM Ecosystem Analysis

Figure 9. SAM Naval System Surveillance Radar Market: Impact Analysis of Drivers and Restraints

Figure 10. SAM Naval System Surveillance Radar Market Forecast and Analysis (US$ Million)

Figure 11. SAM Naval System Surveillance Radar Market Revenue Share, by Type (2021 and 2028)

Figure 12. SAM X-band and Ku-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. SAM L-band and S-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. SAM Others: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. SAM Naval System Surveillance Radar Market Revenue Share, by Application (2021 and 2028)

Figure 16. SAM Weapon Guidance System: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. SAM Surveillance: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM: Naval System Surveillance Radar Market Revenue Share, by Key Country (2021 and 2028)

Figure 19. SAM: Naval System Surveillance Radar Market Revenue Share, by Key Country (2021 and 2028)

Figure 20. Brazil: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Rest of SAM: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

- BAE Systems.

- HENSOLDT.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.a.

- Lockheed Martin Corporation.

- Northrop Grumman Corporation.

- Raytheon Technologies Corporation.

- Saab AB.

- Thales Group.

- Ultra.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South America naval system surveillance radar market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the South America naval system surveillance radar market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South America market trends and outlook coupled with the factors driving the naval system surveillance radar market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution