South America Encapsulation Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Coating Material (Polymers, Gums and Resins, Lipids, Carbohydrates, and Proteins), Technology (Spray Technology, Emulsion Technology, Dripping Technology, and Others), and Application (Pharmaceuticals and Nutraceutical, Food and Beverages, Personal Care Products, Agrochemicals, and Others)

Market Introduction

The South America region include economies such as Brazil, Argentina, and other countries. The demand for natural and nutritional ingredients is increasing in the region. Changes in consumption habits of consumer such as the increasing awareness about benefits of eating healthy are creating new opportunities in the active nutrition ingredients space. The demand for nutraceuticals, supplements and functional food is significantly growing in the region. The market for encapsulated ingredients is expanding, as consumers are adding more supplements and functional food products to their routine. Moreover, the players operating in the region are focusing on providing high performance and safe ingredients for various applications such as nutritional, pharmaceutical and cosmetic applications. Due to all these factors, the encapsulation market is expected to grow in the region during the forecast period.

The country with the most confirmed COVID-19 cases in South America was Brazil, followed by Argentina, Peru, Chile, and Ecuador. The COVID-19 pandemic has significantly disrupted the manufacturing sector in terms of operational efficiency, owing to extended lockdowns, restrictions imposed on international trades, the shutdown of manufacturing units, travel bans, supply chain disintegration, shortage in the supply of raw materials, and many other factors. However, businesses are gaining ground as previously imposed limitations are being eased across various locations. Moreover, the introduction of COVID-19 vaccines by governments of different countries has eased the situation leading to a rise in business activities. Furthermore, governments of various countries are planning to develop modern and technologically advanced infrastructure to mitigate the economic impacts of the COVID-19 pandemic.

Get more information on this report :

Market Overview and Dynamics

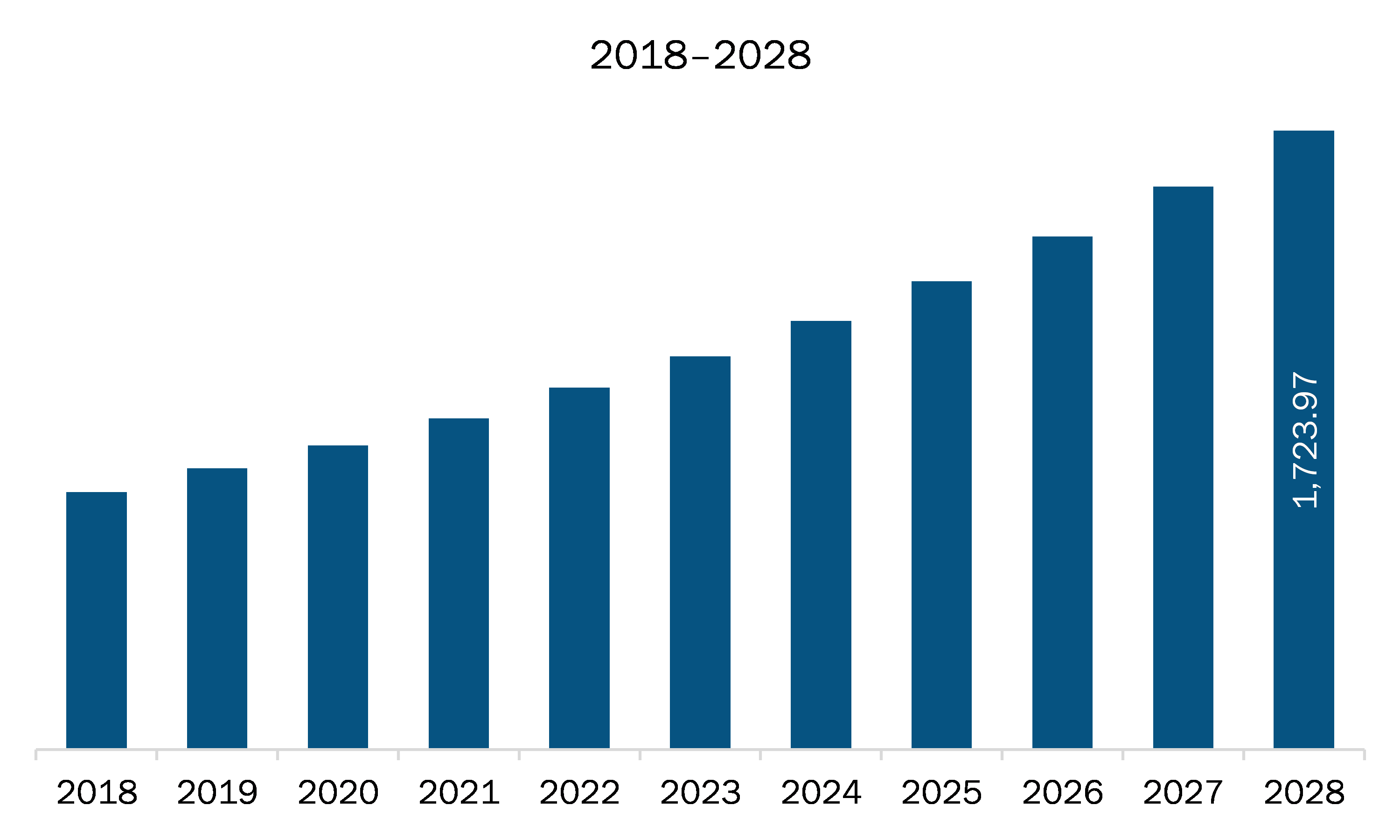

The encapsulation market in South America is expected to grow from US$ 922.78 million in 2021 to US$ 1,723.97 million by 2028; it is estimated to grow at a CAGR of 9.3% from 2021 to 2028. Development of advanced technologies; numerous companies operating in the encapsulation market have made substantial investments in advanced technologies to promote the development of microencapsulation and nanoencapsulation. Modern technologies are being developed to tap niche markets. For instance, pharmaceutical companies are developing medicines for brain tumors that work through specifically operated drug delivery systems. Further, companies operating in the encapsulation market are focused on the development of new products which can display product properties, including different phase temperature change options and improvement in latent heat storage capacity. In addition, there is a growing demand for encapsulated products from the energy sector, primarily for products that can endure high-temperature ranges. Such factors are expected to provide significant growth opportunities for the market players in South America encapsulation market during the forecast period. This is bolstering the growth of the encapsulation market.

Key Market Segments

Based on coating material, the South America encapsulation market is segmented into polymers, gums and resins, lipids, carbohydrates, and lipids. In 2020, the carbohydrates segment held the largest share South America encapsulation market. Based on technology, the South America encapsulation market is segmented into spray technology, emulsion technology, dripping technology and others. In 2020, the spray technology segment held the largest share South America encapsulation market. Based on by application, the South America encapsulation market is segmented into pharmaceuticals and nutraceutical, food and beverages, personal care products, agrochemicals, and other. In 2020, the food and beverages segment held the largest share South America encapsulation market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the encapsulation market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Balchem Inc.; BASF SE; DSM; FrieslandCampina; Givaudan; and TasteTech among others.

Reasons to buy report

- To understand the South America encapsulation market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for South America encapsulation market

- Efficiently plan M&A and partnership deals in South America encapsulation market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form South America Encapsulation Market

- Obtain market revenue forecast for market by various segments from 2021-2028 in South America region.

SOUTH AMERICA ENCAPSULATION MARKET SEGMENTATION

- Polymers

- Gums and Resins

- Lipids

- Carbohydrates

- Proteins

- Spray Technology

- Emulsion Technology

- Dripping Technology

- Others

- Pharmaceuticals and Nutraceutical

- Food and Beverages

- Personal Care Products

- Agrochemicals

- Others

By Country

- Brazil

- Argentina

- Rest of South America

Company Profiles

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. SAM Encapsulation Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.3 Expert Opinion

4.4 Ecosystem Analysis

4.4.1 Raw Material

4.4.2 Manufacturing/Processing

4.4.3 Distributors

4.4.4 End Users

5. SAM Encapsulation Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Demand for Encapsulated Flavors and Colors from Convenience Food Sector

5.1.2 Growing Demand for Encapsulated Pharmaceuticals

5.2 Market Restraints

5.2.1 Increased Cost of Production and Low Profit Margins

5.3 Market Opportunities

5.3.1 Development of Advanced Technologies

5.4 Future Trends

5.4.1 Surge in Demand for Functional Products

5.5 Impact Analysis of Drivers and Restraints

6. Encapsulation – SAM Market Analysis

6.1 SAM Encapsulation Market Overview

6.2 SAM Encapsulation Market –Revenue and Forecast to 2028 (US$ Million)

7. SAM Encapsulation Market Analysis – By Coating Material

7.1 Overview

7.2 SAM Encapsulation Market, By Coating Material (2020 and 2028)

7.3 Polymers

7.3.1 Overview

7.3.2 Polymers: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

7.4 Gums and Resins

7.4.1 Overview

7.4.2 Gums and Resins: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

7.5 Lipids

7.5.1 Overview

7.5.2 Lipids: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

7.6 Carbohydrates

7.6.1 Overview

7.6.2 Carbohydrates: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

7.7 Proteins

7.7.1 Overview

7.7.2 Proteins: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

8. SAM Encapsulation Market Analysis – By Technology

8.1 Overview

8.2 SAM Encapsulation Market, By Technology (2020 and 2028)

8.3 Spray Technology

8.3.1 Overview

8.3.2 Spray Technology: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

8.4 Emulsion Technology

8.4.1 Overview

8.4.2 Emulsion Technology: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

8.5 Dripping Technology

8.5.1 Overview

8.5.2 Dripping Technology: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

8.6 Others

8.6.1 Overview

8.6.2 Others: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

9. SAM Encapsulation Market Analysis – By Application

9.1 Overview

9.2 SAM Encapsulation Market, By Application (2020 and 2028)

9.3 Pharmaceuticals and Nutraceutical

9.3.1 Overview

9.3.2 Pharmaceuticals and Nutraceutical: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

9.4 Food and Beverages

9.4.1 Overview

9.4.2 Food and Beverages: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

9.5 Personal Care Products

9.5.1 Overview

9.5.2 Personal Care Products: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

9.6 Agrochemicals

9.6.1 Overview

9.6.2 Agrochemicals: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

9.7 Others

9.7.1 Overview

9.7.2 Others: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Source: The Insight Partners Analysis

10. SAM Encapsulation Market – Country Analysis

11. Impact of COVID-19 Pandemic on SAM Encapsulation Market

11.1 South America Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Product Launch

12.3 Mergers & acquisition

12.4 Expansion

13. Company Profiles

13.1 TasteTech

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Givaudan

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Balchem Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 FrieslandCampina

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 BASF SE

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 DSM

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. SAM Encapsulation Market –Revenue and Forecast to 2028 (US$ Million)

Table 11. Glossary of Terms, SAM Encapsulation Market

LIST OF FIGURES

Figure 1. SAM Encapsulation Market Segmentation

Figure 2. SAM Encapsulation Market Segmentation – By Country

Figure 3. SAM Encapsulation Market Overview

Figure 4. Carbohydrates Segment Held Largest Share of SAM Encapsulation Market

Figure 5. Brazil Held Largest Share of SAM Encapsulation Market

Figure 6. Porter’s Five Forces Analysis

Figure 7. Expert Opinion

Figure 8. Ecosystem: SAM Encapsulation Market

Figure 9. SAM Encapsulation Market Impact Analysis of Drivers and Restraints

Figure 10. SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. SAM Encapsulation Market Revenue Share, By Coating Material (2020 and 2028)

Figure 12. Polymers: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 13. Gums and Resins: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 14. Lipids: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 15. Carbohydrates: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 16. Proteins: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 17. SAM Encapsulation Market Revenue Share, By Technology (2020 and 2028)

Figure 18. Spray Technology: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 19. Emulsion Technology: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 20. Dripping Technology: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 21. Others: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 22. SAM Encapsulation Market Revenue Share, By Application (2020 and 2028)

Figure 23. Pharmaceuticals and Nutraceutical: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 24. Food and Beverages: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 25. Personal Care Products: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 26. Agrochemicals: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 27. Others: SAM Encapsulation Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 33. Impact of COVID-19 Pandemic in South America Country Markets

- Balchem Inc.

- BASF SE

- DSM

- FrieslandCampina

- Givaudan

- TasteTech

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the South America Encapsulation Market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the South America Encapsulation Market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South America market trends and outlook coupled with the factors driving the Encapsulation Market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution