South America Data Center Colocation Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Retail and Wholesale), Enterprise Size (SMEs and Large Enterprises), and Industry (IT and Telecom, BFSI, Healthcare, Retail, and Others)

Market Introduction

Infrastructure development is a key to South America’s economic growth, which is significantly increasing the per capita incomes of South American countries. Infrastructure development projects have enabled increased productivity, and competitiveness among countries at the global level and domestic levels. Growth of manufacturing facilities, commercial complexes, educational institutions, and government offices, among others with the integration of smart devices and technologies has increased the amount of data generation, and thereby boosted the demands of data center colocation facilities in South America. Governments of countries such as Brazil, Argentina, and Chile are concentrating on attracting FDIs by taking several initiatives such as easing import restrictions, signing international bilateral agreements, and reducing restrictions on foreign investments. Increasing enterprise demands for cost-effective solutions to reduce overall IT cost is the major factor driving the growth of the SAM data center colocation market.

Brazil reported the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina in SAM. To curb the spread of the virus, all economic activities in the region were partially halted. Despite the COVID-19 pandemic, the region recorded growth in the data center business, owing to high pressure on end-user industries to support remote working and fast track their work into digitalization and deploy it on the cloud platform.

Get more information on this report :

Market Overview and Dynamics

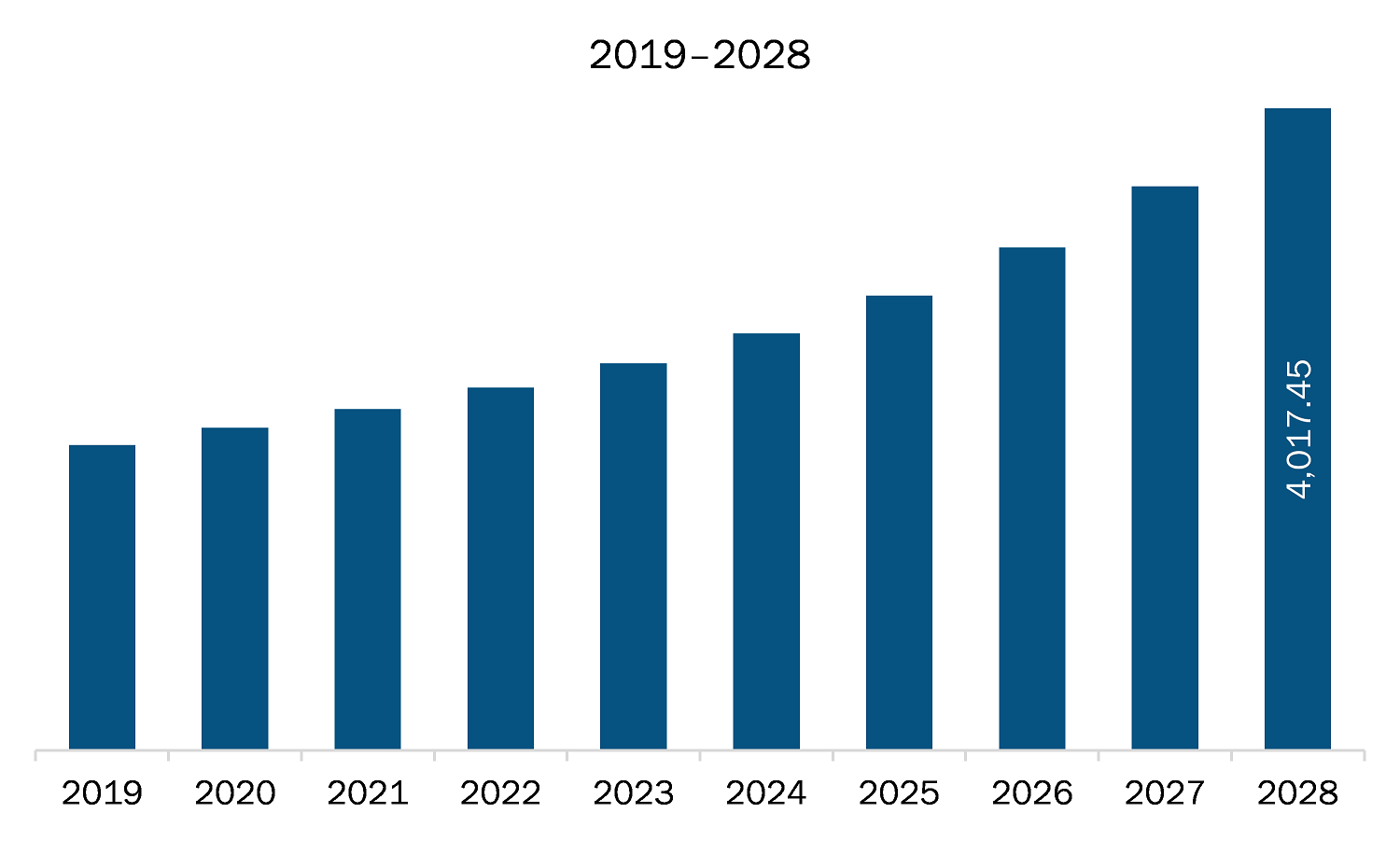

The data center colocation market in SAM is expected to grow from US$ 2,136.99 million in 2021 to US$ 4,017.45 million by 2028; it is estimated to grow at a CAGR of 9.4% from 2021 to 2028. Edge computing has emerged as an ideal solution for companies involved in streamlining their data gathering processes and a large number of customers demanding low-latency streaming content. Companies can deliver faster services and free up valuable bandwidth for several other activities that are performed closer to the network’s core by relocating their considerable processing workloads to devices and edge data centers on the outer edges of the network. Moreover, the growth of edge computing significantly depends on the rapid adoption of devices enabled with the internet of things (IoT). The IoT edge devices have developed incredible applications across diverse industries with their capabilities to collect data beyond the reach of conventional networks and extend services with the use of cellular and Wi-Fi connections. However, these functionalities still require a backbone of infrastructure for operating effectively and efficiently. As a result, companies have begun to re-architect their corporate IT infrastructures with respect to colocation and interconnection points of presence. Through the combination of colocation services with regional edge computing data centers, companies can extend their edge network reach quickly and cost-effectively. E-commerce and retail sectors are embracing the edge data center. There is a growing demand for edge data centers in the pharmaceutical industry due to the regulatory requirements and generation of the humungous amount of data. The flexibility of not being dependent upon a centralized infrastructure enables enterprises to adapt quickly to developing markets and scale their data and computing requirements more efficiently. Thus, the increasing development in edge computing creates lucrative growth opportunities for the data center colocation market players.

Key Market Segments

The SAM data center colocation market is segmented into type, enterprise size, industry, and country. Based on type, the market is segmented into retail and wholesale. The retail segment dominated the market in 2020 and wholesale segment is expected to be the fastest growing during the forecast period. Based on enterprise size, the data center colocation market is divided into SMEs and large enterprises. The large enterprises segment dominated the market in 2020 and SMEs segment is expected to be the fastest growing during the forecast period. Further, based on industry, the market is segmented into IT & Telecom, BFSI, healthcare, retail, and others. The IT & Telecom segment dominated the market in 2020 and BFSI segment is expected to be the fastest growing during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on data center colocation market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AT&T Intellectual Property; CyrusOne, Inc.; Digital Realty Trust LP; Equinix Inc.; NTT Communications Corporation; and Verizon Partner Solutions. are among others.

Reasons to buy report

- To understand the SAM data center colocation market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for SAM data center colocation market

- Efficiently plan M&A and partnership deals in SAM data center colocation market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form SAM data center colocation market

- Obtain market revenue forecast for market by various segments from 2021-2028 in SAM region.

SAM Data Center Colocation Market Segmentation

SAM Data Center Colocation Market –By Type

- Retail

- Wholesale

SAM Data Center Colocation Market –By Industry

- IT and Telecom

- BFSI

- Healthcare

- Retail

- Others

SAM Data Center Colocation Market –By Enterprise Size

- SMEs

- Large Enterprises

SAM Data Center Colocation Market -By Country

- Brazil

- Argentina

- Rest of SAM

SAM Data Center Colocation Market -Company Profiles

- AT&T Intellectual Property

- CyrusOne, Inc.

- Digital Realty Trust LP

- Equinix Inc.

- NTT Communications Corporation

- Verizon Partner Solutions.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Data Center Colocation Market Landscape

4.1 Market Overview

4.2 SAM PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Data Center Colocation Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Increasing Enterprise Demands for Cost-Effective Solutions to Reduce Overall IT Cost

5.1.2 Rising adoption of High-Performance Compute (HPC)

5.2 Market Restraint

5.2.1 High Initial and Maintenance Costs

5.3 Market Opportunities

5.3.1 Developments in Edge Computing

5.4 Market Trends

5.4.1 Advent of 5G Services to Surge Demand for Advanced Data Center Infrastructure

5.5 Impact Analysis of Drivers and Restraints

6. Data Center Colocation Market – SAM Analysis

6.1 Data Center Colocation Market Overview

6.2 Data Center Colocation Market –Revenue and Forecast to 2028 (US$ Million)

7. SAM Data Center Colocation Market– By Type

7.1 Overview

7.2 Data Center Colocation Market, by Type (2020 & 2028)

7.3 Retail

7.3.1 Overview

7.3.2 Retail: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

7.4 Wholesale

7.4.1 Overview

7.4.2 Wholesale: Data Center Colocation Market- Revenue and Forecast to 2028 (US$ Million)

8. SAM Data Center Colocation Market Market– by Enterprise Size

8.1 Overview

8.2 Data Center Colocation Market, by Enterprise Size (2020 & 2028)

8.3 SMEs

8.3.1 Overview

8.3.2 SMEs: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

8.4 Large Enterprises

8.4.1 Overview

8.4.2 Large Enterprises: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

9. SAM Data Center Colocation Market – By Industry

9.1 Overview

9.2 Data Center Colocation Market, by Industry (2020 and 2028)

9.3 IT & Telecom

9.3.1 Overview

9.3.2 IT & Telecom: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

9.4 BFSI

9.4.1 Overview

9.4.2 BFSI: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Healthcare

9.5.1 Overview

9.5.2 Healthcare: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Retail

9.6.1 Overview

9.6.2 Retail: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

10. SAM Data Center Colocation Market – Country Analysis

10.1 Overview

10.1.1 SAM: Data Center Colocation Market- by Key Country

10.1.1.1 Brazil: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 Brazil: Data Center Colocation Market- by Type

10.1.1.1.2 Brazil: Data Center Colocation Market- By Enterprise Size

10.1.1.1.3 Brazil: Data Center Colocation Market- By Industry

10.1.1.2 Argentina: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Argentina: Data Center Colocation Market- by Type

10.1.1.2.2 Argentina: Data Center Colocation Market- By Enterprise Size

10.1.1.2.3 Argentina: Data Center Colocation Market- By Industry

10.1.1.3 Rest of SAM: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Rest of SAM: Data Center Colocation Market- by Type

10.1.1.3.2 Rest of SAM: Data Center Colocation Market- By Enterprise Size

10.1.1.3.3 Rest of SAM: Data Center Colocation Market- By Industry

11. SAM Data Center Colocation Market- COVID-19 Impact Analysis

11.1 Overview

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Merger and Acquisition

13. Company Profiles

13.1 CyrusOne, Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Digital Realty Trust LP

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Equinix Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 NTT Communications Corporation

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Verizon Partner Solutions.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 AT&T Intellectual Property

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. SAM Data Center Colocation Market – Revenue, and Forecast to 2028 (US$ Million)

Table 2. Brazil: Data Center Colocation Market- by Type –Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil: Data Center Colocation Market- By Enterprise Size –Revenue and Forecast to 2028 (US$ Million)

Table 4. Brazil: Data Center Colocation Market- By Industry –Revenue and Forecast to 2028 (US$ Million)

Table 5. Argentina: Data Center Colocation Market- by Type –Revenue and Forecast to 2028 (US$ Million)

Table 6. Argentina: Data Center Colocation Market- By Enterprise Size –Revenue and Forecast to 2028 (US$ Million)

Table 7. Argentina: Data Center Colocation Market- By Industry –Revenue and Forecast to 2028 (US$ Million)

Table 8. Rest of SAM: Data Center Colocation Market- by Type –Revenue and Forecast to 2028 (US$ Million)

Table 9. Rest of SAM: Data Center Colocation Market- By Enterprise Size –Revenue and Forecast to 2028 (US$ Million)

Table 10. Rest of SAM: Data Center Colocation Market- By Industry –Revenue and Forecast to 2028 (US$ Million)

Table 11. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Data Center Colocation Market Segmentation

Figure 2. SAM Data Center Colocation Market Segmentation – By Country

Figure 3. SAM Data Center Colocation Market Overview

Figure 4. Large Enterprises Segment Held the Largest Market Share in 2020

Figure 5. Retail Held the Largest Market Share in 2020

Figure 6. IT & Telecom Held the Largest Market Share in 2020

Figure 7. Brazil was the Largest Revenue Contributor in 2020

Figure 8. SAM – PEST Analysis

Figure 9. Data Center Colocation Market– Ecosystem Analysis

Figure 10. Expert Opinion

Figure 11. SAM Data Center Colocation Market: Impact Analysis of Drivers and Restraints

Figure 12. SAM Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. SAM Data Center Colocation Market, by Type (2020 & 2028)

Figure 14. SAM Retail: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. SAM Wholesale: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. SAM Data Center Colocation Market, by Enterprise Size (2020 & 2028)

Figure 17. SAM SMEs: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM Large Enterprises: Data Center Colocation Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. SAM Data Center Colocation Market Revenue Share, by Industry (2020 and 2028)

Figure 20. SAM IT & Telecom: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. SAM BFSI: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. SAM Healthcare: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. SAM Retail: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. SAM Others: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. SAM: Data Center Colocation Market, By Key Country –Revenue 2020 (US$ Million)

Figure 26. SAM: Data Center Colocation Market Revenue Share, By Key Country (2020 and 2028)

Figure 27. Brazil: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Argentina: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Rest of SAM: Data Center Colocation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Impact of COVID-19 Pandemic in South America Country Markets

- AT&T Intellectual Property

- CyrusOne, Inc.

- Digital Realty Trust LP

- Equinix Inc.

- NTT Communications Corporation

- Verizon Partner Solutions.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the SAM Data Center Colocation market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the SAM Data Center Colocation market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the Data Center Colocation market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution