South America Autonomous Navigation Market Forecast to 2027 - COVID-19 Impact and Regional Analysis by Solution (Sensing System, Navigation System, Processing Unit, and Software), Application (Commercial and Defense), Vehicle Type (AGVs, Mobile Robots, UUVs, Drones, and Others), and Platform (Land, Marine, and Space)

Market Introduction

The region’s major industries, where the demand for inspection drones, generate enormous opportunities for the autonomous navigation market for its application across mining and agriculture. For mining, the drones can be utilized to help operators perform volumetric measurements. With the help of an autonomous navigation system, the drone platform manages to measure considerable distances compared to terrestrial methods and make quicker calculations of extracted material volume. This makes it efficient for mining, taking photos, monitoring all soil movement, and calculating volumes. According to the study conducted by the Association for the Conservation of the Amazon Basin (ACCA) and the Office of the Special Prosecutor for Environmental Matters (FEMA) of Peru, the application of UAVs is vital to attain insights on numerous criminal activities that compromise the environment and communities in the Amazon basin. Brazilian government uses UAVs for surveillance purposes in areas with high crime rates. Brazil is a leading adopter of military UAVs in SAM for military purposes. Embraer Air Corporation is monitoring the UAV development processes in Brazil. Such initiative is boosting the demand for autonomous navigation in the region. Also, Various AI technologies coming together for growing navigation effectiveness is driving the SAM autonomous navigation market.

SAM is severely affected by the COVID-19 pandemic. In SAM, Brazil reported the highest number of COVID-19 confirmed cases, followed by Ecuador, Peru, Chile, Argentina, and others. Governments in SAM are taking several initiatives, such as lockdowns, trade bans, and travel restrictions, to protect people and control the spread of COVID-19 in the region. These measures are expected to have a direct impact on the region’s economic growth due to lower export revenues from the drop in commodity prices and reduction in export volumes, especially to major trading partners. The sharp decline in the sales of the logistics industry and halt in vehicle production in the region due to lockdown measures is expected to directly impact the growth of the SAM autonomous navigation market.

Get more information on this report :

Market Overview and Dynamics

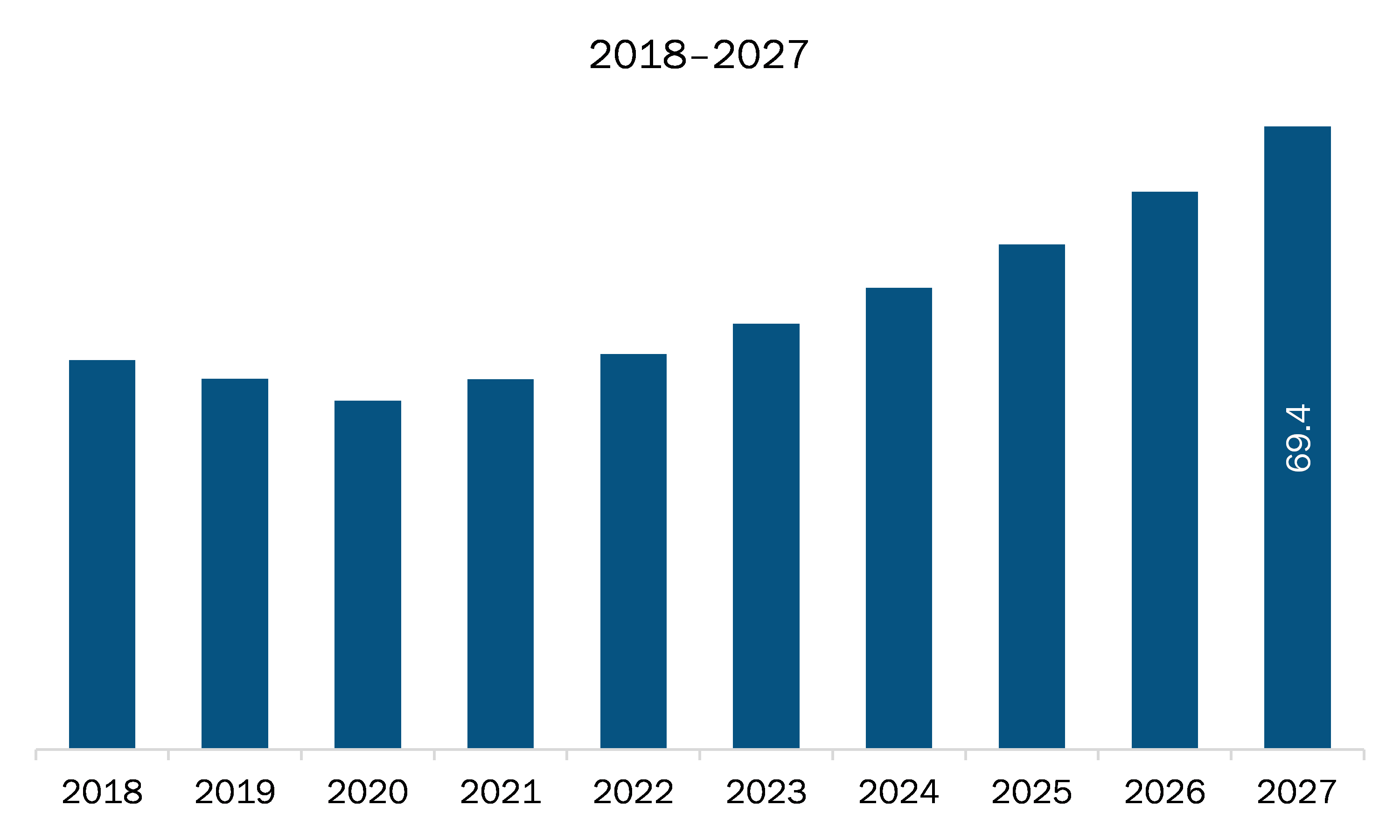

The autonomous navigation market in SAM is expected to grow from US$ 41.3 million in 2019 to US$ 69.4 million by 2027; it is estimated to grow at a CAGR of 8.6% from 2020 to 2027. With growing industrial economies, the industries are integrating advanced technologies in their business process to optimize productivity. With a growing young and aging working population in industries, the need to incorporate autonomous technologies in the industrial sector is rising, intending to provide products on time. Therefore, industries such as logistics are inclined toward automation to develop automated guided vehicles (AVGs) for time management, accuracy, and productivity. With advancements in robotic technologies, the industrial sector, including logistics, is deploying automation to boost production quality with a better time management aspect.

Key Market Segments

In terms of solution, the sensing system segment accounted for the largest share of the SAM autonomous navigation market in 2019. In terms of application, the commercial segment held a larger market share of the SAM autonomous navigation market in 2019. Further, AGVs segment held a larger share of the market based on vehicle type in 2019. Also, on the basis of platform, land segment held largest market share in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the autonomous navigation market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Collins Aerospace, a Raytheon Technologies Corporation Company; FURUNO ELECTRIC CO., LTD.; Kollmorgen; KONGSBERG; Trimble Inc.

Reasons to buy report

- To understand the SAM autonomous navigation market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for SAM autonomous navigation market

- Efficiently plan M&A and partnership deals in SAM autonomous navigation market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form SAM autonomous navigation market

- Obtain market revenue forecast for market by various segments from 2020-2027 in SAM region.

SAM Autonomous navigation Market Segmentation

SAM Autonomous navigation Market - By Solution

- Sensing System

- Navigation System

- Processing Unit

- Software

SAM Autonomous navigation Market - By Application

- Commercial

- Defense

SAM Autonomous navigation Market - By Vehicle Type

- AGVs

- Mobile Robots

- UUVs

- Drones

- Others

SAM Autonomous navigation Market – By Platform

- Land

- Marine

- Space

SAM Autonomous navigation Market - By Country

- Brazil

- Rest of SAM

SAM Autonomous navigation Market - Company Profiles

- Collins Aerospace, a Raytheon Technologies Corporation Company

- FURUNO ELECTRIC CO., LTD

- Kollmorgen

- KONGSBERG

- Trimble Inc.

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 SAM Autonomous Navigation Market – By Solution

1.3.2 SAM Autonomous Navigation Market – By Application

1.3.3 SAM Autonomous Navigation Market – By Vehicle Type

1.3.4 SAM Autonomous Navigation Market – By Platform

1.3.5 SAM Autonomous Navigation Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Autonomous Navigation Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

5. SAM Autonomous Navigation Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Acceptance of AGVs in Logistics Market

5.1.2 Mobile Robots Performing Various Different Applications

5.2 Market Restraints

5.2.1 Technological Costs and Time

5.3 Market Opportunities

5.3.1 Various AI Technologies Coming Together for Growing Navigation Effectiveness

5.4 Future Trends

5.4.1 Vessel Navigation and Unmanned Ship Adopting Autonomous Navigation Technology

5.5 Impact Analysis of Drivers and Restraints

6. Autonomous Navigation Market – SAM Analysis

6.1 SAM Autonomous Navigation Market Overview

6.2 SAM Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning – Five Key Players

7. SAM Autonomous Navigation Market Analysis – By Solution

7.1 Overview

7.2 SAM Autonomous Navigation Market, by Solution (2019 and 2027)

7.3 Sensing Systems

7.3.1 Overview

7.3.2 Sensing Systems: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

7.4 Processing Unit

7.4.1 Overview

7.4.2 Processing Unit: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

7.5 Software

7.5.1 Overview

7.5.2 Software: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

8. SAM Autonomous Navigation Market Revenue and Forecast to 2027 – By Application

8.1 Overview

8.2 SAM Autonomous Navigation Market Breakdown, By Application, 2019 & 2027

8.3 Commercial

8.3.1 Overview

8.3.2 Commercial Market Forecast and Analysis

8.4 Defense

8.4.1 Overview

8.4.2 Defense Market Forecast and Analysis

9. SAM Autonomous Navigation Market Analysis – by Vehicle Type

9.1 Overview

9.2 SAM Autonomous Navigation Market, by Vehicle Type, 2019 & 2027

9.3 AGVs

9.3.1 Overview

9.3.2 AGVs: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

9.4 Mobile Robots

9.4.1 Overview

9.4.2 Mobile Robots: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

9.5 UUVs

9.5.1 Overview

9.5.2 UUVs: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

9.6 Drones

9.6.1 Overview

9.6.2 Drones: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

10. SAM Autonomous Navigation Market Revenue and Forecast to 2027 – by Platform

10.1 Overview

10.2 SAM Autonomous Navigation Market Breakdown, by Platform, 2019 & 2027

10.3 Land

10.3.1 Overview

10.3.2 Land Market Forecast and Analysis

10.4 Marine

10.4.1 Overview

10.4.2 Marine Market Forecast and Analysis

10.5 Space

10.5.1 Overview

10.5.2 Space Market Forecast and Analysis

11. SAM Autonomous Navigation Market – Country Analysis

11.1 Overview

11.1.1 SAM: Autonomous Navigation Market, By Country

11.1.1.1 Brazil: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

11.1.1.1.1 Brazil: Autonomous Navigation Market, By Solution

11.1.1.1.2 Brazil: Autonomous Navigation Market, By Application

11.1.1.1.3 Brazil: Autonomous Navigation Market, By vehicle type

11.1.1.1.4 Brazil: Autonomous Navigation Market, By Platform

11.1.1.2 Rest of SAM: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

11.1.1.2.1 Rest of SAM: Autonomous Navigation Market, By Solution

11.1.1.2.2 Rest of SAM: Autonomous Navigation Market, By Application

11.1.1.2.3 Rest of SAM: Autonomous Navigation Market, By vehicle type

11.1.1.2.4 Rest of SAM: Autonomous Navigation Market, By Platform

12. SAM Autonomous Navigation Market- COVID-19 Impact Analysis

12.1 SAM

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 New Product Development

13.4 Merger and Acquisition

14. Company Profiles

14.1 KONGSBERG

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Trimble Inc.

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Collins Aerospace, a Raytheon Technologies Corporation Company

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Kollmorgen

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 FURUNO ELECTRIC CO., LTD.

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Word IndexLIST OF TABLES

Table 1. SAM Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. Brazil Autonomous Navigation Market, By Solution– Revenue and Forecast to 2027 (US$ Million)

Table 3. Brazil Autonomous Navigation Market, By Application– Revenue and Forecast to 2027 (US$ Million)

Table 4. Brazil Autonomous Navigation Market, by vehicle type– Revenue and Forecast to 2027 (US$ Million)

Table 5. Brazil Autonomous Navigation Market, By Platform – Revenue and Forecast to 2027 (US$ Million)

Table 6. Rest of SAM Autonomous Navigation Market, By Solution– Revenue and Forecast to 2027 (US$ Million)

Table 7. Rest of SAM Autonomous Navigation Market, By Application– Revenue and Forecast to 2027 (US$ Million)

Table 8. Rest of SAM Autonomous Navigation Market, by vehicle type– Revenue and Forecast to 2027 (US$ Million)

Table 9. Rest of SAM Autonomous Navigation Market, By Platform – Revenue and Forecast to 2027 (US$ Million)

Table 10. List of AbbreviationLIST OF FIGURES

Figure 1. SAM Autonomous navigation Market Segmentation

Figure 2. SAM Autonomous navigation Market Segmentation – By Country

Figure 3. SAM Autonomous Navigation Market Overview

Figure 4. Brazil Held the Largest Share in SAM Autonomous Navigation Market in 2019

Figure 5. SAM Autonomous Navigation Market, By Solution

Figure 6. SAM Autonomous Navigations Market, By Application

Figure 7. SAM Autonomous Navigations Market, By Vehicle Type

Figure 8. SAM Autonomous Navigations Market, By Platform

Figure 9. Porter’s Five Forces Analysis

Figure 10. SAM Autonomous Navigation Market– Ecosystem Analysis

Figure 11. SAM Autonomous Navigation Market Impact Analysis of Drivers and Restraints

Figure 12. SAM Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 13. SAM Autonomous Navigation Market Revenue Share, by Solution (2019 and 2027)

Figure 14. SAM Sensing Systems: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 15. SAM Processing Unit: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 16. SAM Software: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 17. SAM Autonomous Navigation Market Breakdown, By Application, 2019 & 2027

Figure 18. SAM Commercial Market Revenue and Forecast to 2027 (US$ Million)

Figure 19. SAM Defense Market Revenue and Forecast to 2027 (US$ Million)

Figure 20. SAM Autonomous Navigation Market Revenue Share, by Vehicle Type, 2019 & 2027)

Figure 21. SAM AGVs: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 22. SAM Mobile Robots: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 23. SAM UUVs: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 24. SAM Drones: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 25. SAM Others: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 26. SAM Autonomous Navigation Market Breakdown, by Platform, 2019 & 2027 (%)

Figure 27. SAM Land Market Revenue and Forecast to 2027 (US$ Million)

Figure 28. SAM Marine Market Revenue and Forecast to 2027(US$ Million)

Figure 29. SAM Space Market Revenue and Forecast to 2027 (US$ Million)

Figure 30. SAM: Autonomous Navigation Market Revenue Share, By Country (2019 and 2027)

Figure 31. Brazil: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 32. Rest of SAM: Autonomous Navigation Market – Revenue and Forecast to 2027 (US$ Million)

Figure 33. Impact of COVID-19 Pandemic in SAM Country MarketsSome of the leading companies are:

- Collins Aerospace, a Raytheon Technologies Corporation Company

- FURUNO ELECTRIC CO., LTD

- Kollmorgen

- KONGSBERG

- Trimble Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the SAM autonomous navigation market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the SAM autonomous navigation market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the autonomous navigation market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution