South America Automotive Tire Aftermarket Market Forecast to 2028 – COVID-19 Impact and Regional Analysis – by Tire Type (Radial Tire and Bias Tire), Distribution Channel (OES and IAM), and Rim Size (13–15, 16–18, 19–21, and More than 21)

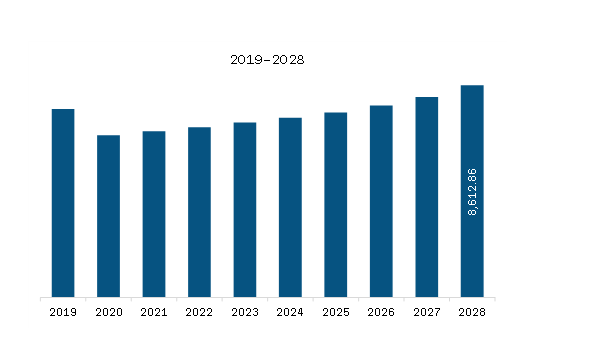

The automotive tire aftermarket market in SAM is expected to grow from US$ 6,774.68 million in 2021 to US$ 8,612.86 million by 2028; it is estimated to grow at a CAGR of 3.5% from 2021 to 2028.

Brazil, Chile, Argentina, Peru, and Colombia are among the key countries in SAM. The SAM automotive industry is booming due to increased credit supply, economic prosperity, and low-interest rates. SAM is predicted to be one of the fastest-growing automotive tire aftermarkets in the automobile industry. Due to increased sales of passenger cars, light commercial vehicles, and two-wheelers, the industry is expected to witness a considerable rise in demand for tires. To satisfy customer demands, car owners in the region are turning to low-cost options, and the market is mainly reliant on tire imports. Governments of major economies have aided the change in the tire manufacturing sector and the automotive industry. The US exports many vehicle parts, especially tires, to Colombia, Peru, and Argentina. In the previous five years, the Chilean tire market witnessed excellent development. The industry's expansion is enticing manufacturers to grow their tire & other auto component manufacturing bases, and this trend is projected to continue in the regional market over the next five years. Furthermore, these three nations are Free Trade Agreement (FTA) partners with the US, which improves market access for the US by removing possible market entrance restrictions. The US has a competitive edge in SAM markets because of the FTA cooperation, product quality, accessible warranties, and geographic closeness. The International Trade Administration (ITA) recognized the prospects for automotive aftermarket providers in SAM. It awarded the Auto Care Association a three-year matching grant of little under US$ 300,000 to help with operations aimed at increasing exports to that region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM automotive tire aftermarket market, which is expected to grow at a decent CAGR during the forecast period.

South America Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

SAM Automotive Tire Aftermarket Market Segmentation

The SAM automotive tire aftermarket market is segmented into tire type, distribution channel, rim size, and country. Based on tire type, the market is bifurcated into radial and bias. The radial segment held a larger market share in 2020. In terms of distribution channel, the market is bifurcated into OES and IAM. The IAM segment held a larger market share in 2020. Based on rim size, the SAM automotive tire aftermarket market is segmented into 13–15, 16–18, 19–21, and more than 21. The 13–15 segment held the largest market share in 2020. Based on country, the SAM automotive tire aftermarket market is segmented into Brazil, Argentina, and the Rest of SAM.

Bridgestone Corporation; Continental AG; Michelin; NEXEN TIRE AMERICA INC; PIRELLI and C. S.P.A.; Sumitomo Rubber Industries, Ltd.; The Goodyear Tire and Rubber Company; Yokohama Rubber Co., Ltd; and ZHONGCE RUBBER GROUP CO. LTD. are among the leading companies in the SAM automotive tire aftermarket market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Automotive Tire Aftermarket Market Landscape

4.1 Market Overview

4.2 SAM PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. SAM Automotive Tire Aftermarket Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Fuel-Efficient Tires at High Demand

5.1.2 Stringent Government Regulations Regarding Tire Labelling

5.2 Market Restraints

5.2.1 Inconsistent Raw Material Prices

5.3 Market Opportunities

5.3.1 Rising Acceptance of Electric Vehicles

5.4 Future Trends

5.4.1 Surging Need for Green Tires in Fleets

5.5 Impact Analysis of Drivers and Restraints

6. Automotive Tire Aftermarket Market – SAM Analysis

6.1 SAM Automotive Tire Aftermarket Market Overview

6.2 SAM Automotive Tire Aftermarket Market Revenue Forecast and Analysis

7. SAM Automotive Tire Aftermarket Market Analysis – By Tire Type

7.1 Overview

7.2 SAM Automotive Tire Aftermarket Market, by Tire type (2020 And 2028)

7.3 Radial tire

7.3.1 Overview

7.3.2 Radial tire: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

7.4 Bias tire

7.4.1 Overview

7.4.2 Bias tire: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

8. SAM Automotive Tire Aftermarket Market Analysis – By Distribution Channel

8.1 Overview

8.2 SAM Automotive Tire Aftermarket Market, by Distribution channel (2020 and 2028)

8.3 OES

8.3.1 Overview

8.3.2 OES: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

8.4 IAM

8.4.1 Overview

8.4.2 IAM: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

9. SAM Automotive Tire Aftermarket Market Analysis – By Rim Size

9.1 Overview

9.2 SAM Automotive Tire Aftermarket Market, by Rim Size (2020 And 2028)

9.3- 15

9.3.1 Overview

9.3.2- 15: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

9.4-18

9.4.1 Overview

9.4.2-18: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

9.5-21

9.5.1 Overview

9.5.2-21: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

9.6 More than 21

9.6.1 Overview

9.6.2 More than 21: Automotive Tire Aftermarket Market Revenue and Forecast To 2028 (US$ Million)

10. SAM Automotive Tire Aftermarket Market – Country Analysis

10.1 Overview

10.1.1 SAM: Automotive Tire Aftermarket Market, by Key Country

10.1.1.1 Brazil: Automotive Tire Aftermarket Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 Brazil: Automotive Tire Aftermarket Market, by Tire type

10.1.1.1.2 Brazil: Automotive Tire Aftermarket Market, by Distribution channel

10.1.1.1.3 Brazil: Automotive Tire Aftermarket Market, by Rim Size

10.1.1.2 Argentina: Automotive Tire Aftermarket Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Argentina: Automotive Tire Aftermarket Market, by Tire type

10.1.1.2.2 Argentina: Automotive Tire Aftermarket Market, by Distribution channel

10.1.1.2.3 Argentina: Automotive Tire Aftermarket Market, by Rim Size

10.1.1.3 Rest of SAM: Automotive Tire Aftermarket Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Rest of SAM: Automotive Tire Aftermarket Market, by Tire type

10.1.1.3.2 Rest of SAM: Automotive Tire Aftermarket Market, by Distribution channel

10.1.1.3.3 Rest of SAM: Automotive Tire Aftermarket Market, by Rim Size

11. Automotive Tire Aftermarket Market-Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Development

12. Automotive Tire Aftermarket Market-Company Profiles

12.1 APOLLO TIRES LTD

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Continental AG

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 PIRELLI AND C. S.P.A.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Sumitomo Rubber Industries, Ltd.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 THE GOODYEAR TIRE AND RUBBER COMPANY

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 YOKOHAMA RUBBER CO., LTD

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 ZHONGCE RUBBER GROUP CO. LTD.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 NEXEN TIRE AMERICA INC

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 BRIDGESTONE CORPORATION

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 MICHELIN

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. SAM Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Table 2. SAM: Automotive Tire Aftermarket Market, by Powertrain Tire type– by Country (UNITS IN MILLION)

Table 3. Brazil: Automotive Tire Aftermarket Market, by Tire type–Revenue and Forecast to 2028 (US$ Million)

Table 4. Brazil: Automotive Tire Aftermarket Market, by Distribution channel–Revenue and Forecast to 2028 (US$ Million)

Table 5. Brazil: Automotive Tire Aftermarket Market, by Rim Size–Revenue and Forecast to 2028 (US$ Million)

Table 6. Argentina: Automotive Tire Aftermarket Market, by Tire type–Revenue and Forecast to 2028 (US$ Million)

Table 7. Argentina: Automotive Tire Aftermarket Market, by Distribution channel–Revenue and Forecast to 2028 (US$ Million)

Table 8. Argentina: Automotive Tire Aftermarket Market, by Rim Size–Revenue and Forecast to 2028 (US$ Million)

Table 9. Rest of SAM: Automotive Tire Aftermarket Market, by Tire type–Revenue and Forecast to 2028 (US$ Million)

Table 10. Rest of SAM: Automotive Tire Aftermarket Market, by Distribution channel–Revenue and Forecast to 2028 (US$ Million)

Table 11. Rest of SAM: Automotive Tire Aftermarket Market, by Rim Size–Revenue and Forecast to 2028 (US$ Million)

Table 12. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Automotive Tire Aftermarket Market Segmentation

Figure 2. SAM Automotive Tire Aftermarket Market Segmentation – By Country

Figure 3. SAM Automotive Tire Aftermarket Market Overview

Figure 4. SAM Automotive Tire Aftermarket Market, by Tire type

Figure 5. SAM Automotive Tire Aftermarket Market, by Country

Figure 6. SAM: PEST Analysis

Figure 7. SAM Automotive Tire Aftermarket Market- Ecosystem Analysis

Figure 8. SAM Automotive Tire Aftermarket Market Impact Analysis of Drivers and Restraints

Figure 9. SAM Automotive Tire Aftermarket Market Revenue Forecast and Analysis (US$ Million)

Figure 10. SAM Automotive Tire Aftermarket Market, by Tire type (2020 And 2028)

Figure 11. SAM Radial tire: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 12. SAM Bias tire: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. SAM Automotive Tire Aftermarket Market, by Distribution channel (2020 and 2028)

Figure 14. SAM OES: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. SAM IAM: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. SAM Automotive Tire Aftermarket Market, by Rim Size (2020 and 2028)

Figure 17. SAM 13- 15 Radial tire: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM 16-18: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. SAM 19-21: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. SAM More than 21: Automotive Tire Aftermarket Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. SAM: Automotive Tire Aftermarket Market, by Key Country – Revenue (2020) (US$ Million)

Figure 22. SAM: Automotive Tire Aftermarket Market Revenue Share, by Key Country (2021 and 2028)

Figure 23. Brazil: Automotive Tire Aftermarket Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Argentina: Automotive Tire Aftermarket Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Rest of SAM: Automotive Tire Aftermarket Market – Revenue and Forecast to 2028 (US$ Million)

- Apollo Tires Ltd

- Bridgestone Corporation

- Continental AG

- Michelin

- NEXEN TIRE AMERICA INC

- PIRELLI and C. S.P.A.

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire and Rubber Company

- Yokohama Rubber Co., Ltd

- ZHONGCE RUBBER GROUP CO. LTD.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the SAM automotive tire aftermarket market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the SAM automotive tire aftermarket market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the automotive tire aftermarket market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution