South America Anti-Money Laundering Solution Market Forecast to 2027 - COVID-19 Impact and Regional Analysis by Component (Software and Services), Deployment Type (On-premises and Cloud), Product (Transaction Monitoring, Compliance Management, Currency Transaction Reporting, and Customer Identity Management), and Industry (Healthcare, BFSI, Retail, IT and Telecom, Government, and Others)

Market Introduction

An anti-money laundering (AML) solution is deployed to meet the financial institutions' legal requirements for preventing and reporting the activities of money laundering. Increasing online transactions and rising concerns regarding fraudulent transactions have steered the adoption of anti-money laundering solutions across SAM region. Further, supportive government regulations supplement the growth of the SAM anti-money laundering solution market to a significant extent. In 2017, the banks in SAM were seen becoming intransitive to strengthen their anti-money laundering solution and KYC processes as a corruption outrage in Brazil added up to the reasons US lenders were catering correspondent lined across the region. The reason banks and other financial enterprises are wanting to make their anti-money laundering solution processes robust is because the countries across the region have attained noteworthy progress in the implementation of the FTAF recommendations. This in response has resulted in increased demand for AML software among the banks. The adoption of anti-money laundering solutions across SAM region has increased over the years due to growing concerns for fraudulent activities and rising online transactions across various verticals. Further, growth in technological advancements, emergence of crypto-currencies, and rise in the adoption of cloud-based solutions supplement the demand for anti-money laundering solutions throughout SAM region.

Furthermore, in case of COVID-19, SAM is highly affected specially the Brazil. The government in SAM is taking several initiatives to protect people and to control COVID-19’s spread in the region through lockdowns, trade bans, and travel restrictions. These measures are expected to directly impact the region’s economic growth as the region will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to major trading partners such as China, Europe, and North America. The total number of cases in Brazil accounted for 7,213,155, out of which 186,356 total deaths are recorded. Due to the coronavirus epidemic, online transactions received a lift in several countries of the region. The online card payment transactions are witnessing an increase, more than doubling in Brazil and Chile. Furthermore, in Brazil, fintech is allocating financial aid to those affected by the coronavirus. Moreover, digital banking penetration in SAM has bolstered as consumers and merchants attempt to evade handling cash.

Get more information on this report :

Market Overview and Dynamics

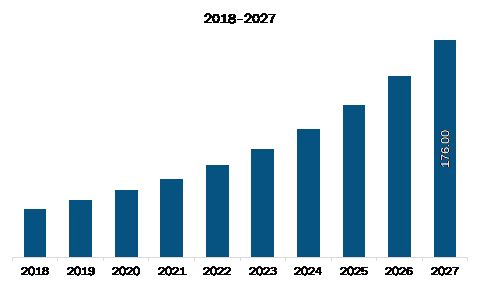

The SAM anti-money laundering solution market is expected to grow from US$ 46.45 million in 2019 to US$ 176.00 million by 2027; it is estimated to grow at a CAGR of 15.8 % from 2020 to 2027. Acceleration in the adoption of cryptocurrency is expected to accelerate the SAM anti-money laundering solution market. The adoption of cryptocurrency across SAM region is expected to continue its course. However, this is expected to raise concern among the firms regarding anti-money laundering compliance. The local as well as countries authorities across SAM region have combatted with the AML risk, several economies have adopted a considered approach allowed for trade and investment. The changes introduced by the adoption of cryptocurrency are anticipated to provide the AML software developers with an opportunity to diversify their offerings to new applications and end users. Companies across SAM region are offering anti-money laundering solutions to address the growing challenges of cryptocurrency businesses. So rise in the use of cryptocurrency is expected to increase the demand of anti-money laundering solution, which will drive the SAM anti-money laundering solution market during forecast period.

Key Market Segments

In terms of component, the software segment accounted for the largest share of the SAM anti-money laundering solution market in 2019. In terms of deployment type, the on-premises segment held a larger market share of the SAM anti-money laundering solution market in 2019. Similarly, in terms of product, the transaction monitoring segment held a larger market share of the SAM anti-money laundering solution market in 2019. Further, the BFSI segment held a larger share of the SAM anti-money laundering solution market based on industry in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the SAM anti-money laundering solution market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Accenture; ACI WORLDWIDE, INC.; BAE Systems plc; EastNets.com; LexisNexis Risk Solutions Group; Nasdaq Inc.; NICE Ltd.; Oracle Corporation; SAS Institute Inc.

Reasons to buy report

- To understand the SAM anti-money laundering solution market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for SAM anti-money laundering solution market

- Efficiently plan M&A and partnership deals in SAM anti-money laundering solution market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form SAM anti-money laundering solution market

- Obtain market revenue forecast for market by various segments from 2020-2027 in SAM region.

SAM Anti-Money Laundering Solution Market Segmentation

SAM Anti-Money Laundering Solution Market - By Component

- Software

- Services

SAM Anti-Money Laundering Solution Market - By Deployment Type

- On-Premises

- Cloud

SAM Anti-Money Laundering Solution Market - By Product

- Transaction Monitoring

- Compliance management

- Currency transaction reporting

- Customer identity management

SAM Anti-Money Laundering Solution Market - By Industry

- Healthcare

- BFSI

- Retail

- IT and Telecom

- Government

- Others

SAM Anti-Money Laundering Solution Market - By Country

- Brazil

- Argentina

- Rest of SAM

SAM Anti-Money Laundering Solution Market - Company Profiles

- Accenture

- ACI WORLDWIDE, INC.

- BAE Systems plc

- EastNets.com

- LexisNexis Risk Solutions Group

- Nasdaq Inc.

- NICE Ltd.

- Oracle Corporation

- SAS Institute Inc.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 SAM Anti-Money Laundering Solution Market – By Deployment Type

1.3.2 SAM Anti-Money Laundering Solution Market – By Component

1.3.3 SAM Anti-Money Laundering Solution Market – By Product

1.3.4 SAM Anti-Money Laundering Solution Market – By Industry

1.3.5 SAM Anti-Money Laundering Solution Market- By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Anti-Money Laundering Solution Market Landscape

4.1 Market Overview

4.2 SAM PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Anti-Money Laundering Solution Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Mounting Focus of FinTech on Implementing Automated Anti-Money Laundering Systems

5.1.2 Surging Demand for Sophisticated Transaction Monitoring Solutions

5.1.3 Escalating Focus on Limiting Risks Related to Digital Payment Methods

5.2 Market Restraints

5.2.1 Problem Related to Complicated Structure and Technology of Anti-Money Laundering Solutions

5.3 Market Opportunities

5.3.1 Acceleration in the Adoption of Cryptocurrency

5.3.2 Burgeoning Adoption of Advanced Analytics

5.4 Future Trends

5.4.1 Information Interchange Among Banks and Other Financial Institutions

5.5 Impact Analysis of Drivers & Restraints

6. Anti-Money Laundering Solution Market – SAM Analysis

6.1 SAM Anti-Money Laundering Solution Market Overview

6.2 SAM Anti-Money Laundering Solution Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning – Five Key Players

7. SAM Anti-Money Laundering Solution Market Analysis – By Deployment type

7.1 Overview

7.2 SAM Anti-Money Laundering Solution Market, by Deployment Type, (2019 and 2027)

7.3 On-Premise

7.3.1 Overview

7.3.2 On-Premise Market Revenue and Forecast to 2027 (US$ Million)

7.4 Cloud

7.4.1 Overview

7.4.2 Cloud Market Revenue and Forecast to 2027 (US$ Million)

8. SAM Anti-Money Laundering Solution Market Analysis –By Component

8.1 Overview

8.2 SAM Anti-Money Laundering Solution Market Breakdown, by Component, (2019 and 2027)

8.3 Software

8.3.1 Overview

8.3.2 Software Market Revenue and Forecast to 2027 (US$ Million)

8.4 Services

8.4.1 Overview

8.4.2 Services Market Revenue and Forecast to 2027 (US$ Million)

9. SAM Anti-Money Laundering Solution Market Analysis –By Product

9.1 Overview

9.2 SAM Anti-Money Laundering Solution Market Breakdown, by Product, (2019 and 2027)

9.3 Transaction Monitoring

9.3.1 Overview

9.3.2 Transaction Monitoring Market Revenue and Forecast to 2027 (US$ Million)

9.4 Compliance Management

9.4.1 Overview

9.4.2 Compliance Management Market Revenue and Forecast to 2027 (US$ Million)

9.5 Currency Transaction Reporting

9.5.1 Overview

9.5.2 Currency Transaction Reporting Market Revenue and Forecast to 2027 (US$ Million)

9.6 Customer Identity Management

9.6.1 Overview

9.6.2 Customer Identity Management Market Revenue and Forecast to 2027 (US$ Million)

10. SAM Anti-Money Laundering Solution Market Analysis –By Industry

10.1 Overview

10.2 SAM Anti-Money Laundering Solution Market Breakdown, by Industry Vertical, (2019 and 2027)

10.3 Healthcare

10.3.1 Overview

10.3.2 Healthcare Market Revenue and Forecast to 2027 (US$ Million)

10.4 BFSI

10.4.1 Overview

10.4.2 BFSI Market Revenue and Forecast to 2027 (US$ Million)

10.5 Retail

10.5.1 Overview

10.5.2 Retail Market Revenue and Forecast to 2027 (US$ Million)

10.6 IT and Telecom

10.6.1 Overview

10.6.2 IT and Telecom Market Revenue and Forecast to 2027 (US$ Million)

10.7 Government

10.7.1 Overview

10.7.2 Government Market Revenue and Forecast to 2027 (US$ Million)

10.8 Others

10.8.1 Overview

10.8.2 Others Revenue and Forecast to 2027 (US$ Million)

11. SAM Anti-Money Laundering Solution Market –Country Analysis

11.1 Overview

11.1.1 SAM: Anti-Money Laundering Solution Market, by Key Country

11.1.1.1 Brazil: Anti-Money Laundering Solution Market – Revenue, and Forecast to 2027 (US$ Million)

11.1.1.1.1 Brazil: Anti-Money Laundering Solution Market, by Deployment Type

11.1.1.1.2 Brazil: Anti-Money Laundering Solution Market, by Component

11.1.1.1.3 Brazil: Anti-Money Laundering Solution Market, by Product

11.1.1.1.4 Brazil: Anti-Money Laundering Solution Market, by Industry

11.1.1.2 Argentina: Anti-Money Laundering Solution Market – Revenue, and Forecast to 2027 (US$ Million)

11.1.1.2.1 Argentina: Anti-Money Laundering Solution Market, by Deployment Type

11.1.1.2.2 Argentina: Anti-Money Laundering Solution Market, by Component

11.1.1.2.3 Argentina: Anti-Money Laundering Solution Market, by Product

11.1.1.2.4 Argentina: Anti-Money Laundering Solution Market, by Industry

11.1.1.3 Rest of SAM: Anti-Money Laundering Solution Market – Revenue, and Forecast to 2027 (US$ Million)

11.1.1.3.1 Rest of SAM: Anti-Money Laundering Solution Market, by Deployment Type

11.1.1.3.2 Rest of SAM: Anti-Money Laundering Solution Market, by Component

11.1.1.3.3 Rest of SAM: Anti-Money Laundering Solution Market, by Product

11.1.1.3.4 Rest of SAM: Anti-Money Laundering Solution Market, by Industry

12. Impact of COVID-19 Pandemic on SAM Anti-Money Laundering Solution Market

12.1 SAM

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Merger and Acquisition

13.4 New Development

14. COMPANY PROFILES

14.1 Accenture

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 ACI WORLDWIDE, INC

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 BAE Systems plc

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 EastNets.com

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Oracle Corporation

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 LexisNexis Risk Solutions Group

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Nasdaq Inc.

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 SAS Institute Inc.

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 NICE Ltd.

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Word Index

LIST OF TABLES

Table 1. SAM Anti-Money Laundering Solution Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. Brazil Anti-Money Laundering Solution Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 3. Brazil Anti-Money Laundering Solution Market, by Component – Revenue and Forecast to 2027 (US$ Million)

Table 4. Brazil Anti-Money Laundering Solution Market, by Product – Revenue and Forecast to 2027 (US$ Million)

Table 5. Brazil Anti-Money Laundering Solution Market, by Industry – Revenue and Forecast to 2027 (US$ Million)

Table 6. Argentina: Anti-Money Laundering Solution Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 7. Argentina: Anti-Money Laundering Solution Market, by Component – Revenue and Forecast to 2027 (US$ Million)

Table 8. Argentina: Anti-Money Laundering Solution Market, by Product – Revenue and Forecast to 2027 (US$ Million)

Table 9. Argentina: Anti-Money Laundering Solution Market, by Industry – Revenue and Forecast to 2027 (US$ Million)

Table 10. Rest of SAM: Anti-Money Laundering Solution Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 11. Rest of SAM: Anti-Money Laundering Solution Market, by Component – Revenue and Forecast to 2027 (US$ Million)

Table 12. Rest of SAM: Anti-Money Laundering Solution Market, by Product – Revenue and Forecast to 2027 (US$ Million)

Table 13. Rest of SAM: Anti-Money Laundering Solution Market, by Industry – Revenue and Forecast to 2027 (US$ Million)

Table 14. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Anti-Money Laundering Solution Market Segmentation

Figure 2. SAM Anti-Money Laundering Solution Market Segmentation – By Country

Figure 3. SAM Anti-Money Laundering Solution Market Overview

Figure 4. On-Premise Segment Held the Largest Market Share

Figure 5. Software Segment Held the Largest Market Share

Figure 6. Transaction Monitoring Segment Held the Largest Market Share

Figure 7. BFSI Segment Held the Largest Market Share

Figure 8. Brazil Held the Largest Market Share

Figure 9. SAM – PEST Analysis

Figure 10. SAM Anti-Money Laundering Solution Market Ecosystem Analysis

Figure 11. SAM Anti-Money Laundering Solution Market Expert Opinion

Figure 12. Impact Analysis of Drivers and Restraints

Figure 13. SAM Anti-Money Laundering Solution Market – Revenue and Forecast to 2027 (US$ Million)

Figure 14. SAM Anti-Money Laundering Solution Market Breakdown, by Deployment Type (2019 and 2027)

Figure 15. SAM On-Premise Market Revenue and Forecast to 2027(US$ Million)

Figure 16. SAM Cloud Market Revenue and Forecast to 2027(US$ Million)

Figure 17. SAM Anti-Money Laundering Solution Market, by Component (2019 and 2027)

Figure 18. SAM Software Market Revenue and Forecast to 2027(US$ Million)

Figure 19. SAM Services Market Revenue and Forecast to 2027(US$ Million)

Figure 20. SAM Anti-Money Laundering Solution Market Breakdown, by Product (2019 and 2027)

Figure 21. SAM Transaction Market Revenue and Forecast to 2027(US$ Million)

Figure 22. SAM Compliance Management Market Revenue and Forecast to 2027(US$ Million)

Figure 23. SAM Currency Transaction Reporting Market Revenue and Forecast to 2027(US$ Million)

Figure 24. SAM Customer Identity Management Market Revenue and Forecast to 2027(US$ Million)

Figure 25. SAM Anti-Money Laundering Solution Market Breakdown, by Industry Vertical (2019 and 2027)

Figure 26. SAM Healthcare Market Revenue and Forecast to 2027(US$ Million)

Figure 27. SAM BFSI Market Revenue and Forecast to 2027(US$ Million)

Figure 28. SAM Retail Market Revenue and Forecast to 2027(US$ Million)

Figure 29. SAM IT and Telecom Market Revenue and Forecast to 2027(US$ Million)

Figure 30. SAM Government Market Revenue and Forecast to 2027(US$ Million)

Figure 31. SAM Others Market Revenue and Forecast to 2027(US$ Million)

Figure 32. SAM: Anti-Money Laundering Solution Market Revenue Share, by Key Country (2019 and 2027)

Figure 33. Brazil: Anti-Money Laundering Solution Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 34. Argentina: Anti-Money Laundering Solution Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 35. Rest of SAM: Anti-Money Laundering Solution Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 36. Impact of COVID-19 Pandemic in SAM Country Markets

Some of the leading companies are:

- Accenture

- ACI WORLDWIDE, INC.

- BAE Systems plc

- EastNets.com

- LexisNexis Risk Solutions Group

- Nasdaq Inc.

- NICE Ltd.

- Oracle Corporation

- SAS Institute Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the SAM anti-money laundering solution market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the SAM anti-money laundering solution market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the anti-money laundering solution market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution