Saudi Arabia Liquid Filtration Market to 2027 - Country Analysis and Forecast by Fabric Material (Polymer, Cotton, Metal); Filter Media (Woven, Nonwoven, Mesh); End User (Municipal Treatment, Industrial Treatment)

The Saudi Arabia liquid filtration market was valued at US$ 77.6 million in 2018 and is expected to grow at a CAGR of 5.1% from 2019 to 2027 to reach US$ 119.8 million by 2027.

The liquid filtration is the process of removal or separation of undesirable chemicals, suspended solids, and biological contaminants from fluids. Liquid filtration system consists of various components such as demister pads, random packing rings, structured packing, vane mist eliminator among others. The liquid filtration system consists of polymer and metal liquid filter housings that available for used in controlling water, collecting dust particles, refining solvents, petrochemicals and chemicals. Liquid filtration system is also used for the sterilization method in laboratories, processing of oils and fats from animal and vegetable source. Latest advanced filtration technology such as ultrafiltration, reverse osmosis and nanofiltration where it removes particles of 0.001–0.1 µm from fluids are gaining popularity in dairy industry, metal industry and other industries. Saudi Arabia is considered as a lucrative region which is contributing the liquid filtration market share and demand. Increase in liquid filtration requirements in different industries such as pharmaceuticals, mining, food, and beverages drive the growth of the Saudi Arabia liquid filtration market. Furthermore, rise in concerns related to water pollution coupled with technical cognizance and constant research and development activity has further stimulated the demand for liquid filtration systems.

Saudi Arabia Liquid Filtration Market

Get more information on this report :

Market Insights

Increasing demand of filtration systems in oil and gas industry is driving the Saudi Arabia liquid filtration

Saudi Arabia is the largest country in Middle East, covering around two million square kilometres and 14th largest country in the world. The country is the second-largest crude oil producer and the largest exporter of petroleum in the world. The oil and gas industry of the country accounts for about 50 per cent of gross domestic product, and about 70 per cent of export earnings. Sustained growth in the consumption of natural gas, petroleum, and petrochemical products across the world has increased the exports and imports of oil and gas in Saudi Arabia. Thus, the oil and gas companies in Saudi Arabia need to expand their production to meet emerging demand in the future. The companies are investing heavily in technologies and modern developments to reduce the cost of operations and optimize the output of petroleum industry. It also has significant applications in many industries such as aeronautics, automobiles, mining, power plant, refineries, water treatment, aerospace, defense petrochemicals and many more. It also has significant applications in many industries such as aeronautics, automobiles, mining, power plant, refineries, water treatment, aerospace, defense petrochemicals and many more.

Fabric Material Insights

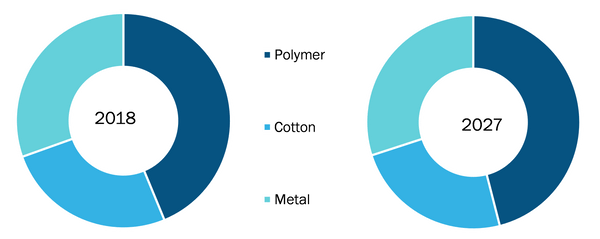

The polymer segment captured the largest share in the Saudi Arabia liquid filtration market. Polymers possess a broad range of properties which makes it an essential and ubiquitous element. Polymers are used to minimize the use of energy and helps to conduct the process of filtration in high-stress and high-temperature conditions. The polymer are of two types natural and synthetic polymers. Mostly, two kinds of polymers are used to make the filtration systems which are poly (oxythelene) and poly (vinylidene fluoride). Several high-performing polymer fibers are incorporated in filter media to meet various specific requirements in varied filtration uses. For instance, filters made from fluoropolymer (Polytetrafluoroethylene (PTFE), 36 Polyvinylidene fluoride (PVDF), 37 and Perfluoroalkoxy alkane (PFA)) fibers, possess inherent, chemical-resistant, and flame-retardant characteristic features, and are widely used to filter aggressive chemicals and acids.

Saudi Arabia Liquid Filtration Market, by Fabric Material – 2018 & 2027

Get more information on this report :

Filter Media Insights

The nonwoven filter media segment captured the largest share in the Saudi Arabia liquid filtration market. Non-woven media are defined as the sheets and web structures which are bonded together by entangling the fiber and filaments together through mechanical or chemical process. They are considered as flat or porous sheets which are made directly by separate fibers. The critical pore size resembles to the diameter of nominally spherical solid particle which is going to pass through the pore. If the number of fiber strata is higher, the thickness of nonwoven count would be greater and higher would be the probability of encountering the pores of minimum size. The application of nonwovens’ kind of fiber material is rising in several filtration applications which is driving the overall Saudi Arabia liquid filtration market in several end use industry.

End User Insights

The industrial treatment segment captured the largest share in the Saudi Arabia liquid filtration market. The industrial treatment covers the processes and mechanisms that are used to treat the waters contaminated in a way by anthropogenic commercial or industrial activities. Most of the industries produce wet waste that is known to contaminate the water. Some of the major sources of industrial wastewater include agricultural waste from breweries, the dairy industry, pulp and paper industry, iron and steel industry, mines and quarries, and food industry amongst others. A range of industries are known to use and manufacture organic complex organic chemicals that pollute and contaminate the water. These include the pharmaceuticals, paint and dyes, pesticides, detergents, petro-chemicals, and plastics amongst others. The industrial treatment comprises of the treatment of water contaminated by the feed-stock materials product material in particulate or soluble form, by-products, washing and cleaning agents, and the solvents and added value products like plasticizers.

Strategic Insights

Strategy and business planning strategy is commonly adopted by companies to expand their footprint worldwide, which is further impacting the size of the market. The players present in the liquid filtration market adopt the strategy of expansion and investment in research and development to enlarge customer base across the world, which also permits the players to maintain their brand name globally.

Saudi Arabia Liquid Filtration Market – By Fabric Material

- Polymer

- Cotton

- Metal

Saudi Arabia Liquid Filtration Market – By Filter Media

- Woven

- Nonwoven

- Mesh

Saudi Arabia Liquid Filtration Market – By End Use Industry

- Municipal Treatment

- Industrial Treatment

Company Profiles

- 3M Company

- Freudenberg Group

- Lenntech B.V.

- Sulzer Ltd

- Filter Concept Private Limited

- Pall Corporation

- Salfi Filtration Company

- JFC Arabia Ltd

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Saudi Arabia Liquid Filtration Market, by Fabric Material

1.3.2 Saudi Arabia Liquid Filtration Market, by Filter Media

1.3.3 Saudi Arabia Liquid Filtration Market, by End User

1.3.4 Saudi Arabia Liquid Filtration Market, by Product Type

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Saudi Arabia Liquid Filtration Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Saudi Arabia Pest Analysis

4.3 Expert Opinions

5. Saudi Arabia Liquid Filtration Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Increasing demand of filtration systems in oil and gas industry

5.1.2 Strict regulations governing the treatment of industrial and municipal wastes

5.2 Key Market Restraints

5.2.1 High installation and maintenance cost of membrane filtration systems

5.3 Key Market Opportunities

5.3.1 Use of liquid filtration systems in water treatment systems

5.4 Future Trends

5.4.1 Continuous technological advancements and product development in filtration systems

5.5 Impact Analysis of Drivers and Restraints

6. Saudi Arabia Liquid Filtration –Market Analysis

6.1 Saudi Arabia Liquid Filtration Market Overview

6.2 Saudi Arabia Liquid Filtration Market Forecast and Analysis

7. Saudi Arabia Liquid Filtration Market Analysis – by Fabric Material

7.1 Overview

7.2 Saudi Arabia Liquid Filtration Market Breakdown, by Fabric Material, Value, 2018 & 2027

7.3 Polymer

7.3.1 Overview

7.3.2 Saudi Arabia Polymer Market Revenue and Forecasts to 2027 (US$ MN)

7.4 Cotton

7.4.1 Overview

7.4.2 Cotton Market Revenue and Forecasts to 2027 (US$ MN)

7.5 Metal

7.5.1 Overview

7.5.2 Metal Market Revenue and Forecasts to 2027 (US$ MN)

8. Saudi Arabia Liquid filtration Market Analysis – by Filter Media

8.1 Overview

8.2 Saudi Arabia Liquid filtration Market Breakdown, by Filter Media, 2018 & 2027

8.3 Woven

8.3.1 Saudi Arabia Woven Market Revenue Forecast to 2027 (US$ Mn)

8.4 Nonwoven

8.4.1 Saudi Arabia Nonwoven Market Revenue Forecasts to 2027 (US$ Mn)

8.5 Mesh

8.5.1 Saudi Arabia Mesh Market Revenue Forecast to 2027 (US$ Mn)

9. Saudi Arabia Liquid Filtration Market Analysis – by End user

9.1 Overview

9.2 Saudi Arabia Liquid filtration Market Breakdown, by End user, 2018 & 2027

9.3 Municipal Treatment

9.3.1 Overview

9.3.2 Saudi Arabia Municipal Treatment Market Revenue and Forecasts to 2027 (US$ Mn)

9.4 Industrial Treatment

9.4.1 Overview

9.4.2 Saudi Arabia Industrial Treatment Market Revenue and Forecasts to 2027 (US$ Mn)

9.4.3 Food

9.4.3.1 Saudi Arabia Food Market Revenue and Forecasts to 2027 (US$ Mn)

9.4.4 Metal and Mining

9.4.4.1 Saudi Arabia Metal and Mining Market Revenue and Forecasts to 2027 (US$ Mn)

9.4.5 Chemical

9.4.5.1 Saudi Arabia Chemical Market Revenue and Forecasts to 2027 (US$ Mn)

9.4.6 Others

9.4.6.1 Saudi Arabia Other Market Revenue and Forecasts to 2027 (US$ Mn)

10. Saudi Arabia Liquid Filtration Market Analysis – by Product Type

10.1 Overview

10.2 Saudi Arabia Liquid Filtration Market Breakdown, by Product Type, 2018 & 2027

10.3 Demister Pads

10.3.1 Overview

10.3.2 Saudi Arabia Demister Pads Market Revenue and Forecasts to 2027 (US$ Mn)

10.4 Random Packing Rings

10.4.1 Overview

10.4.2 Saudi Arabia Random Packing Rings Market Revenue and Forecasts to 2027 (US$ Mn)

10.5 Structured Packaging

10.5.1 Overview

10.5.2 Saudi Arabia Structured Packaging Market Revenue and Forecasts to 2027 (US$ Mn)

10.6 Vane Mist Eliminator

10.6.1 Overview

10.6.2 Saudi Arabia Vane Mist Eliminator Market Revenue and Forecasts to 2027 (US$ Mn)

11. Industry Landscape

11.1 Strategy And Business Planning

12. Company Profiles

12.1 3M Company

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.2 Freudenberg Group

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.3 Lenntech B.V.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.4 Sulzer Ltd

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Filter Concept Private Limited

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.6 Pall Corporation

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 SWOT Analysis

12.7 Salfi Filtration Company

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 SWOT Analysis

12.8 JFC Arabia Ltd.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 SWOT Analysis

12.8.5 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary

LIST OF TABLES

Table 1. Saudi Arabia Liquid Filtration Market Revenue Forecast to 2027 (US$ Mn)

Table 2. Glossary of Terms, Saudi Arabia Liquid Filtration Market

LIST OF FIGURES

Figure 1. Saudi Arabia Liquid Filtration Market Segmentation

Figure 2. Saudi Arabia Liquid Filtration Market Overview

Figure 3. Polymer Held Larger Share of Saudi Arabia Liquid Filtration Market in 2018

Figure 4. Saudi Arabia Liquid Filtration Industry Landscape

Figure 5. Saudi Arabia – PEST Analysis

Figure 6. Liquid Filtration Market Impact Analysis of Driver And Restraints

Figure 7. Saudi Arabia Liquid Filtration Market Forecast and Analysis, (US$ Mn)

Figure 8. Saudi Arabia Liquid filtration Market Breakdown by Fabric Material, Value, 2018 & 2027 (%)

Figure 9. Saudi Arabia Polymer Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 10. Saudi Arabia Cotton Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 11. Saudi Arabia Metal Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 12. Saudi Arabia Liquid filtration Market Breakdown by Filter Media, by Value, 2018 & 2027 (%)

Figure 13. Saudi Arabia Woven Market Revenue Forecasts To 2027 (US$ Mn)

Figure 14. Saudi Arabia Nonwoven Market Revenue Forecasts To 2027 (US$ Mn)

Figure 15. Saudi Arabia Mesh Market Revenue Forecasts To 2027 (US$ Mn)

Figure 16. Saudi Arabia Liquid filtration Market Breakdown by End user, by Value, 2018 & 2027 (%)

Figure 17. Saudi Arabia Municipal Treatment Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 18. Saudi Arabia Industrial Treatment Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 19. Saudi Arabia Food Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 20. Saudi Arabia Metal and Mining Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 21. Saudi Arabia Chemical Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 22. Saudi Arabia Other Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 23. Saudi Arabia Liquid filtration Market Breakdown by Product Type, by Value, 2018 & 2027 (%)

Figure 24. Saudi Arabia Demister Pads Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 25. Saudi Arabia Random Packing Rings Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 26. Saudi Arabia Structured Packaging Market Revenue and Forecasts To 2027 (US$ Mn)

Figure 27. Saudi Arabia Vane Mist Eliminator Market Revenue and Forecasts To 2027 (US$ Mn)

The List of Companies - Saudi Arabia Liquid Filtration Market

- 3M

- FREUDENBERG FILTRATION TECHNOLOGIES SE AND CO. KG

- LENNTECH B.V.

- MODERN ROYAL GROUP

- PALL CORPORATION

- SALFI FILTRATION COMPANY

- SANDLER AG

- WETICO

• The key findings and recommendations highlight crucial progressive industry trends in the Saudi Arabia liquid filtration market, thereby allowing players to develop effective long term strategies.

• Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

• Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

• Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.