North America Vendor Management Software Market to 2027 - Regional Analysis and Forecasts by Deployment Mode (Cloud and On- premise); Enterprise Size (Large Enterprises and SMEs); Industry Vertical (Retail, Manufacturing, BFSI, IT and Telecom, and Others)

North America vendor management software market is expected to grow from US$ 1.58 Bn in 2018 to US$ 3.55 Bn by the year 2027. This represents a CAGR of 9.6% from the year 2018 to 2027.

The IT industries are focusing strongly on their investments in digital technologies through new digital business investments to upgrade the production phase with the integration of artificial intelligence (AI) and real-time analytics. The organizations are adopting vendor management software to manage the critical link among the organization's internal capabilities as well as the external digital business ecosystem. This software collects all the vendor and contract details available in the cloud. The recent 2017 Leadership Vision mainly aims at IT sourcing and vendor management tools, which ensure corporate and personal success, thus, helping the organizations to get practical advice as well as best practices to overcome their challenges and enabling them to gain the expected business outcomes. Such systems provide proficient to focus on sourcing and vendor management, applications, data and analytics, enterprise architecture and technology innovation, infrastructure and operations, program and portfolio management, and security and risk. All these factors are positively impacting the revenue generation of both SMEs and large enterprises by handling the overall vendor management process efficiently at a reduced cost, which is likely to continue to drive the vendor management software market during the forecast period.

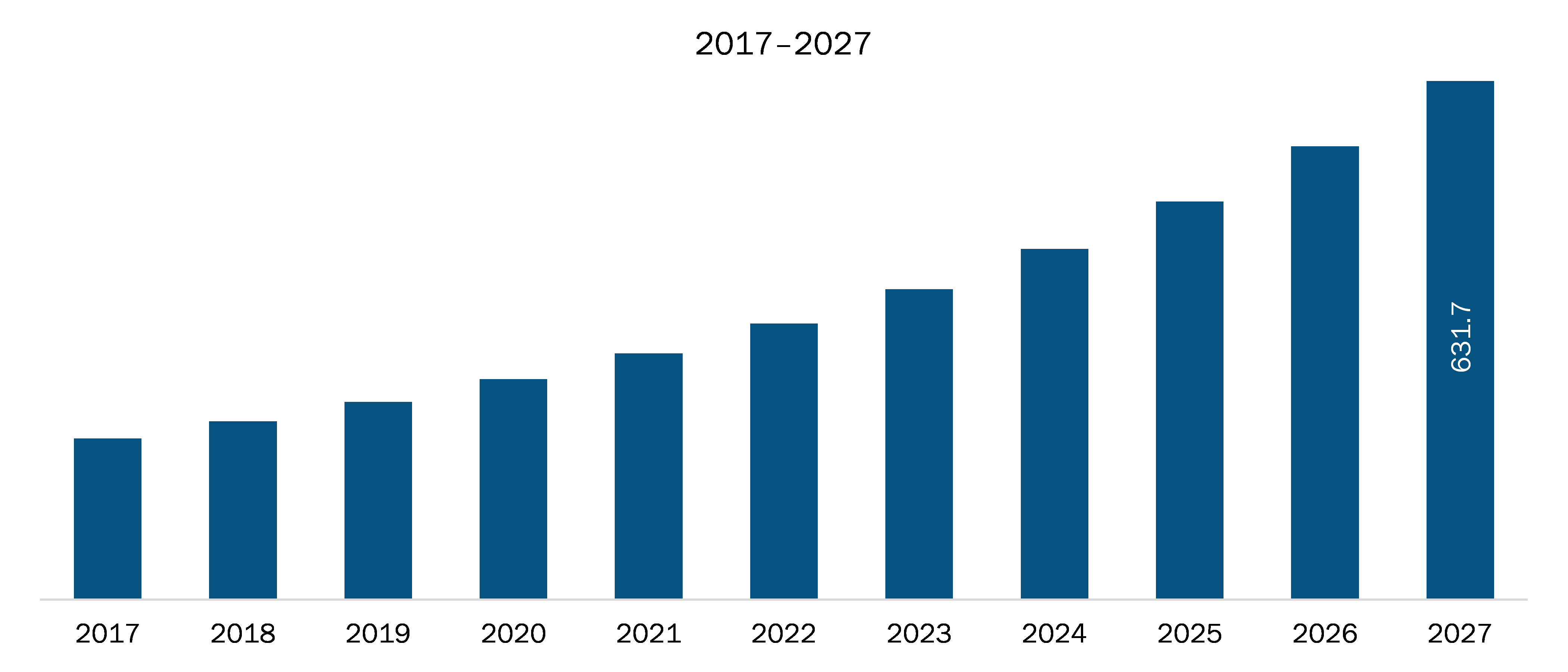

Currently, the US is dominating the vendor management software market in terms of adoption, which in turn boost the demand for vendor management software market. The US is a technologically developed country; hence, the adoption of advanced technology is high across various sectors of the country. The country has the presence of diverse industries and is one of the world's leading high-technology innovators. The presence of a large number of well-established players from various sectors is a significant factor that is driving the growth of vendor management software in the country. The US holds the dominant share in the vendor management software market, and it is expected to continue its dominance during the forecast period due to the wide adoption of advanced technologies and the presence of a wide array of companies. The figure given below highlights the revenue share of Mexico in the North America vendor management software market in the forecast period:

Get more information on this report : Mexico in North America Vendor management software Market Revenue and Forecasts to 2027 (US$ Mn)

NORTH AMERICA VENDOR MANAGEMENT SOFTWARE MARKET - SEGMENTATION

North America Vendor management software Market by Deployment Mode

- On-Premise

- Cloud

North America Vendor management software Market by Organization Size

- SMEs

- Large Enterprise

North America Vendor management software Market by Industry Vertical

- Retail

- Manufacturing

- BFSI

- IT and Telecom

- Others

North America Vendor management software Market by Country

- US

- Canada

- Mexico

North America Vendor management software Companies Mentioned

- Coupa Software Inc.

- Gatekeeper (Cinergy Technology Limited)

- HICX Solutions Ltd.

- IBM Corporation

- Intelex Technologies Inc.

- LogicManager, Inc.

- MasterControl Inc.

- Ncontracts

- SalesWarp

- SAP SE

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Vendor Management Software Market Landscape

4.1 Market Overview

4.2 Ecosystem Analysis

4.3 PEST Analysis

4.3.1 North America PEST Analysis

5. North America Vendor Management Software Market – Key Industry Dynamics

5.1 Key Drivers

5.1.1 Increasing Focus Towards Adoption Of Advanced Technologies To Drive The Operational Efficiencies

5.1.2 Adoption of Vendor Management Software to Maintain Healthy Bottom-Lines

5.2 Key Restraints

5.2.1 Data Privacy and Security Concerns

5.3 Key Opportunities

5.3.1 Growing Focus of SMEs Towards adoption of Vendor Management Software Market

5.4 Future Trends

5.4.1 Integration of Advanced Technologies in Vendor Management Software

5.5 Impact Analysis of Drivers And Restraints

6. North America Vendor Management Software Market – Market Analysis

6.1 North America Vendor Management Software Market Overview

6.2 North America Vendor Management Software Market Forecast and Analysis

7. North America Vendor Management Software Market – By Deployment Mode

7.1 Overview

7.2 Cloud

7.2.1 Overview

7.2.2 North America Cloud Market Revenue and Forecasts to 2027 (US$ Mn)

7.3 On-Premises

7.3.1 Overview

7.3.2 North America On-Premise Market Revenue and Forecasts to 2027 (US$ Mn)

8. North America Vendor Management Software Market– By Enterprise Size

8.1 Overview

8.2 Large Enterprise

8.2.1 Overview

8.2.2 Large Enterprise Market Revenue and Forecasts to 2027 (US$ Mn)

8.3 SMEs

8.3.1 Overview

8.3.2 North America SMEs Market Revenue and Forecasts to 2027 (US$ Mn)

9. North America Vendor Management Software Market–Industry Vertical

9.1 Overview

9.2 North America Vendor Management Software Market Breakdown, By Industry Vertical, 2018 & 2027

9.3 BFSI Market

9.3.1 Overview

9.3.2 BFSI Market Forecast and Analysis

9.4 Retail

9.4.1 Overview

9.4.2 Retail Market Forecast and Analysis

9.5 Manufacturing

9.5.1 Overview

9.5.2 Manufacturing Market Forecast and Analysis

9.6 IT and Telecom Market

9.6.1 Overview

9.6.2 IT and Telecom Market Forecast and Analysis

9.7 Others Market

9.7.1 Overview

9.7.2 Others Market Forecast and Analysis

10. North America Vendor Management Software Market – Country Analysis

10.1 Overview

10.1.1 North America Vendor Management Software Market Breakdown, By Country

10.1.1.1 US Vendor Management Software Market Revenue and Forecast to 2027 (US$ Mn)

10.1.1.1.1 US Vendor Management Software Market Breakdown, By Deployment Mode

10.1.1.1.2 US Vendor Management Software Market Breakdown, By Enterprise Size

10.1.1.1.3 US Vendor Management Software Market Breakdown, By Industry Vertical

10.1.1.2 Canada Vendor Management Software Market Revenue and Forecast to 2027 (US$ Mn)

10.1.1.2.1 Canada Vendor Management Software Market Breakdown, By Deployment Mode

10.1.1.2.2 Canada Vendor Management Software Market Breakdown, By Enterprise Size

10.1.1.2.3 Canada Vendor Management Software Market Breakdown, By Industry Vertical

10.1.1.3 Mexico Vendor Management Software Market Revenue and Forecast to 2027 (US$ Mn)

10.1.1.3.1 Mexico Vendor Management Software Market Breakdown, By Deployment Mode

10.1.1.3.2 Mexico Vendor Management Software Market Breakdown, By Enterprise Size

10.1.1.3.3 Mexico Vendor Management Software Market Breakdown, By Industry Vertical

11. North America Vendor Management Software Market - Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 Merger & Acquisition

11.4 New Product Development

12. North America Vendor Management Software Market- Company Profiles

12.1 Coupa Software Inc.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Gatekeeper (Cinergy Technology Limited)

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 HICX Solutions Ltd.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 International Business Machines Corporation

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Intelex Technologies Inc.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Logicmanager, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Mastercontrol, Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Ncontracts

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Saleswarp

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 SAP SE

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Business Description

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Vendor Management Software Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. North America Vendor Management Software Market Revenue and Forecast to 2027 – By Deployment Mode (US$ Mn)

Table 3. North America Vendor Management Software Market Revenue and Forecast to 2027 – By Enterprise Size (US$ Mn)

Table 4. North America Vendor Management Software Market Revenue and Forecast to 2027 – By Industry Vertical (US$ Mn)

Table 5. North America Vendor Management Software Market Revenue and Forecast to 2027 – By Enterprise Size (US$ Mn)

Table 6. US Vendor Management Software Market Revenue and Forecast to 2027 – By Deployment Mode (US$ Mn)

Table 7. US Vendor Management Software Market Revenue and Forecast to 2027 – By Enterprise Size (US$ Mn)

Table 8. US Vendor Management Software Market Revenue and Forecast To 2027 – By Industry Vertical (US$ Mn)

Table 9. Canada Vendor Management Software Market Revenue and Forecast to 2027 – By Deployment Mode (US$ Mn)

Table 10. Canada Vendor Management Software Market Revenue and Forecast to 2027 – By Enterprise Size (US$ Mn)

Table 11. Canada Vendor Management Software Market Revenue and Forecast To 2027 – By Industry Vertical (US$ Mn)

Table 12. Mexico Vendor Management Software Market Revenue and Forecast to 2027 – By Deployment Mode (US$ Mn)

Table 13. Mexico Vendor Management Software Market Revenue and Forecast to 2027 – By Enterprise Size (US$ Mn)

Table 14. Mexico Vendor Management Software Market Revenue and Forecast To 2027 – By Industry Vertical (US$ Mn)

Table 15. Glossary of Term: North America Vendor Management Software Market

LIST OF FIGURES

Figure 1. North America Vendor Management Software Market Segmentation

Figure 2. North America Vendor Management Software Market Segmentation – By County

Figure 3. Cloud segment to dominate the market by deployment mode throughout the forecast period

Figure 4. SMEs is expected to witness high growth

Figure 5. Retail holds the largest market share

Figure 6. North America Vendor Management Software Market: Competition Landscape

Figure 7. North America Vendor Management Software Market Ecosystem Analysis

Figure 8. North America – PEST Analysis

Figure 9. North America Vendor Management Software Market: Impact Analysis of Driver and Restraints

Figure 10. North America Vendor Management Software Market Forecast and Analysis, (US$ Mn)

Figure 11. North America Vendor Management Software Market Breakdown, By Deployment Mode, 2018 & 2027 (%)

Figure 12. North America Cloud Based Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 13. North America On-Premise Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 14. North America Vendor Management Software Market Breakdown, By Enterprise Size, 2018 & 2027 (%)

Figure 15. North America Large Enterprise Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 16. North America SMEs Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 17. North America Vendor Management Software Market Breakdown, By Industry Vertical, 2018 & 2027 (%)

Figure 18. North America BFSI Market Revenue and Forecasts to 2027(US$ Mn)

Figure 19. North America Retail Market Revenue and Forecasts to 2027(US$ Mn)

Figure 20. North America Manufacturing Market Revenue and Forecasts to 2027(US$ Mn)

Figure 21. North America IT and Telecom Market Revenue and Forecasts to 2027(US$ Mn)

Figure 22. North America Others Market Revenue and Forecasts to 2027(US$ Mn)

Figure 23. North America Vendor Management Software Market Breakdown, By Country, 2018 & 2027(%)

Figure 24. US Vendor Management Software Market Revenue and Forecast to 2027 (US$ Mn)

Figure 25. Canada Vendor Management Software Market Revenue and Forecast to 2027 (US$ Mn)

Figure 26. Mexico Vendor Management Software Market Revenue and Forecast to 2027 (US$ Mn)

Figure 27. Vendor Management Software Market, Industry Landscape (2016-2019) %

The List of Companies

- Coupa Software Inc.

- Gatekeeper (Cinergy Technology Limited)

- HICX Solutions Ltd.

- IBM Corporation

- Intelex Technologies Inc.

- LogicManager, Inc.

- MasterControl Inc.

- Ncontracts

- SalesWarp

- SAP SE

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America Vendor Management Software market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America Vendor Management Software market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution