North America Thermal Scanners Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Type (Handheld and Fixed), Wavelength (Short-Wave Infrared, Mid-Wave Infrared, and Long-Wave Infrared), and End Use (Industrial, Aerospace & Defense, Automotive, Oil & Gas, and Others)

Market Introduction

Thermal scanners detect body heat radiation-usually from the forehead-then estimate core body temperature. These cameras are a potent tool often used by firefighters to track smouldering embers and police to search for suspects who are out of sight. COVID-19 outbreak has increased demand from healthcare facilities for the thermal scanners. The device helps healthcare professionals monitor the temperature of the patient's body and take necessary action based on scanner results. The airline industry has also increased demand for thermal scanners, where air passengers are screened for any symptoms of the virus. Thus, all these factors will affect growth of thermal scanners market over the forecast period.

Get more information on this report :

Market Overview and Dynamics

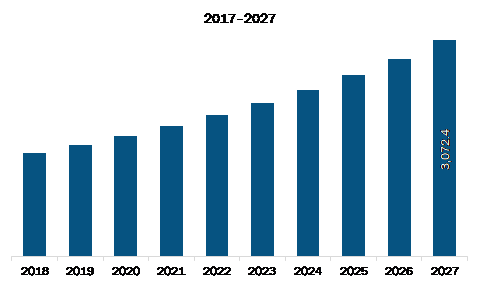

The thermal scanners market in North America is expected to grow from US$ 1591.57 million in 2019 to US$ 3072.43 million by 2027; it is estimated to grow at a CAGR of 8.7% from 2020 to 2027. Thermal imaging cameras or scanners are used as effective and non-invasive means of monitoring and diagnosing the conditions of commercial buildings and homes. A thermal imaging camera helps in identifying the problems at an early stage, allowing them to be documented and corrected before repair becomes more severe and costlier. Besides, a thermal image that includes accurate temperature data can provide to building experts with the essential information about insulation, moisture intake, mold development, electrical faults; presence of thermal bridges; and heating, ventilation, and air conditioning (HVAC) systems. The scanners can detect missing or defective insulation, visualize energy losses, determine the source of air leaks, detect mold and poorly insulated areas, locate thermal bridges, trace water infiltration in flat roofs, check breaches in hot-water pipes, find moisture in insulation, ceilings, and walls (both internal and external), catch construction failures, find faults in supply lines and district heating, and diagnose electrical errors. Further, the ability to visualize differing temperature signatures can also help avoid fires and power failures. The thermal scanners can scan across the walls. Thermal imaging technology may also be used to scan power transmission lines, and exhibit overheating joints and parts in mechanical or electrical equipment that require potential hazards to be eliminated. Thus, the growing use of thermal scanners to diagnose defects in construction sector act as a major opportunity for the growth of thermal scanners market.

North America is one of the most important region for the adoption and growth of new technologies owing to favorable government policies to boost innovation, presence of huge industrial base. The outbreak of COVID-19 has impacted the economic stability in North America, so far US the worst hit country due to outbreak of the Virus. Any impact on the growth of industries is expected to affect the economic growth of the region in a negative manner. In order to contain the spread of the virus the governments across North America imposed factory and businesses shutdown, travel restrictions and lockdown which halted the thermal scanner market in North America for a while. However, as the factories and businesses are re-opening with minimal capacity, need for thermal technologies for checking body temperature is witnessing a growing demand.

Key Market Segments

In terms of type, the fixed segment accounted for the largest share of the North America thermal scanners market in 2019. In terms of wavelength, the long-wavelength infrared segment held a larger market share of the North America thermal scanners market in 2019. Further, the aerospace and defense segment held a larger share of the market based on end use in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the thermal scanners market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are FLIR Systems, Inc., AMETEK Inc., Robert Bosch GmbH, 3M, Leonardo S.p.A, Infrared Cameras Inc., Thermoteknix Systems Ltd., Seek Thermal, Inc., and Fluke Corporation among others.

Reasons to buy report

- To understand the North America thermal scanners market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America thermal scanners market

- Efficiently plan M&A and partnership deals in North America thermal scanners market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America thermal scanners market

- Obtain market revenue forecast for market by various segments from 2020-2027 in North America region.

NORTH AMERICA THERMAL SCANNERS MARKET SEGMENTATION

North America Thermal Scanners Market – By Type

- Handheld

- Fixed

North America Thermal Scanners Market – By Wavelength

- Short-wavelength Infrared

- Medium-wavelength Infrared

- Long-wavelength Infrared

North America Thermal Scanners Market – By End-use

- Industrial

- Aerospace and Defence

- Automotive

- Oil and gas

- Others

North America Thermal Scanners Market – By Country

- US

- Canada

- Mexico

Company Profiles

- Bartec

- BriskHeat

- Chromalox

- Eltherm GmbH

- Emerson Electric Co.

- Mineral Insulated Cable Company (MICC) Ltd.

- Thermocoax Group

- Thermon

- Valin

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Thermal Scanners Market Landscape

4.1 Market Overview

4.2 North America – PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Thermal Scanners Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Upsurge in demand due to the outbreak of COVID-19

5.1.2 Increasing Integration of Thermal Scanner in Automobile

5.2 Market Restraints

5.2.1 Export Restrictions Imposed on Thermal Cameras/Scanners

5.3 Market Opportunities

5.3.1 Rise in adaptation of Thermal Scanners in Construction Sector

5.4 Future Trends

5.4.1 Internet of Things (IoT) powered Thermal Scanner

5.5 Impact Analysis of Drivers and Restraints

6. Thermal Scanners Market – North America Analysis

6.1 Overview

6.1.1 North America Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

6.2 Market Positioning – Five Key Players

7. Thermal Scanners Market Analysis – By Type

7.1 Overview

7.2 North America Thermal Scanners Market Breakdown, by Type, 2019 & 2027

7.3 Handheld

7.3.1 Overview

7.3.2 Handheld Market Revenue and Forecast to 2027 (US$ Million)

7.4 Fixed

7.4.1 Overview

7.4.2 Fixed Market Revenue and Forecast to 2027 (US$ Million)

8. Thermal Scanners Market Analysis– By Wavelength

8.1 Overview

8.2 North America Thermal Scanners Market Breakdown, By Wavelength, 2019 & 2027

8.3 Short-Wave Infrared

8.3.1 Overview

8.3.2 Short-Wave Infrared Market Forecast and Analysis

8.4 Mid-Wave Infrared

8.4.1 Overview

8.4.2 Mid-Wave Infrared Market Forecast and Analysis

8.5 Long-Wave Infrared

8.5.1 Overview

8.5.2 Long-Wave Infrared Market Forecast and Analysis

9. Thermal Scanners Market Analysis – By End-Use

9.1 Overview

9.2 North America Thermal Scanners Market Breakdown, By End-Use, 2019 & 2027

9.3 Industrial

9.3.1 Overview

9.3.2 Industrial Market Forecast and Analysis

9.4 Aerospace and Defense

9.4.1 Overview

9.4.2 North America Aerospace and Defence Market Forecast and Analysis

9.5 Automotive

9.5.1 Overview

9.5.2 Automotive Market Forecast and Analysis

9.6 Oil and Gas

9.6.1 Overview

9.6.2 Oil and Gas Market Forecast and Analysis

9.7 Others

9.7.1 Overview

9.7.2 Others Market Forecast and Analysis

10. Thermal Scanners Market – Country Analysis

10.1 Overview

10.1.1 North America: Thermal Scanners Market, by Key Country

10.1.1.1 US: Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.1.1 US: Thermal Scanners Market, by Type

10.1.1.1.2 US: Thermal Scanners Market, by Wavelength

10.1.1.1.3 US: Thermal Scanners Market, by End Use

10.1.1.2 Canada: Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.2.1 Canada: Thermal Scanners Market, by Type

10.1.1.2.2 Canada: Thermal Scanners Market, by Wavelength

10.1.1.2.3 Canada: Thermal Scanners Market, by End Use

10.1.1.3 Mexico: Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.3.1 Mexico: Thermal Scanners Market, by Type

10.1.1.3.2 Mexico: Thermal Scanners Market, by Wavelength

10.1.1.3.3 Mexico: Thermal Scanners Market, by End Use

11. North America Thermal Scanners Market- COVID-19 Impact Analysis

11.1 North America

12. Thermal Scanners Market-Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

13. Company Profiles

13.1 FLIR Systems, Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 AMETEK Inc.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Robert Bosch GmbH

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 3M

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Leonardo

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Electro Optical Industries

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Infrared Cameras Inc

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Thermoteknix Systems Ltd

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Seek Thermal, Inc.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Fluke Corporation

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. North America Thermal Scanners Market, by Country – Revenue and Forecast to 2027 (USD Million)

Table 3. US: Thermal Scanners Market, by Type – Revenue and Forecast to 2027 (US$ Million)

Table 4. US: Thermal Scanners Market, by Wavelength – Revenue and Forecast to 2027 (US$ Million)

Table 5. US: Thermal Scanners Market, by End Use – Revenue and Forecast to 2027 (US$ Million)

Table 6. Canada: Thermal Scanners Market, by Type – Revenue and Forecast to 2027 (US$ Million)

Table 7. Canada: Thermal Scanners Market, by Wavelength – Revenue and Forecast to 2027 (US$ Million)

Table 8. Canada: Thermal Scanners Market, by End Use – Revenue and Forecast to 2027 (US$ Million)

Table 9. Mexico: Thermal Scanners Market, by Type – Revenue and Forecast to 2027 (US$ Million)

Table 10. Mexico: Thermal Scanners Market, by Wavelength – Revenue and Forecast to 2027 (US$ Million)

Table 11. Mexico: Thermal Scanners Market, by End Use – Revenue and Forecast to 2027 (US$ Million)

Table 12. Glossary of Term: Thermal Scanners Market

LIST OF FIGURES

Figure 1. North America Thermal Scanners Market Segmentation

Figure 2. North America Thermal Scanners Market Overview

Figure 3. North America: Fixed Segment Held the Largest Share During Forecast Period

Figure 4. North America: Aerospace & Defense Segment Dominated the Market

Figure 5. North America: Medium-wave Infrared Segment Dominated the Market

Figure 6. North America: Canada to Show Great Traction During Forecast Period

Figure 7. North America – PEST Analysis

Figure 8. Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. North America Thermal Scanners Market Impact Analysis of Drivers and Restraints

Figure 11. North America Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

Figure 12. North America Thermal Scanners Market Breakdown, by Type (2019 and 2027)

Figure 13. North America Handheld Market Revenue and Forecast to 2027(US$ Million)

Figure 14. North America Fixed Market Revenue and Forecast to 2027(US$ Million)

Figure 15. North America Thermal Scanners Market Breakdown, By Wavelength, 2019 & 2027 (%)

Figure 16. North America Short-Wave Infrared Market Revenue and Forecast to 2027 (US$ Mn)

Figure 17. North America Mid-Wave Infrared Market Revenue and Forecast to 2027 (US$ Mn)

Figure 18. North America Long-Wave Infrared Market Revenue and Forecast to 2027 (US$ Mn)

Figure 19. North America Thermal Scanners Market Breakdown, By End-Use, 2019 & 2027 (%)

Figure 20. North America Industrial Market Revenue and Forecast to 2027(US$ Mn)

Figure 21. North America Aerospace and Defense Market Revenue and Forecast to 2027(US$ Mn)

Figure 22. North America Automotive Market Revenue and Forecast to 2027(US$ Mn)

Figure 23. North America Oil and Gas Market Revenue and Forecast to 2027(US$ Mn)

Figure 24. North America Others Market Revenue and Forecast to 2027(US$ Mn)

Figure 25. North America: Thermal Scanners Market Revenue Share, by Key Country (2019 and 2027)

Figure 26. US: Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

Figure 27. Canada: Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

Figure 28. Mexico: Thermal Scanners Market – Revenue and Forecast to 2027 (US$ Million)

Figure 29. Impact of COVID-19 Pandemic in North American Country Markets

The List of Companies - North America Thermal Scanners Market

- FLIR Systems, Inc.

- AMETEK Inc.

- Robert Bosch GmbH

- 3M

- Leonardo S.p.A.

- Electro Optical Industries

- Infrared Cameras Inc

- Thermoteknix Systems Ltd

- Seek Thermal, Inc.

- Fluke Corporation

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America Thermal Scanners Market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America Thermal Scanners Market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the Thermal Scanners Market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.