North America SiP Technology Market Forecast to 2027 - COVID-19 Impact and Regional Analysis by Packaging Technology (2D IC, 2.5D IC, and 3D IC), Packaging Type (Flip-Chip/Wire-Bond SiP, Fan-Out SiP, and Embedded SiP), Interconnection technique (Small Outline, Flat Packages, Pin Grid Arrays, Surface Mount, and Others), and End-User Industry (Automotive, Aerospace and Defense, Consumer Electronics, Telecommunication, and Others)

Market Introduction

Semiconductor industry is evolving with innovations in product offering to support digitalization. Rising demand for the IoT based electronic devices to enhance connectivity is further propelling the market growth. Advent of 5G network in North America market created lucrative opportunity for the market player to develop new line of electronics devices, having compatibility with 5G connectivity. Rising miniaturization of the electronics to optimize space and design is being fulfilled with system in package technology. New electronic devices require enhanced performance within similar space or compact space for which major companies are selecting SiP. The advanced packaging technologies have to capacity to resolve the 5G chip performance requirements. New packaging technology such as SiP offers solution for various issues like heat dissipation, power consumption and product dimension with embedded antenna for enhanced speed. The system in package technologies are gaining major adoption in North America. Also, electronic miniaturization is at high demand is a major factor driving the North America SiP technology market.

Furthermore, COVID-19 is having a very devastating impact over the North America region. Presently, the US is the worst-affected country due to the COVID-19 outbreak. North America is one of the most important regions for the adoption and growth of new technologies owing to favorable government policies to boost innovation, the presence of a high-tech companies, and high purchasing power, especially in developed countries such as the US and Canada. North American market suffered huge loss in the first half of 2020 owing to high number of COVID-19 patient’s cases, specifically in the US. Post lockdown a market witnessed increasing demand for the digital devices. North America is among the eminent regions in the adoption of advanced network connection devices owing to favorable infrastructure support for high speed internet services. The adoption of the 5G network is supposed to drive the market growth post lockdown. The effect has major impact on manufacturing facilities as production capacities was lowered. Although, the demand for electronics remained still which helped the market to resume the growth. For instance, in December, 2020, Qualcomm Inc a leading manufacturer of microprocessors has predicted that shipments of 5G smartphones will double in year 2022, driven by increasing 5G network deployment. Such increasing adoption of 5G network is lowering the COVID-19 impact for the post lockdown period, while in lockdown it certainly hampered the market growth.

Get more information on this report :

Market Overview and Dynamics

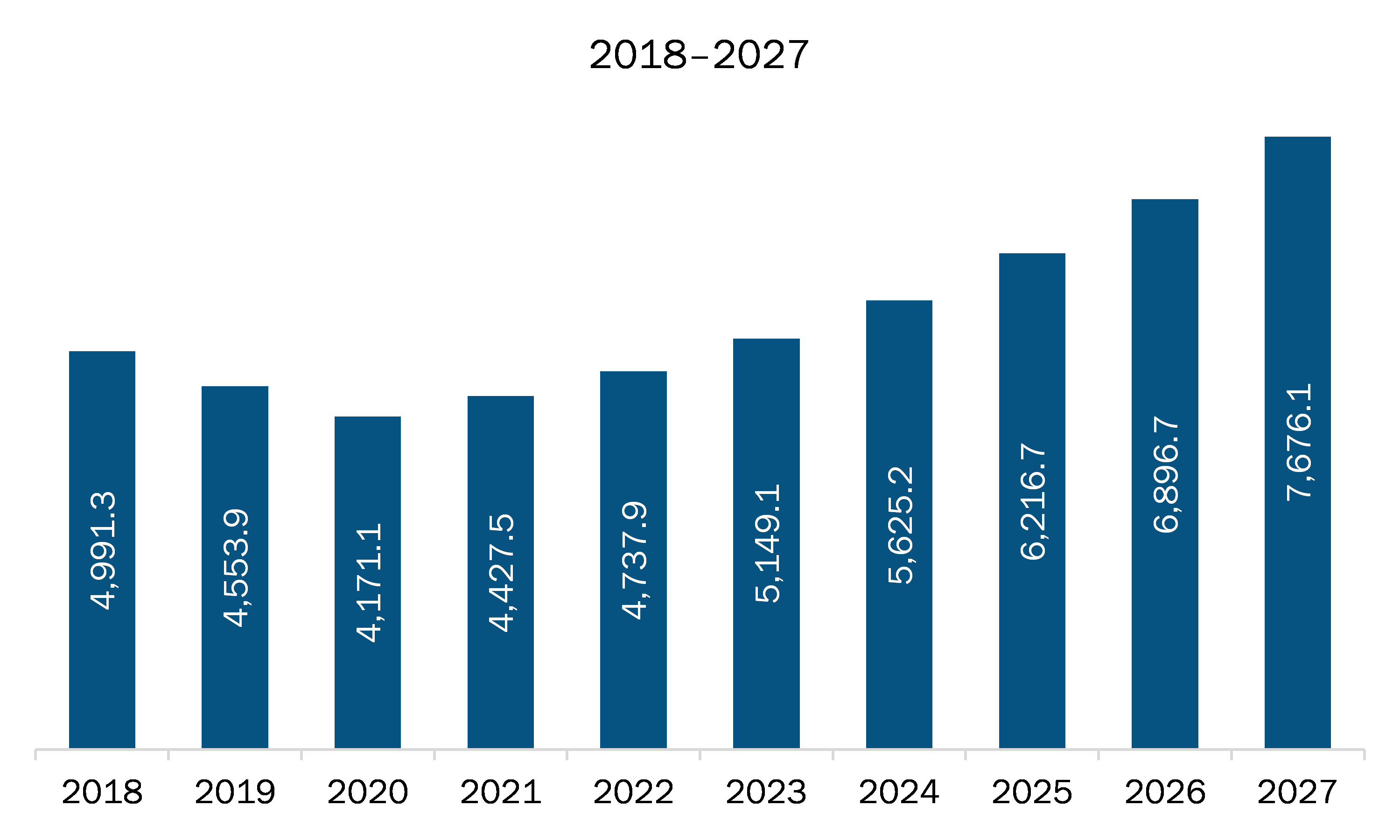

The SiP technology market in North America is expected to grow from US$ 4553.9 million in 2019 to US$ 7676.1 million by 2027; it is estimated to grow at a CAGR of 9.1% from 2020 to 2027. The system in package technology has huge opportunity in the smartphone and PC market to offers advanced processors, transmitters and other components. Technology is improving the device performance as well as offering better space utilization solution. Few market players are developing the processors and other components using the system in packaging technology, while for others its great opportunity to innovate new solution for smartphone and PC processors. For instance, March, 2019, Asus, one of the leading smartphone brands in North America market introduced new ZenFone Max Shot and ZenFone Max Plus M2 smartphones equipped with Qualcomm's new Snapdragon SiP1 chip. Similarly, in December, 2019, Qualcomm developed new arm-based processors for notebooks using the SE Technology’s system-in-package (SiP) services. Such development in the SiP offering in smartphone and PC applications clearly shows the potential opportunity for the market. Rising consumption of smartphones is major supporting factor for the market for which market players needs to provide more focus.

Key Market Segments

In terms of packaging technology, the 2D IC segment accounted for the largest share of the Europe SiP technology market in 2019. Based on packaging type, the flip-chip/wire-bond SiP segment held a larger market share of the Europe SiP technology market in 2019. On basis of interconnection technique, pin grid arrays held a substantial share throughout the forecast period. Based on end-user industry, consumer electronics segment is expected to hold largest market share during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the SiP technology market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amkor Technology, Inc.; ASE Technology Holding Co., Ltd.; ChipMOS TECHNOLOGIES INC.; JCET Group Co., Ltd.; Qualcomm Technologies, Inc.; Renesas Electronics Corporation; Samsung; Taiwan Semiconductor Manufacturing Company, Limited; and Texas Instruments Incorporated.

Reasons to buy report

- To understand the North America SiP technology market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America SiP technology market

- Efficiently plan M&A and partnership deals in North America SiP technology market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America SiP technology market

- Obtain market revenue forecast for market by various segments from 2020-2027 in North America region.

North America SiP technology Market Segmentation

North America SiP technology Market - By Packaging

Technology

- 2D IC

- 2.5D IC

- 3D

North America SiP technology Market - By Packaging Type

- Flip-Chip/Wire-Bond SiP

- Fan-Out SiP

- Embedded SiP

North America SiP technology Market - By Interconnection Technique

- Small Outline

- Flat Packages

- Pin Grid Arrays

- Surface Mount

- Others

North America SiP technology Market - By End-User Industry

- Automotive

- Aerospace and Defense

- Consumer Electronics

- Telecommunication

- Others

North America SiP technology Market, By Country

- US

- Canada

- Mexico

North America SiP technology Market - Company Profiles

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd.

- ChipMOS TECHNOLOGIES INC.

- JCET Group Co., Ltd.

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Samsung

- Taiwan Semiconductor Manufacturing Company, Limited

- Texas Instruments Incorporated

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America System in Package (SiP) Technology Market – By Packaging Technology

1.3.2 North America System in Package (SiP) Technology Market – By Packaging Type

1.3.3 North America System in Package (SiP) Technology Market – By Interconnection Technology

1.3.4 North America System in Package (SiP) Technology Market – By End-User Industry

1.3.5 North America System in Package (SiP) Technology Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America SiP Technology – Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

5. North America SiP Technology –Market Dynamics

5.1 Key Market Drivers

5.1.1 Electronic Miniaturization at High Demand

5.1.2 5G Network Services Developing at Fast Pace

5.2 Key Market Restraints

5.2.1 Issues Related to Technology and Other Alternatives

5.3 Key Market Opportunities

5.3.1 Smartphone and PC performance To Enhance Due to Rising Demand

5.4 Future Trends

5.4.1 Wearable technology including IoT Witnessing Growth

5.5 Impact Analysis of Drivers and Restraints

6. SiP Technology Market – North America Analysis

6.1 North America System in Package (SiP) Technology Market Overview

6.2 North America System in Package (SiP) Technology Market Revenue Forecast and Analysis

6.3 Market Positioning – Five Key Players

7. North America SiP Technology Market Analysis – by Packaging Technology

7.1 Overview

7.2 North America SiP Technology Market Breakdown, by packaging technology, 2019 & 2027

7.3 2D IC

7.3.1 Overview

7.3.2 2D IC Market Forecast and Analysis

7.4 2.5D IC

7.4.1 Overview

7.4.2 2.5D IC Market Forecast and Analysis

7.5 3D IC

7.5.1 Overview

7.5.2 3D IC Market Forecast and Analysis

8. North America SiP Technology Market Analysis – Packaging Type

8.1 Overview

8.2 North America SiP Technology Market Breakdown, By Packaging Type, 2019 &2027

8.3 Flip-Chip/Wire-Bond SiP Market

8.3.1 Overview

8.3.2 Flip-Chip/Wire-Bond SiP Market Forecast and Analysis

8.4 Fan-Out SiP Market

8.4.1 Overview

8.4.2 Fan-Out SiP Market Forecast and Analysis

8.5 Embedded SiP Market

8.5.1 Overview

8.5.2 Embedded SiP Market Forecast and Analysis

9. North America SiP Technology Market Analysis – By Interconnection Technique

9.1 Overview

9.2 North America SiP technology Market Breakdown, By Interconnection Technique, 2019 &2027

9.3 Small Outline

9.3.1 Overview

9.3.2 Small Outline Market Forecast and Analysis

9.4 Flat Packages

9.4.1 Overview

9.4.2 Flat Packages Market Forecast and Analysis

9.5 Pin Grid Arrays

9.5.1 Overview

9.5.2 Pin Grid Arrays Market Forecast and Analysis

9.6 Surface Mount

9.6.1 Overview

9.6.2 Surface Mount Market Forecast and Analysis

9.7 Others

9.7.1 Overview

9.7.2 Others Market Forecast and Analysis

10. North America SiP Technology Market Analysis – By End-User Industry

10.1 Overview

10.2 North America SiP technology Market Breakdown, By END-USER INDUSTRY, 2017 &2027

10.3 Automotive

10.3.1 Overview

10.3.2 Automotive Market Forecast and Analysis

10.4 Aerospace & Defense

10.4.1 Overview

10.4.2 Aerospace and Defense Market Forecast and Analysis

10.5 Consumer Electronics

10.5.1 Overview

10.5.2 Consumer Electronics

10.6 Telecommunications

10.6.1 Overview

10.6.2 Telecommunication Market Forecast and Analysis

10.7 Others

10.7.1 Overview

10.7.2 Others Market Forecast and Analysis

11. North America SiP Technology Market – Country Analysis

11.1 Overview

11.1.1 North America: SiP technology Market, By Country

11.1.2 United States: SiP technology Market – Revenue and Forecast to 2027 (US$ Million)

11.1.2.1 United States System in Package (SiP) Technology Market, by Packaging Technology

11.1.2.2 United States System in Package (SiP) Technology Market, by Packaging Type

11.1.2.3 United States System in Package (SiP) Technology Market, by Interconnection Technology

11.1.2.4 United States System in Package (SiP) Technology Market, by End-user Industry

11.1.3 Canada: SiP technology Market – Revenue and Forecast to 2027 (US$ Million)

11.1.3.1 Canada System in Package (SiP) Technology Market, by Packaging Technology

11.1.3.2 Canada System in Package (SiP) Technology Market, by Packaging Type

11.1.3.3 Canada System in Package (SiP) Technology Market, by Interconnection Technology

11.1.3.4 Canada System in Package (SiP) Technology Market, by End-user

11.1.4 Mexico: SiP technology Market – Revenue and Forecast to 2027 (US$ Million)

11.1.4.1 Mexico System in Package (SiP) Technology Market, by Packaging Technology

11.1.4.2 Mexico System in Package (SiP) Technology Market, by Packaging

11.1.4.3 Mexico System in Package (SiP) Technology Market, by Interconnection Technology

11.1.4.4 Mexico System in Package (SiP) Technology Market, by End-user Industry

12. North America SiP Technology Market - COVID-19 Impact Analysis

12.1 North America: Impact Assessment of COVID-19 Pandemic

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

14. Company Profiles

14.1 Amkor Technology, Inc.

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 ASE Technology Holding Co. Ltd

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 ChipMOS TECHNOLOGIES INC.

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 JCET Group Co., Ltd.

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 SWOT Analysis

14.4.5 Key Developments

14.5 QUALCOMM INCORPORATED

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Samsung

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Renesas Electronics Corporation

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Texas Instruments Incorporated

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Taiwan Semiconductor Manufacturing Company, Limited

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary of TermsLIST OF TABLES

Table 1. North America System in Package (SiP) Technology Market Revenue and Forecasts to 2027 (US$ Million)

Table 2. United States System in Package (SiP) Technology Market, by Packaging Technology – Revenue and Forecast to 2027 (USD Million)

Table 3. United States System in Package (SiP) Technology Market, by Packaging Type – Revenue and Forecast to 2027 (USD Million)

Table 4. United States System in Package (SiP) Technology Market, by Interconnection Technology – Revenue and Forecast to 2027 (USD Million)

Table 5. United States System in Package (SiP) Technology Market, by End-user Industry – Revenue and Forecast to 2027 (USD Million)

Table 6. Canada System in Package (SiP) Technology Market, by Packaging Type – Revenue and Forecast to 2027 (USD Million)

Table 7. Canada System in Package (SiP) Technology Market, by Packaging Type – Revenue and Forecast to 2027 (USD Million)

Table 8. Canada System in Package (SiP) Technology Market, by Interconnection Technology – Revenue and Forecast to 2027 (USD Million)

Table 9. Canada System in Package (SiP) Technology Market, by End-user Industry – Revenue and Forecast to 2027 (USD Million)

Table 10. Mexico System in Package (SiP) Technology Market, by Packaging Technology – Revenue and Forecast to 2027 (USD Million)

Table 11. Mexico System in Package (SiP) Technology Market, by Packaging Type – Revenue and Forecast to 2027 (USD Million)

Table 12. Mexico System in Package (SiP) Technology Market, by Interconnection Technology – Revenue and Forecast to 2027 (USD Million)

Table 13. Mexico System in Package (SiP) Technology Market, by End-user Industry – Revenue and Forecast to 2027 (USD Million)

Table 14. Glossary of TermsLIST OF FIGURES

Figure 1. North America System in Package (SiP) Technology Market Segmentation

Figure 2. North America System in Package (SiP) Technology Market Segmentation – Country

Figure 3. North America System in Package (SiP) Technology Market Overview

Figure 4. US Held the Largest Share in North America System in Package (SiP) Technology Market in 2019

Figure 5. North America System in Package (SiP) Technology Market, By Packaging Technology

Figure 6. North America System in Package (SiP) Technology Market, By Packaging Type

Figure 7. North America System in Package (SiP) Technology Market, By Interconnection Technology

Figure 8. North America System in Package (SiP) Technology Market, By End-User Industry

Figure 9. North America: PEST Analysis

Figure 10. North America System in package (SiP) technology Market- Ecosystem Analysis

Figure 11. North America System in package (SiP) technology Market Impact Analysis of Drivers and Restraints

Figure 12. North America System in Package (SiP) Technology Market Revenue Forecast and Analysis, (US$ Million)

Figure 13. North America SiP technology Market Breakdown, by packaging technology, 2019 & 2027 (%)

Figure 14. North America 2D IC Market Revenue and Forecast to 2027 (US$ Mn)

Figure 15. 2.5D IC Market Revenue and Forecast to 2027 (US$ Mn)

Figure 16. North America 3D IC Market Revenue and Forecast to 2027 (US$ Mn)

Figure 17. North America SiP Technology Market Breakdown, By Packaging Type, 2019 & 2027 (%)

Figure 18. North America Flip-Chip/ Wire-Bond Sip Market Revenue and Forecast to 2027 (US$ MN)

Figure 19. North America Fan-Out SiP Market Revenue and Forecast to 2027 (US$ Mn)

Figure 20. North America Embedded SiP Market Revenue and Forecast to 2027 (US$ Mn)

Figure 21. North America SiP Technology Market Breakdown, By Interconnection Technique, 2019 &2027 (%)

Figure 22. North America Small Outline Market Revenue and Forecast to 2027 (US$ Mn)

Figure 23. North America Flat Packages Market Revenue and Forecast to 2027 (US$ Mn)

Figure 24. North America Pin Grid Arrays Market Revenue and Forecast to 2027 (US$ Mn)

Figure 25. North America Surface Mount Market Revenue and Forecast to 2027 (US$ Mn)

Figure 26. North America Others Market Revenue and Forecast to 2027 (US$ Mn)

Figure 27. North America SiP Technology Market Breakdown, By END-USER INDUSTRY, 2019 &2027 (%)

Figure 28. North America Automotive Market Revenue and Forecast to 2027 (US$ Mn)

Figure 29. North America Aerospace and Defense Market Revenue and Forecast to 2027 (US$ Mn)

Figure 30. North America Consumer Electronics Market Revenue and Forecast to 2027 (US$ Mn)

Figure 31. North America Telecommunication Market Revenue and Forecast to 2027 (US$ Mn)

Figure 32. North America Others Market Revenue and Forecast to 2027 (US$ Mn)

Figure 33. North America SiP Technology Market Revenue Share, By Country (2019 and 2027)

Figure 34. United States: SiP technology Market – Revenue and Forecast to 2027 (US$ Million)

Figure 35. Canada: SiP technology Market – Revenue and Forecast to 2027 (US$ Million)

Figure 36. Mexico: SiP technology Market – Revenue and Forecast to 2027 (US$ Million)

Figure 37. Impact of COVID-19 Pandemic in North American Country MarketsSome of the leading companies are:

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd.

- ChipMOS TECHNOLOGIES INC.

- JCET Group Co., Ltd.

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Samsung

- Taiwan Semiconductor Manufacturing Company, Limited

- Texas Instruments Incorporated

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America SiP technology market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America SiP technology market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the SiP technology market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution