North America Security Inspection Market Forecast to 2027 - COVID-19 Impact and Regional Analysis by Product Type (Personnel Screening Systems, Cargo and Baggage Inspection Systems, Vehicle Inspection Systems, and Others), and Application (Aviation, Border Security, Critical Infrastructure Protection, Commercial Security, and Others)

Market Introduction

Security inspection systems are electronic devices or manual or visual inspection of baggage, person, vehicle, and others to detect possession of prohibited, illegal, and other dangerous items into a secure area. Security inspections assist in threat recognition to safeguard public places, airports, borders, and other places against terrorism. The various technologies used for security inspection are biometric technologies, X-rays, explosive trace detectors, electromagnetic detectors, and others. The advancements in technology are creating a lucrative opportunity for companies offering security inspection system. Companies are developing new applications such as Nuclear Quadrapole Resonance (NQR). This technology can detect explosives embedded in electronics, which are hidden under layers of shoes or clothes. This technology is currently deployed in international airports of America. The recent Rising acceptance of vehicle inspection system at border checkpoints is expected to create a significant demand for security inspection in the coming years, which is further anticipated to drive the North America security inspection market. Furthermore, COVID-19 is having a very devastating impact over the North America region. Presently, the US is the world’s worst-affected country due to the COVID-19 outbreak. North America is one of the most important regions for the adoption and growth of new technologies owing to favorable government policies to boost innovation, the presence of a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Hence, any impact on the growth of industries is expected to affect the economic growth of the region in a negative manner. The US is a prominent market for browser isolation, especially in the IT & BFSI sectors. The huge increase in the number of confirmed cases and falling GDP in the country has affected these industries. The companies and business shutdowns across the US, Canada, and Mexico are impacting the adoption of the security inspection market. North America region is home to a large number of technology companies, and thus the impact of coronavirus outbreak is anticipated to be quite severe in the year 2020 and likely in 2021. However, the impact of COVID-19 is short-term and is likely to decrease in the coming years.

Get more information on this report :

Market Overview and Dynamics

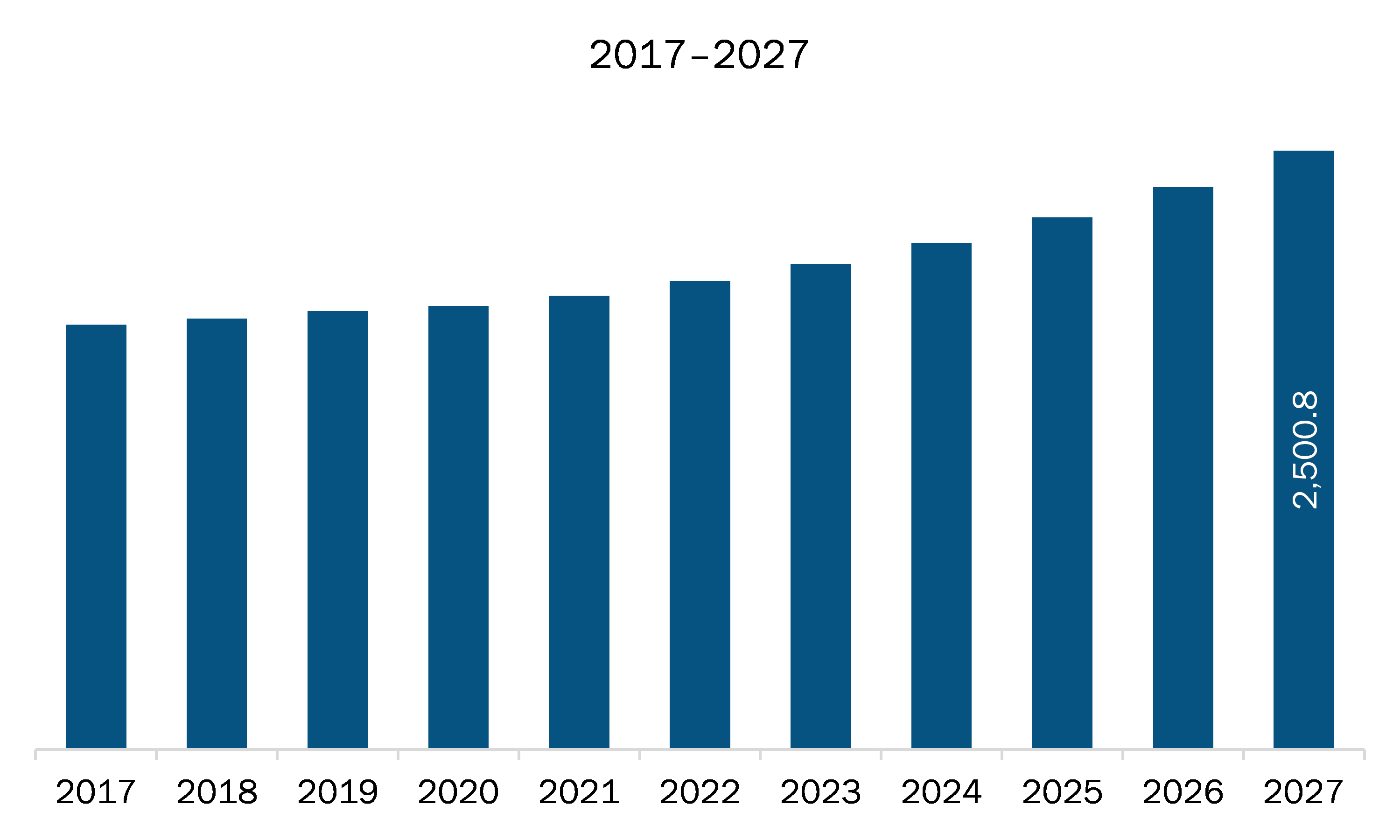

The security inspection market in North America is expected to grow from US$ 1,830.0 million in 2019 to US$ 2,500.8 million by 2027; it is estimated to grow at a CAGR of 4.4% from 2020 to 2027. Lack of skilled security personnel coupled with rising integration of automation technologies in security systems is influencing the surge in demand for automated security scanning systems. These automated systems enable computer-based security operations with predefined rules. Moreover, these systems are enabling to speed up the security checking processes in a systematic manner; thereby, reducing the risk of any human errors. The automated systems reduce the burden of repetitive tasks; thus, offering more time for the security personnel to focus on other critical security operations. Thus, the added benefits of automated security systems are contributing to the growth of the North America security inspection market.

Key Market Segments

In terms of product type, the personnel screening systems segment accounted for the largest share of the North America security inspection market in 2019. In terms of application, the aviation segment held a larger market share of the North America security inspection market in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the security inspection market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADANI; Analogic Corporation; C.E.I.A. SpA; Leidos; Nuctech Company Limited; OSI Systems, Inc.; Smiths Group plc.

Reasons to buy report

- To understand the North America security inspection market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America security inspection market

- Efficiently plan M&A and partnership deals in North America security inspection market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America security inspection market

- Obtain market revenue forecast for market by various segments from 2020-2027 in North America region.

North America Security Inspection Market Segmentation

North America Security Inspection Market - By Product Type

- Personnel Screening Systems

- Cargo and Baggage Inspection Systems

- Vehicle Inspection Systems

- Others

North America Security Inspection Market - By Enterprise Size

- Aviation

- Border Security

- Critical Infrastructure Protection

- Commercial Security

- Others

North America Security Inspection Market - By Country

- US

- Canada

- Mexico

North America Security Inspection Market - Company Profiles

- ADANI

- Analogic Corporation

- C.E.I.A. SpA

- Leidos

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Group plc

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Security Inspection Market – By Product Type

1.3.2 North America Security Inspection Market – by Application

1.3.3 North America Security Inspection Market- By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Security Inspection Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Security Inspection Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Acceptance of Vehicle Inspection System at Border Checkpoints

5.1.2 Rise in Need for Full-Body X-ray Screening Systems at Important Locations

5.2 Market Restraint

5.2.1 Universality of Legacy Security Inspection System

5.3 Market Opportunity

5.3.1 Collaboration of Artificial Intelligence Along with Security Inspection Systems

5.4 Future Trend

5.4.1 Upcoming of Automated Security Scanning

5.5 Impact Analysis of Drivers and Restraints

6. Security Inspection Market –North America Analysis

6.1 Security Inspection Market North America Overview

6.2 North America Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning – Five Key Players

7. North America Security Inspection Market Analysis – By Product Type

7.1 Overview

7.2 North America Security Inspection Market, By Product Type (2019 and 2027)

7.3 Personnel Screening Systems

7.3.1 Overview

7.3.2 Personnel Screening Systems: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

7.4 Cargo and Baggage Inspection Systems

7.4.1 Overview

7.4.2 Cargo and Baggage Inspection Systems: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

7.5 Vehicle Inspection Systems

7.5.1 Overview

7.5.2 Vehicle Inspection Systems: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

8. North America Security Inspection Market Analysis – by Application

8.1 Overview

8.2 North America Security Inspection Market, by Application (2019 and 2027)

8.3 Aviation

8.3.1 Overview

8.3.2 Aviation: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

8.4 Border Security

8.4.1 Overview

8.4.2 Border Security: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

8.5 Critical Infrastructure Protection

8.5.1 Overview

8.5.2 Critical Infrastructure Protection: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

8.6 Commercial Security

8.6.1 Overview

8.6.2 Commercial Security: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

9. North America Security Inspection Market – Country Analysis

9.1 Overview

9.1.1 North America: Security Inspection Market, By Country

9.1.1.1 US: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.1.1 US: Security Inspection Market, By Product Type

9.1.1.1.2 US: Security Inspection Market, By Application

9.1.1.2 Canada: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.2.1 Canada: Security Inspection Market, By Product Type

9.1.1.2.2 Canada: Security Inspection Market, By Application

9.1.1.3 Mexico: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.3.1 Mexico: Security Inspection Market, By Product Type

9.1.1.3.2 Mexico: Security Inspection Market, By Application

10. Impact of COVID-19 Pandemic on North America Security Inspection Market

10.1 North America: Impact assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Merger and Acquisition

12. Company Profiles

12.1 ADANI

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Analogic Corporation

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 C.E.I.A. SpA

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Leidos

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Nuctech Company Limited

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 OSI Systems, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Smiths Group plc

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word IndexLIST OF TABLES

Table 1. North America Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. North America: Security Inspection Market, By Country – Revenue and Forecast to 2027 (US$ Million)

Table 3. US: Security Inspection Market, By Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 4. US: Security Inspection Market, By Application – Revenue and Forecast to 2027 (US$ Million)

Table 5. Canada: Security Inspection Market, By Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 6. Canada: Security Inspection Market, By Application – Revenue and Forecast to 2027 (US$ Million)

Table 7. Mexico: Security Inspection Market, By Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 8. Mexico: Security Inspection Market, By Application – Revenue and Forecast to 2027 (US$ Million)

Table 9. List of AbbreviationLIST OF FIGURES

Figure 1. North America Security Inspection Market Segmentation

Figure 2. North America Security Inspection Market Segmentation – By Country

Figure 3. North America Security Inspection Market Overview

Figure 4. Personnel Screening Systems Segment Held the Largest Market Share Based on Product Type

Figure 5. Aviation Segment Held the Largest Market Share Based on Application

Figure 6. US to Show Great Traction During Forecast Period

Figure 7. North America – PEST Analysis

Figure 8. Expert Opinion

Figure 9. North America Security Inspection Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 11. North America Security Inspection Market Revenue Share, by Product Type (2019 and 2027)

Figure 12. North America Personnel Screening Systems: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 13. North America Cargo and Baggage Inspection Systems: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 14. North America Vehicle Inspection Systems: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 15. North America Others: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 16. North America Security Inspection Market Revenue Share, by Application (2019 and 2027)

Figure 17. North America Aviation: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 18. North America Border Security: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 19. North America Critical Infrastructure Protection: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 20. North America Commercial Security: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 21. North America Others: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 22. North America: Security Inspection Market Revenue Share, By Country (2019 and 2027)

Figure 23. US: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 24. Canada: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 25. Mexico: Security Inspection Market – Revenue and Forecast to 2027 (US$ Million)

Figure 26. Impact of COVID-19 Pandemic in North America Country MarketsSome of the leading companies are:

- ADANI

- Analogic Corporation

- C.E.I.A. SpA

- Leidos

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Group plc

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America security inspection market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America security inspection market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the security inspection market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution