North America Oilfield Service Market Forecast to 2028 – COVID-19 Impact and Analysis – by Application (Onshore and Offshore) and Service Type (Well Completion, Wire line, Artificial Lift, Perforation, Drilling and Completion Fluids, and Others)

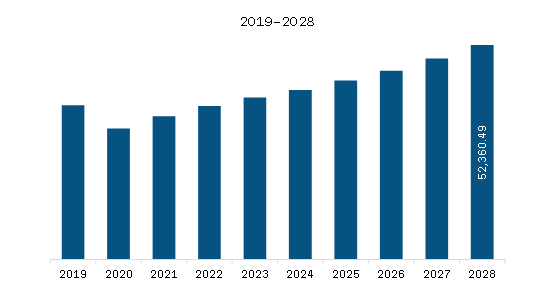

The oilfield service market in North America is expected to grow from US$ 34,957.33 million in 2021 to US$ 52,360.49 million by 2028. It is estimated to grow at a CAGR of 5.9% from 2021 to 2028.

The trapped shale gases cannot easily flow into the well because of the limited permeability of shale rocks. Oil and gas firms use hydraulic fracturing and other stimulation operations to improve the permeability of shale formations and generate trapped shale gases. Shale gas emits less carbon than coal and, therefore, can be a greener energy option in many nations that rely on coal as an energy source. Shale gas production has resulted in a new abundance of natural gas supply. Due to advancements in extraction technology, it is likely to take up the anticipated future.

According to the Energy Information Administration (EIA), the US's unproven theoretically recoverable shale gas potential is estimated to be 482 trillion cubic feet. Shale gas output in the country has surged 12-fold in the previous decade, and the growth is expected to continue until at least 2035. With the development of well-finishing methods such as multistage hydraulic fracturing and drilling techniques, such as long-reach horizontal wellbores, Canada offers long-term possibilities for natural gas supply across the region. Therefore, the continuous growth of shale basins in this region is boosting the growth of the North America oilfield services market.

North America Oilfield Service Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

North America Oilfield Service Market Segmentation

The North America oilfield service market is analyzed on the basis of application, service type, and country. Based on application, the market is bifurcated into onshore and offshore. In 2020, the onshore segment held the largest share in the market.

Based on service type, the market is segmented into well completion, wireline, artificial lift, perforation, drilling and completion fluids, and others. In 2020, the others segment held the largest share in the market.

Similarly, based on country, the market is segmented into the US, Canada, and Mexico. The US contributed a substantial share in 2020.

Archer; Baker Hughes Company; Halliburton Energy Services, Inc; Hunting PLC; NOV Inc; Pioneer Energy Services Corp; Schlumberger Limited; Weatherford International plc; and Wireline Services Group are the leading companies in the North America oilfield service market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Oilfield Service Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 North America

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. North America Oilfield Service Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Oil and Gas Production and Exploration (E&P) Activities

5.1.2 Rising Shale Gas Extraction

5.2 Market Restraints

5.2.1 Volatility in Crude Oil Prices

5.3 Market Opportunities

5.3.1 Increasing Demand of Offshore/Deep-Water Discoveries

5.4 Future Trends

5.4.1 Technological Innovation in Oilfield Service

5.5 Impact Analysis of Drivers And Restraints

6. Oilfield Service – North America Market Analysis

6.1 North America Oilfield Service Market

6.2 North America Oilfield Service Market Revenue Forecast and Analysis

7. North America Oilfield Service Market – By Application

7.1 Overview

7.2 North America Oilfield service Market, By Application (2020 and 2028)

7.3 Onshore

7.3.1 Overview

7.3.2 Onshore: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Offshore

7.4.1 Overview

7.4.2 Offshore: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8. North America Oilfield Service Market – By Service type

8.1 Overview

8.2 North America Oilfield service Market, By Service type (2020 and 2028)

8.3 Well Completion

8.3.1 Overview

8.3.2 Well completion: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Wire line

8.4.1 Overview

8.4.2 Wire line: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Artificial lift

8.5.1 Overview

8.5.2 Artificial lift: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Perforation

8.6.1 Overview

8.6.2 Perforation: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.7 Drilling and Completion Fluids

8.7.1 Overview

8.7.2 Drilling and Completion Fluids: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.8 Others

8.8.1 Overview

8.8.2 Others: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9. North America Oilfield Service Market – Country Analysis

9.1 North America: Oilfield Service Market

9.1.1 North America: Oilfield Service Market, by Key Country

9.1.1.1 US: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 US: Oilfield Service Market, By Application

9.1.1.1.2 US: Oilfield Service Market, by Service type

9.1.1.2 Canada: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 Canada: Oilfield Service Market, By Application

9.1.1.2.2 Canada: Oilfield Service Market, by Service type

9.1.1.3 Mexico: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 Mexico: Oilfield Service Market, By Application

9.1.1.3.2 Mexico: Oilfield Service Market, by Service type

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 Merger and Acquisition

10.4 New Development

11. Company Profiles

11.1 Archer

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Baker Hughes Company

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Halliburton Energy Services, Inc.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Hunting PLC

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 NOV Inc.

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Schlumberger Limited

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Weatherford International plc

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Pioneer Energy Services Corp.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Wireline Services Group

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. North America Oilfield Service Market Revenue and Forecast to 2028 (US$ Million)

Table 2. North America: Oilfield Service Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 7. Mexico: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 9. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Oilfield Service Market Segmentation

Figure 2. North America Oilfield Service Market Segmentation – By Country

Figure 3. North America Oilfield Service Market Overview

Figure 4. North America Oilfield Service Market, By Application

Figure 5. North America Oilfield Service Market, By Service type

Figure 6. North America Oilfield Service Market, By Country

Figure 7. North America – PEST Analysis

Figure 8. North America Oilfield Service Market- Ecosystem Analysis

Figure 9. North America Oilfield Service Market Impact Analysis of Drivers and Restraints

Figure 10. North America Oilfield Service Market Revenue Forecast and Analysis (US$ Million)

Figure 11. North America Oilfield Service Market Revenue Share, by Application (2020 and 2028)

Figure 12. Onshore: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Offshore: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. North America Oilfield Service Market Revenue Share, by Service type (2020 and 2028)

Figure 15. Well completion: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Wire line: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Artificial lift: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Perforation: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Drilling and Completion Fluids: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Others: North America Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America: Oilfield Service Market, by key Country– Revenue (2020) (US$ Million)

Figure 22. North America: Oilfield Service Market Revenue Share, by Key Country (2020 and 2028)

Figure 23. US: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Canada: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Mexico: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

- Archer

- Baker Hughes Company

- Halliburton Energy Services, Inc

- Hunting PLC

- NOV Inc

- Pioneer Energy Services Corp

- Schlumberger Limited

- Weatherford International plc

- Wireline Services Group

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America Oilfield Service Market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America Oilfield Service Market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving Oilfield Service Market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution