North America Lead Generation Solution Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Offering (Software and Services) and Enterprise Size (SMEs and Large Enterprises)

Market Introduction

North America is one of the most powerful economies as alone the US accounts around US$ 18.1 trillion worth nominal GDP in 2019, which is the largest by any country across the world to lead such value. The companies operating in the lead generation solution market in North America are providing solutions to many industries. Real estate is one of the fastest growing industries in the region. The industry in the US is extensively using lead generation techniques for business development activities, such as local search engine optimization (SEO); creating community pages; placing ads on Google; blogging; optimizing social media pages; and creating landing pages of buyers guide, property listing, and appointments page. Real Estate, renting, and leasing constitutes the largest sector of the US economy with the GDP value of around $2 trillion accounting for approx. 13% of the national GDP. The sector contributes to the economy in two fronts; the first being through consumer spending through rent and payment of household utilities, and the other being through residential investment that encompasses the construction of new housing units, broker fees, and residential remodeling. In addition, North America constitutes industries such as finance and insurance, healthcare, retail, and automotive that widely uses lead generation solutions for selling their products. Thus, the strong presence of various industries in the region is propelling the growth of the lead generation solution market in North America.

In case of COVID-19, North America is highly affected especially the US. The economic growth was slowed, which directly impacted various trading activities across the region. By the end of 2020, the US witnessed 140,000 job losses, and unemployment rate stood at 6.7%, clearly indicating that the economy was faltering. One of the biggest impacts of COVID-19 on the B2B industry was the cancellations of in-person meetings and trade shows. eMarketer highlights, a survey from Demand Gen Report in 2020, stated that almost 53% of US B2B marketers see trade shows and in-person meetings as an effective approach to drive the conversion of leads. Since number of trade shows and personal meetings decreased, this has had significant impacts on lead generation as well as sales. On the other hand, limited workforce strength, owing to the imposition of strict containment measures, led to rise of online meetings through platforms such as Zoom, Google Meet, and Cisco. Thus, lead generation software and services helped these online platforms to generate leads for many big and small companies. Decreased demand in sectors such as real estate, travel, and automotive hampered the market growth of lead generation software and services in North America. However, post-pandemic, the lead generation solution market is anticipated to see a promising growth.

Get more information on this report :

Market Overview and Dynamics

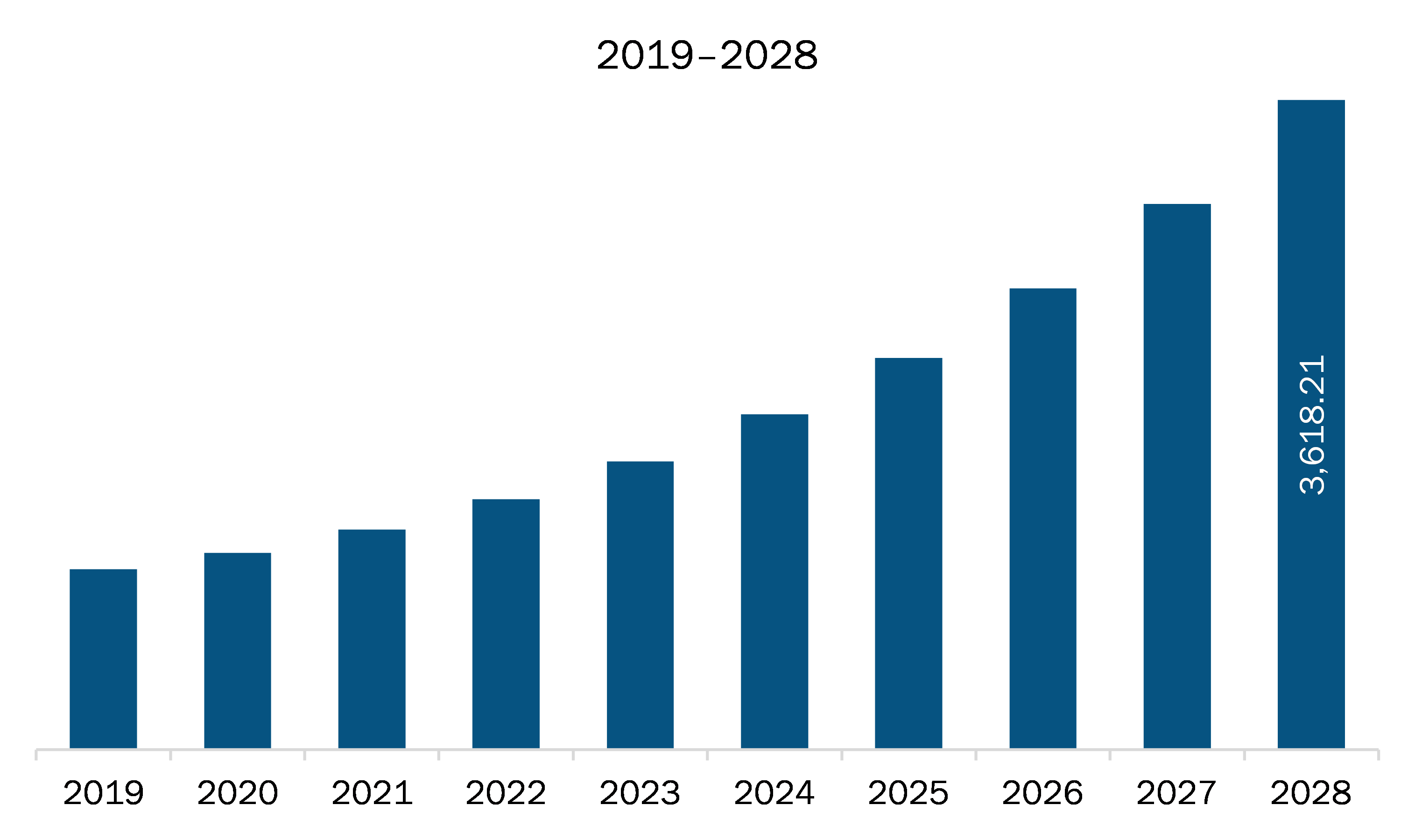

The North America lead generation solution market is expected to grow from US$ 1,224.68 million in 2021 to US$ 3,618.21 million by 2028; it is estimated to grow at a CAGR of 16.7% from 2021 to 2028. In North America, the finance and insurance sector is growing rapidly on a large scale. Rising per capita disposable income has led to increase in impulsive buying. As income has increased, various banks as well as nonbanking financial institutes and finance firms are willing to give loans for various purposes. Vehicle loan, education loan, personal loan, home loan, agriculture loan, gold loan, etc., are the types of loans offered to customers. Along with this, health insurance, vehicle insurance, term insurance, travel insurance, property insurance, etc., are the insurance types offered by insurance companies. Companies and firms can make use of lead generation software and services for approaching relevant customers with high conversion probability. The lead generation software and services help in collecting and generating leads based on parameters such as past loan history, credit score, salary, income, and assets. Based on various statistics and figures, companies can structure innovative plans and schemes for respective new segment of customers. For example, Hubspot’s Marketing Software helps in running successful campaigns, converting visitors to customers, and attracting only potential leads, thereby saving time wasted on every single visitor. Therefore, rising expansion of finance and insurance sector is expected to fuel the North America lead generation solution market growth in coming years.

Key Market Segments

In terms of offering, the software segment accounted for the largest share of the North America lead generation solution market in 2020. In terms of enterprise size, the large enterprises segment held a larger market share of the North America lead generation solution market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America lead generation solution market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are agilecrm.com; Belkins Inc.; Bitrix, Inc.; callboxinc.com; Cience Technologies; Cloudtask; DemandWorks Media; HubSpot, Inc.; Leadfeeder; Martal Group; PureB2B; TechTarget; and WebiMax.com.

Reasons to buy report

- To understand the North America lead generation solution market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America lead generation solution market

- Efficiently plan M&A and partnership deals in North America lead generation solution market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America lead generation solution market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Lead Generation Solution Market Segmentation

North America Lead Generation Solution Market - By Offering

- Software

- Services

North America Lead Generation Solution Market - By Enterprise Size

- SMEs

- Large Enterprises

North America Lead Generation Solution Market - By Country

- US

- Canada

- Mexico

North America Lead Generation Solution Market - Company Profiles

- agilecrm.com

- Belkins Inc.

- Bitrix, Inc.

- callboxinc.com

- Cience Technologies

- Cloudtask

- DemandWorks Media

- HubSpot, Inc.

- Leadfeeder

- Martal Group

- PureB2B

- TechTarget

- WebiMax.com

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Lead Generation Solution Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. North America Lead Generation Solution Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Scope of Education Sector

5.1.2 Increasing Count of Internet Users

5.2 Market Restraints

5.2.1 Less Awareness About Lead Generation Tools

5.3 Market Opportunities

5.3.1 Rising Expansion of Finance and Insurance sector

5.4 Future Trends

5.4.1 Integration with Artificial Intelligence and Machine Learning

5.5 Impact Analysis of Drivers and Restraints

6. Lead Generation Solution Market – North America Analysis

6.1 North America Lead Generation Solution Market Overview

6.2 North America Lead Generation Solution Market Revenue Forecast and Analysis

7. North America Lead Generation Market Analysis – By Offering

7.1 Overview

7.2 North America Lead Generation Solution Market, By Offering (2020 and 2028)

7.3 Software

7.3.1 Overview

7.3.2 Software: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

7.4 Services

7.4.1 Overview

7.4.2 Services: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

8. North America Lead Generation Solution Market Analysis – By Enterprise Size

8.1 Overview

8.2 North America Lead Generation Solution Market, By Enterprise Size (2020 and 2028)

8.3 SMEs

8.3.1 Overview

8.3.2 SMEs: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

8.4 Large Enterprises

8.4.1 Overview

8.4.2 Large Enterprises: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

9. North America Lead Generation Solution Market – Country Analysis

9.1 Overview

9.1.1 North America: Lead Generation Solution Market, By Country

9.1.1.1 US: Lead Generation Solution Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.1.1 US: Lead Generation Solution Market, By Offering

9.1.1.1.2 US: Lead Generation Solution Market, By Enterprise Size

9.1.1.2 Canada: Lead Generation Solution Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.2.1 Canada: Lead Generation Solution Market, By Offering

9.1.1.2.2 Canada: Lead Generation Solution Market, By Enterprise Size

9.1.1.3 Mexico: Lead Generation Solution Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.3.1 Mexico: Lead Generation Solution Market, By Offering

9.1.1.3.2 Mexico: Lead Generation Solution Market, By Enterprise Size

10. North America Lead Generation Solution Market - COVID-19 Impact Analysis

10.1 North America: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

12. Company Profiles

12.1 agilecrm.com

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Belkins Inc.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 callboxinc.com

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Cience Technologies

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Cloudtask

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Bitrix, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 HubSpot, Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Leadfeeder

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Martal Group

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 WebiMax.com

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

12.11 TechTarget

12.11.1 Key Facts

12.11.2 Business Description

12.11.3 Products and Services

12.11.4 Financial Overview

12.11.5 SWOT Analysis

12.11.6 Key Developments

12.12 DemandWorks Media

12.12.1 Key Facts

12.12.2 Business Description

12.12.3 Products and Services

12.12.4 Financial Overview

12.12.5 SWOT Analysis

12.12.6 Key Developments

12.13 PureB2B

12.13.1 Key Facts

12.13.2 Business Description

12.13.3 Products and Services

12.13.4 Financial Overview

12.13.5 SWOT Analysis

12.13.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. North America Lead Generation Solution Market Revenue and Forecast to 2028 (US$ Million)

Table 2. North America: Lead Generation Solution Market Revenue Share, By Country

Table 3. US Lead Generation Solution Market, By Offering– Revenue and Forecast to 2027 (US$ Million)

Table 4. US Lead Generation Solution Market, By Enterprise Size – Revenue and Forecast to 2027 (US$ Million)

Table 5. Canada Lead Generation Solution Market, By Offering– Revenue and Forecast to 2027 (US$ Million)

Table 6. Canada Lead Generation Solution Market, By Enterprise Size – Revenue and Forecast to 2027 (US$ Million)

Table 7. Mexico Lead Generation Solution Market, By Offering– Revenue and Forecast to 2027 (US$ Million)

Table 8. Mexico Lead Generation Solution Market, By Enterprise Size – Revenue and Forecast to 2027 (US$ Million)

Table 9. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Lead Generation Solution Market Segmentation

Figure 2. North America Lead Generation Solution Market Segmentation – By Country

Figure 3. North America Lead Generation Solution Market Overview

Figure 4. North America Lead Generation Solution Market, By Offering

Figure 5. North America Lead Generation Solution Market, By Enterprise Size

Figure 6. North America Lead Generation Solution Market, By Country

Figure 7. North America PEST Analysis

Figure 8. North America Lead Generation Solution Market- Ecosystem Analysis

Figure 9. North America Lead Generation Solution Market Impact Analysis of Drivers and Restraints

Figure 10. North America Lead Generation Solution Market Revenue Forecast and Analysis (US$ Million)

Figure 11. North America Lead Generation Solution Market Revenue Share, by Product Type (2020 and 2028)

Figure 12. North America Software: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

Figure 13. North America Services: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

Figure 14. North America Lead Generation Solution Market Revenue Share, by Application (2020 and 2028)

Figure 15. North America SMEs: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

Figure 16. North America Large Enterprises: Lead Generation Solution Market – Revenue, and Forecast to 2028 (USD Million)

Figure 17. North America: Lead Generation Solution Market, by Key Country – Revenue (2020) (USD Million)

Figure 18. North America: Lead Generation Solution Market Revenue Share, By Country (2020 and 2028)

Figure 19. US: Lead Generation Solution Market – Revenue and Forecast to 2027 (US$ Million)

Figure 20. Canada: Lead Generation Solution Market – Revenue and Forecast to 2027 (US$ Million)

Figure 21. Mexico: Lead Generation Solution Market – Revenue and Forecast to 2027 (US$ Million)

Figure 22. Impact of Covid-19 Pandemic in North American Country Markets

- agilecrm.com

- Belkins Inc.

- Bitrix, Inc.

- callboxinc.com

- Cience Technologies

- Cloudtask

- DemandWorks Media

- HubSpot, Inc.

- Leadfeeder

- Martal Group

- PureB2B

- TechTarget

- WebiMax.com

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America lead generation solution market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America lead generation solution market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the lead generation solution market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution