North America Hydrographic Survey Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Component (Software and Services) and End User (Marine and Oil & Gas)

Market Introduction

North America includes developed economies, such as the US and Canada, and emerging economies, such as Mexico. Technological developments make North America a highly competitive market for various companies. The companies in this region are continuously developing overall business processes to meet end users’ demands for high-quality products. Presently, the US boasts of robust port infrastructure and maritime sector due to its significant reliance on imported goods and notable outsourcing of manufacturing and production facilities over Asian economies. As per the National Ocean Service, the marine transportation system in the US moves ~80% of the country’s overseas trade in terms of weight. The region is highly inclined to keep its marine transportation system functioning in safe and efficient ways. North America is focused on achieving data about water depth, the shape of the seafloor and coastline, and other physical features of water bodies. Thus, it is highly adopting hydrographic survey software and services, which offer efficient data to improve the water bodies. A National Oceanic and Atmospheric Administration (NOAA) survey ship uses its multibeam echo sounder—a sound transmitting and receiving system—to perform the hydrographic surveys. Thus, to conduct surveys to measure various activities in oceans and rivers, the demand for hydrographic surveys is surging in the region; this, in turn, is accelerating the market growth.

Furthermore, in case of COVID-19, North America is highly affected specially the US. North America is one of the most important regions for adopting and developing new digital technologies due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Hence, any negative impact on the growth of industries is expected to affect the economic growth of the region. Presently, the US is the world’s worst-affected country due to the COVID-19 outbreak, with 26,654,965 confirmed cases and 458,544 deaths as of 8th February 2021 by the World Health Organization (WHO). The US is a prominent market for the hydrographic survey for oil & gas and marine sectors. The factory and business shutdowns across the US, Canada, and Mexico impact the adoption of the hydrographic survey market. Due to shortage in the workforce and the practical difficulties in many social distancing cases hindered oil & gas activities in the US, which leads to a halt in various ongoing projects. Thus, it also impacted the integration of hydrographic survey software. The ongoing COVID-19 crisis and critical situation in the US will impact the hydrographic survey market growth of North America negatively for the next few months.

Get more information on this report :

Market Overview and Dynamics

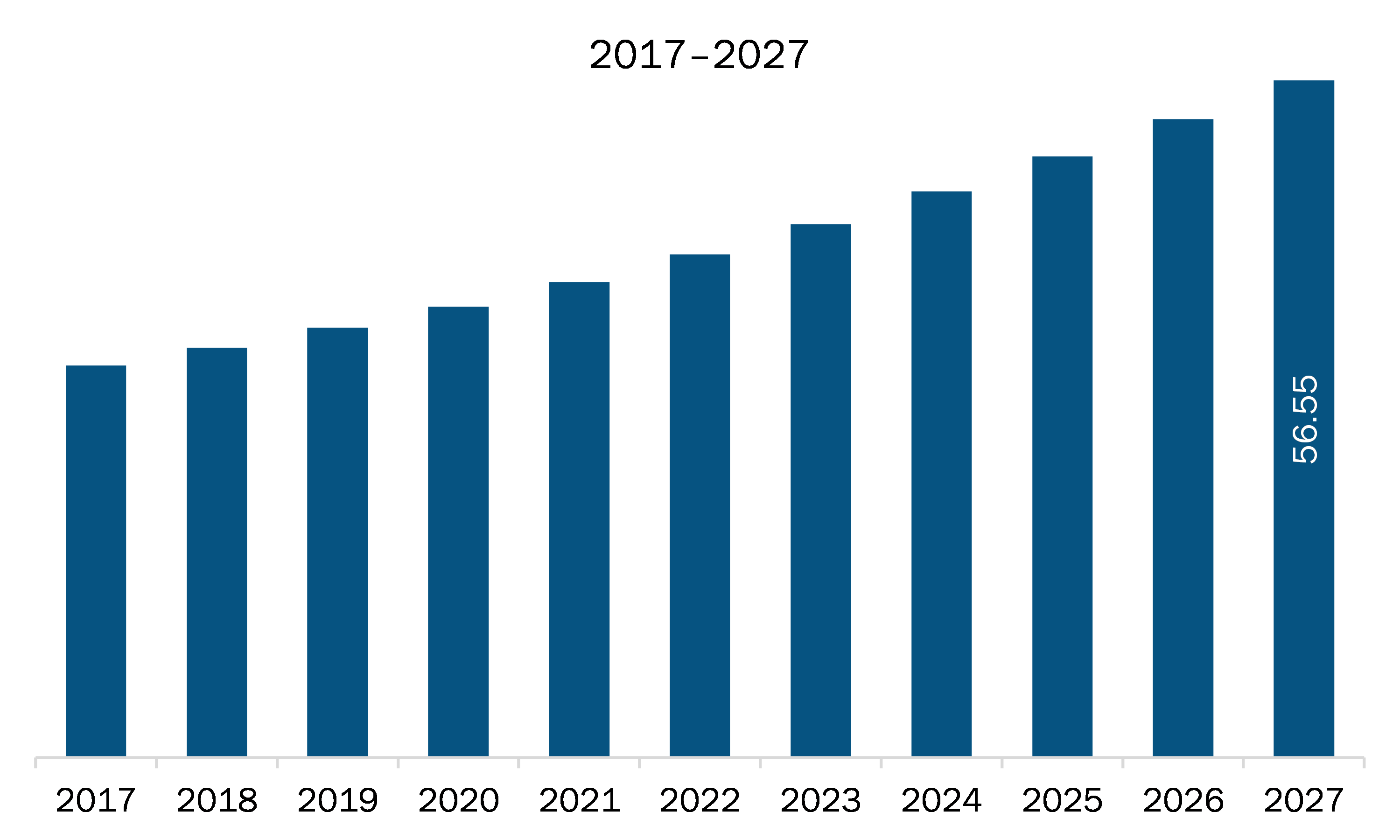

The North America hydrographic survey market is expected to grow from US$ 35.90 million in 2019 to US$ 56.55 million by 2027; it is estimated to grow at a CAGR of 6.0 % from 2020 to 2027. Growing demand for energy & power projects is expected to upsurge the North America hydrographic survey market. North American countries such as Mexico and Canada, are likely to offer numerous growth opportunities to the hydrographic survey providers during the forecast period. The growth in industrialization in these economies has led to urbanization, resulting in a rapid increase in energy consumption. Moreover, the demand for energy and power is set to increase with surging household incomes and expanding manufacturing and heavy industries. The number of energy & power projects, including wind and solar projects, is mounting rapidly in North American countries. Thus, the rise in demand for energy and power—leading to the escalation in the related projects—especially in countries like Mexico, is expected to provide numerous profitable business opportunities for hydrographic survey market players during the forecast period across North America region.

Key Market Segments

In terms of component, the software segment accounted for the largest share of the North America hydrographic survey market in 2019. In terms of end user, the oil & gas segment held a larger market share of the North America hydrographic survey market in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America hydrographic survey market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Esri, HYPACK / Xylem Inc., IIC Technologies, Quality Positioning Services B.V. (QPS), Teledyne Marine (Teledyne Technologies Incorporated), Triton Imaging, Inc.

Reasons to buy report

- To understand the North America hydrographic survey market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America hydrographic survey market

- Efficiently plan M&A and partnership deals in North America hydrographic survey market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America hydrographic survey market

- Obtain market revenue forecast for market by various segments from 2020-2027 in North America region.

North America Hydrographic Survey Market Segmentation

North America Hydrographic Survey Market - By Component

- Software

- Services

North America Hydrographic Survey Market - By End User

- Marine

- Oil & Gas

North America Hydrographic Survey Market - By Country

- US

- Canada

- Mexico

North America Hydrographic Survey Market - Company Profiles

- Esri

- HYPACK / Xylem Inc.

- IIC Technologies

- Quality Positioning Services B.V. (QPS)

- Teledyne Marine (Teledyne Technologies Incorporated)

- Triton Imaging, Inc.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Hydrographic Survey Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Hydrographic Survey Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growth in Number of Offshore Oil & Gas Projects

5.1.2 Increasing Maritime Commerce and Transport

5.2 Market Restraints

5.2.1 Less Awareness in Several Countries

5.3 Market Opportunities

5.3.1 Growing Demand for Energy & Power Projects

5.4 Future Trends

5.4.1 Technological Enhancement in Hydrographic Survey Software and Services

5.5 Impact Analysis of Drivers and Restraints

6. Hydrographic Survey Market – North America Analysis

6.1 North America Hydrographic Survey Market Overview

6.2 North America Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

7. North America Hydrographic Survey Market Analysis – By Component

7.1 Overview

7.2 North America Hydrographic Survey Market, By Component (2019 and 2027)

7.3 Software

7.3.1 Overview

7.3.2 Software: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

7.4 Services

7.4.1 Overview

7.4.2 Services: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

8. North America Hydrographic Survey Market Analysis –By End User

8.1 Overview

8.2 North America Hydrographic Survey Market Breakdown, by End User, 2019 & 2027

8.3 Marine

8.3.1 Overview

8.3.2 Marine Market Revenue and Forecast to 2027 (US$ Million)

8.4 Oil & Gas

8.4.1 Overview

8.4.2 Oil & Gas Market Revenue and Forecast to 2027 (US$ Million)

9. North America Hydrographic Survey Market – Country Analysis

9.1 Overview

9.1.1 North America: Hydrographic Survey Market, by Key Country

9.1.1.1 US: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.1.1 US: Hydrographic Survey Market, by Component

9.1.1.1.2 US: Hydrographic Survey Market, by End User

9.1.1.2 Canada: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.2.1 Canada: Hydrographic Survey Market, by Component

9.1.1.2.2 Canada: Hydrographic Survey Market, by End User

9.1.1.3 Mexico: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.3.1 Mexico: Hydrographic Survey Market, by Component

9.1.1.3.2 Mexico: Hydrographic Survey Market, by End User

10. North America Hydrographic Survey Market- COVID-19 Impact Analysis

10.1 North America: Impact assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

12. COMPANY PROFILES

12.1 HYPACK / Xylem Inc.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 IIC Technologies

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Teledyne Marine (Teledyne Technologies Incorporated)

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Triton Imaging, Inc.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Quality Positioning Services B.V. (QPS)

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Esri

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. North America Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. US: Hydrographic Survey Market, by Component –Revenue and Forecast to 2027 (US$ Million)

Table 3. US: Hydrographic Survey Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 4. Canada: Hydrographic Survey Market, by Component – Revenue and Forecast to 2027 (US$ Million)

Table 5. Canada: Hydrographic Survey Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 6. Mexico: Hydrographic Survey Market, by Component – Revenue and Forecast to 2027 (US$ Million)

Table 7. Mexico: Hydrographic Survey Market, by End User –Revenue and Forecast to 2027 (US$ Million)

Table 8. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Hydrographic Survey Market Segmentation

Figure 2. North America Hydrographic Survey Market Segmentation – By Country

Figure 3. North America Hydrographic Survey Market Overview

Figure 4. Software Segment is Expected to Dominate the Market by Component

Figure 5. Oil & Gas segment Held Largest Market Share in 2019

Figure 6. US Held Largest Market Share in 2019

Figure 7. North America PEST Analysis

Figure 8. Expert Opinion

Figure 9. North America Hydrographic Survey Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Figure 11. North America Hydrographic Survey Market Revenue Share, by Component (2019 and 2027)

Figure 12. North America Software: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Figure 13. North America Services: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Figure 14. North America Hydrographic Survey Market Breakdown, by End User (2019 and 2027)

Figure 15. North America Marine Market Revenue and Forecast to 2027(US$ Million)

Figure 16. North America Oil & Gas Market Revenue and Forecast to 2027(US$ Million)

Figure 17. North America: Hydrographic Survey Market, by Key Country – Revenue (2019) (USD Million)

Figure 18. North America: Hydrographic Survey Market Revenue Share, by Key Country (2019 and 2027)

Figure 19. US: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Figure 20. Canada: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Figure 21. Mexico: Hydrographic Survey Market – Revenue and Forecast to 2027 (US$ Million)

Figure 22. Impact of COVID-19 Pandemic in North American Country Markets

- Esri

- HYPACK / Xylem Inc.

- IIC Technologies

- Quality Positioning Services B.V. (QPS)

- Teledyne Marine (Teledyne Technologies Incorporated)

- Triton Imaging, Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America hydrographic survey market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America hydrographic survey market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the hydrographic survey market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution