North America Household Insecticides Market to 2027 - Regional Analysis and Forecasts By Insect Type (Mosquitoes & Flies, Rats & other Rodents, Termites, Bedbugs & Beetles, Others); Composition (Natural, Synthetic); Packaging (Small, Medium, Large); Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Store, others)

The North America household insecticides market is accounted to US$ 2245.1 Mn in 2018 and is expected to grow at a CAGR of 5.5% during the forecast period 2019 – 2027, to account to US$ 3610.3 Mn by 2027.

US is dominating the North America household insecticides market, followed by Mexico. The market for household insecticides in US is increasing due to the dense populations in major metropolitan areas. US is also a leading producer of household insecticides in North America. The domestic sales of household insecticides in US have increased with the increase in production capacities and a surge in export. The need to protect oneself from deadly vector-borne diseases has led to high demand for insect sprays used in kitchens, bedrooms, outdoors, and lawns. This growing need for household insecticides to control and prevent the proliferation of insects is anticipated to generate significant demand for household insecticides in North America during the forecast period.

North America Household Insecticides Market

Get more information on this report :

Market Insights

Growing preference for natural household insecticides by a large share of consumer base

Increasing demand for household insecticides made from natural ingredients has led to a surge in the demand for non-synthetic household insecticides for domestic uses. Synthetic insecticides are known to contain harmful chemicals and substances which are perceived to negatively impact the health of individual. The growing awareness related to health and rising concern over the potential harm caused by synthetic insecticides has driven the need for natural insecticides. Natural household insecticides such as plant-based dust, liquid and aerosol formulations offer a wide variety of indoor and outdoor protection from a range of different insect species. Natural household insecticides are eco-friendly, very efficient and safe.

Insect Type Insights

The North America household insecticides market is segmented on the basis of insect type as mosquitoes & flies, rats & other rodents, termites, bedbugs & beetles, and others. The mosquitoes & flies North America household insecticides market is estimated to hold a dominant share in the market in 2018. There has been a rising demand for mosquito insecticides in the North America market. There are two leading and most widely used insecticides that are used in the preparation of household insecticides to be effective against mosquitoes known as malathion and permethrin. Malathion is an organophosphate that is quite often used for the elimination of mosquitoes indoors as well as outdoors and also against a wide range of insects. It is used in a small amount as in the mosquito insecticide as it possesses no harm to humans. Permethrin is another chemical that is widely used in the preparation of mosquito insecticides that belongs to the group of chemicals known as pyrethroids. This chemical is mixed with water or oil and is applied as a mist. This chemical is used in the preparation of mosquito insecticides as it damages the central nervous system of the mosquitoes and is noted to cause no harm to the humans as well as animals. Growing concerns regarding the risks associated with vector-borne diseases carried by mosquitoes and flies in urban areas is expected to fuel the growth of the household insecticides market in North America

Form Insights

The North America household insecticides market is segmented based on composition as natural and synthetic. The synthetic segment accounts for the largest share in the North America household insecticides market, while the natural segment also contributes a significant share in the market. The rising awareness of the effects of insects and it playing the role of epidemic diseases has led to an upsurge in the use of household insecticides and synthetic household insecticides in particular. Synthetic household insecticides are widely used all over North America as they are relatively inexpensive and are very efficient in killing pest and insects. The rising spread of mosquitoes, and other bugs due to deforestation and rapid urbanization is expected to drive the market for synthetic household insecticides market in the forecast period. While growing awareness about the ill-effects of synthetic pesticides has swayed many users towards more eco-friendly natural household insecticides. Manufacturers are launching new natural household insecticides to cater to these demand. The market for natural household insecticides is anticipated to grow in the forecast period.

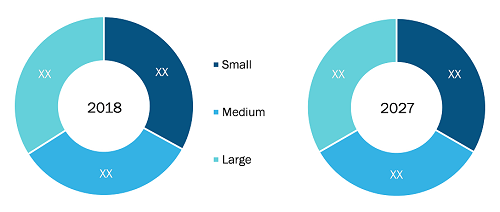

Packaging Insights

The North America household insecticides market is segmented based on packaging as small, medium, and large. The small segment leads the North America household insecticides market whereas medium segment is expected to grow at fastest growth rate during the forecast period of 2019-2027. The small packaging type of household insecticides generally weighs between 250 gm. to 500 gm. It has been noted that the small packaging insecticides have been frequently used as they are easy to port and can be used before the product expires. It has a short period of use due to its acute weight. The easy portability and low weight of the small packaging household insecticides has been a contributing factor for the expansion of the market all over the globe.

North America Household Insecticides Market by Packaging

Get more information on this report :

Strategic Insights

New product development, market initiatives and merger and acquisition were observed as the most adopted strategies in North America household insecticides market. Few of the recent developments in the North America household insecticides market are listed below:

2018: Neogen Corp announced the addition of DeciMax Place Packs and Blocks — a proven effective and all-weather rodenticide bait available in multiple product formats.

2017: Neogen Corp announced the launch of DeciMax Soft Bait, an effective rodenticide bait that combines superior palatability with the flexibility to use in extreme weather conditions

2016: Liphatech Inc. launches TakeDown soft bait to fight against anticoagulant-resistant rodent populations

NORTH AMERICA HOUSEHOLD INSECTICIDES SEGMENTATION

By Insect Type

- Mosquitoes & Flies

- Rats & other Rodents

- Termites

- Bedbugs & Beetles

- Others

By Composition

- Natural

- Synthetic

By Packaging

- Small

- Medium

- Large

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Stores

- Others

By Country

- US

- Canada

- Mexico

Company Profiles

- Godrej Consumer Products Limited

- Liphatech, Inc.

- Neogen Corporation

- SC Johnson & Son, Inc.

- Spectrum Brands, Inc.

- Reckitt Benckiser Group plc

- Sumitomo Chemical Co., Ltd.

- Bayer AG.

- Medella Laboratories

- Chase Products Co.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Household Insecticides Market – By Insect Types

1.3.2 North America Household Insecticides Market – By Composition

1.3.3 North America Household Insecticides Market – By Packaging

1.3.4 North America Household Insecticides Market – By Distribution Channel

1.3.5 North America Household Insecticides Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Household Insecticides Market Landscape

4.1 Market Overview

4.2 PEST Analysis – North America

5. Household Insecticides Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Increase in Consumption of Household Insecticides in the US

5.1.2 Increased Emphasis On The Control Of Insect Vectors By Local And National Government Bodies

5.2 Key Market Restraints

5.2.1 Harmful Health Effects of Synthetic Household Insecticides

5.3 Key Market Opportunity

5.3.1 Rising acceptance of natural form of household insecticides

5.4 Future Trends

5.4.1 Protection of bees from harmful effects of insectecides

5.5 Impact Analysis Of Drivers And Restraints

6. Household Insecticides – North America Market Analysis

6.1 North America Household Insecticides Market Overview

6.2 North America Household Insecticides Market Forecast and Analysis

7. North America Household Insecticides Market Analysis – By Insect Types

7.1 Overview

7.2 North America Household Insecticides Market Breakdown, By Insect Types, 2018 & 2027

7.3 Mosquitoes & Flies

7.3.1 Overview

7.3.2 North America Mosquitoes & Flies Market Revenue Forecasts To 2027 (US$ Mn)

7.4 Rats & Other Rodents

7.4.1 Overview

7.4.2 North America Rat & Other Rodents Market Revenue Forecasts To 2027 (US$ Mn)

7.5 Termites

7.5.1 Overview

7.5.2 North America Termites Market Revenue Forecasts To 2027 (US$ Mn)

7.6 Bedbugs & Beetles

7.6.1 Overview

7.6.2 North America Bedbugs & Beetles Market Revenue Forecasts To 2027 (US$ Mn)

7.7 Others

7.7.1 Overview

7.7.2 North America Others Market Revenue Forecasts To 2027 (US$ Mn)

8. North America Household Insecticides Market Analysis – By Composition

8.1 Overview

8.2 North America Household Insecticides Market Breakdown, By Composition, 2018 & 2027

8.3 Synthetic

8.3.1 Overview

8.3.2 North America Synthetic Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

8.4 Natural

8.4.1 Overview

8.4.2 North America Natural Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

9. North America Household Insecticides Market Analysis – By Packaging

9.1 Overview

9.2 North America Household Insecticides Market Breakdown, By Packaging, 2018 & 2027

9.3 Small

9.3.1 Overview

9.3.2 North America Small Packaging Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

9.4 Medium

9.4.1 Overview

9.4.2 North America Medium Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

9.5 Large

9.5.1 Overview

9.5.2 North America Large Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

10. Household Insecticides Market – Country Analysis

10.1 Overview

10.1.1 North America Household Insecticides Market Breakdown, by Country

10.1.1.1 US Household Insecticides Market Revenue Forecasts to 2027 (US$ MN)

10.1.1.1.1 US Household Insecticides Market Breakdown by Insect Types

10.1.1.1.2 US Household Insecticides Market Breakdown by Composition

10.1.1.1.3 US Household Insecticides Market Breakdown by Packaging

10.1.1.1.4 US Household Insecticides Market Breakdown by Distribution Channel

10.1.1.2 Canada Household Insecticides Market Revenue Forecasts To 2027 (Us$ Mn)

10.1.1.2.1 Canada Household Insecticides Market Breakdown By Insect Types

10.1.1.2.2 Canada Household Insecticides Market Breakdown by Composition

10.1.1.2.3 Canada Household Insecticides Market Breakdown By Packaging

10.1.1.2.4 Canada Household Insecticides Market Breakdown By Distribution Channel

10.1.1.3 Mexico Household Insecticides Market Revenue Forecasts to 2027 (US$ MN)

10.1.1.3.1 Mexico Household Insecticides Market Breakdown By Insect Types

10.1.1.3.2 Mexico Household Insecticides Market Breakdown By Composition

10.1.1.3.3 Mexico Household Insecticides Market Breakdown By Packaging

10.1.1.3.4 Mexico Household Insecticides Market Breakdown By Distribution Channel

11. Industry Landscape

11.1 Overview

11.2 New Development

11.3 Strategy and Business Planning

12. Company Profiles

12.1 Godrej Consumer Products Limited

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Liphatech, Inc.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Neogen Corporation

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 SC Johnson & Son, Inc.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.5 Spectrum Brands, Inc.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Reckitt Benckiser Group plc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.7 Sumitomo Chemical Co., Ltd.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.8 Bayer AG.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.9 Medella Laboratories

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.10 Chase Products Co.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Financial Overview

12.10.4 SWOT Analysis

13. Appendix

13.1 About The Insight Partners

13.2 Glossary

LIST OF TABLES

Table 1. North America Household insecticides Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. North America Household Insecticides Market Revenue and Forecasts to 2027 – By Insect Types (US$ Mn)

Table 3. North America Household Insecticides Market Revenue and Forecasts to 2027 – By Composition (US$ Mn)

Table 4. North America Household Insecticides Market Revenue and Forecasts to 2027 – By Packaging (US$ Mn)

Table 5. US Household Insecticides Market Revenue and Forecasts to 2027 – By Insect Types (US$ Mn)

Table 6. US Household Insecticides Market Revenue and Forecasts to 2027 – By Composition (US$ Mn)

Table 7. US Household Insecticides Market Revenue and Forecasts to 2027 – By Packaging (US$ Mn)

Table 8. US Household Insecticides Market Revenue and Forecasts to 2027 – By Distribution Channel (US$ Mn)

Table 9. Canada Household Insecticides Market Revenue And Forecasts To 2027 – By Insect Types (Us$ Mn)

Table 10. Canada Household Insecticides Market Revenue and Forecasts to 2027 – By Composition (US$ Mn)

Table 11. Canada Household Insecticides Market Revenue And Forecasts To 2027 – By Packaging (US$ Mn)

Table 12. Canada Household Insecticides Market Revenue And Forecasts To 2027 – By Distribution Channel (US$ Mn)

Table 13. Mexico Household Insecticides Market Revenue And Forecasts To 2027 – By Insect Types (Us$ Mn)

Table 14. Mexico Household Insecticides Market Revenue And Forecasts To 2027 – By Composition (Us$ Mn)

Table 15. Mexico Household Insecticides Market Revenue And Forecasts To 2027 – By Packaging (Us$ Mn)

Table 16. Mexico Household Insecticides Market Revenue And Forecasts To 2027 – By Distribution Channel (Us$ Mn)

Table 17. Glossary of Terms, North America Household Insecticides Market

LIST OF FIGURES

Figure 1. North America Household Insecticides Market Segmentations

Figure 2. North America Household Insecticides Market Segmentation – By Country

Figure 3. North America Household Insecticides Market Overview

Figure 4. Mosquitoes & Flies Segment Held Largest Share In The North America Household insecticides Market

Figure 5. US Dominated The Asia Pacific Household Insecticides Market In 2018

Figure 6. North America Household Insecticides Market, Industry Landscape

Figure 7. North America– PEST Analysis

Figure 8. North America Household insecticides Market Impact Analysis of Driver and Restraints

Figure 9. North America Household Insecticides Market Breakdown by Insect Types, 2018 & 2027 (%)

Figure 10. North America Mosquitoes & Flies Market Revenue Forecasts To 2027 (US$ Mn)

Figure 11. North America Rat & Other Rodents Market Revenue Forecasts To 2027 (US$ Mn)

Figure 12. North America Termites Market Revenue Forecasts To 2027 (US$ Mn)

Figure 13. North America Bedbugs & Beetles Market Revenue Forecasts To 2027 (US$ Mn)

Figure 14. North America Household Insecticides Market Breakdown by Composition, 2018 & 2027 (%)

Figure 15. North America Synthetic Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 16. North America Natural Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 17. North America Household Insecticides Market Breakdown by Packaging, 2018 & 2027 (%)

Figure 18. North America Small Packaging Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 19. North America Medium Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 20. North America Large Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 21. North America Household Insecticides Market Breakdown by Country, 2018 & 2027(%)

Figure 22. US Household Insecticides Market Forecasts to 2027 (US$ MN)

Figure 23. Canada Household Insecticides Market Forecasts To 2027 (Us$ Mn)

Figure 24. Mexico Household Insecticides Market Forecasts to 2027 (US$ MN)

The List of Companies

- Godrej Consumer Products Limited

- Liphatech, Inc

- Neogen Corporation

- SC Johnson & Son, Inc

- Spectrum Brands, Inc.

- Reckitt Benckiser Group plc

- Sumitomo Chemical Co., Ltd.

- Bayer AG

- Medella Laboratories

- Chase Products Co.