North America Helicopters Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Single Rotor, Multi Rotor, and Tilt Rotor), Weight (Light Weight, Medium Weight, and Heavy Weight), and Application (Commercial & Civil and Military)

Market Introduction

The technological advancements in North America have led to highly competitive markets. Moreover, the region is a home of world’s largest manufacturing industry, which is harnessing the latest designing and tools for producing the most advanced products and solutions, including helicopters. The region has a diversified manufacturing sector that produces consumer as well as industrial products. It is the home of most of the fortune 500 companies in the world, who also happen to be the extensive designing and R&D centers based in the region. The region houses key helicopter manufacturers such as Bell Helicopter Textron, Inc.; Airbus Helicopters, Inc.; Boeing Military Aircraft; Enstrom Helicopter Corporation; and Lockheed Martin Corporation. Airbus Helicopters Inc. is one of the prominent helicopter manufacturers in the region. The company has served the region’s customers for more than 50 years with its manufacturing/production facilities lines in Columbus and Mississippi (states in the US). More than 1,000 skilled and dedicated employees support some 800 customers and more than 2,600 aircraft in service in the region/country. The demand for helicopters in the region is driven by growing procurement of helicopters for commercial and military uses. The commercial helicopter market growth in the region is largely propelled by usage of helicopters for professional training and leisure purpose. The demand for military helicopters is fueled by the ongoing process of replacing and modernizing the fleet size and capabilities undertaken by regional military/armed forces.

In case of COVID-19, North America is highly affected specially the US, with thousands of infected individuals facing severe health conditions across the country. The US is the highest military spender across the globe and has a substantial number of defense contractors across its borders. On the contrary, the continuous growth of infected individuals has led the government to impose lockdown across the nation’s borders. During Q2 and Q3 of 2020, the majority of the manufacturing plants were either temporarily shut or operating with minimum staff. Moreover, the supply chain of equipment and related components are disrupted. In addition, the demand for defense equipment has been showcasing a slowdown since the outbreak of the virus in the country. The US is the hub of prominent helicopter manufacturers; however, the emergence of the pandemic has resulted in supply chain issues, leading to disruption in helicopter production.

Get more information on this report :

Market Overview and Dynamics

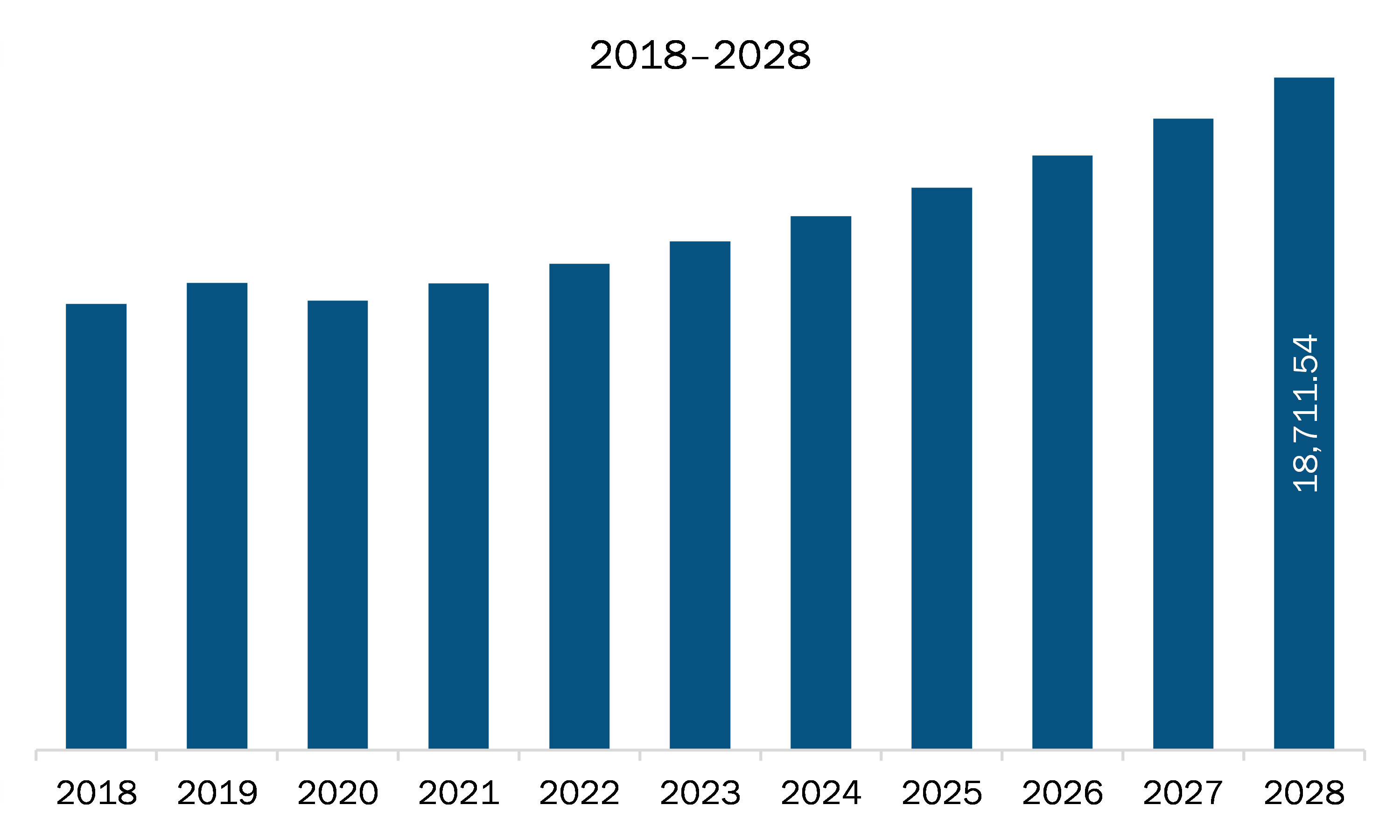

The North America helicopters market is expected to grow from US$ 12,982.93 million in 2021 to US$ 18,711.54 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028. Aging helicopter fleet will drive the North America helicopters market. Many countries across North America are now witnessing an increase in aging helicopter fleet size, which is creating immense demand for new and advanced helicopters. OEMs can effectively use this opportunity to strengthen their market position. Further, according to a report published in 2018–2019, approximately 25% of the total helicopter fleet size in US is over 20 years old and falls under “fleet renewal pending “category, which is expected to create opportunity for OEMs in the market. Several ongoing upgrade programs taking place in various major countries are expected to create growth opportunity for OEMs, which will drive the North America helicopters market in coming years.

Key Market Segments

In terms of type, the single rotor segment accounted for the largest share of the North America helicopters market in 2020. In terms of weight, the medium weight segment held a larger market share of the North America helicopters market in 2020. Further, the military segment held a larger share of the North America helicopters market based on application in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America helicopters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Airbus S.A.S.; Bell Textron Inc.; Boeing; Enstrom Helicopter Corp.; Kaman Corporation; Leonardo S.p.A.; Lockheed Martin Corporation; MD Helicopters, Inc.; Robinson Helicopter Company; and Russian Helicopters.

Reasons to buy report

- To understand the North America helicopters market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America helicopters market

- Efficiently plan M&A and partnership deals in North America helicopters market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America helicopters market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Helicopters Market Segmentation

North America Helicopters Market - By Type

- Single Rotor

- Multi Rotor

- Tilt Rotor

North America Helicopters Market - By Weight

- Light Weight

- Medium Weight

- Heavy Weight

North America Helicopters Market - By Application

- Commercial & Civil

- Transport

- Emergency Rescue

- Utility

- Training

- Military

- Attack and Reconnaissance

- Maritime

- Transport Search and Rescue

- Training

North America Helicopters Market - By Country

- US

- Canada

- Mexico

North America Helicopters Market - Company Profiles

- Airbus S.A.S.

- Bell Textron Inc.

- Boeing

- Enstrom Helicopter Corp.

- Kaman Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, Inc.

- Robinson Helicopter Company

- Russian Helicopters

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Helicopters Market – By Type

1.3.2 North America Helicopters Market – By Weight

1.3.3 North America Helicopters Market – By Application

1.3.4 North America Helicopters Market- By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Helicopters Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat of New Entrants

4.2.4 Threat of Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. North America Helicopters Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Demand for Search and Rescue (SAR) Helicopters

5.1.2 Increasing Military Expenditure on Advanced and Lightweight Helicopters

5.2 Market Restraints

5.2.1 Less Adoption of Advanced Helicopters

5.3 Market Opportunities

5.3.1 Aging Helicopter Fleet

5.4 Future Trends

5.4.1 Growing Development of Unmanned Helicopters and Use of Advanced Materials and Technology

5.5 Impact Analysis of Drivers and Restraints

6. Helicopters Market – North America Analysis

6.1 North America Helicopters Market Overview

6.2 North America Helicopters Market –Revenue and Forecast to 2028 (US$ Million)

7. North America Helicopters Market Analysis – By Type

7.1 Overview

7.2 North America Helicopters Market Breakdown, by Type, 2020 and 2028

7.3 Single Rotor

7.3.1 Overview

7.3.2 Single Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

7.4 Multi Rotor

7.4.1 Overview

7.4.2 Multi Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

7.5 Tilt Rotor

7.5.1 Overview

7.5.2 Tilt Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

8. North America Helicopters Market Analysis – By Weight

8.1 Overview

8.2 North America Helicopters Market, by Weight (2020 and 2028)

8.3 Light Weight

8.3.1 Overview

8.3.2 Light Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Medium Weight

8.4.1 Overview

8.4.2 Medium Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Heavy Weight

8.5.1 Overview

8.5.2 Heavy Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9. North America Helicopters Market Analysis – By Application

9.1 Overview

9.2 North America Helicopters Market, by Application (2020 and 2028)

9.3 Commercial and Civil

9.3.1 Overview

9.3.2 Commercial and Civil: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.3 Transport

9.3.3.1 Overview

9.3.3.2 Transport: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.4 Emergency Rescue

9.3.4.1 Overview

9.3.4.2 Emergency Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.5 Utility

9.3.5.1 Overview

9.3.5.2 Utility: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.6 Training

9.3.6.1 Overview

9.3.6.2 Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Military

9.4.1 Overview

9.4.2 Military: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.3 Attack and Reconnaissance

9.4.3.1 Overview

9.4.3.2 Attack and Reconnaissance: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.4 Maritime

9.4.4.1 Overview

9.4.4.2 Maritime: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.5 Transport, Search and Rescue

9.4.5.1 Overview

9.4.5.2 Transport Search and Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.6 Training

9.4.6.1 Overview

9.4.6.2 Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10. North America Helicopters Market – Country Analysis

10.1 Overview

10.1.1 North America: Helicopters Market- by Key Country

10.1.1.1 US: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 US: Helicopters Market- By Type

10.1.1.1.2 US: Helicopters Market- By Weight

10.1.1.1.3 US: Helicopters Market- By Application

10.1.1.2 Canada: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Canada: Helicopters Market- By Type

10.1.1.2.2 Canada: Helicopters Market- By Weight

10.1.1.2.3 Canada: Helicopters Market- By Application

10.1.1.3 Mexico: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Mexico: Helicopters Market- By Type

10.1.1.3.2 Mexico: Helicopters Market- By Weight

10.1.1.3.3 Mexico: Helicopters Market- By Application

11. North America Helicopters Market- COVID-19 Impact Analysis

11.1 North America

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

13. Company Profiles

13.1 Airbus S.A.S.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Boeing

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Bell Textron Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Enstrom Helicopter Corp.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Kaman Corporation

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 roducts and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Leonardo S.p.A.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Lockheed Martin Corporation

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 MD Helicopters, Inc.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Robinson Helicopter Company

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Russian Helicopters

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. North America Helicopters Market – Revenue, and Forecast to 2028 (US$ Million)

Table 2. US: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 5. US: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 6. US: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 10. Canada: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 11. Canada: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 12. Mexico: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 13. Mexico: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 14. Mexico: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 15. Mexico: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 16. Mexico: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 17. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Helicopters Market Segmentation

Figure 2. North America Helicopters Market Segmentation – By Country

Figure 3. North America Helicopters Market Overview

Figure 4. Single Rotor Segment Held the Largest Market Share in 2020

Figure 5. Medium Weight Segment Held the Largest Market Share in 2020

Figure 6. Military Application Held the Largest Market Share in 2020

Figure 7. US was the Largest Revenue Contributor in 2020

Figure 8. North America Helicopters Market– Porter’s Five Forces Analysis

Figure 9. North America Helicopters Market– Ecosystem Analysis

Figure 10. Expert Opinions

Figure 11. North America Helicopters Market Impact Analysis of Drivers and Restraints

Figure 12. North America Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America Helicopters Market Revenue Share, by Type (2020 and 2028)

Figure 14. North America Single Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Multi Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Tilt Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. North America Helicopters Market Revenue Share, by Weight (2020 and 2028)

Figure 18. North America Light Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America Medium Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. North America Heavy Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America Helicopters Market Revenue Share, by Application (2020 and 2028)

Figure 22. North America Commercial and Civil: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. North America Transport: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. North America Emergency Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. North America Utility: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. North America Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. North America Military: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. North America Attack and Reconnaissance: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. North America Maritime: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. North America Transport Search and Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. North America Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. North America: Helicopters Market, by Key Country – Revenue (2020) (USD Million)

Figure 33. North America: Helicopters Market Revenue Share, by Key Country (2020 and 2028)

Figure 34. US: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Canada: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Mexico: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Impact Of COVID-19 Pandemic in North American Country Markets

- Airbus S.A.S.

- Bell Textron Inc.

- Boeing

- Enstrom Helicopter Corp.

- Kaman Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, Inc.

- Robinson Helicopter Company

- Russian Helicopters

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America helicopters market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America helicopters market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the helicopters market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution