North America Food Inclusions Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Chocolates, Fruit and Nuts, Flavored Sugar and Caramels, and Others), by Form (Solid and Semi- Solid), and Application (Dairy and Frozen Desserts, Bakery Products, Breakfast Cereals, Chocolate and Confectionery Products, and Others)

Market Introduction

The US, Canada, and Mexico are the key countries in North America. Food inclusions such as chocolate, fruits, and nuts; flavored sugars; and caramel are used as ingredients that are primarily responsible for the characteristic appearance, texture, and flavor of most bakery and confectionery products. In addition, food inclusions can effectively modify these characteristics and contribute toward high quality of products. According to the National Confectioners Association (NCA), chocolate represents 60% of the confectionery industry in the US, which is worth ~US$ 35 billion. Chocolate is a consumer favorite that is loved by people of all ages from various socioeconomic groups, races, and geographies. It is made available by various iconic brands as well as by micro-manufacturers. Chocolate inclusions are used in the production of chocolate chips, crispy bites, chocolate flakes, chocolate curls, and a wide range of other confectionery products. Further, millennial confectionery preferences are highlighting the needs of innovative flavors, ingredients, and textures, thereby driving the demand for food infusions in confectioneries.

The US has the highest number of confirmed cases of coronavirus, as, compared to Canada and Mexico. This has negatively affected the food & beverages industry in the region as the COVID-19 outbreak has negatively affected the supply and distribution chain. The unavailability of raw materials due to lockdown in many raw material supplying countries has halted the production. The food inclusions market has had a major impact on its product trends. The pandemic has propelled consumers to opt for healthy food products with various functional properties. Additionally, to break through the regular routine imposed due to the lockdown, the consumer’s desire for new and innovative products to experience different culinary adventure is also influencing the market trends for food inclusions. Fruits and nuts are expected to witness an increasing demand during the upcoming years owing to the health benefits offered by them. Travel restrictions are influencing the flavor trends in food. Thus, though the COVID-19 pandemic has had a negative impact on the production and supply of food inclusions, it has positively influenced the product trends in the market.

Get more information on this report :

Market Overview and Dynamics

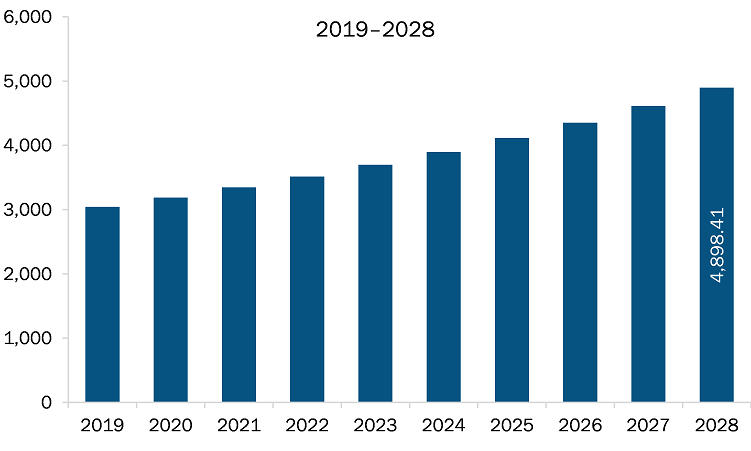

The food inclusions market in North America is expected to grow from US$ 3,345.79 million in 2021 to US$ 4,898.41 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028. Food inclusions were mainly been associated with indulgence for a long period of time. However, nowadays, they are also being associated with health and nutrition, apart from delivering flavor, texture, color, and aroma. The COVID-19 pandemic has had a huge impact on the consumer buying behavior. Rising health concerns as well as growing awareness regarding the consumption of natural and functional food have given rise to new food & beverage trends. Majority of the consumers are opting for immunity-boosting functional food products. Rising consumer preference for products that offer, both, indulgence and health attributes is propelling food manufacturers to use fitting inclusions in their products. Super-foods such as blueberries, cranberries, elderberry, and aronia berries are being used as food inclusions as they provide high levels of antioxidants that boost immunity. The demand for such fruit inclusions in functional food such as yogurt and cottage cheese that help maintain gut health is on rise. Moreover, surging demand for food products and beverages with low sugar content, lower synthetic additive content, and clean label ingredients is triggering the demand for food inclusions such as fruit purees, juices, concentrates, and exotic fruits and vegetables. Fruit-based inclusions, which are sources of natural sugars, are rapidly substituting sugar in several food products and beverages. The demand for whole-food inclusion is increasing in the worldwide market as they feature a complete package of texture, flavor, and function. Whole foods undergo minimal or zero processing and are thus considered as natural ingredients. For instance, nuts are identified as whole-food inclusions with a clean label listing and having health halo. Walnuts are majorly being used as a food inclusions in several food products such as yogurt, snacks, and breakfast cereals. Apart from providing flavor, walnuts also offer functional health benefits, as they are rich in plant-based ALA omega-3 fatty acids. Similarly, almonds are an excellent source of proteins, vitamin E, fiber, magnesium, calcium, potassium, riboflavin, and phosphorous. Legumes are also a crucial ingredient used in functional and healthy food products, as they are rich source of fiber and protein. Black beans are emerging as a lucrative food inclusions as majority of consumers resonate with the health benefits of black beans. Thus, surging demand for functional and healthy food products is emerging as a lucrative opportunity for the food inclusions market players.

Key Market Segments

In terms of type, the chocolate segment accounted for the largest share of the North America food inclusions market in 2020. In term of form, the solid segment held a larger market share of the food inclusions market in 2020. Further, the bakery products segment held a larger share of the market based on application in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the food inclusions market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; AGRANA Beteiligungs-AG; Puratos; Barry Callebaut; Cargill, Incorporated; Kerry Group; Georgia Nut Company; Taura Natural Ingredients Ltd.; and Sensient Technologies among others.

Reasons to buy report

- To understand the North America food inclusions market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America food inclusions market

- Efficiently plan M&A and partnership deals in North America food inclusions market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America food inclusions market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Food Inclusions Market Segmentation

North America Food Inclusions Market – By Type

- Chocolates

- Fruit and Nuts

- Flavored Sugar and Caramels

- Others

North America Food Inclusions Market – By Form

- Solid

- Semi-Solid

North America Food Inclusions Market – By Application

- Dairy and Frozen Desserts

- Bakery Products

- Breakfast Cereals

- Chocolate and Confectionery Products

- Others

North America Food Inclusions Market – By Country

- US

- Canada

- Mexico

North America Food Inclusions Market – Companies Mentioned

- ADM

- AGRANA Beteiligungs-AG

- Puratos

- Barry Callebaut

- Cargill, Incorporated.

- Kerry Group

- Georgia Nut Company

- Taura Natural Ingredients Ltd

- Sensient Technologies

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Food Inclusions Market, by Type

1.3.2 Food Inclusions Market, by Form

1.3.3 Food Inclusions Market, by Application

1.3.4 North America Food Inclusions Market, by Country

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

3.2.8 Assumptions and Limitations:

4. North America Food Inclusions Market Landscape

4.1 Market Overview

4.2 Value Chain Analysis

4.2.1 Macadamia Nuts

4.2.2 Raw Material:

4.2.3 Manufacturing/Processing:

4.2.4 Caramel

4.3 Porter’s Five Forces Analysis

4.4 Expert Opinion

5. North America Food Inclusions Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Broad Scope of Application

5.1.2 Raising Focus Towards Value Addition to Achieve Product Differentiation

5.2 Market Restraints

5.2.1 Up-surging Production Costs of Food Products and Beverages

5.3 Market Opportunities

5.3.1 Flourishing Demand for Functional and Healthy Food Products

5.4 Future Trends

5.4.1 Altering Consumer Preferences

5.5 Impact Analysis of Drivers and Restraint

6. North America Food Inclusions – Market Analysis

6.1 North America Food Inclusions Market Overview

6.2 North America Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

7. North America Food Inclusions Market Analysis – By Type

7.1 Overview

7.2 North America: Food Inclusions Market, by Type

7.3 Chocolates

7.3.1 Overview

7.3.2 Chocolates: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

7.4 Fruits and Nuts

7.4.1 Overview

7.4.2 Fruits and Nuts: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

7.5 Flavored Sugar and Caramel

7.5.1 Overview

7.5.2 Flavored Sugar and Caramel: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

8. North America Food Inclusions Market Analysis – By Form

8.1 Overview

8.2 North America: Food Inclusions Market, by Form

8.3 Solid

8.3.1 Overview

8.3.2 Solid: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

8.4 Semi- Solid

8.4.1 Overview

8.4.2 Semi- Solid: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

9. North America Food Inclusions Market Analysis – By Application

9.1 Overview

9.2 North America: Food Inclusions Market, by Application

9.3 Dairy and Frozen Desserts

9.3.1 Overview

9.3.2 Dairy and Frozen Desserts: Food Inclusions Market, Revenue And Forecast to 2028 (US$ Million)

9.4 Bakery Products

9.4.1 Overview

9.4.2 Bakery Products: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

9.5 Breakfast Cereals

9.5.1 Overview

9.5.2 Breakfast Cereals: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

9.6 Chocolate and Confectionery Products

9.6.1 Overview

9.6.2 Chocolate and Confectionery Products: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

10. North America Food Inclusions Market – Country Analysis

10.1.1 North America: Food Inclusions Market, by Key Country

10.1.1.1 US: Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 US: Food Inclusions Market, by Type

10.1.1.1.2 US: Food Inclusions Market, by Form

10.1.1.1.3 US: Food Inclusions Market, by Application

10.1.1.2 Canada: Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Canada: Food Inclusions Market, by Type

10.1.1.2.2 Canada: Food Inclusions Market, by Form

10.1.1.2.3 Canada: Food Inclusions Market, by Application

10.1.1.3 Mexico: Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Mexico: Food Inclusions Market, by Type

10.1.1.3.2 Mexico: Food Inclusions Market, by Form

10.1.1.3.3 Mexico: Food Inclusions Market, by Application

11. North America Food Inclusions Market – Impact of COVID-19

11.1 Overview

12. Industry Landscape

12.1 Overview

12.2 Mergers & acquisition

12.3 Product Launch

12.4 Expansion

13. Company Profiles

13.1 ADM

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 AGRANA Beteiligungs-AG

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Puratos

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Barry Callebaut

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Cargill, Incorporated.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Kerry Group

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Georgia Nut Company

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Taura Natural Ingredients Ltd.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Sensient Technologies

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Food Inclusions Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. US Food Inclusions Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. US Food Inclusions Market, by Form – Revenue and Forecast to 2028 (US$ Million)

Table 5. US Food Inclusions Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada Food Inclusions Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada Food Inclusions Market, by Form – Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada Food Inclusions Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico Food Inclusions Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico Food Inclusions Market, by Form– Revenue and Forecast to 2028 (US$ Million)

Table 11. Mexico Food Inclusions Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 12. Glossary of Terms, Food Inclusions Market

LIST OF FIGURES

Figure 1. Food Inclusions Market Segmentation

Figure 2. Food Inclusions Market Segmentation – By Country

Figure 3. North America Food Inclusions Market Overview

Figure 4. Chocolates Segment Held Largest Share of North America Food Inclusions Market

Figure 5. Europe Region Held Largest Share of North America Food Inclusions Market

Figure 6. North America Food Inclusions Market, Industry Landscape

Figure 7. Value Chain: Macadamia Nuts

Figure 8. Value Chain: Caramel

Figure 9. Porter’s Five Forces Analysis

Figure 10. Expert Opinion

Figure 11. Food Inclusions Market Impact Analysis of Driver and Restraint

Figure 12. North America Food Inclusions Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America: Food Inclusions Market Revenue Share, by Type (2020 and 2028)

Figure 14. Chocolates: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 15. Fruits and Nuts: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 16. Flavored Sugar and Caramel: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 17. Others: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 18. North America: Food Inclusions Market Revenue Share, by Form (2020 and 2028)

Figure 19. Solid: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 20. Semi- Solid: Food Inclusions Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 21. North America: Food Inclusions Market Revenue Share, by Application (2020 and 2028)

Figure 22. Dairy and Frozen Desserts: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

Figure 23. Bakery Products: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

Figure 24. Breakfast Cereals: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

Figure 25. Chocolate and Confectionery Products: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

Figure 26. Others: Food Inclusions Market, Revenue and Forecast to 2028 (US$ Million)

Figure 27. Geographic Overview of Food Inclusions Market

Figure 28. North America: Food Inclusions Market Revenue Share, by Key Country (2020 and 2028)

Figure 29. US: Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

Figure 30. Canada: Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

Figure 31. Mexico: Food Inclusions Market –Revenue and Forecast to 2028 (US$ Million)

Figure 32. Impact of COVID-19 Pandemic in North America

- ADM

- AGRANA Beteiligungs-AG

- Puratos

- Barry Callebaut

- Cargill, Incorporated.

- Kerry Group

- Georgia Nut Company

- Taura Natural Ingredients Ltd

- Sensient Technologies

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America Food Inclusions market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America Food Inclusions market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the Food Inclusions market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution