North America Floor Coating Market to 2027 - Regional Analysis and Forecasts by Type (Epoxy, Polyurethane, Acrylics, Polymethyl Methacrylate, and Others); Formulation (Solvent-Based and Water-Based); Coating Component (1K, 2K, and 3K); Flooring Material (Wood, Concrete, Mortar, Terrazzo, and Others), Application (Residential, Commercial, and Industrial), and Countries

The North America floor coating market is accounted to US$ 493.7 Mn in 2018 and is predicted to grow at a CAGR of 7.8% during the forecast period 2019 - 2027, to account for US$ 965.6 Mn by 2027.

Floor coatings are surface coatings applied on concrete surfaces to enhance its wear and abrasion resistance and prolong life. They are inert to oils, detergents and cleaners, transmission fluids, water, hail, snow, and corrosive chemicals. Floor coatings impart waterproof, anti-static, anti-vibration, and anti-skid properties to concrete floors and hence are favored in many industrial, as well as construction industries.

In 2018, US dominated the North America floor coating market, followed by Canada. According to The Associated General Contractors of America (AGC), the construction sector is a key contributor to the US economy. This construction sector in the country has more than 680,000 employers with over 7 million employees and creates nearly $1.3 trillion worth of structures every year. The US construction industry is characterized by higher volumes of construction in the residential sector and especially in the construction of individual houses. Higher living standards and higher disposable incomes among the masses drive the purchase of houses by the consumers. Also, lower interest rates on housing loans in the country further encourage home purchases across the country. Higher disposable income also instills the procurement of modern products, which enhances the aesthetics of the residences, which facilitates in growth of adoption of floor coating. The South and Western parts of the US feature some of the reputed international cities and have witnessed the rapid pace of construction of apartment buildings, commercial spaces, and public utility infrastructures. This is further anticipated to propel the demand for floor coating in the US. The demand for epoxy floor coating is increasing in the US over the past few years as epoxy floor coating is one of the most versatile floor coating systems available.

North America Floor Coating Market

Get more information on this report :

Market Insights

Growing Demand for Floor Coatings in Industrial Applications

In numerous industrial settings, such as warehouses, airplane hangars, assembly plants, paint shops, body shops, and distribution facilities, concrete floors are subject to wear and tear from exposure to harsh as well as corrosive chemicals and oils, and damage by scratches and abrasions caused by heavy machines and equipment such as airplanes and forklifts. Floor coatings impart durability and strength to the normal concrete floors. They provide protection to the concrete floors from abrasions and wear from the constant movement of automated guided vehicles, sliding carts, forklifts, etc. Moreover, the slip resistance provided by these coatings to floors help minimize the accidents on work floors. The rising importance of ensuring workplace safety and worker welfare has led to high consumption of floor coatings in industrial applications. The deployment of floor coatings in industrial applications to increase the productivity by allowing faster material movement and lowering the risks of accidents at workplaces is expected to fuel the demand for industrial-grade floor coatings during the forecast period. Rapid industrialization and establishment of manufacturing and processing plants in the US, Canada, and Mexico is expected to drive the demand for floor coatings in the pharmaceuticals, food & beverages, and automotive assembly industries.

Type Insights

Based on type, the North America floor coating market is bifurcated as epoxy, polyurethane, acrylics, polymethyl methacrylate, and others. In 2018, the North America floor coating market was dominated by the epoxy segment. Epoxy floor coating offer many advantages as compared to other traditional coating applied over concrete. The epoxy floor coating is known to create a shiny high-gloss surface that significantly increases the brightness of the interior area. It offers a hard-wearing, durable surface that is able to withstand heavy and continuous traffic. It is quick and easy to install, requires no layout, cutting additional adhesives, or special tools. This floor coating is durable and easy to clean and serves to be ideal for industrial and warehouses applications. The epoxy floor coating is known to resists oil stains and water and also creates a seamless surface that is known to last many years. The epoxy coating can be combined with colors and paints to mask off chips and cracks. The epoxy coating is known to provide a chemically resistant surface that is ideal for manufacturing plants. It is known to offer enhanced safety when the surface contains anti-slip additives. The coating can be applied in various patterns for creating visible driveways or to identify walkable areas.

Formulation Insights

The North America floor coating market is bifurcated based on formulation into solvent-based and water-based. The water-based floor coating dominated the North America floor coatings market in 2018. The low VOC content of the water-based formulation has been a major contributing factor responsible for the development and expansion of the floor coating market all over the globe. Solvent-based floor coatings have various advantages over water-based epoxy systems, typically included that it has greater durability and performance. The solvent-based formulations are more tolerant of petroleum contaminates on a concrete surface that makes it ideal for garages and parking structures and also gives a glossier finish. These benefits were ultimately overshadowed by the fact that government regulations stated for products containing volatile organic compounds (VOCs) and other pollutants have been progressively tighter over the years. With industry and individual consumers seeking more environmentally friendly alternatives, high VOC solvent-based formulation systems are no longer the norm.

Coating Component Insights

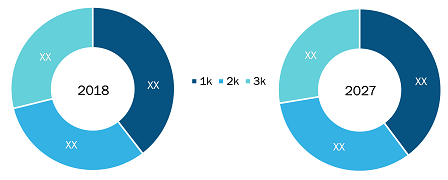

The North America floor coating market is bifurcated based on coating component into 1k, 2k, and 3k. In 2018, the 1k coating component segment accounted for a substantial share in the North America floor coating market. 1k coating components are floor coatings that don’t require a hardener, catalyst, or activator for their application. All lacquer, enamel, and acrylic enamel floor coatings can be included under 1k coatings. Single components or 1k floor coatings are easy to apply as they don’t require to be measured and mixed with other coating ingredients. As 1k floor coatings does not require an activator to cure it usually requires less drying time, however the final coating is not as hard wearing and resilient. Single component penetrating synthetic acrylic coating have excellent adhesion to concrete surfaces and when dried or cured, form a semi-gloss flexible film. The 1k coatings are easy to apply. They can be applied by simple roller, or brush application. Ease of application, rapid curing, and good mechanical properties, has makes 1k components ideal for parquet coatings. 1k coating systems are environment friendly and can be formulated with low levels of VOC. The ease of application, better mechanical properties, and low curing time has led to significant demand for 1k floor coatings market in North America during 2019–2027.

Flooring Material Insights

The North America floor coating market is bifurcated based on flooring material as wood, concrete, mortar, terrazzo, and others. The concrete segment dominated the North America floor coating market in 2018. The concrete flooring material is not only durable, reliable, and incredibly long-lasting, but also developed a reputation for being austere, utilitarian, and course underfoot. However, modern advancements have given the flooring professionals a variety of design options that are allowing them to reinvent this primary building material entirely. Today concrete floors have the option to be polished smooth or even be textured to provide traction.

Application Insights

The North America floor coating market is bifurcated based on application as commercial, residential, and industrial buildings. The industrial segment dominated the North America floor coatings market in 2018. Bare concrete at a manufacturing facility is prone to cause problems. Unprotected concrete eventually starts to crack and crumble due to the constant movement of heavy machinery. Concrete repair costs get expensive quickly, which is why many of the industrial facilities have turned to floor coatings to protect the floors. Thus the rising costs of the floor maintenance have led to an upsurge in the floor coating market all over North America and have proven to be a contributing factor for the increasing demand of the floor coatings across North America.

North America Floor Coating Market by Coating Component

Get more information on this report :

Strategic Insights

New product development, market initiatives and merger and acquisition were observed as the most adopted strategies in North America floor coating market. Few of the recent developments in the North America floor coating market are listed below:

2018: Michelman Inc. launched new Michem Wood Coating 44, a water-based surface modifier for use in exterior wood stains and sealants which helps produce wood coatings with excellent weatherability characteristics.

2017: Sika AG acquired Butterfield Color, Inc. a US-based market leader in the production of decorative concrete floor products and systems.

2017: The Sherwin-Williams Company announced it has completed its acquisition of The Valspar Corporation. The acquisition of Valspar accelerates Sherwin-Williams' global growth strategy and creates the global leader in paints and coatings.

NORTH AMERICA FLOOR COATING MARKET SEGMENTATION

By Type

- Epoxy

- Polyurethane

- Acrylics

- Polymethyl Methacrylate

- Others

By Formulation

- Solvent-Based

- Water-Based

By Coating Component

- 1k

- 2k

- 3k

By Flooring Material

- Wood

- Concrete

- Mortar

- Terrazzo

- Others

By Application

- Residential

- Commercial

- Industrial

By Country

- US

- Canada

- Mexico

Company Profiles

- Axalta Coating Systems Ltd

- Maris Polymers S.A.

- Michelman, Inc

- The Lubrizol Corporation

- The Sherwin-Williams Company

- PPG Industries, Inc

- 3M Company

- Sika AG

- Nippon Paint Holdings Co., Ltd.

- Rust Oleum

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Floor Coating Market – By Type

1.3.2 North America Floor Coating Market – By Formulation

1.3.3 North America Floor Coating Market – By Coating Component

1.3.4 North America Floor Coating Market – By Flooring Material

1.3.5 North America Floor Coating Market – By Application

1.3.6 North America Floor Coating Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Floor Coating Market Landscape

4.1 Market Overview

4.1.1 North America PEST Analysis

5. Floor Coating Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Rising in Number of Commercial and Residential Construction Projects

5.1.2 Growing Demand for Floor Coatings in Industrial Applications

5.2 Key Market Restraints

5.2.1 Stringent Government Regulations

5.3 Key Market Opportunity

5.3.1 Increasing Use of Floor Coatings in Sports Complexes

5.4 Future Trends

5.4.1 Development of Fast-Cure Coatings

5.5 Impact Analysis Of Drivers And Restraints

6. Floor coating – North America Market Analysis

6.1 North America Floor Coating Market Overview

6.2 North America Floor Coating Market Forecast and Analysis

7. North America Floor coating market Analysis – By Type

7.1 Overview

7.2 North America Floor coating market Breakdown, By Type, 2018 & 2027

Epoxy

7.2.1 Overview

7.2.2 North America Epoxy Market Revenue Forecasts To 2027 (US$ Mn)

7.3 Polyurethane

7.3.1 Overview

7.3.2 North America Polyurethane Market Revenue Forecasts To 2027 (US$ Mn)

7.4 Acrylics

7.4.1 Overview

7.4.2 North America Acrylics Market Revenue Forecasts To 2027 (US$ Mn)

7.5 Polymethyl Methacrylate

7.5.1 Overview

7.5.2 North America Polymethyl Methacrylate Market Revenue Forecasts To 2027 (US$ Mn)

7.6 Others

7.6.1 Overview

7.6.2 North America Others Market Revenue Forecasts To 2027 (US$ Mn)

8. North America Floor coating market Analysis – By Formulation

8.1 Overview

8.2 North America Floor Coating Market Breakdown, By Formulation, 2018 & 2027

8.3 Solvent-based

8.3.1 Overview

8.3.2 North America Solvent-based Floor coating Market Revenue Forecasts To 2027 (US$ Mn)

8.4 Water-based

8.4.1 Overview

8.4.2 North America Water-based Floor coating Market Revenue Forecasts To 2027 (US$ Mn)

9. North America Floor coating market Analysis – By Coating Component

9.1 Overview

9.2 North America Floor Coating Market Breakdown, By Coating Component, 2018 & 2027

9.3 1k Coatings

9.3.1 Overview

9.3.2 North America 1k Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

9.4 2k Coatings

9.4.1 Overview

9.4.2 North America 2k Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

9.5 3k Coatings

9.5.1 Overview

9.5.2 North America 3k Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

10. North America Floor coating Market Analysis – By Flooring Material

10.1 Overview

10.2 North America Floor Coating Market Breakdown, By Flooring Material, 2018 & 2027

10.3 Wood

10.3.1 Overview

10.3.2 North America Wood Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

10.4 Concrete

10.4.1 Overview

10.4.2 North America Concrete Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

10.5 Terrazzo

10.5.1 Overview

10.5.2 North America Terrazzo Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

10.6 Others

10.6.1 Overview

10.6.2 North America Others Floor coating Market Revenue Forecasts To 2027 (US$ Mn)

11. North America Floor Coating Market Analysis – By Application

11.1 Overview

11.2 North America Floor Coating Market Breakdown, By Application, 2018 & 2027

11.3 Commercial Building

11.3.1 Overview

11.3.2 North America Commercial Building Application Market Revenue Forecasts To 2027 (US$ Mn)

11.4 Industrial

11.4.1 Overview

11.4.2 North America Industrial Application Market Revenue Forecasts To 2027 (US$ Mn)

11.5 Residential

11.5.1 Overview

11.5.2 North America Residential Application Market Revenue Forecasts To 2027 (US$ Mn)

12. Floor Coating Market – Country Analysis

12.1 Overview

12.1.1 North America Floor Coating Market Breakdown, by Country

12.1.1.1 US Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

12.1.1.1.1 US Floor coating Market Breakdown By Type

12.1.1.1.2 US Floor Coating Market Breakdown by Formulation

12.1.1.1.3 US Floor Coating Market Breakdown By Coating Component

12.1.1.1.4 US Floor coating Market Breakdown By Flooring Material

12.1.1.1.5 US Floor Coating Market Breakdown By Application

12.1.1.2 Canada Floor Coating Market Revenue Forecasts to 2027 (US$ MN)

12.1.1.2.1 Canada Floor coating Market Breakdown By Type

12.1.1.2.2 Canada Floor Coating Market Breakdown By Formulation

12.1.1.2.3 Canada Floor Coating Market Breakdown By Coating Component

12.1.1.2.4 Canada Floor coating Market Breakdown By Flooring Material

12.1.1.2.5 Canada Floor Coating Market Breakdown By Application

12.1.1.3 Mexico Floor Coating Market Revenue Forecasts to 2027 (US$ MN)

12.1.1.3.1 Mexico Floor Coating Market Breakdown by Type

12.1.1.3.2 Mexico Floor Coating Market Breakdown by Formulation

12.1.1.3.3 Mexico Floor Coating Market Breakdown by Coating Component

12.1.1.3.4 Mexico Floor coating Market Breakdown by Flooring Material

12.1.1.3.5 Mexico Floor Coating Market Breakdown by Application

13. Industry Landscape

13.1 Overview

13.2 Product news

13.3 Merger And Acquisition

14. Company Profiles

14.1 Axalta Coating Systems Ltd.

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.2 Maris Polymers S.A.

14.2.1 Key Facts

14.2.2 Business Description

14.2.1 Products and Services

14.2.2 Financial Overview

14.2.3 SWOT Analysis

14.3 Michelman, Inc.

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 The Lubrizol Corporation

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.5 The Sherwin-Williams Company

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 PPG Industries, Inc.

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 3M Company

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Sika AG

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Nippon Paint Holdings Co., Ltd.

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.10 Rust-Oleum

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

15. Appendix

15.1 About The Insight Partners

15.2 Glossary

LIST OF TABLES

Table 1. North America Floor Coating Market Revenue and Forecasts to 2027 (US$ Mn)

Table 2. North America Floor Coating Market Revenue and Forecasts to 2027 – By Type (US$ Mn)

Table 3. North America Floor Coating Market Revenue and Forecasts to 2027 – By Formulation (US$ Mn)

Table 4. North America Floor Coating Market Revenue and Forecasts to 2027 – By Coating Component (US$ Mn)

Table 5. North America Floor Coating Market Revenue and Forecasts to 2027 – By Flooring Material (US$ Mn)

Table 6. North America Floor Coating Market Revenue and Forecasts to 2027 – By Application (US$ Mn)

Table 7. US Floor coating Market Revenue And Forecasts To 2027 – By Type (US$ Mn)

Table 8. US Floor Coating Market Revenue and Forecasts to 2027 – By Formulation (US$ Mn)

Table 9. US Floor Coating Market Revenue And Forecasts To 2027 – By Coating Component (US$ Mn)

Table 10. US Floor Coating Market Revenue And Forecasts To 2027 – By Flooring Material (US$ Mn)

Table 11. US Floor Coating Market Revenue And Forecasts To 2027 – By Application (US$ Mn)

Table 12. Canada Floor Coating Market Revenue And Forecasts To 2027 – By Type (US$ Mn)

Table 13. Canada Floor Coating Market Revenue And Forecasts To 2027 – By Formulation (US$ Mn)

Table 14. Canada Floor Coating Market Revenue And Forecasts To 2027 – By Coating Component (US$ Mn)

Table 15. Canada Floor coating Market Revenue And Forecasts To 2027 – By Flooring Material (US$ Mn)

Table 16. Canada Floor Coating Market Revenue And Forecasts To 2027 – By Application (US$ Mn)

Table 17. Mexico Floor Coating Market Revenue and Forecasts to 2027 – By Type (US$ Mn)

Table 18. Mexico Floor Coating Market Revenue and Forecasts to 2027 – By Formulation (US$ Mn)

Table 19. Mexico Floor Coating Market Revenue and Forecasts to 2027 – By Coating Component (US$ Mn)

Table 20. Mexico Floor Coating Market Revenue and Forecasts to 2027 – By Flooring Material (US$ Mn)

Table 21. Mexico Floor Coating Market Revenue and Forecasts to 2027 – By Application (US$ Mn)

Table 22. Glossary of Terms, North America Floor Coating Market

LIST OF FIGURES

Figure 1. North America Floor Coating Market Segmentations

Figure 2. North America Floor Coating Market Segmentation – By Country

Figure 3. North America Floor Coating Market Overview

Figure 4. Industrial Segment Held The Largest Share In The North America Floor Coating Market

Figure 5. US Dominated The North America Floor Coating Market In 2018

Figure 6. North America Floor Coating Market, Industry Landscape

Figure 7. North America - PEST Analysis

Figure 8. North America Floor Coating Market Impact Analysis of Driver and Restraints

Figure 9. North America Floor Coating Market Forecast And Analysis, (US$ Mn)

Figure 10. North America Floor Coating Market Breakdown by Type, 2018 & 2027 (%)

Figure 11. North America Epoxy Market Revenue Forecasts To 2027 (US$ Mn)

Figure 12. North America Polyurethane Market Revenue Forecasts To 2027 (US$ Mn)

Figure 13. North America Acrylics Market Revenue Forecasts To 2027 (US$ Mn)

Figure 14. North America Polymethyl Methacrylate Market Revenue Forecasts To 2027 (US$ Mn)

Figure 15. North America Others Market Revenue Forecasts To 2027 (US$ Mn)

Figure 16. North America Floor Coating Market Breakdown by Formulation, 2018 & 2027 (%)

Figure 17. North America Solvent-based Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 18. North America Water-based Floor coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 19. North America Floor Coating Market Breakdown by Coating Component, 2018 & 2027 (%)

Figure 20. North America 1k Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 21. North America 2k Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 22. North America 3k Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 23. North America Floor Coating Market Breakdown by Flooring Material, 2018 & 2027 (%)

Figure 24. North America Wood Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 25. North America Concrete Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 26. North America Terrazzo Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 27. North America Others Floor Coating Market Revenue Forecasts To 2027 (US$ Mn)

Figure 28. North America Floor Coating Market Breakdown by Application, 2018 & 2027 (%)

Figure 29. North America Commercial Building Application Market Revenue Forecasts To 2027 (US$ Mn)

Figure 30. North America Industrial Application Market Revenue Forecasts To 2027 (US$ Mn)

Figure 31. North America Residential Application Market Revenue Forecasts To 2027 (US$ Mn)

Figure 32. North America Floor Coating Market Breakdown by Country, 2018 & 2027(%)

Figure 33. US Floor Coating Market Forecasts To 2027 (US$ Mn)

Figure 34. Canada Floor Coating Market Forecasts to 2027 (US$ MN)

Figure 35. Mexico Floor Coating Market Forecasts to 2027 (US$ MN)

List of Companies - North America Floor Coating Market

- Axalta Coating Systems Ltd

- Maris Polymers S.A.

- Michelman, Inc

- The Lubrizol Corporation

- The Sherwin-Williams Company

- PPG Industries, Inc

- 3M Company

- Sika AG

- Nippon Paint Holdings Co., Ltd.

- Rust-Oleum

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America floor coating market, thereby allowing players to develop effective long term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.