North America Endoscopy Guidewire Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Monofilament, Coiled, and Coated), Core Material (Stainless Steel and Nitinol), and Application (Diagnostics and Therapeutic)

Market Introduction

The North America endoscopy guidewire market has been analyzed on the basis of three major countries — the US, Canada, and Mexico. The US is estimated to hold the largest share in the endoscopy guidewire market during the forecast period. ERCP is currently the procedure of choice for many biliary and pancreatic disorders. About 350000-500000 ERCP’s are currently performed annually in the United States. Common indications include choledocholithiasis, obstructive jaundice, biliary pancreatitis, malignant biliary obstruction, and benign biliary strictures; while uncommon indications include recurrent pancreatitis of unknown etiology, biliary or pancreatic duct leaks, pancreatic stones, pancreatic strictures, chronic pancreatitis, and sphincter of Oddi dysfunction. As per the data provided by, American Society of Clinical Oncology (ASCO) in 2021, an estimated 60,430 adults (31,950 men and 28,480 women) in the United States will be diagnosed with pancreatic cancer. The disease accounts for approximately 3% of all cancers. Pancreatic cancer is the eighth most common cancer in women and the tenth most common cancer in men. Incidence rates of pancreatic cancer have gone up by around 1% each year since 2000. It is estimated that 48,220 deaths (25,270 men and 22,950 women) from this disease will occur this year. It is the fourth leading cause of cancer death in both men and women. It accounts for 7% of all cancer deaths. The death rate has very slowly increased each year since 2000. Also, awareness and screening can enable to save 30,000 lives each year. Therefore, the American Society for Gastrointestinal Endoscopy (ASGE) in 2018, launched a campaign to inform the public about the link between chronic heartburn and esophageal adenocarcinoma, one of the fastest growing cancers in the US, and that due to recent advances in the detection and treatment of precancerous cells, gastroenterologists (GI's) are now better equipped to help prevent this cancer before it can even start

In the US, due to an increasing number of infected patients, healthcare professionals and leading organizations are distracting the flow of healthcare resources from research & development to primary care, which is slowing down the process of innovation. Gastrointestinal (GI) endoscopy centers are specialized units where thousands of endoscopies are performed annually. A significant proportion of these procedures are affected due to the national and regional lockdowns across the globe. To adapt to this rapidly evolving situation, endoscopy centers have undergone significant changes and have taken unprecedented precautions to avoid the transmission of the virus. However, endoscopy centers are going through financial strain due to a reduction in the number of procedures from lockdowns and fear of virus transmission. Theoretically, endoscopies could add to the disease transmission as SARS-CoV-2 has shown to be present in the GI secretions. Multiple precautions such as mandatory use of face masks, safe distancing, use of barriers between the endoscopists and patients, negative pressure rooms, extended use of personal protective equipment, and volume reduction have been taken to decrease the risk of disease transmission by these centers. Moreover, pre-endoscopy COVID-19 testing has now become the norm.

Get more information on this report :

Market Overview and Dynamics

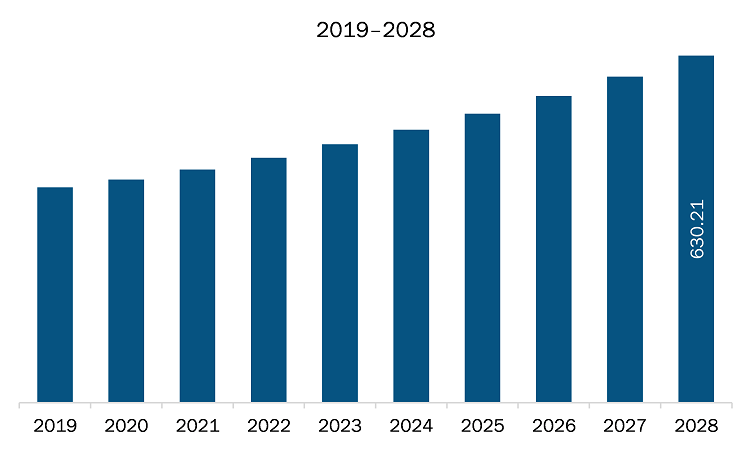

The endoscopy guidewire market in North America is expected to grow from US$ 422.94 million in 2021 to US$ 630.21 million by 2028; it is estimated to grow at a CAGR of 5.9% from 2021 to 2028. Rising patient preference for minimally invasive procedures; Minimally invasive procedures are being performed widely during recent years. As a result, there has been a rise in number of people opting for minimally invasive surgeries. Unlike traditional clinical procedures such as open surgeries, minimally invasive procedures require only a small incision to be made at the site of the procedure. The small incision size facilitates speedy recovers compared to open procedures, reduces discomfort and risk of infection among patients. Moreover, the minimally invasive procedures include a few minor cuts; less trauma to the muscles, nerves, and tissues; less bleeding & scarring; minor trauma to organs; less pain; reduced use of narcotics; less hospital time; and negligible effect on the immune system. Minimally invasive surgeries such as endoscopy, laparoscopy, and robot-assisted surgery are opted by most of the health professionals owing to better results. For example, an instrument called an endoscope is inserted into the patient’s body through small incisions made in the body in endoscopy. This technique allows the physician to look inside the patient’s body and operate if needed. In laparoscopy, the surgical scars are minor, hospital stays are shorter, and the incisions created are much smaller, enabling faster healing and recovery. Moreover, in recent days, laparoscopy is being used widely for bariatric surgery and are economical compared to the traditional surgery method. Thus, the benefits and the accuracy offered by minimally invasive procedures are expected to provide broad growth opportunities to the players operating in the market. This is bolstering the growth of the endoscopy guidewire market.

Key Market Segments

Based on type, the market is segmented into monofilament, coiled, coated. In 2020, the coated segment held the largest share North America endoscopy guidewire market. Based on core material, the market is divided into stainless steel and nitinol. In 2020, the stainless steel segment held the largest share North America endoscopy guidewire market. Based on application, the market is segmented into diagnostics and therapeutic. In 2020, the therapeutic segment held the largest share North America endoscopy guidewire market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the endoscopy guidewire market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Boston Scientific Corporation; CONMED Corporation; Cook Medical LLC; HOBBS MEDICAL INC; Medtronic; Merit Medical Systems Inc; Olympus Corporation; STERIS plc.

Reasons to buy report

- To understand the North America endoscopy guidewire market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America endoscopy guidewire market

- Efficiently plan M&A and partnership deals in North America endoscopy guidewire market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America endoscopy guidewire market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

NORTH AMERICA ENDOSCOPY GUIDEWIRE MARKETSEGMENTATION

By Type

- Monofilament

- Coiled

- Coated

By Core Material

- Stainless Steel

- Nitinol

By Application

- Diagnostics

- Therapeutic

By Country

- US

- Canada

- Mexico

Companies Mentioned

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical LLC

- HOBBS MEDICAL INC

- Medtronic

- Merit Medical Systems Inc

- Olympus Corporation

- STERIS plc.

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Endoscopy Guidewire Market – By Type

1.3.2 North America Endoscopy Guidewire Market – By Core Material

1.3.3 North America Endoscopy Guidewire Market – By Application

1.3.4 North America Endoscopy Guidewire Market – By Country

2. North America Endoscopy Guidewire Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Endoscopy Guidewire– Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America – PEST Analysis

4.3 Expert Opinions

5. North America Endoscopy Guidewire Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Prevalence of Diseases Requiring Endoscopy

5.1.2 Favourable Government Initiatives

5.2 Market Restraints

5.2.1 Risk of Infections Caused Due to Endoscopy and High Cost of Endoscopy Procedures & Equipment

5.3 Market Opportunities

5.3.1 Rising Patient Preference for Minimally Invasive Procedures

5.4 Future Trends

5.4.1 Development of Endoscopic Robotic Systems

5.5 Impact analysis

6. Endoscopy Guidewire Market – North America Analysis

6.1 North America Endoscopy Guidewire Market Revenue Forecast and Analysis

7. North America Endoscopy Guidewire Market Analysis By Type

7.1 Overview

7.2 North America Endoscopy Guidewire Market Revenue Share, by Type (2020 and 2028)

7.3 Monofilament

7.3.1 Overview

7.3.2 Monofilament: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

7.4 Coiled

7.4.1 Overview

7.4.2 Coiled: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

7.5 Coated

7.5.1 Overview

7.5.2 Coated: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

8. North America Endoscopy Guidewire Market Analysis – By Core Material

8.1 Overview

8.2 North America Endoscopy Guidewire Market Revenue Share, by Core Material (2020 and 2028)

8.3 Stainless Steel

8.3.1 Overview

8.3.2 Stainless Steel: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

8.4 Nitinol

8.4.1 Overview

8.4.2 Nitinol: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

9. North America Endoscopy Guidewire Market Analysis – By Application

9.1 Overview

9.2 North America Endoscopy Guidewire Market Revenue Share, by Application (2020 and 2028)

9.3 Diagnostics

9.3.1 Overview

9.3.2 Diagnostics: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

9.4 Therapeutic

9.4.1 Overview

9.4.2 Therapeutic: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

10. North America Endoscopy Guidewire Market – Country Analysis

10.1 North America Endoscopy Guidewire Market, Revenue and Forecast to 2028

10.1.1 Overview

10.1.2 North America Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Country (%)

10.1.3 US: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.1 Overview

10.1.3.2 US Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.3.3 US Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.3.4 US Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.3.5 US Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

10.1.4 Canada: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.4.1 Overview

10.1.4.2 Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.4.3 Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.4.4 Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.4.5 Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

10.1.5 Mexico: Endoscopy Guidewire Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.1 Overview

10.1.5.2 Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

10.1.5.3 Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

10.1.5.4 Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

10.1.5.5 Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

11. Impact of COVID-19 Pandemic on North America Endoscopy Guidewire Market

11.1 North America: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Organic Developments

12.2.1 Overview

12.3 Inorganic Developments

12.3.1 Overview

13. Company Profiles

13.1 Olympus Corporation

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 STERIS plc.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 CONMED Corporation

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Boston Scientific Corporation

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Merit Medical Systems Inc.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Medtronic

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Cook Medical LLC

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.9 HOBBS MEDICAL INC

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Table 2. US Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 3. US Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 4. US Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 5. Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 6. Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 7. Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 8. Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Type (US$ Million)

Table 9. Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Core Material (US$ Million)

Table 10. Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Application (US$ Million)

Table 11. Organic Developments Done by Companies

Table 12. Inorganic Developments Done by Companies

Table 13. Glossary of Terms, Endoscopy Guidewire Market

LIST OF FIGURES

Figure 1. North America Endoscopy Guidewire Market Segmentation

Figure 2. North America Endoscopy Guidewire Market Segmentation, By Country

Figure 3. North America Endoscopy Guidewire Market Overview

Figure 4. Coated Segment Held Largest Share of North America Endoscopy Guidewire Market

Figure 5. Canada to Show Significant Growth During Forecast Period

Figure 6. North America PEST Analysis

Figure 7. North America Endoscopy Guidewire Market Impact Analysis of Drivers and Restraints

Figure 8. North America Endoscopy Guidewire Market – Revenue Forecast and Analysis – 2020- 2028 (US$ Million)

Figure 9. North America Endoscopy Guidewire Market Revenue Share, by Type (2020 and 2028)

Figure 10. Monofilament: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 11. Coiled: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 12. Coated: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America Endoscopy Guidewire Market Revenue Share, by Core Material (2020 and 2028)

Figure 14. Stainless Steel: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 15. Nitinol: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Endoscopy Guidewire Market Revenue Share, by Application (2020 and 2028)

Figure 17. Diagnostics: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 18. Therapeutic: North America Endoscopy Guidewire Market– Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America Endoscopy Guidewire Market Overview, By Country — 2020 (US$ Million)

Figure 20. North America Endoscopy Guidewire Market, Revenue and Forecast to 2028, By Country (%)

Figure 21. US Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 22. Canada Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 23. Mexico Endoscopy Guidewire Market, Revenue and Forecast to 2028 (US$ Million)

Figure 24. Impact of COVID-19 Pandemic in North American Country Markets

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical LLC

- HOBBS MEDICAL INC

- Medtronic

- Merit Medical Systems Inc

- Olympus Corporation

- STERIS plc.

- To understand the North America endoscopy guidewire market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America endoscopy guidewire market

- Efficiently plan M&A and partnership deals in North America endoscopy guidewire market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America endoscopy guidewire market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.