North America Diagnostic Imaging Market Forecast to 2028 – COVID-19 Impact and Regional Analysis – by Modality [X-ray, Computed Tomography, Endoscopy, Ultrasound, Magnetic Resonance Imaging (MRI), Nuclear Imaging, Mammography, and Other], Application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Obstetrics/Gynecology, and Others), and End User (Hospital & Clinics, Diagnostic Imaging Centers, Ambulatory Surgical Centers, and Others)

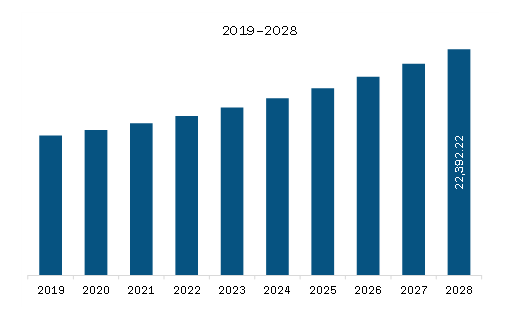

The diagnostic imaging market in North America is expected to grow from US$ 15,802.91 million in 2021 to US$ 19,287.90 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028.

According to the Centers for Disease Control and Prevention (CDC) report, six in ten Americans live with at least one chronic disease, including heart disease and stroke, cancer, and diabetes. Chronic diseases are the leading causes of death and disability in North America and stand as a leading healthcare cost. According to CDC, the leading chronic diseases accounted for almost US$ 4.1 trillion in annual healthcare costs in America in 2020. Diagnostic imaging is widely adopted for chronic conditions of the geriatric population as the population is more vulnerable to the above chronic indications. For instance, JMIR Publications revealed that the population aged >60 is expected to rise to 2 billion by 2050 worldwide. Thus, with the increasing prevalence of aging and chronic diseases, it is essential to focus on healthcare innovation to improve health services. For example, innovation in diagnostic imaging with the support of information and communication technology (ICT) has been used in several settings that assist individuals in diagnosing, treating, and managing chronic diseases better. Also, ICT interventions in diagnostic imaging provide solutions to some of the challenges associated with aging and chronic diseases. Osteoporosis is a significant health problem globally and is responsible for a severe clinical and financial burden, owing to increasing life expectancy. Moreover, osteoporosis increases the chances of falls, fractures, hospitalization, and mortality. Several diagnostic imaging techniques such as computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound imaging provide information on different aspects of the same pathologies for the detection of osteoporosis at an early stage. For example, MRI provides information on various aspects of bone pathophysiology, and its results play an essential role in diagnosing diseases early in preventing clinical onset and consequences. The factors mentioned above are responsible for driving the overall diagnostic imaging market.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America diagnostic imaging market at a substantial CAGR during the forecast period.

North America Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

North America Diagnostic Imaging Market Segmentation

The North America diagnostic imaging market is segmented based on modality, application, end user, and country. Based on modality, the market is segmented into X-ray, computed tomography, endoscopy, ultrasound, magnetic resonance imaging (MRI), nuclear imaging, mammography, and others. In 2021, the computed tomography segment held the largest share of the market. It is also expected to register the highest CAGR during the forecast period. Based on application, the North America diagnostic imaging market is segmented into cardiology, oncology, neurology, orthopedics, gastroenterology, obstetrics/gynecology, and others. The cardiology segment held the largest market share in 2021, and the oncology segment is expected to register the highest CAGR during the forecast period. Based on end user, the market is segmented into hospitals and clinics, diagnostic imaging centers, ambulatory surgical centers (ASCs), and others. In 2021, the hospitals and clinics segment held the largest market share. However, the diagnostic imaging centers segment is expected to register the highest CAGR during the forecast period. Based on country, the North America diagnostic imaging market is segmented into the US, Canada, and Mexico. In 2021, the US held the largest market share. It is also expected to register the highest CAGR during the forecast period.

General Electric Company; Siemens Healthineers; Koninklijke Philips N.V.; KARL STORZ SE & Co. KG; FUJIFILM Holdings Corporation; Canon Inc.; Hologic, Inc.; Carestream Health Inc.; Stryker Corporation; and Olympus Corporation are among the leading companies in the North America diagnostic imaging market.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Diagnostic Imaging Market – By Modality

1.3.2 North America Diagnostic Imaging Market – By Application

1.3.3 North America Diagnostic Imaging Market – By End User

1.3.4 North America Diagnostic Imaging Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Research

4. North America Diagnostic Imaging Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Experts Opinion

5. North America Diagnostic Imaging Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Surging Prevalence of Chronic Diseases

5.1.2 Burgeoning Technological Advancements in Diagnostics Imaging Equipment

5.2 Market Restraints

5.2.1 Limited Skilled Healthcare Professionals and High Costs Related to Diagnostic Imaging Equipment

5.3 Market Opportunities

5.3.1 Advancing Government Initiatives for Diagnostic Imaging Services Reach and Sanctioning Funds and Grants

5.4 Future Trends

5.4.1 Growing Use of Artificial Intelligence (AI) and Analytics in Diagnostic Imaging Equipment

5.5 Impact Analysis

6. North America Diagnostic Imaging Market Analysis

6.1 North America Diagnostic Imaging Market Revenue Forecasts and Analysis

7. North America Diagnostic Imaging Market Revenue and Forecasts to 2028– by Modality

7.1 Overview

7.2 North America Diagnostic Imaging Market, By Modality, 2022 & 2028 (%)

7.3 Endoscopy

7.3.1 Overview

7.3.2 Endoscopy: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.4 X-ray

7.4.1 Overview

7.4.2 X-ray: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.5 Ultrasound

7.5.1 Overview

7.5.2 Ultrasound: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.6 Magnetic resonance imaging (MRI)

7.6.1 Overview

7.6.2 MRI: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.7 CT

7.7.1 Overview

7.7.2 CT: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.8 Nuclear Imaging

7.8.1 Overview

7.8.2 Nuclear Imaging: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.9 Mammography

7.9.1 Overview

7.9.2 Mammography: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

7.10 Others

7.10.1 Overview

7.10.2 Others: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

8. North America Diagnostic Imaging Market Revenue and Forecasts to 2028 – By Application

8.1 Overview

8.2 North America Diagnostic Imaging Market Share by Application - 2022 & 2028 (%)

8.3 Cardiology

8.3.1 Overview

8.3.2 Cardiology: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

8.4 Oncology

8.4.1 Overview

8.4.2 Oncology: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

8.5 Neurology

8.5.1 Overview

8.5.2 Neurology: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

8.6 Orthopedics

8.6.1 Overview

8.6.2 Orthopedics: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

8.7 Gastroenterology

8.7.1 Overview

8.7.2 Gastroenterology: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

8.8 Obstetrics/Gynecology

8.8.1 Overview

8.8.2 Obstetrics/Gynecology: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

8.9 Others

8.9.1 Overview

8.9.2 Others: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

9. North America Diagnostic Imaging Market Revenue and Forecasts to 2028 – End User

9.1 Overview

9.2 North America Diagnostic Imaging Market Share by End User - 2022 & 2028 (%)

9.3 Hospitals and Clinics

9.3.1 Overview

9.3.2 Hospitals and Clinics: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

9.4 Ambulatory Surgical Centers

9.4.1 Overview

9.4.2 Ambulatory Surgical Centers: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

9.5 Diagnostics Imaging Centers

9.5.1 Overview

9.5.2 Diagnostics Imaging Centers: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

9.6 Others

9.6.1 Overview

9.6.2 Others: Diagnostic Imaging Market Revenue and Forecast to 2028 (US$ Million)

10. North America Diagnostic Imaging Market Revenue and Forecasts to 2028 – Country Analysis

10.1 North America Diagnostic Imaging Market

10.1.1 North America: Diagnostic Imaging Market, by Country, 2021 & 2028 (%)

10.1.1.1 US: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 Overview

10.1.1.1.2 US: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.3 US: Diagnostic Imaging Market, by Modality, 2019–2028 (US$ Million)

10.1.1.1.4 US: Diagnostic Imaging Market, by Application, 2019–2028 (US$ Million)

10.1.1.1.5 US: Diagnostic Imaging Market, by End User, 2019–2028 (US$ Million)

10.1.1.2 Canada: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Overview

10.1.1.2.2 Canada: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.3 Canada: Diagnostic Imaging Market, by Modality, 2019–2028 (US$ Million)

10.1.1.2.4 Canada: Diagnostic Imaging Market, by Application, 2019–2028 (US$ Million)

10.1.1.2.5 Canada: Diagnostic Imaging Market, by End User, 2019–2028 (US$ Million)

10.1.1.3 Mexico: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Overview

10.1.1.3.2 Mexico: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.3 Mexico: Diagnostic Imaging Market, by Modality, 2019–2028 (US$ Million)

10.1.1.3.4 Mexico: Diagnostic Imaging Market, by Application, 2019–2028 (US$ Million)

10.1.1.3.5 Mexico: Diagnostic Imaging Market, by End User, 2019–2028 (US$ Million)

11. North America Diagnostic Imaging Market – Industry Landscape

11.1 Overview

11.2 Inorganic Growth Strategies

11.2.1 Overview

11.3 Organic Growth Strategies

11.3.1 Overview

12. Company Profiles

12.1 General Electric Company

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Siemens Healthineers

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Koninklijke Philips N.V.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 KARL STORZ SE & Co. KG

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 FUJIFILM Holdings Corporation

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Canon Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Hologic, Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Carestream Health Inc.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Stryker Corporation

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Olympus Corporation

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. US Diagnostic Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 2. US Diagnostic Imaging Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 3. US Diagnostic Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 4. Canada: Diagnostic Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada Diagnostic Imaging Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada Diagnostic Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 7. Mexico: Diagnostic Imaging Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico Diagnostic Imaging Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico Diagnostic Imaging Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 10. Recent Inorganic Growth Strategies in the Diagnostic Imaging Market

Table 11. Recent Organic Growth Strategies in the Diagnostic Imaging Market

Table 12. Glossary of Terms

LIST OF FIGURES

Figure 1. North America Diagnostic Imaging Market Segmentation

Figure 2. North America Diagnostic Imaging Market, By Country

Figure 3. North America Diagnostic Imaging Market Overview

Figure 4. X-ray Segment Held the Largest Share of Modality Segment in Diagnostic Imaging Market

Figure 5. The US is Expected to Show Remarkable Growth During the Forecast Period

Figure 6. North America Diagnostic Imaging Market, Industry Landscape

Figure 7. North America: PEST Analysis

Figure 8. Experts Opinion

Figure 9. Impact Analysis of Drivers and Restraints on North America Diagnostic Imaging Market

Figure 10. North America Diagnostic Imaging Market – Revenue Forecasts and Analysis – 2020- 2028

Figure 11. North America Diagnostic Imaging Market, by Modality, 2022 & 2028 (%)

Figure 12. Endoscopy: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 13. X-ray: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 14. Ultrasound: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 15. MRI: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 16. CT: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 17. Nuclear Imaging: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 18. Mammography: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 19. Others: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 20. North America Diagnostic Imaging Market Share by Application - 2022 & 2028 (%)

Figure 21. Cardiology: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 22. Oncology: Diagnostic Imaging Market Revenue and Forecasts To 2028 (US$ Million)

Figure 23. Neurology: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 24. Orthopedics: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 25. Gastroenterology: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 26. Obstetrics/Gynecology: Diagnostic Imaging Market Revenue and Forecasts To 2028 (US$ Million)

Figure 27. Others: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 28. North America Diagnostic Imaging Market Share by End User - 2022 & 2028 (%)

Figure 29. Hospitals and Clinics: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 30. Ambulatory Surgical Centers: Diagnostic Imaging Market Revenue and Forecasts To 2028 (US$ Million)

Figure 31. Diagnostics and Imaging Centers: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 32. Others: Diagnostic Imaging Market Revenue and Forecasts to 2028 (US$ Million)

Figure 33. North America: Diagnostic Imaging Market, by Key Country – Revenue (2022) (US$ Million)

Figure 34. North America: Diagnostic Imaging Market, by Country, 2021 & 2028 (%)

Figure 35. US: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Canada: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Mexico: Diagnostic Imaging Market – Revenue and Forecast to 2028 (US$ Million)

- General Electric Company

- Siemens Healthineers

- Koninklijke Philips N.V.

- KARL STORZ SE & Co. KG

- FUJIFILM Holdings Corporation

- Canon Inc.

- Hologic, Inc.

- Carestream Health Inc.

- Stryker Corporation

- Olympus Corporation

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America diagnostic imaging market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America diagnostic imaging market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the diagnostic imaging market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution