North America Contraceptives Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Product (Condoms, Intrauterine Product (IUDs), Vaginal Rings, Implants, Patches, Diaphragms, Emergency Contraceptives, Sponges, and Others), End User (Home Care, Hospitals and Clinics), and Distribution Channel (Retail Pharmacy, Online Pharmacy, and Hospital Pharmacy)

Market Introduction

The North America Contraceptives Market is segmented into the US, Canada, and Mexico. The US held the largest share of the North American contraceptives market in 2020. The growth can be attributed to awareness among the population, prevention of unwanted pregnancies and increasing product developments by key players in the region. Also, rising awareness for sexually transmitted diseases is likely to favor market growth. In North America, the US holds a significant share in the contraceptives market. The growth of the market in the country is primarily driven by increasing awareness for birth control. As per the 2015–2017 National Survey of Family Growth data, in 2015–2017, around 64.9% (46.9 million) of the 72.2 million women aged between 15–49 years in the US were using contraception. It also mentioned the commonly used contraceptive methods were female sterilization (18.6%), oral contraceptive pill (12.6%), long-acting reversible contraceptives (LARCs) (10.3%), and male condom (8.7%). As per the survey female sterilization decreased and use of the pill increased with higher education. Further, also the growing prevalence of sexually transmitted diseases is increasing the demand for contraceptives. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2018, one in five (68 million) people in the US have an STI (sexually transmitted infection) of which 26 million cases were new STIs in 2018. Increasing rate of unwanted pregnancies is the major factor driving the growth of the North America contraceptives market.

North America has been witnessing a growing number of COVID-19 cases since its outbreak. For instance, according to Worldometer, the number of cases increased to 30,521,774, with 555,314 deaths reported in the US as of March 22, 2021. The cases are also increasing in Mexico and Canada. In Mexico, the cases have reached 2,195,772, with 198,036 deaths. Similarly, in Canada, there are about 933,785 COVID cases, with 22,676 deaths reported so far.The pandemic is straining public health systems globally, interrupting and delaying many kinds of critical health care. A recent survey by the World Health Organization found that family planning and contraception are among the most frequently disrupted health services. 7 in 10 countries around the world are experiencing disruptions along with United States, Canada and Mexico. However, the COVID-19 pandemic does not disrupt the supply of and demand generation for condoms. Sexual relations may be transformed in the new context of the pandemic, but they have not stopped. While access to male and female condoms has been critical in the global response to reduce HIV, sexually transmitted infections (STIs), and unintended pregnancies over the past three decades, these gains can be lost if condoms are not included in the essential commodities that are freely available to populations during the lockdown of countries. This brief for country condom program managers and experts provides a summary of relevant actions to sustain supplies of male condoms, female condoms, and lubricants and to adjust approaches for condom promotion during the time of COVID-19. However, in the long run, market is expected to boost the demand, as IUDs centers now opening for patients for reproductive health other than COVID -19.

Get more information on this report :

Market Overview and Dynamics

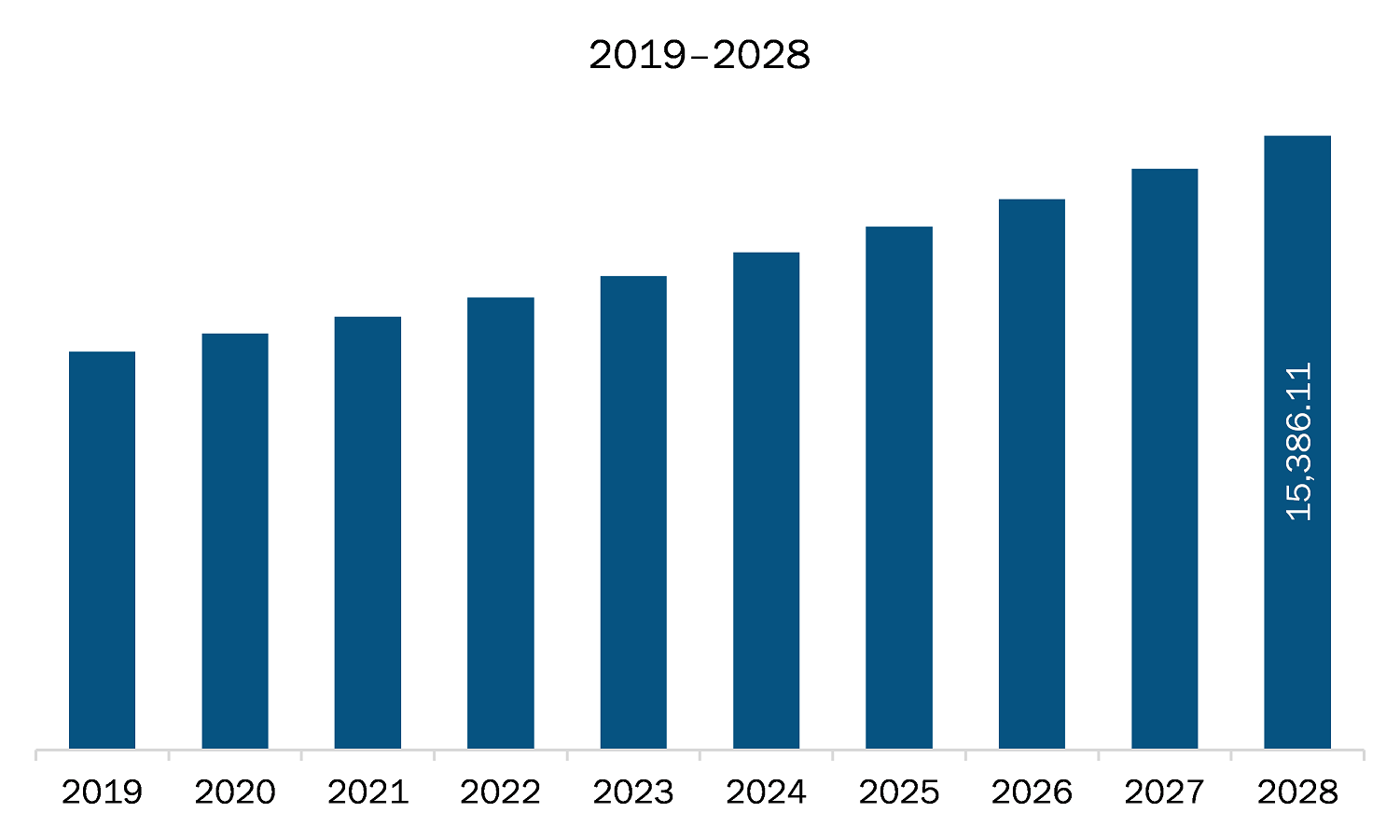

The contraceptives market in North America is expected to grow from US$ 10,859.29 million in 2021 to US$ 15,386.11 million by 2028; it is estimated to grow at a CAGR of 5.1% from 2021 to 2028. Sexually transmitted diseases (STDs) have a major impact on sexual and reproductive health worldwide. As per the WHO, more than 1 million sexually transmitted infections (STIs) are acquired every day worldwide. Each year, ~376 million new infections with chlamydia, gonorrhea, syphilis, and trichomoniasis are reported. Contraceptive methods alter the risk of acquiring STDs. For instance, spermicides have been reported to kill a wide range of bacteria and viruses, including HIV, in vitro; moreover, they have been reported to provide protection against gonorrhea, chlamydia, and pelvic inflammatory disease in vivo. Condoms and diaphragms also provide a certain level of protection from bacterial and viral infections.

Key Market Segments

The market for North America contraceptives market is segmented into product, end user, and distribution channel, and country. Based on product, the market is segmented condoms, intrauterine product (IUDs), vaginal rings, implants, patches, diaphragms, emergency contraceptives, sponges, and others. The condoms segment dominated the market in 2020 and intrauterine product (IUDs) segment is expected to be the fastest growing during the forecast period. Further, the condoms segment has been bifurcated into female condoms and male condoms. Similarly, intrauterine product (IUDs) is bifurcated into hormonal IUDs and copper IUDs. Based on end user, the market is segmented into home care, and hospitals and clinics. The home care segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Based on distribution channel, the market is segmented into retail pharmacy, online pharmacy, and hospital pharmacy. The retail pharmacy segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the contraceptives market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bayer AG; Church & Dwight, Inc.; CooperSurgical (Cooper Companies, Inc.); Mayer Laboratories, Inc.; Medicines360; Merck & Co., Inc.; and Prosan International B.V. among others.

Reasons to buy report

- To understand the North America contraceptives market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America contraceptives market

- Efficiently plan M&A and partnership deals in North America contraceptives market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America contraceptives market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Contraceptives Market Segmentation

North America Contraceptives Market -By Product

- Condoms

- Male Condoms

- Female Condoms

- Intrauterine Product (IUDs)

- Hormonal IUDs

- Copper IUDs

- Vaginal Rings

- Implants

- Patches

- Diaphragms

- Emergency Contraceptives

- Sponges

- Others

North America Contraceptives Market -By End User

- Home Care

- Hospitals and Clinics

North America Contraceptives Market -By Distribution Channel

- Retail Pharmacy

- Online Pharmacy

- Hospital Pharmacy

North America Contraceptives Market -By Country

- US

- Canada

- Mexico

North America Contraceptives Market -Company Profiles

- Bayer AG

- Church & Dwight, Inc.

- CooperSurgical (Cooper Companies, Inc.)

- Mayer Laboratories, Inc.

- Medicines360

- Merck & Co., Inc.

- Prosan International B.V.

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Contraceptives Market – By Product

1.3.2 North America Contraceptives Market – By End User

1.3.3 North America Contraceptives Market – By Distribution Channel

1.3.4 North America Contraceptives Market– By Country

2. North America Contraceptives Market– Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Contraceptives Market– Market Landscape

4.1 Overview

4.2 North America PEST Analysis

4.3 Expert Opinion

5. North America Contraceptives Market– Industry Dynamics

5.1 Market Drivers

5.1.1 Increasing Rate of Unwanted Pregnancies

5.1.2 Surge in Product Innovations and Launches

5.2 Market Restraints

5.2.1 Lack of Adoption in Low Income Countries

5.3 Market Opportunities

5.3.1 Increasing Awareness About Sexually Transmitted Diseases

5.4 Future Trends

5.4.1 Digital Fertility Methods for Family Planning

5.5 Impact analysis

6. Contraceptives Market– North America Analysis

6.1 North America Contraceptives Market Revenue Forecast and Analysis

7. Contraceptives Market Analysis – By Product

7.1 Overview

7.2 Contraceptives Market Revenue Share, by Product (2020 and 2028)

7.3 Condoms

7.3.1 Overview

7.3.2 Condoms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.3.2.1 Male Condoms

7.3.2.1.1 Overview

7.3.2.1.2 Male Condoms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.3.2.2 Female Condoms

7.3.2.2.1 Overview

7.3.2.2.2 Female Condoms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Intrauterine Product (IUDs)

7.4.1 Overview

7.4.2 Intrauterine Product (IUDs): Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.4.2.1 Hormonal IUDs

7.4.2.1.1 Overview

7.4.2.1.2 Hormonal IUDs: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.4.2.2 Copper IUDs

7.4.2.2.1 Overview

7.4.2.2.2 Copper IUDs: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Vaginal Rings

7.5.1 Overview

7.5.2 Vaginal Rings: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Implants

7.6.1 Overview

7.6.2 Implants: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.7 Patches

7.7.1 Overview

7.7.2 Patches: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.8 Diaphragms

7.8.1 Overview

7.8.2 Diaphragms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.9 Emergency Contraceptives

7.9.1 Overview

7.9.2 Emergency Contraceptives: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.10 Sponges

7.10.1 Overview

7.10.2 Sponges: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

7.11 Others

7.11.1 Overview

7.11.2 Others: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

8. North America Contraceptives Market Analysis – By End User

8.1 Overview

8.2 Contraceptives Market Revenue Share, by End User (2020 and 2028)

8.3 Hospitals and Clinics

8.3.1 Overview

8.3.2 Hospitals and Clinics: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Home Care

8.4.1 Overview

8.4.2 Home Care: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

9. North America Contraceptives Market – By Distribution Channel

9.1 Overview

9.2 Contraceptives Market, by Distribution Channel, 2020 and 2028 (%)

9.3 Hospital Pharmacy

9.3.1 Overview

9.3.2 Hospital Pharmacy: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Retail Pharmacy

9.4.1 Overview

9.4.2 Retail Pharmacy: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Online Pharmacy

9.5.1 Overview

9.5.2 Online Pharmacy: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

10. North America Contraceptives Market – Country Analysis

10.1 Overview

10.1.1 North America: Contraceptives Market, by Country, 2020 & 2028 (%)

10.1.2 US: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

10.1.2.1 US: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

10.1.2.2 US: Contraceptives Market, by Product, 2019–2028 (USD Million)

10.1.2.2.1 US: Condoms Market, by Type, 2019–2028 (USD Million)

10.1.2.2.2 US: Intrauterine Product (IUDs) Market, by Type, 2019–2028 (USD Million)

10.1.2.3 US: Contraceptives Market, by End User, 2019–2028 (USD Million)

10.1.2.4 US: Contraceptives Market, by Distribution Channel, 2019–2028 (USD Million)

10.1.3 Canada: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

10.1.3.1 Canada: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

10.1.3.2 Canada: Contraceptives Market, by Product, 2019–2028 (USD Million)

10.1.3.2.1 Canada: Condoms Market, by Type, 2019–2028 (USD Million)

10.1.3.2.2 Canada: Intrauterine Product (IUDs) Market, by Type, 2019–2028 (USD Million)

10.1.3.3 Canada: Contraceptives Market, by End User, 2019–2028 (USD Million)

10.1.3.4 Canada: Contraceptives Market, by Distribution Channel, 2019–2028 (USD Million)

10.1.4 Mexico: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

10.1.4.1 Mexico: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

10.1.4.2 Mexico: Contraceptives Market, by Product, 2019–2028 (USD Million)

10.1.4.2.1 Mexico: Condoms Market, by Type, 2019–2028 (USD Million)

10.1.4.2.2 Mexico: Intrauterine Product (IUDs) Market, by Type, 2019–2028 (USD Million)

10.1.4.3 Mexico: Contraceptives Market, by End User, 2019–2028 (USD Million)

10.1.4.4 Mexico: Contraceptives Market, by Distribution Channel, 2019–2028 (USD Million)

11. Impact of COVID-19 Pandemic on North America Contraceptives Market

11.1 Overview

12. Contraceptives Market– Industry Landscape

12.1 Overview

12.2 Organic Developments

12.2.1 Overview

12.3 Inorganic Developments

12.3.1 Overview

13. Company Profiles

13.1 Bayer AG

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 CooperSurgical (Cooper Companies, Inc.)

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Merck & Co., Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Church & Dwight, Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Mayer Laboratories, Inc.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Medicines360

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Prosan International B.V.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

14. Appendix

14.1 About the Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. US Contraceptives Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 3. US Condoms Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 4. US Intrauterine Product (IUDs) Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 5. US Contraceptives Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 6. US Contraceptives Market, by Distribution Channel – Revenue and Forecast to 2028 (USD Million)

Table 7. Canada Contraceptives Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 8. Canada Condoms Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 9. Canada Intrauterine Product (IUDs) Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 10. Canada Contraceptives Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 11. Canada Contraceptives Market, by Distribution Channel – Revenue and Forecast to 2028 (USD Million)

Table 12. Mexico Contraceptives Market, by Product – Revenue and Forecast to 2028 (USD Million)

Table 13. Mexico Condoms Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 14. Mexico Intrauterine Product (IUDs) Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 15. Mexico Contraceptives Market, by End User – Revenue and Forecast to 2028 (USD Million)

Table 16. Mexico Contraceptives Market, by Distribution Channel – Revenue and Forecast to 2028 (USD Million)

Table 17. Organic Developments Done By Companies

Table 18. Inorganic Developments Done By Companies

Table 19. Glossary of Terms, Contraceptives Market

LIST OF FIGURES

Figure 1. North America Contraceptives Market Segmentation

Figure 2. North America Contraceptives Segmentation, By Country

Figure 3. North America Contraceptives Market Overview

Figure 4. Condoms Held Largest Share of Product Segment in Contraceptives Market

Figure 5. US to Show Remarkable Growth During Forecast Period

Figure 6. North America: PEST Analysis

Figure 7. North America Contraceptives Market Impact Analysis of Driver and Restraints

Figure 8. North America Contraceptives Market– Revenue Forecast and Analysis – 2020- 2028

Figure 9. Contraceptives Market Revenue Share, by Product (2020 and 2028)

Figure 10. North America Condoms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. North America Male Condoms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. North America Female Condoms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America Intrauterine Product (IUDs): Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. North America Hormonal IUDs: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Copper IUDs: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Vaginal Rings: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. North America Implants: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America Patches: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America Diaphragms: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. North America Emergency Contraceptives: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America Sponges: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. North America Others: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. North America Contraceptives Market Revenue Share, by End User (2020 and 2028)

Figure 24. North America Hospitals and Clinics: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. North America Home Care: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. North America Contraceptives Market, by Distribution Channel, 2020 and 2028 (%)

Figure 27. North America Hospital Pharmacy: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. North America Retail Pharmacy: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. North America Online Pharmacy: Contraceptives Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. North America: Contraceptives Market, by Key Country – Revenue (2020) (USD Million)

Figure 31. North America: Contraceptives Market, by Country, 2020 & 2028 (%)

Figure 32. US: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

Figure 33. Canada: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

Figure 34. Mexico: Contraceptives Market – Revenue and Forecast to 2028 (USD Million)

Figure 35. Impact of COVID-19 Pandemic in North American Country Markets

- Bayer AG

- Church & Dwight, Inc.

- CooperSurgical (Cooper Companies, Inc.)

- Mayer Laboratories, Inc.

- Medicines360

- Merck & Co., Inc.

- Prosan International B.V.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America Contraceptives market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America Contraceptives market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the Contraceptives market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution