North America Automotive Lead Acid Battery Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Product (SLI and Micro Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), and End User (Passenger Cars, LCV, and M&HCV)

Market Introduction

North America is a major market for lead-acid battery manufacturers. North America has the largest vehicle industry due to the presence of the majority of car manufacturers. Increased passenger car and light commercial vehicle supply and vehicle parc are expected to increase demand. For instance, in 2020, the automobile industry in the United States, delivered almost 14.5 million light vehicle units. This figure represents about 3.4 million cars and over 11 million light truck units sold at retail. Increasing vehicle sales are the primary driver of demand growth, especially in developed economies like the United States and Canada. The rising demand for electric cars and e-bikes, which are being used to boost living standards and raise income levels, are the other major factors affecting lead-acid battery sales in the region. Additionally, the automotive industry's increased research and development efforts to improve battery performance are expected to boost demand growth over the projected period.

The US is the worst-hit country by the COVID-19 pandemic in North America, with ~30.5 million cases as of March 2021. The continuous growth of infected individuals has led the government to impose lockdown across the nation’s borders. Majority of the manufacturing plants are shut down, municipalities are functioning with lower strength, and the automotive and semiconductor industries are at a halt, which is negatively impacting the automotive lead acid batteries market. Canada and Mexico have reported less cases than the US. However, the manufacturing plants, automotive industry, and several other businesses are functioning slowly, which is negatively impacting on the automotive lead acid batteries market. The short-term effect of the COVID-9 pandemic would not affect the recovery of overall sales in the automotive industry in 2021, mainly due to the continued promotion of passenger vehicles by various companies in the region.

Get more information on this report :

Market Overview and Dynamics

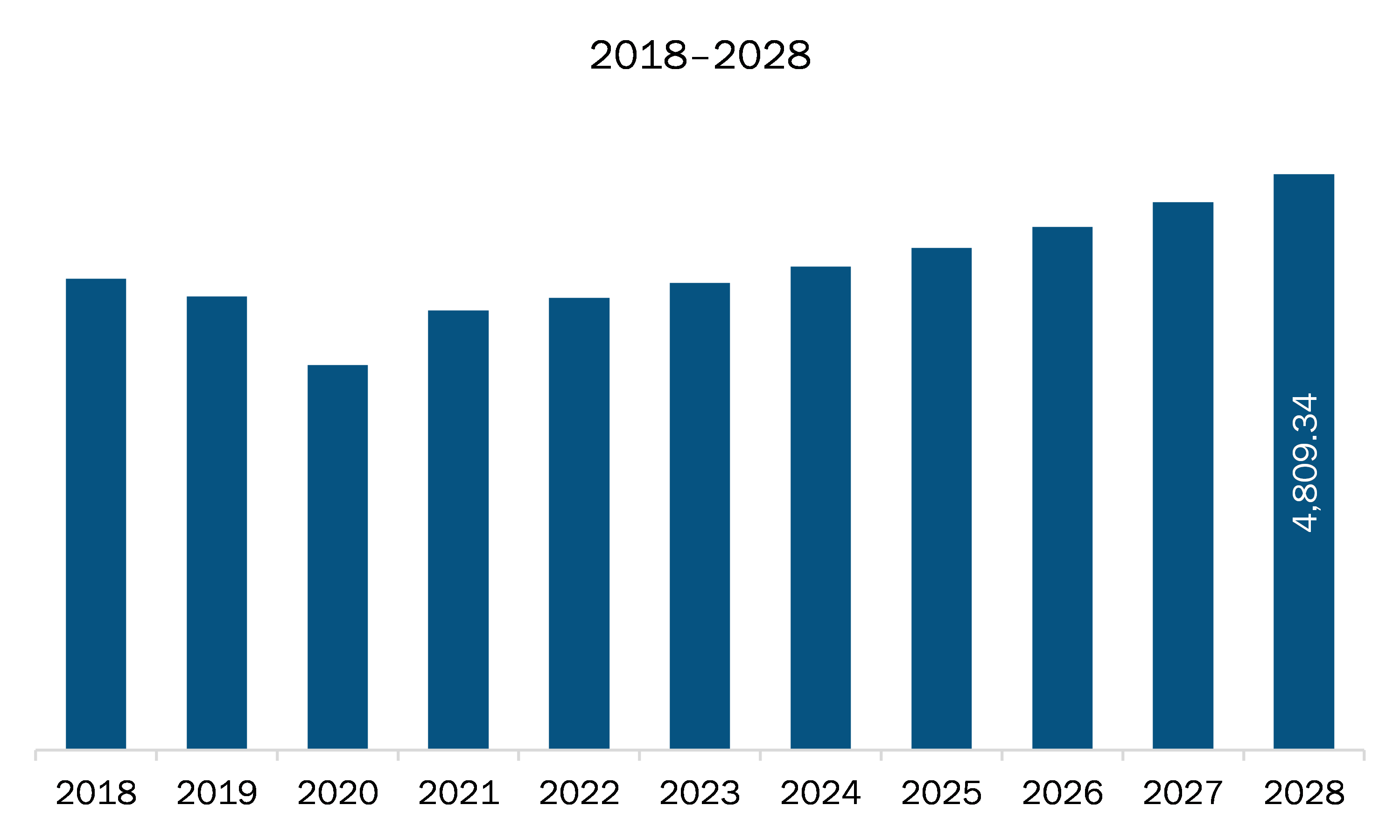

The automotive lead acid battery market in North America is expected to grow from US$ 3,669.33 million in 2021 to US$ 4,809.34 million by 2028; it is estimated to grow at a CAGR of 3.9% from 2021 to 2028. At present, the vehicles are becoming more electrified and autonomous, the future of vehicle technology is getting evolved. Companies like Clarios have developed a 12-volt advanced lead-acid battery which would be a part of changing future vehicle technology. The 12-volt battery is important to evolving vehicle technologies and AGM technology is a preferred battery choice. The technology provides higher reliability and better performance for fulfilling rising power demands. Thus, emergence of 12-volt lead acid batteries would be a key enable in promoting the market growth.

Key Market Segments

The North America automotive lead acid battery market is segmented based on product, type, and end user. Based on product, the North America automotive lead acid battery market is segmented into SLI, micro hybrid batteries. The SLI segment held the largest market share in 2020 Based on type, North America automotive lead acid battery market is segmented into flooded, enhanced flooded, and VRLA. The flooded lead acid battery segment dominated the market. Based on end user, the market is segmented into passenger cars, LCV, M&HCV. The passenger cars segment dominated the end user segment in the market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the automotive lead acid battery market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Clarios; CSB Energy Technology Co., Ltd.; East Penn Manufacturing Company; EnerSys; Exide Industries Limited; GS Yuasa International Ltd.; Johnson Controls, Inc.; leoch International Technology Limited Inc; and Panasonic Corporation.

Reasons to buy report

- To understand the North America automotive lead acid battery market landscape and identify market segments that are most likely to guarantee a strong return.

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America automotive lead acid battery market.

- Efficiently plan M&A and partnership deals in North America automotive lead acid battery market by identifying market segments with the most promising probable sales.

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America automotive lead acid battery market.

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Automotive Lead Acid Battery Market Segmentation

North America Automotive Lead Acid Battery Market - By Product

- SLI

- Micro Hybrid Batteries

North America Automotive Lead Acid Battery Market - By Type

- Flooded

- Enhanced Flooded

- VRLA

North America Automotive Lead Acid Battery Market - By End User

- Passenger Cars

- LCV

- M&HCV

North America Automotive Lead Acid Battery Market - By Country

- US

- Canada

- Mexico

North America Automotive Lead Acid Battery Market - Company Profiles

- Clarios

- CSB Energy Technology Co., Ltd.

- East Penn Manufacturing Company

- EnerSys

- Exide Industries Limited

- GS Yuasa International Ltd.

- Johnson Controls, Inc.

- leoch International Technology Limited Inc

- Panasonic Corporation

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Automotive Lead Acid Battery Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Automotive Lead Acid Battery Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Growing Adoption of Mild Hybrid Vehicles

5.1.2 Rising Production of Cars and Commercial Vehicles

5.2 Key Market Restraints

5.2.1 High Adoption of Electric Vehicles in North America

5.3 Key Market Opportunities

5.3.1 Upcoming of 12-volt lead-acid battery for vehicle technology

5.4 Future Trends

5.4.1 Emergence of BSVI-Compliant Vehicles

5.5 Impact Analysis of Drivers and Restraints

6. Automotive Lead Acid Battery Market – North America Analysis

6.1 North America Automotive Lead Acid Battery Market Overview

6.2 North America Automotive Lead Acid Battery Market – Revenue and Forecast to 2028 (US$ Million)

7. North America Automotive Lead Acid Batteries Market Analysis – By Product

7.1 Overview

7.2 North America Automotive Lead Acid Batteries Market, By Product (2020 and 2028)

7.3 SLI

7.3.1 Overview

7.3.2 SLI: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Micro Hybrid batteries

7.4.1 Overview

7.4.2 Micro hybrid batteries: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

8. North America Automotive Lead Acid Batteries Market – By Type

8.1 Overview

8.2 North America Automotive Lead Acid Batteries Market, by Type (2020 and 2028)

8.3 Flooded

8.3.1 Overview

8.3.2 Flooded: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Enhanced Flooded

8.4.1 Overview

8.4.2 Enhanced Flooded: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

8.5 VRLA

8.5.1 Overview

8.5.2 VRLA: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

9. North America Automotive Lead Acid Batteries Market – By End-User

9.1 Overview

9.2 North America Automotive Lead Acid Batteries Market, by End-User (2020 and 2028)

9.3 Passenger Car

9.3.1 Overview

9.3.2 Passenger Car: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

9.4 LCV

9.4.1 Overview

9.4.2 LCV: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

9.5 MCV AND HCV

9.5.1 Overview

9.5.2 MCV AND HCV: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

10. North America Automotive Lead Acid Battery Market – Country Analysis

10.1 Overview

10.1.1 North America: Automotive Lead Acid Batteries Market- by Key Country

10.1.1.1 US: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 US: Automotive Lead Acid Batteries Market- by Product

10.1.1.1.2 US: Automotive Lead Acid Batteries Market- By Type

10.1.1.1.3 US: Automotive Lead Acid Batteries Market- By End-user

10.1.1.2 Canada: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Canada: Automotive Lead Acid Batteries Market- by Product

10.1.1.2.2 Canada: Automotive Lead Acid Batteries Market- By Type

10.1.1.2.3 Canada: Automotive Lead Acid Batteries Market- By End-user

10.1.1.3 Mexico: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Mexico: Automotive Lead Acid Batteries Market- by Product

10.1.1.3.2 Mexico: Automotive Lead Acid Batteries Market- By Type

10.1.1.3.3 Mexico: Automotive Lead Acid Batteries Market- By End-user

11. North America Automotive Lead Acid Battery Market- COVID-19 Impact Analysis

11.1 North America

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

13. Company Profiles

13.1 Clarios

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 CSB Energy Technology Co., Ltd.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 EnerSys

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 East Penn Manufacturing Company

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Exide Industries Limited

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 GS Yuasa International Ltd.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Johnson Controls, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 leoch International Technology Limited Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Panasonic Corporation

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. North America Automotive Lead Acid Battery Market – Revenue, and Forecast to 2028 (US$ Million)

Table 2. US: Automotive Lead Acid Batteries Market- by Product –Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Automotive Lead Acid Batteries Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Automotive Lead Acid Batteries Market- By End-user –Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada: Automotive Lead Acid Batteries Market- by Product –Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada: Automotive Lead Acid Batteries Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada: Automotive Lead Acid Batteries Market- By End-user –Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico: Automotive Lead Acid Batteries Market- by Product –Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico: Automotive Lead Acid Batteries Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico: Automotive Lead Acid Batteries Market- By End-user –Revenue and Forecast to 2028 (US$ Million)

Table 11. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Automotive Lead Acid Battery Market Segmentation

Figure 2. North America Automotive Lead Acid Battery Market Segmentation – By Country

Figure 3. North America Automotive Lead Acid Battery Market Overview

Figure 4. SLI Segment Held the Largest Market Share in 2020

Figure 5. Flooded Held the Largest Market Share in 2020

Figure 6. Passenger Cars Held the Largest Market Share in 2020

Figure 7. US was the Largest Revenue Contributor in 2020

Figure 8. North America – PEST Analysis

Figure 9. North America Automotive Lead Acid Battery Market– Ecosystem Analysis

Figure 10. Expert Opinion

Figure 11. North America Automotive Lead Acid Battery Market: Impact Analysis of Drivers and Restraints

Figure 12. North America Automotive Lead Acid Battery Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America Automotive Lead Acid Batteries Market Revenue Share, by Product (2020 and 2028)

Figure 14. North America SLI: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Micro hybrid batteries: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Automotive Lead Acid Batteries Market Revenue Share, by Type (2020 and 2028)

Figure 17. North America Flooded: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America Enhanced Flooded: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America VRLA: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. North America Automotive Lead Acid Batteries Market Revenue Share, by End-User (2020 and 2028)

Figure 21. North America Passenger Car: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. North America LCV: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. North America MCV AND HCV: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. North America: Automotive Lead Acid Batteries Market, by Key Country – Revenue 2020 (US$ Million)

Figure 25. North America: Automotive Lead Acid Batteries Market Revenue Share, by Key Country (2020 and 2028)

Figure 26. US: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Canada: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Mexico: Automotive Lead Acid Batteries Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Impact of COVID-19 Pandemic in North American Country Markets

- Clarios

- CSB Energy Technology Co., Ltd.

- East Penn Manufacturing Company

- EnerSys

- Exide Industries Limited

- GS Yuasa International Ltd.

- Johnson Controls, Inc.

- leoch International Technology Limited Inc

- Panasonic Corporation

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America automotive lead acid battery market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America automotive lead acid battery market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the automotive lead acid battery market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution