North America Aircraft Wire & Cable Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Cable, Wire, and Harness), Aircraft Type (Commercial and Military), Fit Type (Line Fit and Retrofit), and Application (Power Transfer, Data Transfer, Flight Control System, Avionics, and Lighting)

Market Introduction

Aircraft wires and cables are used for numerous aircraft applications, such as lighting, flight control system, power transfer, data transfer, and avionics. The stranded cables used are versatile and have a greater degree of flexibility. The wires and cables used in aircraft are produced in diverse configurations with variable lays, materials, and diameters to suit different applications. Over the years, the aircraft fleet has significantly increased and has resulted in the mounting installation of electrical and electronic equipment. Further, the growth in the safety of the aircraft is expected to propel the demand for aircraft wires and cables. The rapid expansion of the aviation sector and the growing adoption of advanced technologies for the smooth functioning of aircraft supplement the growth of the market significantly. Besides, the presence of robust aircraft manufacturers, such as Boeing and Airbus, and growing disposable incomes in developing countries and are among the factors driving the demand for these aircraft wires and cables. The growing defense expenditure across significant economies, such as the US and Canada is expected to drive the North America aircraft wires and cables market in the coming years. Increasing technological developments, growing investments in research and development (R&D) by aircraft original equipment manufacturers (OEMs), and rising demand for air transportation are propelling the growth of the aerospace & defense sector, which is subsequently driving the North America aircraft wires & cables market growth. Also, deliveries and orders of aircraft rising is the major factor driving the North America aircraft wire & cable market.

The ongoing COVID-19 is having a very devastating impact over the North America region. North America is one of the most important regions for adopting and developing new technologies due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Due to COVID-19, several aircraft manufacturers in the region faced challenges, which includes shutdowns of production sites and disruptions in the workplace, raw materials, and goods. For instance, in the second quarter of 2020, Boeing suspended its operations in Philadelphia, Puget Sound, South Carolina, and numerous other major production sites. The company’s revenues declined by US$ 18,401 million in 2020 compared with 2019, majorly due to less revenues in its commercial airplane and services businesses. Besides, due to global breakdown Boeing delivered 157 aircraft in 2020, which is down from 380 in 2019 and 806 in 2018. Due to disruption in the business of aircraft manufacturers, several wires & cables suppliers also suspended operations during the second quarter of 2020, and they witnessed additional disruptions in 2021. Thus, the North American aircraft wire & cable market has been shattered by the momentary shutdown of the aviation industry, reflecting severely less demand for various types of components, including wires & cables. Due to this, the aircraft wire & cable market players have been witnessing noteworthy less demand; however, as the unlock measures started, and airlines resumed their operations, the procurement rate of wires & cables begun to uprise at a slow pace.

Get more information on this report :

Market Overview and Dynamics

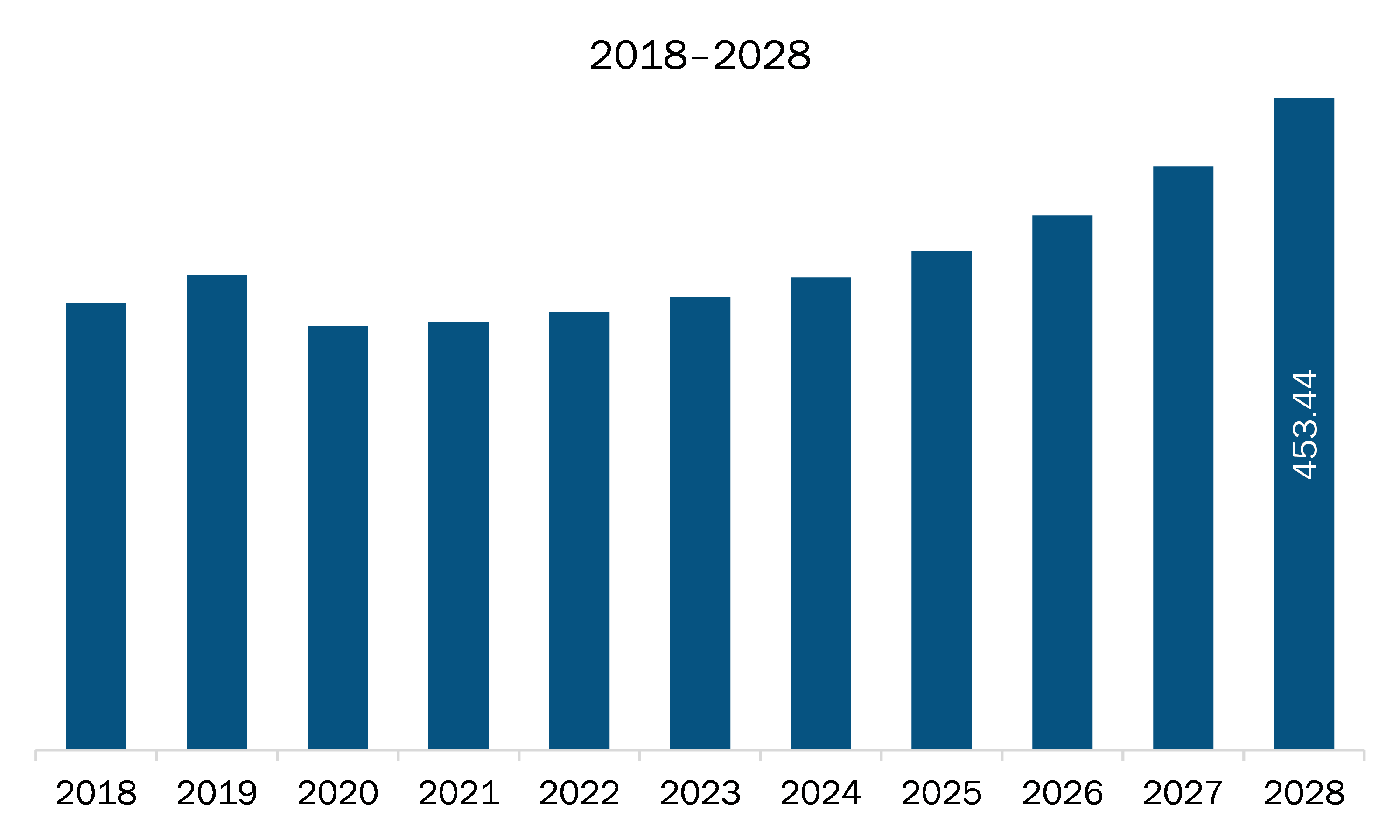

The aircraft wire & cable market in North America is expected to grow from US$ 295.17 million in 2020 to US$ 453.44 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028. At present, the aircraft wires and cables manufacturers can explore potential business opportunities through conducting extensive research & development (R&D) for developing lightweight cables and wires. The availability of lightweight efficient, mechanically durable wires could provide scope for creating sustainable market offerings and subsequently provide attractive market growth opportunities for the market players operating in the market. The wires and cables encompass most of the weight portion of aircraft power systems and a huge fraction of the entire aircraft weight. By opting for substantially lightweight wires would enhance the fuel economy of an aircraft while also surging the amount of load it could carry. The Battlefield Air Operations Kit (BAO) program, which offers equipment for Battlefield Airmen to perform a wide range of missions, has documented requirements to mitigate the volume and weight of cables to reduce personnel fatigue and any hazards during special operations missions. Thus, governments across the regions are swiftly moving from traditional wires and cables to fiber optics.

Key Market Segments

The North America aircraft wire & cable market is segmented into type, fit type, aircraft type, and application. Based on type, the North America aircraft wire & cable market is further segmented into harness, wire, and cable. Wire segment held a substantial market share in 2020. Based on fit type, the market is further categorized into line fit and retrofit. Line fit segment held a substantial market share in 2020. Further, the market is segmented based on aircraft type into commercial and military. Commercial segment held a substantial market share in 2020. Based on application, the market is classified into power transfer, data transfer, flight control system, avionics, and lighting. Power transfer segment held a substantial market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the aircraft wire & cable market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are A.E. Petsche Company; AMETEK Inc.; Amphenol Corporation; Axon Enterprise, Inc.; Carlisle Companies Incorporated; Collins Aerospace, a Raytheon Technologies Corporation Company; Draka; Glenair, Inc.; Harbour Industries, LLC; HUBER+SUHNER; Nexans; PIC Wire & Cable; Radiall; TE Connectivity Ltd.; W. L. Gore and Associates, Inc.

Reasons to buy report

- To understand the North America aircraft wire & cable market landscape and identify market segments that are most likely to guarantee a strong return.

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America aircraft wire & cable market.

- Efficiently plan M&A and partnership deals in North America aircraft wire & cable market by identifying market segments with the most promising probable sales.

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America aircraft wire & cable market.

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Aircraft Wire & Cable Market Segmentation

North America Aircraft Wire & Cable Market - By Type

- Cable

- Wire

- Harness

North America Aircraft Wire & Cable Market - By Aircraft Type

- Commercial

- Military

North America Aircraft Wire & Cable Market - By Fit Type

- Line Fit

- Retrofit

North America Aircraft Wire & Cable Market - By Application

- Power Transfer

- Data Transfer

- Flight Control System

- Avionics

- Lighting

North America Aircraft Wire & Cable Market - By Country

- US

- Canada

- Mexico

North America Aircraft Wire & Cable Market - Company Profiles

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Axon Enterprise, Inc.

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Company

- Draka

- Glenair, Inc.

- Harbour Industries, LLC

- HUBER+SUHNER

- Nexans

- PIC Wire & Cable

- Radiall

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Aircraft Wire & Cable Market Landscape

4.1 Market Overview

4.2 Ecosystem Analysis

4.3 Porter’s Five Forces Analysis

5. North America Aircraft Wire & Cable Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Deliveries and Orders of Aircraft Rising

5.1.2 Rising Development of Innovative Aircraft Solutions

5.2 Market Restraints

5.2.1 Aircrafts Getting Discontinued

5.3 Future Trends

5.3.1 Scope for Lightweight and Durable Aircraft Wires and Cables

5.4 Impact Analysis of Drivers and Restraints

6. Aircraft Wire & Cable Market– North America Analysis

6.1 North America Aircraft Wire & Cable Market Overview

6.2 North America Aircraft Wire & Cable Market Forecast and Analysis

7. North America Aircraft Wire & Cable Market Analysis – Type

7.1 Overview

7.2 North America Aircraft Wire & Cable Market Breakdown, By Type, 2020 & 2028

7.3 Cable

7.3.1 Overview

7.3.2 Cable: Aircraft Wire & Cable Market Forecasts and Analysis

7.4 Wire

7.4.1 Overview

7.4.2 Wire: Aircraft Wire & Cable Market Forecasts and Analysis

7.5 Harness

7.5.1 Overview

7.5.2 Harness: Aircraft Wire & Cable Market Forecasts and Analysis

8. North America Aircraft Wire & Cable Market Analysis – By Aircraft Type

8.1 Overview

8.2 North America Aircraft Wire & Cable Market Breakdown, By Aircraft Type, 2020 & 2028

8.3 Commercial

8.3.1 Overview

8.3.2 Commercial: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn)

8.4 Military

8.4.1 Overview

8.4.2 Military: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn)

9. North America Aircraft Wire & Cable Market Analysis – Fit Type

9.1 Overview

9.2 North America Aircraft Wire & Cable Market Breakdown, By Fit Type, 2020 & 2028

9.3 Line Fit

9.3.1 Overview

9.3.2 Line Fit: Aircraft Wire & Cable Market Forecasts and Analysis

9.4 Retrofit

9.4.1 Overview

9.4.2 Retrofit: Aircraft Wire & Cable Market Forecasts and Analysis

10. North America Aircraft Wire & Cable Market Analysis – Application

10.1 Overview

10.2 North America Aircraft Wire & Cable Market Breakdown, By Application, 2020 & 2028

10.3 Power Transfer

10.3.1 Overview

10.3.2 Power Transfer: Aircraft Wire & Cable Market Forecasts and Analysis

10.4 Data Transfer

10.4.1 Overview

10.4.2 Data Transfer: Aircraft Wire & Cable Market Forecasts and Analysis

10.5 Avionics

10.5.1 Overview

10.5.2 Avionics: Aircraft Wire & Cable Market Forecasts and Analysis

10.6 Lighting

10.6.1 Overview

10.6.2 Lighting: Aircraft Wire & Cable Market Forecasts and Analysis

10.7 Flight Control Systems

10.7.1 Overview

10.7.2 Flight Control System: Aircraft Wire & Cable Market Forecasts and Analysis

11. North America Aircraft Wire & Cable Market – Country Analysis

11.1 Overview

11.1.1.1 North America: Aircraft Wire & Cable Market Breakdown, by Key Countries

11.1.1.2 US: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn)

11.1.1.2.1 US: Aircraft Wire & Cable Market Breakdown by Type

11.1.1.2.2 US: Aircraft Wire & Cable Market Breakdown by Fit Type

11.1.1.2.3 US: Aircraft Wire & Cable Market Breakdown by Aircraft Type

11.1.1.2.4 US: Aircraft Wire & Cable Market Breakdown by Application

11.1.1.3 Canada: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn)

11.1.1.3.1 Canada: Aircraft Wire & Cable Market Breakdown by Type

11.1.1.3.2 Canada: Aircraft Wire & Cable Market Breakdown by Fit Type

11.1.1.3.3 Canada: Aircraft Wire & Cable Market Breakdown by Aircraft Type

11.1.1.3.4 Canada: Aircraft Wire & Cable Market Breakdown by Application

11.1.1.4 Mexico: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn)

11.1.1.4.1 Mexico: Aircraft Wire & Cable Market Breakdown by Type

11.1.1.4.2 Mexico: Aircraft Wire & Cable Market Breakdown by Fit Type

11.1.1.4.3 Mexico: Aircraft Wire & Cable Market Breakdown by Aircraft Type

11.1.1.4.4 Mexico: Aircraft Wire & Cable Market Breakdown by Application

12. Impact of COVID-19 Pandemic on North America Aircraft Wire & Cable Market

12.1 North America

13. Aircraft Wire and Cable Market - Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Merger and Acquisition

13.4 New Development

14. Company Profiles

14.1 Axon Enterprise, Inc

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Harbour Industries, LLC

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Draka

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Glenair, Inc.

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 HUBER+SUHNER

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 A.E. Petsche Company

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 AMETEK Inc.

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Amphenol Corporation

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Carlisle Companies Incorporated

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Collins Aerospace, a Raytheon Technologies Corporation Company

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

14.11 TE Connectivity Ltd.

14.11.1 Key Facts

14.11.2 Business Description

14.11.3 Products and Services

14.11.4 Financial Overview

14.11.5 SWOT Analysis

14.11.6 Key Developments

14.12 W. L. Gore and Associates, Inc.

14.12.1 Key Facts

14.12.2 Business Description

14.12.3 Products and Services

14.12.4 Financial Overview

14.12.5 SWOT Analysis

14.12.6 Key Developments

14.13 PIC Wire & Cable

14.13.1 Key Facts

14.13.2 Business Description

14.13.3 Products and Services

14.13.4 Financial Overview

14.13.5 SWOT Analysis

14.13.6 Key Developments

14.14 Nexans

14.14.1 Key Facts

14.14.2 Business Description

14.14.3 Products and Services

14.14.4 Financial Overview

14.14.5 SWOT Analysis

14.14.6 Key Developments

14.15 Radiall

14.15.1 Key Facts

14.15.2 Business Description

14.15.3 Products and Services

14.15.4 Financial Overview

14.15.5 SWOT Analysis

14.15.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Glossary of Terms

LIST OF TABLES

Table 1. Boeing and Airbus: Aircraft Order and Delivery Data, 2018, 2019, and 2020

Table 2. North America Aircraft Wire & Cable Market Revenue and Forecasts to 2028 (US$ Mn)

Table 3. US Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million)

Table 4. US: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million)

Table 5. US: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million)

Table 6. US: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million)

Table 7. Canada: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million)

Table 8. Canada: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million)

Table 9. Canada: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million)

Table 10. Canada: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million)

Table 11. Mexico: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Type (US$ Million)

Table 12. Mexico: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Fit Type (US$ Million)

Table 13. Mexico: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Aircraft Type (US$ Million)

Table 14. Mexico: Aircraft Wire & Cable Market Revenue and Forecasts to 2028 – By Application (US$ Million)

Table 15. Glossary of Term: North America Aircraft Wire & Cable Market

LIST OF FIGURES

Figure 1. North America Aircraft Wire & Cable Market Segmentation

Figure 2. North America Aircraft Wire & Cable Market Segmentation - Country

Figure 3. North America Aircraft Wire & Cable Market Overview

Figure 4. North America Aircraft Wire & Cable Market, By Country

Figure 5. North America Aircraft Wire & Cable Market, By Type

Figure 6. North America Aircraft Wire & Cable Market, By Application

Figure 7. North America Aircraft Wire & Cable Market Ecosystem Analysis

Figure 8. North America Aircraft Wire & Cable Market - Porter’s Five Forces Analysis

Figure 9. North America Aircraft Wire & Cable Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Aircraft Wire & Cable Market Forecast and Analysis, (US$ Mn)

Figure 11. North America Aircraft Wire & Cable Market Breakdown, By Type, 2020 & 2028 (%)

Figure 12. North America Cable: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 13. North America Wire: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 14. North America Harness: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 15. North America Aircraft Wire & Cable Market Breakdown by Aircraft Type, 2020 & 2028 (%)

Figure 16. North America Commercial: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 17. North America Military: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 18. North America Aircraft Wire & Cable Market Breakdown, By Fit Type, 2020 & 2028 (%)

Figure 19. North America Line Fit: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 20. North America Retrofit: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 21. North America Aircraft Wire & Cable Market Breakdown, By Application, 2020 & 2028 (%)

Figure 22. North America Power Transfer: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 23. North America Data Transfer: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 24. North America Avionics: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 25. North America Lighting: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 26. North America Flight Control System: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 27. North America: Aircraft Wire & Cable Market Breakdown by Key Countries, Revenue 2020 (US$ Million)

Figure 28. North America: Aircraft Wire & Cable Market Breakdown by Key Countries, 2020 & 2028(%)

Figure 29. US: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 30. Canada: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 31. Mexico: Aircraft Wire & Cable Market Revenue and Forecasts To 2028 (US$ Mn)

Figure 32. Impact of COVID-19 Pandemic in North American Country Markets

- A.E. Petsche Company

- AMETEK Inc.

- Amphenol Corporation

- Axon Enterprise, Inc.

- Carlisle Companies Incorporated

- Collins Aerospace, a Raytheon Technologies Corporation Company

- Draka

- Glenair, Inc.

- Harbour Industries, LLC

- HUBER+SUHNER

- Nexans

- PIC Wire & Cable

- Radiall

- TE Connectivity Ltd.

- W. L. Gore and Associates, Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America aircraft wire & cable market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America aircraft wire & cable market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the aircraft wire & cable market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution