North America Aircraft Wheels and Brakes Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Braking System, Wheels, and Brakes), Fit Type (Line Fit and Retro Fit), and End User (Defense and Commercial)

Market Introduction

North America dominates the global aircraft wheels and brakes market, owing to the substantial production volume of commercial and military aircraft fleets. Another factor promoting the North American aircraft wheels and brakes market is the continuously growing number of air passengers. According to the International Civil Aviation Organization (ICAO), the total passenger traffic of North America is expected to grow by around 3.1% annually by 2045, which is anticipated to boost aircraft production and increase the demand for aircraft wheels and brakes. Improvements in airport infrastructure, installation of advanced air traffic control and air navigation systems, and better safety and security services are estimated to promote North America’s aviation sector. Government investment in the travel industry and powerful incentives for foreign direct investors to explore economic opportunities in the region’s air transportation sector are likely to augment North America’s aircraft industry and increase the demand for the aircraft wheels and brakes market. Growth in air transport activities, focus on NextGen air transportation systems, and presence of key players that are significantly investing in R&D to develop technologically advanced braking systems are estimated to boost North America’s aircraft wheels and brakes market during the forecast period. The increasing demand for lightweight aircraft in the commercial and military sectors has created a need for lightweight electric brakes. Alaska Airlines, United Airlines, American Airlines, Delta Air Lines, and Southwest Airlines are among the key companies in the North American aviation sector that are investing millions of dollars in the R&D of newer and advanced technologies in partnership with several technology developers. Also, these airlines continuously procure higher volumes of aircraft, which enables the aircraft OEMs to procure a significant volume of wheels and brakes. This is catalyzing the aircraft wheels and brakes market. Significant rise in the assembly of wheels and braking systems in an aircraft and replacement of old components and requirement of maintenance services are bolstering the market growth. There is a high demand for long-lasting wheels and carbon brakes, which is encouraging manufacturers to upgrade the existing systems, thereby enhancing market growth. North American countries have an extensive range of MRO facilities across borders encompassing commercial and military aircraft MRO services. The frequency of landing and take-off has raised the frequency of wheels and brakes MRO across aircraft fleet. Moreover, the region accounts for the largest volume of the existing aircraft fleet. Thus, the frequency of wheels and brakes MRO with the existence of a large aircraft fleet highlights a higher procurement rate of wheels and brakes among the MRO service providers. The MRO sector is witnessing growth in the number of MRO service providers, especially in Canada and Mexico, which is further expected to catalyze the demand for wheels and brakes, thereby boosting the aircraft wheels and brakes market.

In North America, the US witnessed the most severe impact of COVID-19 in 2020. The aircraft wheels and brake manufacturers and service providers in the region are affected due to imposition of nationwide lockdowns and travel restrictions, shutdown of production facilities, and shortage of employees. The massive outbreak created both a health crisis and an economic crisis in the North American countries, especially in the US, which also led to major disruptions in the aerospace industry, impacting supply chains, manufacturing, product sales, and so on. The COVID-19 pandemic has directly and indirectly impacted the industry’s short-term and long-term strategies. The pandemic has caused huge havoc in the airlines industry in North America due to huge net losses and delayed recovery. The aircraft industry in North America was one of the strongest performers in the pre-crisis period, however, IATA reports an estimated loss of ~US$ 45.8 billion in 2020 in the region. Nevertheless, in 2021, following the recovery, the net profit margin of the North American aerospace industry is anticipated to improve to –6.8% from –41.4% in 2020. The presence of large domestic markets is anticipated to drive the improvement. Recovery in demands for passenger, cargo, and military aircraft fleet is anticipated to boost manufacturing and sales of the aircraft wheels and brakes in the coming financial quarters.

Get more information on this report :

Market Overview and Dynamics

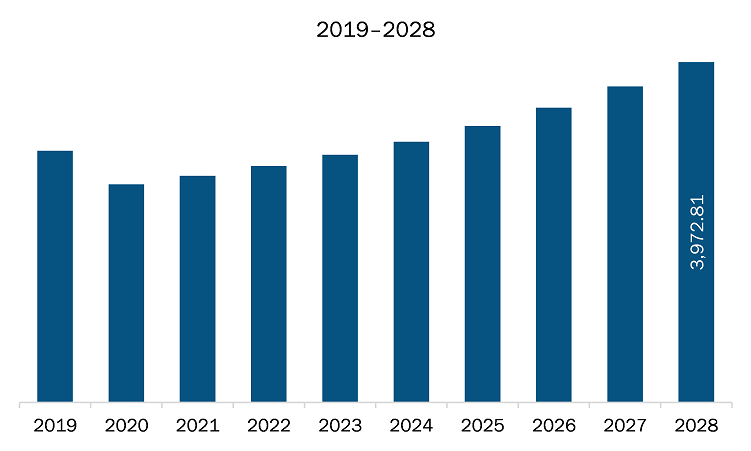

The aircraft wheels and brakes market in North America is expected to grow from US$ 2,645.80 million in 2021 to US$ 3,972.81 million by 2028; it is estimated to grow at a CAGR of 6.0% from 2021 to 2028. Electric brakes and fiber-reinforced plastic wheels; electric brakes have emerged as an attractive alternative to conventional aircraft brake systems due to their benefits such as reduction in fuel consumption and CO2 emissions due to optimized weight of aircraft. These brake systems come with easy installation procedures and maintenance requirements, which simplifies the process of retrofitting for aircraft MRO services players. The electric brake systems integrate smart features such as real-time assessment of carbon disk wear and quick data transmission to the cockpit to bring greater convenience in aircraft operations. The anti-oxidation coating on brakes increases their service life and provides better protection against de-icing products. Electric brakes are predominantly used in several military aircraft models; on the other hand, B787 Dreamliner is the only commercial aircraft model that uses electric brakes. Advanced features such as real-time assessment reporting and data transmission make it popular among aircraft manufacturers. With these benefits, electric brake systems are anticipated to become a prominent trend in the aircraft wheels and brakes market in the coming years. In the aircraft wheel manufacturing segment, many conceptual developments are underway as several manufacturers are concentrating on the development of fiber-reinforced plastics wheels. Since wheels bear the maximum dynamic and thermal loads during aircraft take-off and landing, several stakeholders are engaged in exploring different advanced raw materials as suitable and better replacements for aluminum or magnesium in wheel production. Thus, a carbon-fiber-reinforced plastic wheel is another trend emerging in the aircraft wheels and brakes market.

Key Market Segments

Based on component, the market is segmented into braking systems, wheels, and brakes. In 2020, the brakes segment held the largest share North America aircraft wheels and brakes market. Based on fit type, the market is divided into line fit and retro fit. In 2020, the retro fit segment held the largest share North America aircraft wheels and brakes market. Based on end user, the market is segmented into defense and commercial. In 2020, commercial segment held the largest share North America aircraft wheels and brakes market.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the aircraft wheels and brakes market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BERINGER AERO, Collins Aerospace, Crane Aerospace & Electronics, Grove Aircraft Landing Gear System Inc, Honeywell International Inc., JAY-Em Aerospace and Machine, Inc., MATCO Manufacturing Inc, Meggitt PLC, Parker Hannifin Corporation, and Safran among others.

Reasons to buy report

- To understand the North America aircraft wheels and brakes market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America aircraft wheels and brakes market

- Efficiently plan M&A and partnership deals in North America aircraft wheels and brakes market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America aircraft wheels and brakes market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

NORTH AMERICA AIRCRAFT WHEELS AND BRAKES MARKET SEGMENTATION

By Component

- Braking System

- Wheels

- Brakes

By Fit Type

- Line Fit

- Retro Fit

By End User

- Defense

- Commercial

By Country

- US

- Canada

- Mexico

Company Profiles

- BERINGER AERO

- Collins Aerospace

- Crane Aerospace & Electronics

- Grove Aircraft Landing Gear System Inc

- Honeywell International Inc.

- JAY-Em Aerospace and Machine, Inc.

- MATCO Manufacturing Inc

- Meggitt PLC

- Parker Hannifin Corporation

- Safran

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Aircraft Wheels and Brakes Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.3 Ecosystem Analysis

5. North America Aircraft Wheels and Brakes – Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Use of Durable, Lightweight, Sturdy Carbon Brakes

5.1.2 Growing Demand for Passenger Airline Services

5.2 Market Restraints

5.2.1 Recall of B737 Max and Discontinuation of A380 and B747 Manufacturing

5.3 Market Opportunities

5.3.1 Burgeoning Demand for MRO Activities

5.4 Future Trends

5.4.1 Electric Brakes and Fiber-Reinforced Plastic Wheels

5.5 Impact Analysis of Drivers and Restraints

6. Aircraft Wheels and Brakes Market – North America Market Analysis

6.1 North America Aircraft Wheels and Brakes Market Overview

6.2 North America Aircraft Wheels and Brakes Market Revenue Forecast and Analysis

7. North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 – Component

7.1 Overview

7.2 North America Aircraft Wheels and Brakes Market, By Component (2020 & 2028)

7.3 Braking Systems

7.3.1 Overview

7.3.2 Braking System: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

7.4 Wheels

7.4.1 Overview

7.4.2 Wheels: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

7.5 Brakes

7.5.1 Overview

7.5.2 Brakes: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

8. North America Aircraft Wheels and Brakes Market Analysis and Forecast to 2028 – Fit Type

8.1 Overview

8.2 North America Aircraft Wheels and Brakes Market, By Fit Type (2020 & 2028)

8.3 Line Fit

8.3.1 Overview

8.3.2 Line Fit: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

8.4 Retro Fit

8.4.1 Overview

8.4.2 Retro Fit: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

9. North America Aircraft Wheels and Brakes Market Analysis and Forecast to 2028 – End User

9.1 Overview

9.2 North America Aircraft Wheels and Brakes Market, By End User (2020 & 2028)

9.3 Defense

9.3.1 Overview

9.3.2 Defense: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

9.4 Commercial

9.4.1 Overview

9.4.2 Commercial: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

10. North America Aircraft Wheels and Brakes Market – Country Analysis

10.1 North America: Aircraft Wheels and Brakes Market

10.1.1 North America: Aircraft Wheels and Brakes Market, by Key Country

10.1.2 US: Aircraft Wheels and Brakes Market – Revenue and Forecast to 2028 (US$ Million)

10.1.2.1 US: Aircraft Wheels and Brakes Market, by Component

10.1.2.2 US: Aircraft Wheels and Brakes Market, by Fit Type

10.1.2.3 US: Aircraft Wheels and Brakes Market, by End User

10.1.3 Canada: Aircraft Wheels and Brakes Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3.1 Canada: Aircraft Wheels and Brakes Market, by Component

10.1.3.2 Canada: Aircraft Wheels and Brakes Market, by Fit Type

10.1.3.3 Canada: Aircraft Wheels and Brakes Market, by End User

10.1.4 Mexico: Aircraft Wheels and Brakes Market – Revenue and Forecast to 2028 (US$ Million)

10.1.4.1 Mexico: Aircraft Wheels and Brakes Market, by Component

10.1.4.2 Mexico: Aircraft Wheels and Brakes Market, by Fit Type

10.1.4.3 Mexico: Aircraft Wheels and Brakes Market, by End User

11. North America Aircraft Wheels and Brakes Market - COVID-19 Impact Analysis

11.1 Overview

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Merger and Acquisition

13. Company Profiles

13.1 BERINGER AERO

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Collins Aerospace

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Honeywell International Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Meggitt PLC

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Parker Hannifin Corporation

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Safran

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 MATCO Manufacturing Inc

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 JAY-Em Aerospace and Machine, Inc.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Grove Aircraft Landing Gear System Inc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Crane Aerospace & Electronics

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Table 2. North America: Aircraft Wheels and Brakes Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Aircraft Wheels and Brakes Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Aircraft Wheels and Brakes Market, by Fit Type – Revenue and Forecast to 2028 (US$ Million)

Table 5. US: Aircraft Wheels and Brakes Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada: Aircraft Wheels and Brakes Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada: Aircraft Wheels and Brakes Market, by Fit Type – Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada: Aircraft Wheels and Brakes Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico: Aircraft Wheels and Brakes Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico: Aircraft Wheels and Brakes Market, by Fit Type – Revenue and Forecast to 2028 (US$ Million)

Table 11. Mexico: Aircraft Wheels and Brakes Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 12. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Aircraft Wheels and Brakes Market Segmentation

Figure 2. North America Aircraft Wheels and Brakes Market Segmentation – By Country

Figure 3. North America Aircraft Wheels and Brakes Market Overview

Figure 4. North America Aircraft Wheels and Brakes Market, by Component

Figure 5. North America Aircraft Wheels and Brakes Market, by Fit Type

Figure 6. North America Aircraft Wheels and Brakes Market, By Country

Figure 7. North America Aircraft Wheels and Brakes Market - Porter’s Five Forces Analysis

Figure 8. North America Aircraft Wheels and Brakes Market: Ecosystem Analysis

Figure 9. North America Aircraft Wheels and Brakes Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Aircraft Wheels and Brakes Market Revenue Forecast and Analysis (US$ Million)

Figure 11. North America Aircraft Wheels and Brakes Market, by Component (2020 & 2028)

Figure 12. Braking System: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. Wheels: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. Brakes: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Aircraft Wheels and Brakes Market, By Fit Type (2020 & 2028)

Figure 16. Line Fit: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. Retro Fit: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America Aircraft Wheels and Brakes Market, By End User (2020 & 2028)

Figure 19. Defense: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Commercial: North America Aircraft Wheels and Brakes Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America: Aircraft Wheels and Brakes Market – Revenue by Country to 2028 (US$ Million)

Figure 22. North America: Aircraft Wheels and Brakes Market Revenue Share, by Key Country (2020 & 2028)

Figure 23. US: Aircraft Wheels and Brakes Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Canada: Aircraft Wheels and Brakes Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Mexico: Aircraft Wheels and Brakes Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Impact of COVID-19 Pandemic in North America Country Markets

- BERINGER AERO

- Collins Aerospace

- Crane Aerospace & Electronics

- Grove Aircraft Landing Gear System Inc

- Honeywell International Inc.

- JAY-Em Aerospace and Machine, Inc.

- MATCO Manufacturing Inc

- Meggitt PLC

- Parker Hannifin Corporation

- Safran

- To understand the North America aircraft wheels and brakes market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America aircraft wheels and brakes market

- Efficiently plan M&A and partnership deals in North America aircraft wheels and brakes market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America aircraft wheels and brakes market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.