North America Adhesive Tapes Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Resin Type (Acrylic, Rubber, Silicone, and Others), Technology (Water-Based Adhesive Tapes, Solvent-Based Adhesive Tapes, and Hot-Melt- Based Adhesive Tapes), Tape Backing Material (Polypropylene (PP), Paper, Polyvinyl Chloride (PVC), and Others), and Application (Packaging, Healthcare, Automotive, Electrical and Electronics, Building and Construction, and Others)

Market Introduction

North America comprises potential economies such as the US, Canada, and Mexico. The adhesive tapes market across the region is witnessing remarkable growth owing to a significant product demand from various end-use industries, such as packaging, healthcare, and automotive. The US packaging sector accounted for US$ 177 billion in 2020, according to the Flexible Packaging Association (FPA). The rapidly growing packaging sector owing to the rising demand for packaged food & beverages, growing e-commerce industry, and rising retail sector across the region are a few major factors propelling the demand for adhesive tapes in North America. Moreover, the rapidly growing food service sector across the region is contributing toward the product demand. Food delivery providers use adhesive tapes to seal the boxes in which food is kept and delivered. People across the region are preferring to order food online owing to the COVID-19 outbreak pandemic. This factor is likely to spur the growth of the food delivery sector in the region, which would eventually favor the growth of the adhesive tapes market during the forecast period. The presence of prominent adhesive tapes manufacturers in the region, such as 3M and Avery Dennison Corporation, would contribute to the market growth during the forecast period. These manufacturers offer an extensive portfolio of products based on different applications. Moreover, they focus on product innovation and development to improve their functionality and cater to changing customer requirements, which is expected to enhance their profitability and provide potential growth opportunities in the future.

In North America, the US recorded the highest COVID-19 confirmed cases than Canada and Mexico. The COVID-19 pandemic is negatively impacting the chemical & materials industry in the region as the crisis is restricting the supply and distribution chain. The unavailability of raw materials due to lockdown in many raw material supplying countries has halted the production. There is a mixed impact of the pandemic on the adhesives tape market. Various industries, such as automobiles, construction, electronics and electrical, experienced sharp declines amid the pandemic. However, the healthcare industry has grown since the outbreak due to excessive demand for PPE kits and medical equipment. With the state of economic recovery, several industrial sectors and economies are strategically planning to invest in the healthcare sector. This is expected to provide an impetus to the market growth in the coming years.

Get more information on this report :

Market Overview and Dynamics

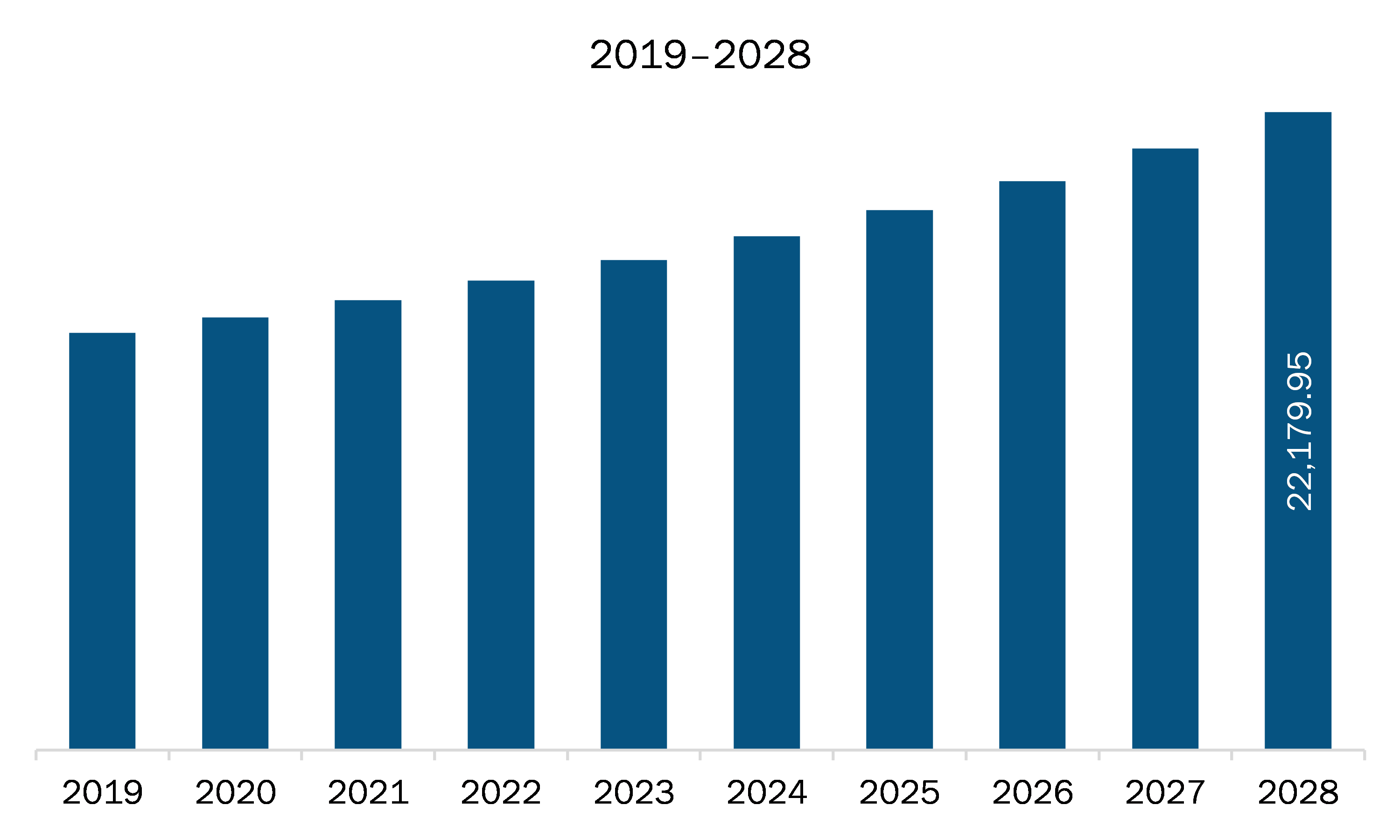

The North America adhesive tapes market is expected to grow from US$ 15,649.30 million in 2021 to US$ 22,179.95 million by 2028; it is estimated to grow at a CAGR of 5.1% from 2021 to 2028. Using adhesive tape instead of mechanical fasteners can change many product design areas and manufacturing efficiency. Screws, bolts, clips, rivets, and other mechanical fastening systems are quickly replaced by adhesive tapes due to their design and assembly advantages. Mechanical fasteners are considered the strongest and reliable joining methods. However, connecting different surfaces is a challenge because the material may tear due to tensile stress under high pressure. Therefore, it lacks reliability and long-term responsibility. These tapes eliminate the challenges related to traditional fastening systems and extend the life of a product. In addition, it eliminates rust and corrosion, lowers noise and vibration, reduces manufacturing and assembly time, and improves product design. These benefits significantly help improve efficiency and performance in various applications packaging, healthcare, automotive, electrical and electronics, building and construction, and others while reducing production and material costs. Further, many companies are manufacturing adhesive tapes for replacing mechanical fasteners. For instance, 3M has a range of VHB and Vhpb high-performance adhesive tapes, which consist of a durable acrylic adhesive with viscoelasticity. The company provides an exceptionally strong double-sided foam tape that can be adhered to a variety of substrates, such as stainless steel, aluminum, galvanized steel, composites, plastics, acrylic, polycarbonate, ABS, and painted or sealed wood and concrete. The tapes are widely used in applications across various markets, such as transportation, electrical appliances, electronics, construction, and signs and displays, as well as in general industries. 3M VHB Tape GPH060GF is a permanent adhesive solution that can replace traditional mechanical fasteners and liquid adhesives in demanding high-temperature applications. Its acrylic foam core provides a good balance between strength and adaptability. The tape has excellent temperature resistance and is very suitable for powder coating or liquid coating processes that undergo thermal baking cycles. Thus, the replacement of mechanical fasteners with adhesive tape would create lucrative opportunities for the North America adhesive tapes market players during the forecast period.

Key Market Segments

In terms of resin type, the rubber segment accounted for the largest share of the North America adhesive tapes market in 2020. In terms of technology, the solvent-based adhesive tapes segment held a larger market share of the North America adhesive tapes market in 2020. In terms of tape backing material, the polypropylene (PP) segment held a larger market share of the North America adhesive tapes market in 2020. Further, the automotive segment held a larger share of the North America adhesive tapes market based on application in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America adhesive tapes market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are 3M, Avery Dennison Corporation, Berry Global Inc., Intertape Polymer Group, LINTEC Corporation, Lohmann GmbH & Co.KG, Nitto Denko Corporation, Rogers Corporation, Scapa, and tesa SE.

Reasons to buy report

- To understand the North America adhesive tapes market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America adhesive tapes market

- Efficiently plan M&A and partnership deals in North America adhesive tapes market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America adhesive tapes market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Adhesive Tapes Market Segmentation

North America Adhesive Tapes Market - By Resin Type

- Acrylic

- Rubber

- Silicone

- Others

North America Adhesive Tapes Market - By Technology

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt- Based Adhesive Tapes

North America Adhesive Tapes Market - By Tape Backing Material

- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

North America Adhesive Tapes Market - By Application

- Packaging

- Healthcare

- Automotive

- Electrical and Electronics

- Building and Construction

- Others

North America Adhesive Tapes Market - By Country

- US

- Canada

- Mexico

North America Adhesive Tapes Market - Company Profiles

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- Intertape Polymer Group

- LINTEC Corporation

- Lohmann GmbH & Co.KG

- Nitto Denko Corporation

- Rogers Corporation

- Scapa

- tesa SE

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. North America Adhesive Tapes Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of Substitutes

4.2.4 Threat of New Entrants

4.2.5 Intensity of Competitive Rivalry

4.3 Expert Opinion

4.4 Ecosystem Analysis

5. North America Adhesive Tapes Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Extensive Range of Applications of Adhesive Tapes

5.1.2 Rising Demand for Adhesive Tapes from Automotive Industry

5.2 Market Restraints

5.2.1 Variation in Raw Material Prices

5.3 Market Opportunities

5.3.1 Changing Mechanical Fasteners with Adhesive Tape

5.4 Future Trends

5.4.1 Growing Adoption of Electric Vehicles

5.5 Impact Analysis of Drivers and Restraints

6. Adhesive Tapes Market – North America Analysis

6.1 North America Adhesive Tapes Market Overview

6.2 North America Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

7. North America Adhesive Tapes Market Analysis – By Resin Type

7.1 Overview

7.2 North America Adhesive Tapes Market, By Resin Type (2020 and 2028)

7.3 Acrylic

7.3.1 Overview

7.3.2 Acrylic: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

7.4 Rubber

7.4.1 Overview

7.4.2 Rubber: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

7.5 Silicone

7.5.1 Overview

7.5.2 Silicone: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

7.6 Others

7.6.1 Overview

7.6.2 Others: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

8. North America Adhesive Tapes Market Analysis – By Technology

8.1 Overview

8.2 North America Adhesive Tapes Market, By Technology (2020 and 2028)

8.3 Water-Based Adhesive Tapes

8.3.1 Overview

8.3.2 Water-Based Adhesive Tapes: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

8.4 Solvent-Based Adhesive Tapes

8.4.1 Overview

8.4.2 Solvent-Based Adhesive Tapes: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

8.5 Hot-Melt-Based Adhesive Tapes

8.5.1 Overview

8.5.2 Hot-Melt-Based Adhesive Tapes: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

9. North America Adhesive Tapes Market Analysis – By Tape Backing Material

9.1 Overview

9.2 North America Adhesive Tapes Market, By Tape Backing Material (2020 and 2028)

9.3 Polypropylene (PP)

9.3.1 Overview

9.3.2 Polypropylene (PP): Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

9.4 Paper

9.4.1 Overview

9.4.2 Paper: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

9.5 Polyvinyl Chloride (PVC)

9.5.1 Overview

9.5.2 Polyvinyl Chloride (PVC): Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

9.6 Others

9.6.1 Overview

9.6.2 Others: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

10. North America Adhesive Tapes Market Analysis – By Application

10.1 Overview

10.2 North America Adhesive Tapes Market, By Application (2020 and 2028)

10.3 Packaging

10.3.1 Overview

10.3.2 Packaging: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

10.4 Healthcare

10.4.1 Overview

10.4.2 Healthcare: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

10.5 Automotive

10.5.1 Overview

10.5.2 Automotive: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

10.6 Electrical and Electronics

10.6.1 Overview

10.6.2 Electrical and Electronics: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

10.7 Building and Construction

10.7.1 Overview

10.7.2 Building and Construction: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

10.8 Others

10.8.1 Overview

10.8.2 Others: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Mn)

11. North America Adhesive Tapes Market – Country Analysis

11.1 Overview

11.1.1 North America: Adhesive Tapes Market, by Key Country

11.1.1.1 US: Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

11.1.1.1.1 US: Adhesive Tapes Market, by Resin Type

11.1.1.1.2 US: Adhesive Tapes Market, by Technology

11.1.1.1.3 US: Adhesive Tapes Market, by Tape Backing Material

11.1.1.1.4 US: Adhesive Tapes Market, by Application

11.1.1.2 Canada: Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

11.1.1.2.1 Canada: Adhesive Tapes Market, by Resin Type

11.1.1.2.2 Canada: Adhesive Tapes Market, by Technology

11.1.1.2.3 Canada: Adhesive Tapes Market, by Tape Backing Material

11.1.1.2.4 Canada: Adhesive Tapes Market, by Application

11.1.1.3 Mexico: Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

11.1.1.3.1 Mexico: Adhesive Tapes Market, by Resin Type

11.1.1.3.2 Mexico: Adhesive Tapes Market, by Technology

11.1.1.3.3 Mexico: Adhesive Tapes Market, by Tape Backing Material

11.1.1.3.4 Mexico: Adhesive Tapes Market, by Application

12. Impact of COVID-19 on North America Adhesive Tapes Market

12.1 North America: Impact Assessment of COVID-19 Pandemic

13. Industry Landscape

13.1 Overview

13.2 Mergers & acquisition

14. Company Profiles

14.1 3M

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Nitto Denko Corporation

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 tesa SE

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Avery Dennison Corporation

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Intertape Polymer Group

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 LINTEC Corporation

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Berry Global Inc.

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 Scapa

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 Lohmann GmbH & Co.KG

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Rogers Corporation

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Word Index

LIST OF TABLES

Table 1. North America Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. US Adhesive Tapes Market, by Resin Type– Revenue and Forecast to 2028 (USD Million)

Table 3. US Adhesive Tapes Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 4. US Adhesive Tapes Market, by Tape Backing Material – Revenue and Forecast to 2028 (USD Million)

Table 5. US Adhesive Tapes Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 6. Canada: Adhesive Tapes Market, by Resin Type– Revenue and Forecast to 2028 (USD Million)

Table 7. Canada Adhesive Tapes Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 8. Canada Adhesive Tapes Market, by Tape Backing Material – Revenue and Forecast to 2028 (USD Million)

Table 9. Canada Adhesive Tapes Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 10. Mexico Adhesive Tapes Market, by Resin Type– Revenue and Forecast to 2028 (USD Million)

Table 11. Mexico Adhesive Tapes Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 12. Mexico Adhesive Tapes Market, by Tape Backing Material – Revenue and Forecast to 2028 (USD Million)

Table 13. Mexico Adhesive Tapes Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 14. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Adhesive Tapes Market Segmentation

Figure 2. North America Adhesive Tapes Market Segmentation – By Country

Figure 3. North America Adhesive Tapes Market Overview

Figure 4. Rubber Segment Held Largest Share of the Market in 2020

Figure 5. The US Held Largest Share of the Market in 2020

Figure 6. Porter ‘s Five Forces Analysis

Figure 7. Expert Opinion

Figure 8. North America Adhesive Tapes Market – Ecosystem Analysis

Figure 9. North America Adhesive Tapes Market Impact Analysis of Drivers and Restraints

Figure 10. North America: Adhesive Tapes Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. North America Adhesive Tapes Market Revenue Share, By Resin Type (2020 and 2028)

Figure 12. North America Acrylic: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 13. North America Rubber: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 14. North America Silicone: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 15. North America Others: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 16. North America Adhesive Tapes Market Revenue Share, By Technology (2020 and 2028)

Figure 17. North America Water-Based Adhesive Tapes: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 18. North America Solvent-Based Adhesive Tapes: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 19. North America Hot-Melt-Based Adhesive Tapes: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 20. North America Adhesive Tapes Market Revenue Share, By Tape Backing Material (2020 and 2028)

Figure 21. North America Polypropylene (PP): Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 22. North America Paper: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 23. North America Polyvinyl Chloride (PVC): Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 24. North America Others: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 25. North America Adhesive Tapes Market Revenue Share, By Application (2020 and 2028)

Figure 26. North America Packaging: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 27. North America Healthcare: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 28. North America Automotive: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 29. North America Electrical and Electronics: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 30. North America Building and Construction: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 31. North America Others: Adhesive Tapes Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 32. North America: Adhesive Tapes Market, by Key Country – Revenue (2020) (USD Million)

Figure 33. North America: Adhesive Tapes Market Revenue Share, by Key Country (2020 and 2028)

Figure 34. US: Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

Figure 35. Canada: Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

Figure 36. Mexico: Adhesive Tapes Market –Revenue and Forecast to 2028 (US$ Million)

Figure 37. Impact of COVID-19 Pandemic in North American Country Markets

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- Intertape Polymer Group

- LINTEC Corporation

- Lohmann GmbH & Co.KG

- Nitto Denko Corporation

- Rogers Corporation

- Scapa

- tesa SE

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America adhesive tapes market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America adhesive tapes market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the adhesive tapes market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution