Middle East and Africa Vertical Farming Crops Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Crop Type (Tomato, Leafy Greens, Herbs, and Others), End-Use (Food Retail, and Food Service), and Farming Technique (Hydroponics, Aeroponics, and Aquaponics)

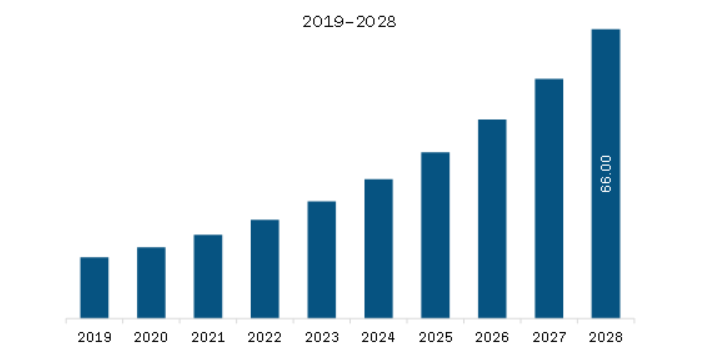

The vertical farming crops market in the Middle East & Africa(MEA) is expected to grow from US$ 19.12 million in 2021 to US$ 66.00 million by 2028; it is estimated to grow at a CAGR of 19.4% from 2021 to 2028.

The growth of the population, combined with a looming water crisis, is moving the Earth toward a major food crisis. The impact of climate change is variable and unpredictable, thereby adding pressure on the food system. For example, higher CO2 levels increase some crop yields but reduce their nutritional values. Further, warmer temperatures lead to the growth of many new pests and weeds. In addition, extreme temperatures lead to droughts or excessive rainfall, thereby preventing crops from growing. Vertical farming can be part of the solution as it uses less water and allows farmers to control the climate needed for the crops. For instance, the UAE is building the world's largest indoor farm. The country's dry climate, low soil quality, and occasional locust plagues make indoor farming a more economical and feasible alternative. Vertical farms do not use soil for farming. They use little water (compared to traditional agricultural practices) and a combination of natural and artificial lighting. Also, the manufacturers' strategic activities are further driving the adoption of vertical farming. For instance, companies such as Signify and Valoya are developing better lighting solutions, resulting in a decrease in the costs of running a vertical farm.

Saudi Arabia had the highest COVID-19 cases in the MEA region and is followed by Turkey and the UAE. The UAE was the first country in the Middle East and Africa to report a confirmed case of COVID-19. However, support by the government during the COVID-19 outbreak will offer opportunities in the region. For instance, in October 2020, FAO launched a pioneering project to provide capacity building and technical support for Jordan's Integrated Agri-Aquaculture (IAA) farming systems. The project was designed to train unemployed agricultural engineer graduates and farmers, set up a knowledge base, and research “Hydroponics and Aquaponics” farming units. Furthermore, it aimed to support youth and women's employment by creating employment opportunities in aquaponics and hydroponics.

Vendors can attract new customers and expand their footprints in emerging markets with the new features and technologies, thereby driving the Middle East & Africa vertical farming crops market. The Middle East & Africa vertical farming crops market is expected to grow at a significant CAGR during the forecast period.

Middle East & Africa Vertical Farming Crops Market Revenue and Forecast to 2028 (US$ Million)

Middle East & Africa Vertical Farming Crops Market Segmentation

Middle East & Africa Vertical Farming Crops Market – By Crop Type

- Tomato

- Leafy Greens

- Herbs

- Others

Middle East & Africa Vertical Farming Crops Market – By End-Use

- Food Service

- Food Retail

Middle East & Africa Vertical Farming Crops Market – By Farming Technique

- Hydroponics

- Aeroponics

- Aquaponics

Middle East & Africa Vertical Farming Crops Market – By Country

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Middle East & Africa Vertical Farming Crops Market – Companies Mentioned

- AeroFarms

- CropOne

- Plantlab

- Gotham Greens

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis Formulation:

3.2.4 Macro-economic Factor Analysis:

3.2.5 Developing Base Number:

3.2.6 Data Triangulation:

3.2.7 Country Level Data:

3.2.8 Assumptions & Limitations:

4. Middle East & Africa Vertical Farming Crops Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.3 Expert Opinion

5. Middle East & Africa Vertical Farming Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Burgeoning Demand for Fresh, Pesticide-Free, and Locally Grown Produce

5.1.2 Modest Availability of Arable Land for Conventional Agriculture

5.2 Market Restraints

5.2.1 Extensive Initial Investment

5.3 Market Opportunities

5.3.1 Fostering Demand for Vertical Farming in Highly Populated Urban Countries

5.4 Future Trends

5.4.1 AI-Controlled Vertical Farms

5.5 Impact Analysis of Drivers and Restraints

6. Middle East & Africa Vertical Farming Crops – Market Analysis

6.1 Middle East & Africa Vertical Farming Crops Market Overview

6.2 Middle East & Africa Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

7. Middle East & Africa Vertical Farming Market Analysis – By Crop Type

7.1 Overview

7.2 Middle East & Africa Vertical Farming Market, By Crop Type (2020 and 2028)

7.3 Tomato

7.3.1 Overview

7.3.2 Tomato: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

7.4 Leafy Greens

7.4.1 Overview

7.4.2 Leafy Greens: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

7.5 Herbs

7.5.1 Overview

7.5.2 Herbs: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

8. Middle East & Africa Vertical Farming Market Analysis – By End-Use

8.1 Overview

8.2 Middle East & Africa Vertical Farming Crops Market, By End-Use (2020 and 2028)

8.3 Food Retail

8.3.1 Overview

8.3.2 Food Retail: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

8.4 Food Service

8.4.1 Overview

8.4.2 Food Service: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

9. Middle East & Africa Vertical Farming Market Analysis – By Farming Technique

9.1 Overview

9.2 Middle East & Africa Vertical Farming Crops Market, By Farming Technique (2020 and 2028)

9.3 Hydroponics

9.3.1 Overview

9.3.2 Hydroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

9.4 Aeroponics

9.4.1 Overview

9.4.2 Aeroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

9.5 Aquaponics

9.5.1 Overview

9.5.2 Aquaponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

10. Middle East & Africa Vertical Farming Crops Market – Country Analysis

10.1 Overview

10.1.1 Middle East and Africa: Vertical Farming Crops Market, by Key Country

10.1.1.1 South Africa: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 South Africa: Vertical Farming Crops Market, by Crop Type

10.1.1.1.2 South Africa: Vertical Farming Crops Market, by End-Use

10.1.1.1.3 South Africa: Vertical Farming Crops Market, by Farming Techniques

10.1.1.2 Saudi Arabia: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Saudi Arabia: Vertical Farming Crops Market, by Crop Type

10.1.1.2.2 Saudi Arabia: Vertical Farming Crops Market, by End-Use

10.1.1.2.3 Saudi Arabia: Vertical Farming Crops Market, by Farming Technique

10.1.1.3 UAE: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 UAE: Vertical Farming Crops Market, by Crop Type

10.1.1.3.2 UAE: Vertical Farming Crops Market, by End-Use

10.1.1.3.3 UAE: Vertical Farming Crops Market, by Farming Techniques

10.1.1.4 Rest of the Middle East & Africa: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.4.1 Rest of the Middle East & Africa: Vertical Farming Crops Market, by Crop Type

10.1.1.4.2 Rest of the Middle East & Africa: Vertical Farming Crops Market, by End-Use

10.1.1.4.3 Rest of the Middle East & Africa: Vertical Farming Crops Market, by Farming Technique

11. Impact of COVID-19 Pandemic on Middle East & Africa Vertical Farming Crops Market

11.1 Overview

12. Industry Landscape

12.1 Overview

12.2 Strategy & Business Planning

12.3 Merger and Acquisition

13. Company Profiles

13.1 AeroFarms

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 CropOne

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Plantlab

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Gotham Greens

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Middle East & Africa Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. Middle East and Africa Vertical Farming Crops Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. South Africa Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. South Africa Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 5. South Africa Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 6. Saudi Arabia Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 7. Saudi Arabia Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 8. Saudi Arabia Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 9. UAE Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. UAE Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 11. UAE Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 12. Rest of Middle East and Africa Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 13. Rest of Middle East and Africa Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 14. Rest of Middle East and Africa Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 15. Glossary of Terms, Vertical Farming Crops Market

LIST OF FIGURES

Figure 1. Middle East & Africa Vertical Farming Crops Market Segmentation

Figure 2. Middle East & Africa Vertical Farming Crops Market Segmentation – By Country

Figure 3. Middle East & Africa Vertical Farming Crops Market Overview

Figure 4. Middle East & Africa Vertical Farming Crops Market, By Crop Type

Figure 5. Middle East & Africa Vertical Farming Crops Market, By Country

Figure 6. Middle East & Africa Vertical Farming Crops Market, Industry Landscape

Figure 7. Middle East & Africa: PEST Analysis

Figure 8. Expert Opinion

Figure 9. Middle East & Africa Vertical Farming Crops Market Impact Analysis of Drivers and Restraints

Figure 10. Middle East & Africa Vertical Farming Crops Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. Middle East & Africa Vertical Farming Crops Market Revenue Share, by Crop Type (2020 and 2028)

Figure 12. Tomato: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 13. Leafy Greens: Vertical Farming Crops Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. Herbs: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 15. Others: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 16. Middle East & Africa Vertical Farming Crops Market Revenue Share, by End-Use (2020 and 2028)

Figure 17. Food Retail: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 18. Food Service: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 19. Middle East & Africa Vertical Farming Crops Market Revenue Share, by Farming Technique (2020 and 2028)

Figure 20. Hydroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 21. Aquaponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 22. Geographic Overview of Vertical Farming Crops Market

Figure 23. Middle East and Africa: Vertical Farming Crops Market Revenue Share, by Key Country (2020 and 2028)

Figure 24. South Africa: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 25. Saudi Arabia: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 26. UAE: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 27. Rest of the Middle East & Africa: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 28. Impact of COVID-19 Pandemic in the Middle East and Africa Country Markets

- AeroFarms

- CropOne

- Plantlab

- Gotham Greens

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Middle East & Africa vertical farming crops market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa vertical farming crops market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the vertical farming crops market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution