Middle East and Africa Robotic Welding Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Spot Welding, Arc Welding, and Others), Payload (Less Than 50 Kg, 50-150 Kg, and More Than 150 Kg), and End-User (Automotive and Transportation, Electrical and Electronics, Metal and Machinery, Construction, and Others)

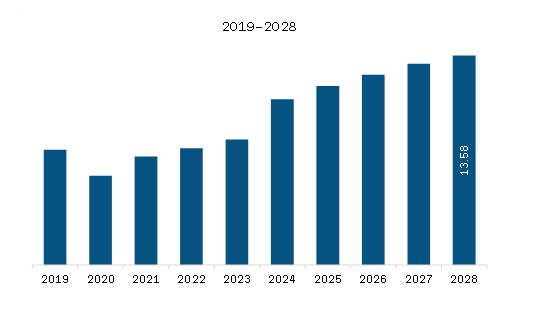

The robotic welding market in the Middle East & Africa is expected to grow from US$ 7.04 million in 2021 to US$ 13.58 million by 2028; it is estimated to grow at a CAGR of 9.8% from 2021 to 2028.

Automation has improved the industrial sector drastically. It has changed the way of production and reduced the manufacturing time and the production cost owing to which welding robot manufacturers are shifting toward networked and intelligent production of Industry 4.0-compatible robots. Additionally, the robotic welding market players have adopted various strategic initiatives toward advanced Industry 4.0-ready solutions. For instance, in October 2020, Fujitsu; FANUC Corporation; and NTT Communications established DUCNET Co., Ltd. to offer a cloud service for supporting digital transformation (DX) in the machine tool industry and the broader manufacturing industry. However, the rising need for automation across industries and significant technological growth are expected to fuel the demand for robotic welding, which is further anticipated to drive the robotic welding market in the Middle East & Africa.

The Middle East & Africa robotic welding market is adversely affected by the disruptions in the supply chain of robotics & related components. The demand for industrial robotics, including robotic welding, has decreased marginally since the emergence of the COVID-19 pandemic in the Middle East & African countries as the region witnessed a decline in GDPs. This has led to a loss of revenue among the welding robotics manufacturers, distributors, system integrators, and service providers who offered their products across the region in 2020. However, the region showcased a positive trend for the adoption of the automation system, including robotic welding, from 2021, owing to containment measures imposed by various governments.

Middle East & Africa Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

Middle East & Africa Robotic Welding Market Segmentation

Middle East & Africa Robotic Welding Market – By Type

- Spot Welding

- Arc Welding

- Others

Middle East & Africa Robotic Welding Market – By Payload

- Less than 50 Kg

- 50 KG -150 Kg

- More than 150 Kg

Middle East & Africa Robotic Welding Market – By End-User

- Automotive & Transportation

- Electrical & Electronics

- Metals & Machinery

- Construction

- Others

Middle East & Africa Robotic Welding Market– By Country

- The UAE

- The Rest of the Middle East & Africa

Middle East & Africa Robotic Welding Market-Companies Mentioned

- ABB

- Fanuc Corporation

- Kawasaki Heavy Industries, Ltd.

- Kuka AG

- NACHI FUJIKOSHI CORP

- Panasonic Corporation

- Yaskawa Electric Corporation

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Robotic Welding Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 MEA

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. MEA Robotic Welding Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Industrial 4.0 to Drive Demand for Industrial Robots

5.1.2 Rise in Adoption of Welding Robots in the Automotive Industry

5.2 Market Restraints

5.2.1 High Initial Costs Associated with The Installation of Welding Robots

5.3 Future Trends

5.3.1 The Emergence of Laser And Plasma Welding Technologies

5.4 Impact Analysis of Drivers and Restraints

6. Robotic Welding Market – MEA Analysis

6.1 MEA Robotic Welding Market Overview

6.2 MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

7. MEA Robotic Welding Market Analysis – by Type

7.1 Overview

7.2 MEA Robotic Welding Market Breakdown, by Type (2020 and 2028)

7.3 Spot Welding

7.3.1 Overview

7.3.2 Spot Welding: MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

7.4 Arc Welding

7.4.1 Overview

7.4.2 Arc Welding: MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

8. MEA Robotic Welding Market Analysis – by Payload

8.1 Overview

8.2 MEA Robotic Welding Market, by Payload (2020 and 2028)

8.3 Less than 50kg

8.3.1 Overview

8.3.2 Less than 50kg: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

8.4kg-150kg

8.4.1 Overview

8.4.2kg-150kg: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

8.5 More than 150kg

8.5.1 Overview

8.5.2 More than 150kg: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

9. MEA Robotic Welding Market Analysis – by End-User

9.1 Overview

9.2 MEA Robotic Welding Market, by End-User (2020 and 2028)

9.3 Automotive and Transportation

9.3.1 Overview

9.3.2 Automotive and Transportation: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Electrical and Electronics

9.4.1 Overview

9.4.2 Electrical and Electronics: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Metal and Machinery

9.5.1 Overview

9.5.2 Metal and Machinery: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Construction

9.6.1 Overview

9.6.2 Construction: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

10. MEA Robotic Welding Market – Country Analysis

10.1 Overview

10.1.1 MEA: Robotic Welding Market, by Key Country

10.1.1.1 UAE: Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 UAE: Robotic Welding Market, by Type

10.1.1.1.2 UAE: Robotic Welding Market, by Payload

10.1.1.1.3 UAE: Robotic Welding Market, by End-User

10.1.1.2 Rest of MEA: Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Rest of MEA: Robotic Welding Market, by Type

10.1.1.2.2 Rest of MEA: Robotic Welding Market, by Payload

10.1.1.2.3 Rest of MEA: Robotic Welding Market, by End-User

11. Impact of COVID-19 Pandemic on MEA Welding Robotic Market

11.1 MEA: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

13. Company Profiles

13.1 Panasonic Corporation

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Yaskawa Electric Corporation

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 ABB

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Fanuc Corporation

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Kawasaki Heavy Industries, Ltd.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Kuka AG

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 NACHI FUJIKOSHI CORP

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

14. Appendix

14.1 About the Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. UAE: Robotic Welding Market, by Type –Revenue and Forecast to 2028 (US$ Million)

Table 3. UAE: Robotic Welding Market, by Payload –Revenue and Forecast to 2028 (US$ Million)

Table 4. UAE: Robotic Welding Market, by End-User –Revenue and Forecast to 2028 (US$ Million)

Table 5. Rest of MEA: Robotic Welding Market, by Type –Revenue and Forecast to 2028 (US$ Million)

Table 6. Rest of MEA: Robotic Welding Market, by Payload –Revenue and Forecast to 2028 (US$ Million)

Table 7. Rest of MEA: Robotic Welding Market, by End-User –Revenue and Forecast to 2028 (US$ Million)

Table 8. List of Abbreviation

LIST OF FIGURES

Figure 1. MEA Robotic Welding Market Segmentation

Figure 2. MEA Robotic Welding Market Segmentation – By Country

Figure 3. MEA Robotic Welding Market Overview

Figure 4. Spot Welding Segment held the largest share in 2020

Figure 5.kg-150kg segment held the largest share in 2020

Figure 6. Automotive and Transportation Segment held the largest share in 2020

Figure 7. Rest of MEA held the largest share in 2020

Figure 8. MEA: PEST Analysis

Figure 9. Expert Opinion

Figure 10. MEA Robotic Welding Market: Impact Analysis of Drivers and Restraints

Figure 11. MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

Figure 12. MEA Robotic Welding Market Revenue Share, by Type (2020 and 2028)

Figure 13. Spot Welding: MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. Arc Welding: MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. Others: MEA Robotic Welding Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. MEA Robotic Welding Market Revenue Share, by Payload (2020 and 2028)

Figure 17. Less than 50kg: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18.kg-150kg: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. More than 150kg: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. MEA Robotic Welding Market Revenue Share, by End-User (2020 and 2028)

Figure 21. Automotive and Transportation: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Electrical and Electronics: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Metal and Machinery: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Construction: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Others: MEA Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. MEA: Robotic Welding Market, by key Country – Revenue (2020) (US$ Million)

Figure 27. MEA: Robotic Welding Market Revenue Share, by Key Country (2020 and 2028)

Figure 28. UAE: Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Rest of MEA: Robotic Welding Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. Impact of COVID-19 Pandemic in MEA Country Markets

- ABB

- Fanuc Corporation

- Kawasaki Heavy Industries, Ltd.

- Kuka AG

- NACHI FUJIKOSHI CORP

- Panasonic Corporation

- Yaskawa Electric Corporation

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Middle East & Africa Robotic Welding Market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa Robotic Welding Market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Robotic Welding Market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution