Middle East & Africa Oilfield Service Market Forecast to 2028 – COVID-19 Impact and Analysis – by Application (Onshore and Offshore) and Service Type (Well Completion, Wire line, Artificial Lift, Perforation, Drilling and Completion Fluids, and Others)

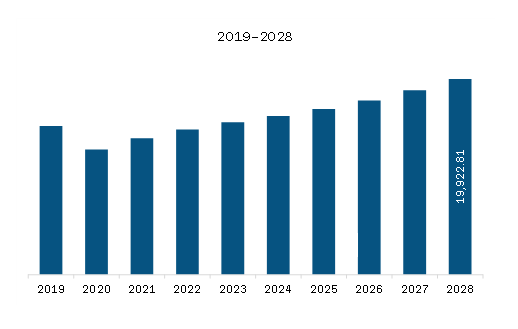

The oilfield service market in Middle East & Africa is expected to grow from US$ 13,830.46 million in 2021 to US$ 19,922.81 million by 2028. It is estimated to grow at a CAGR of 5.4% from 2021 to 2028.

Oilfield service providers have always played an essential part in the upstream oil & gas industry's technological growth. As the frontline source of equipment and experience, operators ranging from the most significant national oil corporations to the tiniest independents rely on these enterprises to promote technological innovation and improve field performance under various economic situations. The Fourth Industrial Revolution's resurgence arrives at a critical juncture for the oilfield service business. As drilling technologies advance and siloed computerization procedures reach their limitations, the evolving digital technology area opens up a new horizon for production, uptime, and efficiency breakthroughs based on efficient data integration from many sources.

Oilfield service providers create open-architecture platforms where customers' digital teams may map out their digitalization journeys. Artificial intelligence and machine learning models tailored to the industry operate on the company's OSDUTM Data Platform, built on the scalable architecture of the iEnergy Cloud. Data engineers and data scientists can design, construct, and deploy AI models at scale and rapidly train ML models.

Furthermore, in November 2021, Baker Hughes made its JewelSuite apps accessible in the Microsoft Azure Marketplace, simplifying the deployment and maintenance of AI and machine learning applications on the Azure cloud platform. The JewelSuite Subsurface Modeling tool allows for the quick building of detailed geological models that can be easily updated and modified with new well data to promote optimal field development and enhanced production. Also, in September 2021, Schlumberger collaborated with AVEVA to connect edge, AI, and digital cloud systems in its DELFITM cognitive E&P environment, improving how energy businesses gather, analyze, and utilize field data to improve website efficiency and equipment health management and performance.

Moreover, NOV Inc. is tackling a common challenge when implementing digital tools for processing technologies: a scarcity of sensors across the plant. While the increased online characterization of process fluids is a significant result, many instruments in a process system remain underutilized for process improvement. Improving Machine-to-Machine (M2M) connectivity and gaining new insights from virtual sensors allow oilfield service providers to expand the volume and diversity of data available for decision-making while discovering new methods to improve operational performance.

Oilfield service companies have sought to promote technology breakthroughs that have made exploration and production activities efficient and cost-effective. Since the 1980s, robotic oil rigs and remotely operated vehicles (ROVs) have aided in developing offshore oil resources. The ultimate effect of these technological developments is a streamlined, rapid, and efficient procedure, which aids in raising production levels. Thus, technological innovation in oilfield service is expected to propel the oilfield service market during the forecast period.

Middle East & Africa Oilfield Service Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

Middle East & Africa Oilfield Service Market Segmentation

The Middle East & Africa oilfield service market is analyzed on the basis of application, service type, and country. Based on application, the market is bifurcated into onshore and offshore. In 2020, the onshore segment held the largest share in the market.

Based on service type, the market is segmented into well completion, wireline, artificial lift, perforation, drilling and completion fluids, and others. In 2020, the others segment held the largest share in the market.

Similarly, based on country, the market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of the Middle East & Africa. Saudi Arabia contributed a substantial share in 2020.

Baker Hughes Company; Halliburton Energy Services, Inc; NOV Inc; Petrodyn; Schlumberger Limited; and Weatherford International plc are the leading companies in the Middle East & Africa oilfield service market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Oilfield Service Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 MEA

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. MEA Oilfield Service Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Oil and Gas Production and Exploration (E&P) Activities

5.1.2 Increasing Shale Gas Extraction

5.2 Market Restraints

5.2.1 Volatility in Crude Oil Prices

5.3 Market Opportunities

5.3.1 Increasing Demand of Offshore/Deep-Water Discoveries

5.4 Future Trends

5.4.1 Technological Innovation in Oilfield Service

5.5 Impact Analysis of Drivers And Restraints

6. Oilfield Service – MEA Market Analysis

6.1 MEA Oilfield Service Market

6.2 MEA Oilfield Service Market Revenue Forecast and Analysis

7. MEA Oilfield Service Market – By Application

7.1 Overview

7.2 MEA Oilfield service Market, By Application (2020 and 2028)

7.3 Onshore

7.3.1 Overview

7.3.2 Onshore: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Offshore

7.4.1 Overview

7.4.2 Offshore: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8. MEA Oilfield Service Market – By Service type

8.1 Overview

8.2 MEA Oilfield service Market, By Service type (2020 and 2028)

8.3 Well Completion

8.3.1 Overview

8.3.2 Well completion: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Wire line

8.4.1 Overview

8.4.2 Wire line: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Artificial lift

8.5.1 Overview

8.5.2 Artificial lift: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.6 Perforation

8.6.1 Overview

8.6.2 Perforation: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.7 Drilling and Completion Fluids

8.7.1 Overview

8.7.2 Drilling and Completion Fluids: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

8.8 Others

8.8.1 Overview

8.8.2 Others: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9. MEA Oilfield Service Market – Country Analysis

9.1 Overview

9.1.1 MEA: Oilfield Service Market, by Key Country

9.1.1.1 South Africa: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 South Africa: Oilfield Service Market, By Application

9.1.1.1.2 South Africa: Oilfield Service Market, by Service type

9.1.1.2 UAE: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 UAE: Oilfield Service Market, By Application

9.1.1.2.2 UAE: Oilfield Service Market, by Service type

9.1.1.3 Saudi Arabia: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 Saudi Arabia: Oilfield Service Market, By Application

9.1.1.3.2 Saudi Arabia: Oilfield Service Market, by Service type

9.1.1.4 Rest of MEA: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.4.1 Rest of MEA: Oilfield Service Market, By Application

9.1.1.4.2 Rest of MEA: Oilfield Service Market, by Service type

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 Merger and Acquisition

10.4 New Development

11. Company Profiles

11.1 Baker Hughes Company

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Halliburton Energy Services, Inc.

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 NOV Inc.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Schlumberger Limited

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4

11.4.5 Financial Overview

11.4.6 SWOT Analysis

11.4.7 Key Developments

11.5 Weatherford International plc

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Petrodyn

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. MEA Oilfield Service Market Revenue and Forecast to 2028 (US$ Million)

Table 2. MEA: Oilfield Service Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. South Africa: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 4. South Africa: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 5. UAE: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 6. UAE: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 7. Saudi Arabia: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 8. Saudi Arabia: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 9. Rest of MEA: Oilfield Service Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 10. Rest of MEA: Oilfield Service Market, by Service type – Revenue and Forecast to 2028 (US$ Million)

Table 11. List of Abbreviation

LIST OF FIGURES

Figure 1. MEA Oilfield Service Market Segmentation

Figure 2. MEA Oilfield Service Market Segmentation – By Country

Figure 3. MEA Oilfield Service Market Overview

Figure 4. MEA Oilfield Service Market, By Application

Figure 5. MEA Oilfield Service Market, By Service type

Figure 6. MEA Oilfield Service Market, By Country

Figure 7. MEA – PEST Analysis

Figure 8. MEA Oilfield Service Market- Ecosystem Analysis

Figure 9. MEA Oilfield Service Market Impact Analysis of Drivers and Restraints

Figure 10. MEA Oilfield Service Market Revenue Forecast and Analysis (US$ Million)

Figure 11. MEA Oilfield Service Market Revenue Share, by Application (2020 and 2028)

Figure 12. Onshore: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Offshore: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. MEA Oilfield Service Market Revenue Share, by Service type (2020 and 2028)

Figure 15. Well completion: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Wire line: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Artificial lift: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Perforation: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Drilling and Completion Fluids: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Others: MEA Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. MEA: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. MEA: Oilfield Service Market Revenue Share, by Key Country (2020 and 2028)

Figure 23. South Africa: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. UAE: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Saudi Arabia: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Rest of MEA: Oilfield Service Market – Revenue and Forecast to 2028 (US$ Million)

- Baker Hughes Company

- Halliburton Energy Services, Inc

- NOV Inc

- Petrodyn

- Schlumberger Limited

- Weatherford International plc

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Middle East & Africa Oilfield Service Market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa Oilfield Service Market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving Oilfield Service Market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution