Middle East & Africa Homeland Security Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By End User (Public Security and Private Security) and Security Type (Border Security, Mass Transit Security, Cyber Security, Critical Infrastructure Security, Aviation Security, Maritime Security, and Others)

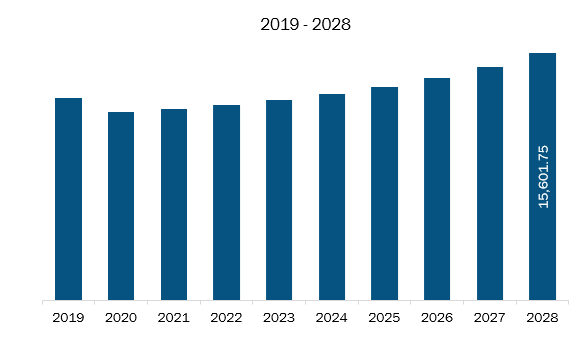

The homeland security market in Middle East & Africa is expected to grow from US$ 12,356.66 million in 2022 to US$ 15,601.75 million by 2028. It is estimated to grow at a CAGR of 4.0% from 2022 to 2028.

Increase in Number of Airports and Passenger Traffic

The growing number of airports and air passenger traffic is influencing the demand for aviation security solutions. According to International Civil Aviation Organization (ICAO), the number of air passengers traveling between January to April 2022 showcased an increase of 65% compared to the same period in 2021. The total flight departures also increased by 30% across the region. The analysis by the organization also states that the total seating capacity offered by the airline also increased by 20% in the same time frame. Rising purchasing power of the regional population, increasing trend of regional tourism, and surging business travel are among the major reasons contributing to the growth of air traffic across the region. The rise in air traffic is directly influencing the need for more efficient aviation security solutions to ensure safety across all airports. Moreover, stringent government regulations on airport security to ensure proper checks of all individuals entering and leaving the nation are also enhancing the demand for aviation security solutions. Additionally, several nations are significantly investing in developing new airport infrastructure, further driving the demand for aviation security solutions. Various countries are experiencing high investment in the construction and expansion of airport infrastructures. Thus, the rise in investment in airport infrastructure development, coupled with an increase in air passenger traffic, is driving the demand for aviation security solutions, thereby contributing to the Middle East & Africa homeland security market growth.

Market Overview

The growth of the Middle East & Africa homeland security market is attributed to the increase in the procurement of advanced biometrics, communication systems, warfare systems, border deployed security systems, crisis management systems, critical infrastructure security systems, aviation security systems, mass transit security systems, cyber security systems, and maritime security systems to deal with the constantly rising cross-border conflicts, cyberattacks, terrorism, and civil wars across the region. The region has many airports and airlines' security services, fueling the demand for homeland security across the region. The region has some of the largest airlines that operate worldwide, such as Qatar Airways, Air Arabia, Emirates, Etihad Airways, and Kuwait Airways. The airports and airlines are generating the demand for airport security, which is boosting the homeland market growth in the region. Further, the Middle East & Africa homeland security market is growing due to the investments in multiple projects and recent developments, such as the Dubai Expo 2020 in the UAE and the 2022 FIFA World Cup in Qatar. The advanced technologies' economic growth and investment in infrastructure development in the region are also driving the market. The investments in infrastructure development include residential and commercial construction, transportation infrastructure, and public utilities. The Department of Homeland Security (DHS) and the UAE expand security cooperation between the US and each nation for the advance key homeland security agreements and objectives in the country. In Qatar, Under Secretary Silvers signed security arrangements with the State of Qatar, engaged with key Qatari government partners on a range of joint security issues, and reaffirmed DHS's commitment to enhance Qatar's security for the FIFA World Cup Qatar 2022. In the UAE, the Under Secretary engaged with key representatives from the Ministry of the Interior and the Dubai Police in July 2022. Further, in June 2019, Elbit Systems, an Israeli defense electronics company, revealed that the US Customs and Border Protection had given its US subsidiary a US$ 26 million contract to deploy a multi-sensor system to monitor the US-Mexico border. In Arizona, Elbit will install an Integrated Fixed Towers (IFT) system. Moreover, in 2022 the Saudi National Cybersecurity Authority (NCA) announced the signing of a Memorandum of Understanding (MoU) for Cybersecurity Cooperation with the U.S. Department of Homeland Security (DHS), Cybersecurity and Infrastructure Security Agency (CISA). Such initiatives in the Middle East & Africa region are propelling the growth of the Middle East & Africa homeland security market.

Middle East & Africa Homeland Security Market Revenue and Forecast to 2028 (US$ Million)

Middle East & Africa Homeland Security Market Segmentation

The Middle East & Africa homeland security market is segmented into end user, security type, and country.

Based on end user, the market is bifurcated into public security and private security. The public security segment registered the larger market share in 2022.

Based on security type, the market is segmented into border security, mass transit security, cyber security, critical infrastructure security, aviation security, maritime security, and others. The cyber security segment held the largest market share in 2022.

Based on country, the market is segmented into Saudi Arabia, UAE, South Africa, and rest of Middle East & Africa. Rest of Middle East & Africa dominated the market share in 2022.

Elbit Systems Ltd; IBM Corporation; Lockheed Martin Corporation; Leidos; Thales Group; Teledyne FLIR LLC; Northrop Grumman Corporation; Raytheon Technologies Corporation; Textron Systems; and General Dynamic Information Technology, Inc. are the leading companies operating in the Middle East & Africa homeland security market in the region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Homeland Security Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. MEA Homeland Security Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Rise in Severe Cyberattacks

5.1.2 Increase in Number of Airports and Passenger Traffic

5.2 Key Market Restraints

5.2.1 Lack of Central Governing Body for Homeland Security Across Countries

5.3 Key Market Opportunities

5.3.1 Rise in Strategic Initiatives by Market Players

5.4 Future Trends

5.4.1 Rise in Procurement of Various Security Solutions and Services

5.5 Impact Analysis of Drivers and Restraints

6. Homeland Security Market – MEA Market Analysis

6.1 MEA Homeland Security Market Forecast and Analysis

7. MEA Homeland Security Market Analysis – by End User

7.1 Overview

7.2 MEA Homeland Security Market Breakdown, by End User, 2021 and 2028

7.3 Public Sector

7.3.1 Overview

7.3.2 Public Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Private Sector

7.4.1 Overview

7.4.2 Private Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

8. MEA Homeland Security Market Analysis – by Security Type

8.1 Overview

8.2 MEA Homeland Security Market Breakdown, by Security Type, 2021 and 2028

8.3 Border Security

8.3.1 Overview

8.3.2 Border Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.4 Mass Transit Security

8.4.1 Overview

8.4.2 Mass Transit Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.5 Cyber Security

8.5.1 Overview

8.5.2 Cyber Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.6 Critical Infrastructure Security

8.6.1 Overview

8.6.2 Critical Infrastructure Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.7 Aviation Security

8.7.1 Overview

8.7.1.1 Aviation Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.8 Maritime Security

8.8.1 Overview

8.8.2 Maritime Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.9 Others

8.9.1 Overview

8.9.2 Others: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

9. MEA Homeland Security Market – Country Analysis

9.1 Overview

9.1.1 MEA: Homeland Security Market, by Key Country

9.1.1.1 South Africa: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 South Africa: Homeland Security Market, by End User

9.1.1.1.2 South Africa: Homeland Security Market, by Service Type

9.1.1.2 Saudi Arabia: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 Saudi Arabia: Homeland Security Market, by End User

9.1.1.2.2 Saudi Arabia: Homeland Security Market, by Service Type

9.1.1.3 UAE: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 UAE: Homeland Security Market, by End User

9.1.1.3.2 UAE: Homeland Security Market, by Service Type

9.1.1.4 Rest of MEA: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.4.1 Rest of MEA: Homeland Security Market, by End User

9.1.1.4.2 Rest of MEA: Homeland Security Market, by Service Type

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 New Product Development

11. Company Profiles

11.1 Elbit Systems Ltd.

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 IBM Corporation

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Lockheed Martin Corporation

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Leidos

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Thales Group

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Teledyne FLIR LLC

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Northrop Grumman Corporation

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Raytheon Technologies Corporation

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Textron Systems

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 General Dynamics Information Technology, Inc.

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. MEA Homeland Security Market, Revenue and Forecast, 2020–2028 (US$ Million)

Table 2. South Africa: Homeland Security Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 3. South Africa: Homeland Security Market, by Service Type– Revenue and Forecast to 2028 (US$ Million)

Table 4. Saudi Arabia: Homeland Security Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 5. Saudi Arabia: Homeland Security Market, by Service Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. UAE: Homeland Security Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 7. UAE: Homeland Security Market, by Service Type– Revenue and Forecast to 2028 (US$ Million)

Table 8. Rest of MEA: Homeland Security Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 9. Rest of MEA: Homeland Security Market, by Service Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. List of Abbreviation

LIST OF FIGURES

Figure 1. MEA Homeland Security Market Segmentation

Figure 2. MEA Homeland Security Market Segmentation – Country

Figure 3. MEA Homeland Security Market Overview

Figure 4. MEA Homeland Security Market, By End User

Figure 5. MEA Homeland Security Market, By Security Type

Figure 6. MEA Homeland Security Market, By Country

Figure 7. MEA Porter’s Five Forces Analysis

Figure 8. MEA Homeland Security Market Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. MEA Homeland Security Market: Impact Analysis of Drivers and Restraints

Figure 11. MEA Homeland Security Market, Forecast and Analysis (US$ Million)

Figure 12. MEA Homeland Security Market Revenue Share, by End User (2021 and 2028)

Figure 13. MEA Public Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. MEA Private Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. MEA Homeland Security Market Revenue Share, by Security Type (2021 and 2028)

Figure 16. MEA Border Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. MEA Mass Transit Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. MEA Cyber Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. MEA Critical Infrastructure Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. MEA Aviation Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. MEA Maritime Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. MEA Others: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. MEA: Homeland Security Market Revenue Share, by Key Country- Revenue (2021) (US$ Million)

Figure 24. MEA: Homeland Security Market Revenue Share, by Key Country (2021 and 2028)

Figure 25. South Africa: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Saudi Arabia: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. UAE: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Rest of MEA: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

- Elbit Systems Ltd.

- IBM Corporation.

- LOCKHEED MARTIN Corporation.

- Leidos.

- Thales Group.

- Teledyne FLIR LLC.

- NORTHROP GRUMMAN Corporation.

- RAYTHEON TECHNOLOGIES Corporation.

- TEXTRON Systems.

- General Dynamic Information Technology.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa homeland security market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa homeland security market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the homeland security market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution