Middle East and Africa Helicopters Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Single Rotor, Multi Rotor, and Tilt Rotor), Weight (Light Weight, Medium Weight, and Heavy Weight), and Application (Commercial & Civil and Military)

Market Introduction

Geographically, the helicopter market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the Middle East & Africa. The governments of Middle East & African countries such as Saudi Arabia, South Africa, the UAE, Qatar, Kuwait, and Iran have been investing in technologically advanced equipment, which has propelled the adoption of helicopters. This factor has resulted in the entry of OEMs in the region, thereby creating competition in the Middle East market. Established OEMs such as Airbus S.A.S and Leonardo S.p.A have strengthened their local network in the region. These players have been investing in R&D to fill the gap of supply and demand and cater the pre-requisite needs of military forces and commercial application. In the MEA, a large number of helicopters planned to be procured are for light twin engine model. Further, medium twin-engine model is the next most preferred helicopter model in the region. Airbus S.A.S has a significant presence throughout the region, employing more than 3,100 people across Morocco, Tunisia, South Africa, Nigeria, Saudi Arabia, the UAE, Qatar, and Oman. Regional headquarter of Airbus is in Dubai.

In case of COVID-19, MEA is highly affected especially South Africa. The MEA helicopter market is majorly affected by the disruption in the supply chain. Owing to the closure of countries' borders, the supply chain of several components and parts has been disturbed. South Africa has a few helicopter manufacturers, which produce general aviation helicopters. The widespread COVID-19 virus has led the manufacturers to suspend their operations or operate with a minimal workforce temporarily. Additionally, the disruption in the supply chain business due to the trade ban has also adversely affected the country’s helicopter manufacturing process. On the other hand, Saudi Arabian government spends substantial amounts toward its military force, law enforcement teams, and firefighting teams, thereby continuously supporting the teams with upgraded technologies in order to remain mission ready. However, the COVID-19 outbreak in the country has impacted and postponed a number of helicopter procurement deals.

Get more information on this report :

Market Overview and Dynamics

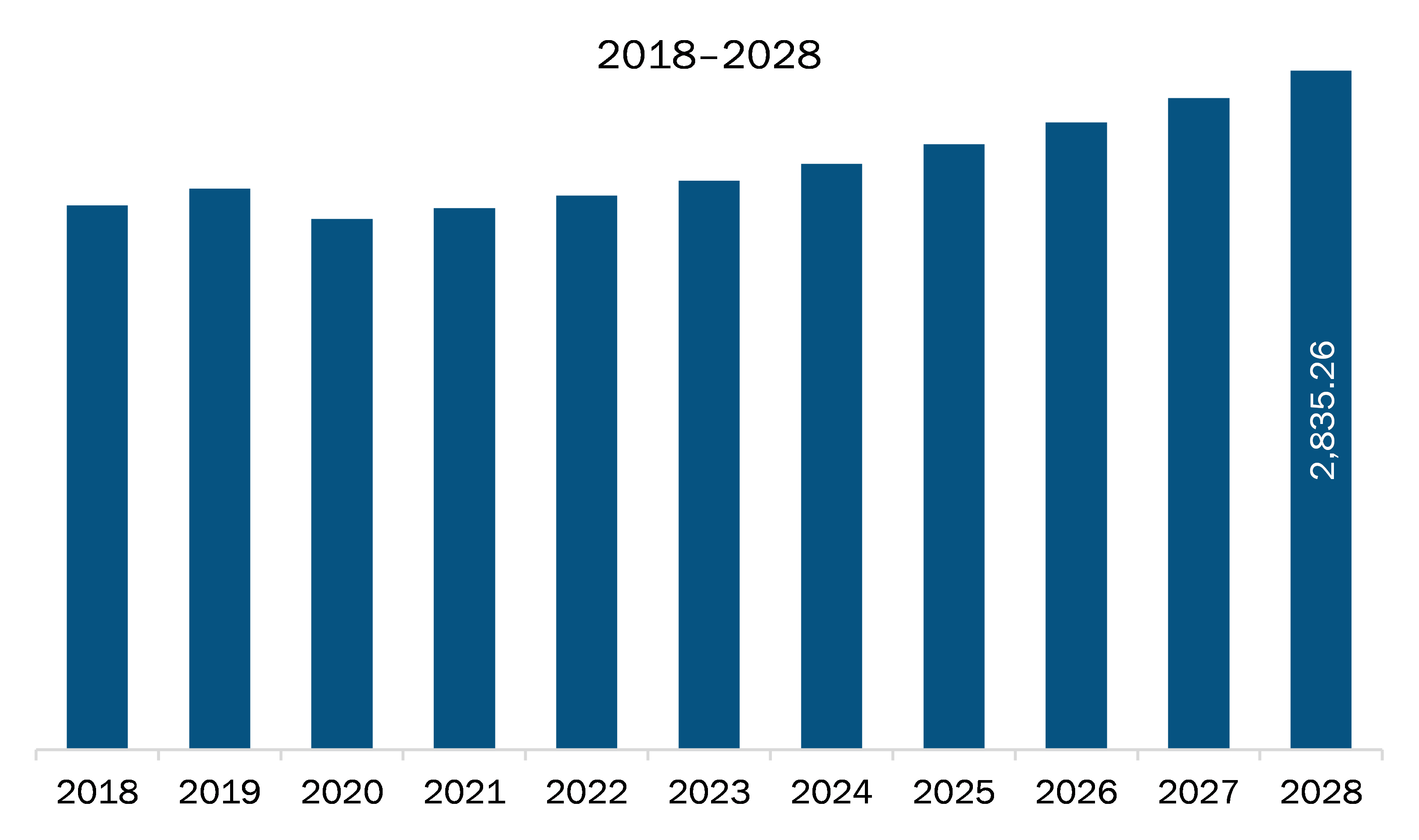

The MEA helicopters market is expected to grow from US$ 2,261.45 million in 2021 to US$ 2,835.26 million by 2028; it is estimated to grow at a CAGR of 3.3% from 2021 to 2028. The increasing need for helicopters for various search and rescue operations is driving the MEA helicopter market. Countries located in MEA region are heavily investing in procuring the most advanced and highly capable helicopters. Due to the growing demand for new and advanced SAR helicopters, the overall market is growing. These helicopters were heavily equipped with advanced solutions including reliable and powerful rescue hoists and winches. The SAR helicopters are used for medical emergency/evacuation, firefighting and law enforcement, utility, and search and rescue operation. Helicopters are being significantly used for medical emergency or medical evacuation as well. Medical evacuation is the process of safely evacuating wounded people by medical personnel with assistance from military forces. During any kind of natural calamities or man-made calamities, there is heavy requirement for medical evacuation team. The team consists of medical professionals and military personnel who provide the needed medical care to the victims of any disaster. The team uses aircraft/helicopter fleet to evacuate the disaster-prone area. For law enforcement and firefighting, the helicopter is used for fire or other emergencies, patrol duties, and back up to ground unit. For utility application, helicopters are used for lifting operation that happens during oil and gas offshore processing. For search and rescue operation, the helicopters are deployed by military personnel to rescue and search operations. As a part of rescue and search operation, helicopters are used for all types of search and rescue processes (mountain rescue, disaster rescue, and natural calamity rescue among others).

Key Market Segments

In terms of type, the single rotor segment accounted for the largest share of the MEA helicopters market in 2020. In terms of weight, the medium weight segment held a larger market share of the MEA helicopters market in 2020. Further, the military segment held a larger share of the MEA helicopters market based on application in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the MEA helicopters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Airbus S.A.S.; Bell Textron Inc.; Boeing; Kaman Corporation; Leonardo S.p.A.; Lockheed Martin Corporation; and MD Helicopters, Inc.

Reasons to buy report

- To understand the MEA helicopters market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for MEA helicopters market

- Efficiently plan M&A and partnership deals in MEA helicopters market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form MEA helicopters market

- Obtain market revenue forecast for market by various segments from 2021-2028 in MEA region.

MEA Helicopters Market Segmentation

MEA Helicopters Market - By Type

- Single Rotor

- Multi Rotor

- Tilt Rotor

MEA Helicopters Market - By Weight

- Light Weight

- Medium Weight

- Heavy Weight

MEA Helicopters Market - By Application

- Commercial & Civil

- Transport

- Emergency Rescue

- Utility

- Training

- Military

- Attack and Reconnaissance

- Maritime

- Transport Search and Rescue

- Training

MEA Helicopters Market - By Country

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

MEA Helicopters Market - Company Profiles

- Airbus S.A.S.

- Bell Textron Inc.

- Boeing

- Kaman Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, Inc.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 MEA Helicopters Market – By Type

1.3.2 MEA Helicopters Market – By Weight

1.3.3 MEA Helicopters Market – By Application

1.3.4 MEA Helicopters Market- By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Helicopters Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat of New Entrants

4.2.4 Threat of Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. MEA Helicopters Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Surging Demand for Search and Rescue (SAR) Helicopters

5.1.2 Escalating Military Expenditure on Advanced and Lightweight Helicopters

5.2 Market Restraints

5.2.1 Inadequate Adoption of Advanced Helicopters

5.3 Market Opportunities

5.3.1 Increasing Demand due to Aging Helicopter Fleet

5.4 Future Trends

5.4.1 Mounting Development of Unmanned Helicopters and Use of Advanced Materials and Technology

5.5 Impact Analysis of Drivers and Restraints

6. Helicopters Market – MEA Analysis

6.1 MEA Helicopters Market Overview

6.2 MEA Helicopters Market –Revenue and Forecast to 2028 (US$ Million)

7. MEA Helicopters Market Analysis – By Type

7.1 Overview

7.2 MEA Helicopters Market Breakdown, by Type, 2020 and 2028

7.3 Single Rotor

7.3.1 Overview

7.3.2 Single Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

7.4 Multi Rotor

7.4.1 Overview

7.4.2 Multi Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

7.5 Tilt Rotor

7.5.1 Overview

7.5.2 Tilt Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

8. MEA Helicopters Market Analysis – By Weight

8.1 Overview

8.2 MEA Helicopters Market, by Weight (2020 and 2028)

8.3 Light Weight

8.3.1 Overview

8.3.2 Light Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Medium Weight

8.4.1 Overview

8.4.2 Medium Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Heavy Weight

8.5.1 Overview

8.5.2 Heavy Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9. MEA Helicopters Market Analysis – By Application

9.1 Overview

9.2 MEA Helicopters Market, by Application (2020 and 2028)

9.3 Commercial and Civil

9.3.1 Overview

9.3.2 Commercial and Civil: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.3 Transport

9.3.3.1 Overview

9.3.3.2 Transport: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.4 Emergency Rescue

9.3.4.1 Overview

9.3.4.2 Emergency Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.5 Utility

9.3.5.1 Overview

9.3.5.2 Utility: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.3.6 Training

9.3.6.1 Overview

9.3.6.2 Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Military

9.4.1 Overview

9.4.2 Military: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.3 Attack and Reconnaissance

9.4.3.1 Overview

9.4.3.2 Attack and Reconnaissance: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.4 Maritime

9.4.4.1 Overview

9.4.4.2 Maritime: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.5 Transport, Search and Rescue

9.4.5.1 Overview

9.4.5.2 Transport Search and Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

9.4.6 Training

9.4.6.1 Overview

9.4.6.2 Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10. MEA Helicopters Market – Country Analysis

10.1 Overview

10.1.1 MEA: Helicopters Market- by Key Country

10.1.1.1 South Africa: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 South Africa: Helicopters Market- By Type

10.1.1.1.2 South Africa: Helicopters Market- By Weight

10.1.1.1.3 South Africa: Helicopters Market- By Application

10.1.1.2 Saudi Arabia: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Saudi Arabia: Helicopters Market- By Type

10.1.1.2.2 Saudi Arabia: Helicopters Market- By Weight

10.1.1.2.3 Saudi Arabia: Helicopters Market- By Application

10.1.1.3 UAE: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 UAE: Helicopters Market- By Type

10.1.1.3.2 UAE: Helicopters Market- By Weight

10.1.1.3.3 UAE: Helicopters Market- By Application

10.1.1.4 Rest of MEA: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.4.1 Rest of MEA: Helicopters Market- By Type

10.1.1.4.2 Rest of MEA: Helicopters Market- By Weight

10.1.1.4.3 Rest of MEA: Helicopters Market- By Application

11. MEA Helicopters Market- COVID-19 Impact Analysis

11.1 MEA

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

13. Company Profiles

13.1 Airbus S.A.S.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Boeing

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Bell Textron Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Kaman Corporation

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Leonardo S.p.A.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Lockheed Martin Corporation

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 MD Helicopters, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. MEA Helicopters Market – Revenue, and Forecast to 2028 (US$ Million)

Table 2. South Africa: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 3. South Africa: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 4. South Africa: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 5. South Africa: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 6. South Africa: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 7. Saudi Arabia: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 8. Saudi Arabia: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 9. Saudi Arabia: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 10. Saudi Arabia: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 11. Saudi Arabia: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 12. UAE: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 13. UAE: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 14. UAE: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 15. UAE: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 16. UAE: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 17. Rest of MEA: Helicopters Market- By Type –Revenue and Forecast to 2028 (US$ Million)

Table 18. Rest of MEA: Helicopters Market- By Weight –Revenue and Forecast to 2028 (US$ Million)

Table 19. Rest of MEA: Helicopters Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 20. Rest of MEA: Helicopters Market- By Commercial and Civil – Revenue and Forecast to 2028 (US$ Million)

Table 21. Rest of MEA: Helicopters Market- By Military– Revenue and Forecast to 2028 (US$ Million)

Table 22. List of Abbreviation

LIST OF FIGURES

Figure 1. MEA Helicopters Market Segmentation

Figure 2. MEA Helicopters Market Segmentation – By Country

Figure 3. MEA Helicopters Market Overview

Figure 4. Single Rotor Segment Held the Largest Market Share in 2020

Figure 5. Medium Weight Segment Held the Largest Market Share in 2020

Figure 6. Military Application Held the Largest Market Share in 2020

Figure 7. Rest of MEA was the Largest Revenue Contributor in 2020

Figure 8. MEA Helicopters Market– Porter’s Five Forces Analysis

Figure 9. MEA Helicopters Market– Ecosystem Analysis

Figure 10. Expert Opinions

Figure 11. MEA Helicopters Market Impact Analysis of Drivers and Restraints

Figure 12. MEA Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. MEA Helicopters Market Revenue Share, by Type (2020 and 2028)

Figure 14. MEA Single Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. MEA Multi Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. MEA Tilt Rotor: Helicopters Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. MEA Helicopters Market Revenue Share, by Weight (2020 and 2028)

Figure 18. MEA Light Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. MEA Medium Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. MEA Heavy Weight: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. MEA Helicopters Market Revenue Share, by Application (2020 and 2028)

Figure 22. MEA Commercial and Civil: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. MEA Transport: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. MEA Emergency Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. MEA Utility: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. MEA Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. MEA Military: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. MEA Attack and Reconnaissance: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. MEA Maritime: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. MEA Transport Search and Rescue: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. MEA Training: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. MEA: Helicopters Market, by Key Country – Revenue (2020) (USD Million)

Figure 33. MEA: Helicopters Market Revenue Share, By Key Country (2020 and 2028)

Figure 34. South Africa: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Saudi Arabia: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. UAE: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Rest of MEA: Helicopters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Impact of COVID-19 Pandemic in MEA Countries Market

- Airbus S.A.S.

- Bell Textron Inc.

- Boeing

- Kaman Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MD Helicopters, Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the MEA helicopters market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the MEA helicopters market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth MEA market trends and outlook coupled with the factors driving the helicopters market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution