Middle East & Africa Fired Air Heaters Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Direct Fired Air Heater and Indirect Fired Air Heater) and End-User (Manufacturing, Chemicals, Mining, Construction, Oil & Gas, Pharmaceuticals, Food, and Others)

Market Introduction

The Middle East & Africa fired air heater market is projected to register a decent CAGR during the forecast period. Process air heaters and industrial air heaters are both available in the regional market. The heating air intensity of industrial air heaters can be modified according to the input voltage, making it an efficient option for industrial sectors. This is augmenting the market growth in the region. In the oil & gas industry, fired heaters heat thermodynamic fluids, process fluids, feedstock, charge heating, steam heating, and thermal cracking in refineries. Over the last two decades, the Middle East countries have made enormous expenditures to improve their crude oil processing capacity. These investments continued to bolster the market in the early 2020s. Moreover, the region has also been working to diversify its product line by constructing big petrochemical plants. The region's investment plans aim to integrate refineries and chemical plants to produce even more value-added goods from local crude. Mines use the ventilation system to heat the new inlet air. Recently, it has been observed that the mining sector in the Gulf Cooperation Council is making rapid progress in exploiting the region's natural resources. Rather than relying solely on oil & gas earnings, the GCC countries have prioritized economic diversification, investing in non-oil areas such as mining to grow their economies and create jobs. The GCC countries are depending heavily on mineral reserves such as gold, silver, iron ore, copper, and bauxite to realize this. Mineral deposits leftover after desalinating seawater, such as magnesium, are also recycled. The GCC possesses vast undeveloped mineral reserves of many types, which might evolve into a significant industry with investment. Therefore, the rapid growth in the mining industry is anticipated to augment the fired air heaters market in the region.

The MEA fired air heaters market is majorly affected by the disruption in the supply chain due to the COVID-19 pandemic. Owing to the closure of country borders, the supply chain of several components and systems has been disturbed, and the demand for advanced technologies such as fired air heaters has declined. South Africa faced a decline in its construction industry. The widespread COVID-19 has led manufacturers to suspend their operations or operate with a minimal workforce temporarily. This weakened the demand for fired air heaters, thereby hindering the market performance in the country.

Get more information on this report :

Market Overview and Dynamics

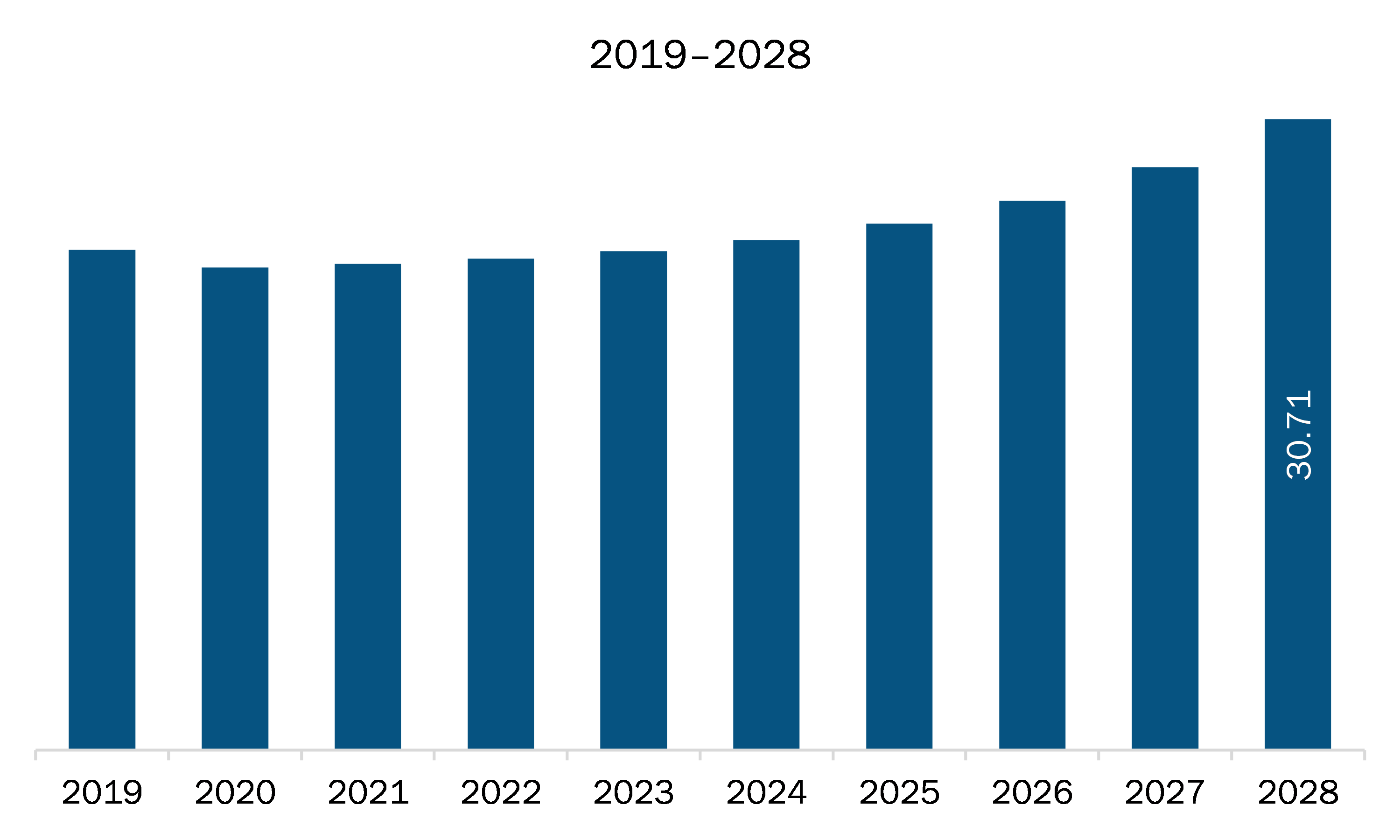

The MEA fired air heaters market is expected to grow from US$ 23.67 million in 2021 to US$ 30.71 million by 2028; it is estimated to grow at a CAGR of 3.8% from 2021 to 2028. In the oil & gas industry, fired heaters heat thermodynamic fluids, process fluids, feedstock, charge heating, steam heating, and thermal cracking in refineries. The unit type depends on the application and whether it is a "vertical cylindrical" or a "box-type furnace." These devices are available for installation, either offshore or onshore. Fired air heaters, which are common in refineries and petrochemical industries, pose serious safety concerns. Various process fluids are heated, vaporized, and thermally cracked using them. These heaters must control the system to ensure adequate fuel combustion and safe operation and control temperature and charge rate. The governments of various economies are taking several measures to attract private investments in oil & gas development. The Adana Refinery and Petrochemical Complex in Turkey, for instance, aims to reduce reliance on imports in the energy, mining, refining, and petrochemical industries. The project is currently in the feasibility stage, with a US$ 10 billion investment from a Turkish wealth fund disclosed in December of last year. Expropriation of a 10 million square meter block of land for the planned facilities is the first step. It will be constructed in Ceyhan, Turkey, which is regarded as a petrochemical products hub. It is expected to contribute roughly US$ 1.5 billion per year to Turkey's trade deficit, decreasing its annual petrochemical import cost of US$ 13 billion. A wealth of potential has unfolded as African governments open up development prospects and firms invest extensively in new areas. The Gas Revolution Industrial Park (GRIP), a downstream refinery and petrochemical complex in Nigeria's Delta area, has been in the works for a long time. The Nigerian National Petroleum Corporation (NNPC) owns the entire complex, containing several new chemical factories that would utilize Nigeria's plentiful natural gas as a feedstock. The GRIP has been declared a tax-free zone because it is a government-owned project, allowing for faster planning and access to a broader range of resources. The rise in oil & gas refinery capacity and expansion of petrochemical and specialty chemicals sectors are driving the MEA fired air heaters market.

Key Market Segments

In terms of type, the direct fired air heater segment accounted for the largest share of the MEA fired air heaters market in 2020. In terms of end-user, the chemicals segment held a larger market share of the MEA fired air heaters market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the MEA fired air heaters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ALLMAND BROS., INC; Pirobloc, S.A.; SIGMA THERMAL, INC; Wacker Neuson SE; and Zeeco, Inc.

Reasons to buy report

- To understand the MEA fired air heaters market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for MEA fired air heaters market

- Efficiently plan M&A and partnership deals in MEA fired air heaters market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form MEA fired air heaters market

- Obtain market revenue forecast for market by various segments from 2021-2028 in MEA region.

MEA Fired Air Heaters Market Segmentation

MEA Fired Air Heaters Market - By Type

- Direct Fired Air Heater

- Indirect Fired Air Heater

MEA Fired Air Heaters Market - By End-User

- Manufacturing

- Chemicals

- Mining

- Construction

- Oil & Gas

- Pharmaceuticals

- Food

- Others

MEA Fired Air Heaters Market - By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

MEA Fired Air Heaters Market - Company Profiles

- ALLMAND BROS., INC

- Pirobloc, S.A.

- SIGMA THERMAL, INC

- Wacker Neuson SE

- Zeeco, Inc.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Fired Air Heaters Market Landscape

4.1 Market Overview

4.2 MEA PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. MEA Fired Air Heaters Market – Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Surging Oil & Gas Refinery Capacity

5.1.2 Escalating Demand for Heating Equipment for Industrial Application

5.2 Key Market Restraints

5.2.1 Issues Such as Longer Life Span and Operational Negligence

5.3 Key Market Opportunities

5.3.1 Rising Initiatives by Market Players

5.4 Future Trends

5.4.1 Burgeoning Construction Sector

5.5 Impact Analysis of Drivers and Restraints

6. Fired Air Heaters Market – MEA Analysis

6.1 Fired Air Heaters Market Overview

6.2 MEA Fired Air Heaters Market – Revenue and Forecast to 2028 (US$ Million)

7. MEA Fired Air Heaters Market Analysis – By Type

7.1 Overview

7.2 MEA Fired Air Heaters Market Revenue Breakdown, By Type, 2020 and 2028

7.3 Direct fired air heater

7.3.1 Overview

7.3.2 Direct Fired Air Heater: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

7.4 Indirect fired air heater

7.4.1 Overview

7.4.2 Indirect Fired Air Heater: Fired Air Heaters Market, Revenue and Forecast to 2028 (US$ Million)

8. MEA Fired Air Heaters Market Analysis– By End-User

8.1 Overview

8.2 MEA Fired Air Heaters Market Breakdown, By End-User, 2020 and 2028

8.3 Manufacturing

8.3.1 Overview

8.3.2 Manufacturing: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.4 Chemicals

8.4.1 Overview

8.4.2 Chemicals: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.5 Mining

8.5.1 Overview

8.5.2 Mining: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.6 Construction

8.6.1 Overview

8.6.2 Construction: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.7 Oil and Gas

8.7.1 Overview

8.7.2 Oil and Gas: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.8 Pharmaceuticals

8.8.1 Overview

8.8.2 Pharmaceuticals: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.9 Food

8.9.1 Overview

8.9.2 Food: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

8.10 Others

8.10.1 Overview

8.10.2 Others: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

9. MEA Fired Air Heaters Market – Country Analysis

9.1 Overview

9.1.1 MEA: Fired Air Heaters Market Breakdown, By Country

9.1.1.1 Saudi Arabia: Fired Air Heaters Market, Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 Saudi Arabia: Fired Air Heaters Market Breakdown, by Type

9.1.1.1.2 Saudi Arabia: Fired Air Heaters Market Breakdown, by End-User

9.1.1.2 UAE: Fired Air Heaters Market, Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 UAE: Fired Air Heaters Market Breakdown, by Type

9.1.1.2.2 UAE: Fired Air Heaters Market Breakdown, by End-User

9.1.1.3 South Africa: Fired Air Heaters Market, Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 South Africa: Fired Air Heaters Market Breakdown, by Type

9.1.1.3.2 South Africa: Fired Air Heaters Market Breakdown, by End-User

9.1.1.4 Rest of MEA: Fired Air Heaters Market, Revenue and Forecast to 2028 (US$ Million)

9.1.1.4.1 Rest of MEA: Fired Air Heaters Market Breakdown, by Type

9.1.1.4.2 Rest of MEA: Fired Air Heaters Market Breakdown, by End-User

10. MEA Fired Air Heaters Market - COVID-19 Impact Analysis

10.1 MEA: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

12. Company Profiles

12.1 ALLMAND BROS., INC

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Pirobloc, S.A.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 SIGMA THERMAL, INC

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Wacker Neuson SE

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Zeeco, Inc.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. MEA Fired Air Heaters Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. MEA: Fired Air Heaters Market, Revenue and Forecast to 2028 – By Country (US$ Million)

Table 3. Saudi Arabia: Fired Air Heaters Market, Revenue and Forecast to 2028 – By Type (US$ Million)

Table 4. Saudi Arabia: Fired Air Heaters Market, Revenue and Forecast to 2028 – By End-User (US$ Million)

Table 5. UAE: Fired Air Heaters Market, Revenue and Forecast to 2028 – By Type (US$ Million)

Table 6. UAE: Fired Air Heaters Market, Revenue and Forecast to 2028 – By End-User (US$ Million)

Table 7. South Africa: Fired Air Heaters Market, Revenue and Forecast to 2028 – By Type (US$ Million)

Table 8. South Africa: Fired Air Heaters Market, Revenue and Forecast to 2028 – By End-User (US$ Million)

Table 9. Rest of MEA: Fired Air Heaters Market, Revenue and Forecast to 2028 – By Type (US$ Million)

Table 10. Rest of MEA: Fired Air Heaters Market, Revenue and Forecast to 2028 – By End-User (US$ Million)

Table 11. List of Abbreviation

LIST OF FIGURES

Figure 1. MEA Fired Air Heaters Market Segmentation

Figure 2. MEA Fired Air Heaters Market Segmentation – By Country

Figure 3. MEA Fired Air Heaters Market Overview

Figure 4. Direct Fired Air Heaters Held the Largest Market Share in 2020

Figure 5. Chemicals Held the Largest Market Share in 2020

Figure 6. The UAE was the Largest Revenue Contributor in 2020

Figure 7. MEA – PEST Analysis

Figure 8. MEA Fired Air Heaters Market– Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. MEA Fired Air Heaters Market: Impact Analysis of Drivers and Restraints

Figure 11. MEA Fired Air Heaters Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. MEA Fired Air Heaters Market Revenue Breakdown, by type, 2020 and 2028 (%)

Figure 13. MEA Direct Fired Air Heater: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 14. MEA Indirect Fired Air Heater: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 15. MEA Fired Air Heaters Market Breakdown, By End-User, 2020 and 2028 (%)

Figure 16. MEA Manufacturing: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 17. MEA Chemicals: Fired Air Heaters Market- Revenue and Forecast To 2028 (US$ Million)

Figure 18. MEA Mining: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 19. MEA Construction: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 20. MEA Oil and Gas: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 21. MEA Pharmaceuticals: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 22. MEA Food: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 23. MEA Others: Fired Air Heaters Market- Revenue and Forecast to 2028 (US$ Million)

Figure 24. MEA: Fired Air Heaters Market Revenue Overview, by Country (2020) (US$ Mn)

Figure 25. MEA: Fired Air Heaters Market Breakdown, By Country, 2020 & 2028 (%)

Figure 26. Saudi Arabia: Fired Air Heaters Market, Revenue and Forecast To 2028 (US$ Million)

Figure 27. UAE: Fired Air Heaters Market, Revenue and Forecast To 2028 (US$ Million)

Figure 28. South Africa: Fired Air Heaters Market, Revenue and Forecast To 2028 (US$ Million)

Figure 29. Rest of MEA: Fired Air Heaters Market, Revenue and Forecast To 2028 (US$ Million)

Figure 30. Impact of COVID-19 Pandemic in MEA Countries

- ALLMAND BROS., INC

- Pirobloc, S.A.

- SIGMA THERMAL, INC

- Wacker Neuson SE

- Zeeco, Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the MEA fired air heaters market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the MEA fired air heaters market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth MEA market trends and outlook coupled with the factors driving the fired air heaters market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution