Middle East & Africa Composites Market Forecast to 2028 – COVID-19 Impact and Regional Analysis– by Fiber Type (Carbon Fiber Composites, Glass Fiber Composites, and Others), Resin Type [Thermoset (Polyester, Vinyl Ester, Epoxy, Polyurethane, and Others) and Thermoplastic (Polypropylene, Polyethylene, Polyvinylchloride, Polystyrene, Polyethylene Terephthalate, Polycarbonate, and Others)], and End Use Industry (Automotive, Aerospace and Defense, Wind, Construction, Marine, Sporting Goods, and Others)

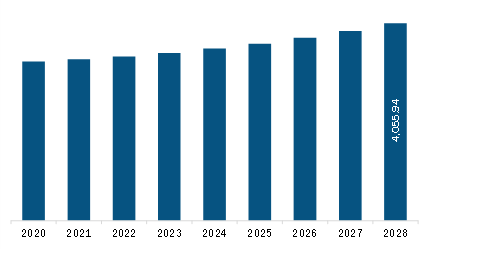

The Middle East & Africa composites market is expected to grow from US$ 3,373.59 million in 2022 to US$ 4,055.94 million by 2028. It is estimated to grow at a CAGR of 3.1% from 2022 to 2028.

Development of Composites from Biobased Matrices Fuels Middle East & Africa Composites Market

Biobased composites are a new class of materials with an attractive combination of good technical performance and low environmental impact. The replacement of petroleum-derived plastics matrices with bio-based matrices or resins, sourced from carbohydrates, vegetable fats and oils, starch, bacteria, and other biological materials, is an emerging trend in the composites market. Bio-based polymer matrices are environmentally friendly and are the subject of extensive research in various fields. Bio-based matrices are eco-friendly and lightweight, and exhibit long-term sustainability, which drives their use in commercial applications. The easy availability of natural raw materials for the production of bio-based resin is another factor fueling its supply and demand .

Bio-based matrices and biocomposites are employed in several secondary applications in aerospace, automobiles, packaging, electronics, and construction sectors. In the construction industry, biocomposites are generally used for the production of doors, windows, terrace decking, insulation material, and acoustic components. Hence, owing to the rising concern and awareness about the social and environmental impacts of conventional building materials, manufacturers of composites are shifting toward environment-friendly materials, which is expected to fuel the Middle East & Africa composites market growth during the forecast period.

Middle East & Africa Composites Market Overview

The composites market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. These countries are rapidly developing their public infrastructure, including airports, hospitals, and administrative buildings. The construction of commercial infrastructure has increased due to the rising tourism industry and the growing immigrant population. In the coming years, the composites market in the Middle East & Africa is expected to grow at a significant rate due to the continuous investment in expansion, research and development activities in the aerospace sector by prominent players in the region. For instance, in 2022, SAMI Composites LLC partnered with The Lockheed Martin Corporation, for development of Composites Manufacturing Center of Excellence in Riyadh with the support of the General Authority for Military Industries (GAMI), to boost Saudi Arabia’s aerospace manufacturing capabilities. These key trends are anticipated to increase the demand for composites in the region, during the forecast period.

Middle East & Africa Composites Market Revenue and Forecast to 2028 (US$ Million)

Middle East & Africa Composites Market Segmentation

The Middle East & Africa composites market is segmented into fiber type, resin type, end use industry, and country.

Based on fiber type, the Middle East & Africa composites market is segmented into carbon fiber composites, glass fiber composites, and others. The glass fiber composites segment held the largest share of the Middle East & Africa composites market in 2022.

Based on resin type, the Middle East & Africa composites market is segmented into thermoset and thermoplastic. The thermoset segment held a larger share of the Middle East & Africa composites market in 2022. The thermoset is segmented into polyester, vinyl ester, epoxy, polyurethane, and others. The Thermoplastic is segmented into polypropylene, polyethylene, polyvinylchloride, polystyrene, polyethylene terephthalate, polycarbonate, and others.

Based on end use industry, the Middle East & Africa composites market is segmented into automotive, aerospace and defense, wind, construction, marine, sporting goods, and others. The automotive segment held the largest share of the Middle East & Africa composites market in 2022.

Based on country, the Middle East & Africa composites market is segmented into South Africa

Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the share of the Middle East & Africa composites market in 2022.

DuPont de Nemours Inc; Gurit Holding AG; Hexion Inc; Mitsubishi Chemical Holdings Corp; SGL Carbon SE; Solvay SA; and Toray Industries Inc are the leading companies operating in the Middle East & Africa composites market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Middle East & Africa Composites Market, by Fiber Type

1.3.2 Middle East & Africa Composites Market, by Resin Type

1.3.3 Middle East & Africa Composites Market, by End Use Industry

1.3.4 Middle East & Africa Composites Market, by Country

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. Middle East & Africa Composites Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Threat of New Entrants:

4.2.2 Bargaining Power of Suppliers:

4.2.3 Bargaining Power of Buyers:

4.2.4 Competitive Rivalry:

4.2.5 Threat of Substitutes:

4.3 Ecosystem Analysis

4.3.1 Overview:

4.3.2 Raw Material Suppliers:

4.3.3 Manufacturers

4.3.4 Distributors

4.3.5 End-User

4.4 Expert Opinion

5. Middle East & Africa Composites Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Demand for Lightweight Materials from Automotive & Aerospace Industry

5.1.2 Rising Utilization of Glass-fiber Composites in End-use Industries

5.2 Market Restraints

5.2.1 Challenges in Recycling of Thermoset Composites

5.3 Market Opportunities

5.3.1 Applications of Composites in Wind Energy Sector

5.4 Future Trends

5.4.1 Development of Composites from Biobased Matrices

5.5 Impact Analysis

6. Composites – Middle East & Africa Market Analysis

6.1 Middle East & Africa Composites Market Overview

6.2 Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

6.3 Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

7. Middle East & Africa Composites Market Analysis – By Fiber Type

7.1 Overview

7.2 Middle East & Africa Composites Market, By Fiber Type (2021 and 2028)

7.3 Carbon Fiber Composites

7.3.1 Overview

7.3.2 Carbon Fiber Composites: Middle East & Africa Composites Market – Volume and Forecast to 2028 (Kilo Tons)

7.3.3 Carbon Fiber Composites: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Glass Fiber Composites

7.4.1 Overview

7.4.2 Glass Fiber Composites: Middle East & Africa Composites Market – Volume and Forecast to 2028 (Kilo Tons)

7.4.3 Glass Fiber Composites: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Middle East & Africa Composites Market – Volume and Forecast to 2028 (Kilo Tons)

7.5.3 Others: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Mn)

8. Middle East & Africa Composites Market Analysis – By Resin Type

8.1 Overview

8.2 Middle East & Africa Composites Market, By Resin Type (2021 and 2028)

8.3 Thermoset

8.3.1 Overview

8.3.2 Thermoset: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.3.3 Polyester

8.3.3.1 Overview

8.3.3.2 Polyester: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.3.4 Vinyl Ester

8.3.4.1 Overview

8.3.4.2 Vinyl Ester: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.3.5 Epoxy

8.3.5.1 Overview

8.3.5.2 Epoxy: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.3.6 Polyurethane

8.3.6.1 Overview

8.3.6.2 Polyurethane: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.3.7 Others

8.3.7.1 Overview

8.3.7.2 Others: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Thermoplastic

8.4.1 Overview

8.4.2 Thermoplastic: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.3 Polypropylene

8.4.3.1 Overview

8.4.3.2 Polypropylene: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.4 Polyethylene

8.4.4.1 Overview

8.4.4.2 Polyethylene: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.5 Polyvinylchloride

8.4.5.1 Overview

8.4.5.2 Polyvinylchloride: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.6 Polystyrene

8.4.6.1 Overview

8.4.6.2 Polystyrene: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.7 Polyethylene Terephthalate

8.4.7.1 Overview

8.4.7.2 Polyethylene Terephthalate: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.8 Polycarbonate

8.4.8.1 Overview

8.4.8.2 Polycarbonate: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

8.4.9 Others

8.4.9.1 Overview

8.4.9.2 Others: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9. Middle East & Africa Composites Market Analysis – By End Use Industry

9.1 Overview

9.2 Middle East & Africa Composites Market, By End Use Industry (2021 and 2028)

9.3 Automotive

9.3.1 Overview

9.3.2 Automotive: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Aerospace and Defense

9.4.1 Overview

9.4.2 Aerospace and Defense: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Wind

9.5.1 Overview

9.5.2 Wind: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Construction

9.6.1 Overview

9.6.2 Construction: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Marine

9.7.1 Overview

9.7.2 Marine: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9.8 Sporting Goods

9.8.1 Overview

9.8.2 Sporting Goods: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

9.9 Others

9.9.1 Overview

9.9.2 Others: Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

10. Middle East & Africa Composites Market – Country Analysis

10.1 Overview

10.1.1 Middle East & Africa Composites Market, by Key Country

10.1.1.1 South Africa: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

10.1.1.2 South Africa: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 South Africa: Middle East & Africa Composites Market, by Fiber Type

10.1.1.2.2 South Africa: Middle East & Africa Composites Market, by Fiber Type

10.1.1.2.3 South Africa: Middle East & Africa Composites Market, by Resin Type

10.1.1.2.4 South Africa: Middle East & Africa Composites Market, by End Use Industry

10.1.1.3 Saudi Arabia: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

10.1.1.4 Saudi Arabia: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.4.1 Saudi Arabia: Middle East & Africa Composites Market, by Fiber Type

10.1.1.4.2 Saudi Arabia: Middle East & Africa Composites Market, by Fiber Type

10.1.1.4.3 Saudi Arabia: Middle East & Africa Composites Market, by Resin Type

10.1.1.4.4 Saudi Arabia: Middle East & Africa Composites Market, by End Use Industry

10.1.1.5 UAE: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

10.1.1.6 UAE: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.6.1 UAE: Middle East & Africa Composites Market, by Fiber Type

10.1.1.6.2 UAE: Middle East & Africa Composites Market, by Fiber Type

10.1.1.6.3 UAE: Middle East & Africa Composites Market, by Resin Type

10.1.1.6.4 UAE: Middle East & Africa Composites Market, by End Use Industry

10.1.1.7 Rest of MEA: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

10.1.1.8 Rest of MEA: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.8.1 Rest of MEA: Middle East & Africa Composites Market, by Fiber Type

10.1.1.8.2 Rest of MEA: Middle East & Africa Composites Market, by Fiber Type

10.1.1.8.3 Rest of MEA: Middle East & Africa Composites Market, by Resin Type

10.1.1.8.4 Rest of MEA: Middle East & Africa Composites Market, by End Use Industry

11. Company Profiles

11.1 DuPont de Nemours Inc

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Gurit Holding AG

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Hexion Inc

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Mitsubishi Chemical Holdings Corp

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 SGL Carbon SE

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Solvay SA

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Toray Industries Inc

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary of Terms

LIST OF TABLES

Table 1. Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

Table 2. Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

Table 3. South Africa: Middle East & Africa Composites Market, by Fiber Type –Volume and Forecast to 2028 (Kilo Tons)

Table 4. South Africa: Middle East & Africa Composites Market, by Fiber Type – Revenue and Forecast to 2028 (US$ Million)

Table 5. South Africa: Middle East & Africa Composites Market, by Resin Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. South Africa: Middle East & Africa Composites Market, by End Use Industry – Revenue and Forecast to 2028 (US$ Million)

Table 7. Saudi Arabia: Middle East & Africa Composites Market, by Fiber Type – Volume and Forecast to 2028 (Kilo Tons)

Table 8. Saudi Arabia: Middle East & Africa Composites Market, by Fiber Type – Revenue and Forecast to 2028 (US$ Million)

Table 9. Saudi Arabia: Middle East & Africa Composites Market, by Resin Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. Saudi Arabia: Middle East & Africa Composites Market, by End Use Industry – Revenue and Forecast to 2028 (US$ Million)

Table 11. UAE: Middle East & Africa Composites Market, by Fiber Type – Volume and Forecast to 2028 (Kilo Tons)

Table 12. UAE: Middle East & Africa Composites Market, by Fiber Type – Revenue and Forecast to 2028 (US$ Million)

Table 13. UAE: Middle East & Africa Composites Market, by Resin Type – Revenue and Forecast to 2028 (US$ Million)

Table 14. UAE: Middle East & Africa Composites Market, by End Use Industry – Revenue and Forecast to 2028 (US$ Million)

Table 15. Rest of MEA Middle East & Africa Composites Market, by Fiber Type – Volume and Forecast to 2028 (Kilo Tons)

Table 16. Rest of MEA Middle East & Africa Composites Market, by Fiber Type – Revenue and Forecast to 2028 (US$ Million)

Table 17. Rest of MEA Middle East & Africa Composites Market, by Resin Type – Revenue and Forecast to 2028 (US$ Million)

Table 18. Rest of MEA Middle East & Africa Composites Market, by End Use Industry – Revenue and Forecast to 2028 (US$ Million)

Table 19. Glossary of Terms, Middle East & Africa Composites Market

LIST OF FIGURES

Figure 1. Middle East & Africa Composites Market Segmentation

Figure 2. Middle East & Africa Composites Market Segmentation – By Country

Figure 3. Middle East & Africa Composites Market Overview

Figure 4. Middle East & Africa Composites Market, By End Use Industry

Figure 5. Middle East & Africa Composites Market, by Country

Figure 6. Porter’s Five Forces Analysis of Middle East & Africa Composites Market

Figure 7. Middle East & Africa Composites Market, Ecosystem

Figure 8. Expert Opinion

Figure 9. Middle East & Africa Composites Market Impact Analysis of Drivers and Restraints

Figure 10. Middle East & Africa Composites Market – Volume and Forecast to 2028 (Kilo Tons)

Figure 11. Middle East & Africa Composites Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. Middle East & Africa Composites Market Revenue Share, By Fiber Type (2021 and 2028)

Figure 13. Carbon Fiber Composites: Middle East & Africa Composites Market – Volume and Forecast To 2028 (Kilo Tons)

Figure 14. Carbon Fiber Composites: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 15. Glass Fiber Composites: Middle East & Africa Composites Market – Volume and Forecast To 2028 (Kilo Tons)

Figure 16. Glass Fiber Composites: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 17. Others: Middle East & Africa Composites Market – Volume and Forecast To 2028 (Tons)

Figure 18. Others: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 19. Middle East & Africa Composites Market Revenue Share, By Resin Type (2021 and 2028)

Figure 20. Thermoset: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 21. Polyester: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 22. Vinyl Ester: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 23. Epoxy: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 24. Polyurethane: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 25. Others: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 26. Thermoplastic: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 27. Polypropylene: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 28. Polyethylene: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 29. Polyvinylchloride: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 30. Polystyrene: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 31. Polyethylene Terephthalate: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 32. Polycarbonate: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 33. Others: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 34. Middle East & Africa Composites Market Revenue Share, By End Use Industry (2021 and 2028)

Figure 35. Automotive: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 36. Aerospace and Defense: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 37. Wind: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 38. Construction: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 39. Marine: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 40. Sporting Goods: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 41. Others: Middle East & Africa Composites Market – Revenue and Forecast To 2028 (US$ Million)

Figure 42. Middle East & Africa Composites Market – Revenue (2021) (US$ Million)

Figure 43. Middle East & Africa Composites Market Revenue Share, by Key Country (2021 and 2028)

Figure 44. South Africa: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

Figure 45. South Africa: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

Figure 46. Saudi Arabia: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

Figure 47. Saudi Arabia: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

Figure 48. UAE: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

Figure 49. UAE: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

Figure 50. Rest of MEA: Middle East & Africa Composites Market –Volume and Forecast to 2028 (Kilo Tons)

Figure 51. Rest of MEA: Middle East & Africa Composites Market –Revenue and Forecast to 2028 (US$ Million)

- DuPont de Nemours Inc

- Gurit Holding AG

- Hexion Inc

- Mitsubishi Chemical Holdings Corp

- SGL Carbon SE

- Solvay SA

- Toray Industries Inc

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa composites market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Middle East & Africa composites market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.