Middle East & Africa and South America Drinking Water Adsorbents Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Product (Zeolite, Clay, Activated Alumina, Activated Carbon, Manganese Oxide, Cellulose, Others)

Market Introduction

The MEA region includes South Africa, Saudi Arabia, the UAE, and the rest of MEA. The drinking water adsorbents are highly preferred in these regions. The meat industry in the MEA is considered to be one of the fastest-growing sectors. There has been an increasing demand for water treatment procedures in the Middle East owing to the scarcity of water. The market for MEA is experiencing rapid development with the growth of markets such as Dubai, Abu Dhabi, and Iran. These markets are expected to expand and stimulate the demand for drinking water adsorbents. The demand for drinking water adsorbents in the municipal water treatment is another reason that has been contributing to the expansion of the drinking water adsorbents market in this region. New procedures and innovations in water treatment have led to the capture of market share in the MEA Region. The market is highly dominated using drinking water adsorbents for purifying drinking water.

SAM includes countries such as Brazil, Argentina, and the rest of SAM. SAM is another region contributing to the growth of drinking water adsorbents in relation to the growing health-related issues, such as cancer, brain damage, and organ failure, caused by drinking polluted water that can be treated with adsorbents, are expected to fuel development. Further, the industry is expected to benefit from an increase in demand for activated carbon for the removal of turbidity and naturally occurring organic matter. Drinking water adsorbents are used to eliminate the microorganism’s growth in water and purify water. There has been an increasing emphasis on the water treatment applications all over South America owing to the rising education of the scarcity of water.

The ongoing COVID-19 pandemic is adversely impacting the MEA and SAM. Iran, Saudi Arabia, Qatar, South Africa, and the UAE are among the MEA countries with a high number of COVID-19 cases and deaths. These countries have experienced hindered economic and industrial growth in the past few months. The region comprises several growing economies such as the UAE, which are the prospective markets for drinking water adsorbents providers due to the presence of huge and diverse customer base. Most of the businesses in these countries have suspended their operations and are expected to operate with a slower pace. The MEA countries are taking significant containment measures to control the infection spread. The COVID-19 outbreak has severely affected the drinking water adsorbents market due to the shutdown of various drinking water adsorbents facilities in the MEA. In SAM, Brazil has reported the highest number of COVID-19 cases, followed by Ecuador, Peru, Chile, and Argentina, among others. The governments of SAM countries are taking several initiatives to protect people and control the spread of COVID-19 through lockdowns, trade bans, and travel restrictions. These measures are affecting their economic growth due to lower export revenues, both from the drop in commodity prices and reduction in export volumes. The outbreak has also resulted in the shutdown of production plants, which has impacted the growth of the chemical industries in SAM, thereby limiting the drinking water adsorbents market growth in the region.

Get more information on this report :

Market Overview and Dynamics

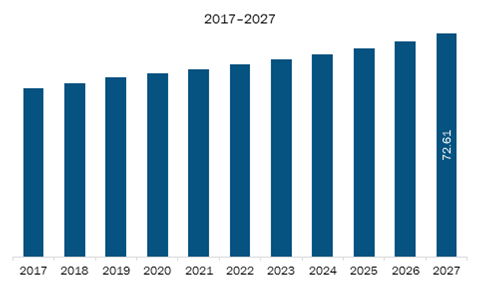

The drinking water adsorbents market in MEA is expected to grow from US$ 58.49 million in 2019 to US$ 72.61 million by 2027; it is estimated to grow at a CAGR of 2.8% from 2020 to 2027. Similarly, the drinking water adsorbents market in SAM is expected to grow from US$ 44.81 million in 2019 to US$ 57.25 million by 2027; it is estimated to grow at a CAGR of 3.2% from 2020 to 2027. Rapid urbanization, migration of population from villages and small towns to metropolitan cities, and population growth in tier 1 and tier 2 cities have created a need for clean and pure drinking water. Therefore, the demand for drinking water adsorbents is growing at a significant pace owing to the rising demand for pure drinking water. Moreover, increasing investment on drinking water treatment facilities by government and private institutions is expected to propel the demand for drinking water treatment chemicals such as drinking water adsorbents. Thus, the favorable government initiatives regarding drinking water are subsequently driving the adoption of drinking water adsorbents.

Key Market Segments

Based on product, the MEA & SAM drinking water adsorbents market is categorized into zeolite, clay, activated alumina, activated carbon, manganese oxide, cellulose, and others. In 2019, the activated carbon segment dominated the market by accounting for highest market share.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the drinking water adsorbents market in MEA & SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE, Dupont, KURARAY CO. LTD, Lenntech B.V., and Purolite.

Reasons to buy report

- To understand the MEA & SAM drinking water adsorbents market landscape and identify market segments that are most likely to guarantee a strong return.

- Stay ahead of the race by comprehending the ever-changing competitive landscape for MEA & SAM drinking water adsorbents market.

- Efficiently plan M&A and partnership deals in MEA & SAM drinking water adsorbents market by identifying market segments with the most promising probable sales.

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form MEA & SAM drinking water adsorbents market.

- Obtain market revenue forecast for market by various segments from 2020-2027 in MEA & SAM region.

MEA & SAM Drinking Water Adsorbents Market Segmentation

MEA & SAM Drinking Water Adsorbents Market - By Product

- Zeolite

- Clay

- Activated Alumina

- Activated Carbon

- Manganese Oxide

- Cellulose

- Others

MEA & SAM Drinking Water Adsorbents Market - By Country

- MEA

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- SAM

- Brazil

- Argentina

- Rest of SAM

MEA & SAM Drinking Water Adsorbents Market - Company Profiles

- BASF SE

- Dupont

- KURARAY CO. LTD

- Lenntech B.V.

- Purolite

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. MEA & SAM Drinking Water Adsorbents Market Landscape

4.1 Market Overview

4.2 MEA PEST Analysis

4.3 SAM PEST Analysis

4.4 Expert Opinion

4.5 PFAS Water Pollution Problem and Potential Solutions

4.5.1 PFAS Overview and Water Pollution Problem

4.5.2 Potential Solutions To Address PFAS Contamination

5. MEA & SAM Drinking Water Adsorbents Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Activated Carbon Demand Rising

5.1.2 Favourable Government Initiatives Related to Drinking Water

5.2 Market Restraints

5.2.1 Presence of Substitutes

5.3 Market Opportunities

5.3.1 Rice Husk Derived Adsorbents Extensively Being Used for Water Purification

5.4 Future Trends

5.4.1 Bio-Based Adsorbents Getting Highly Adopted

5.5 Impact Analysis of Drivers and Restraints

6. Drinking Water Adsorbents Market – MEA & SAM Analysis

6.1 MEA Drinking Water Adsorbents Market Overview

6.2 MEA Drinking Water Adsorbents Market –Revenue and Forecast to 2027 (US$ Million)

6.3 SAM Drinking Water Adsorbents Market Overview

6.4 SAM Drinking Water Adsorbents Market –Revenue and Forecast to 2027 (US$ Million)

7. MEA & SAM Drinking Water Adsorbents Market Analysis – By Product

7.1 Overview

7.2 MEA Drinking Water Adsorbents Market, By Product (2019 and 2027)

7.3 SAM Drinking Water Adsorbents Market, By Product (2019 and 2027)

7.4 Zeolite

7.4.1 Overview

7.4.1.1 Zeolite: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.4.1.2 Zeolite: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.5 Clay

7.5.1 Overview

7.5.1.1 Clay: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.5.1.2 Clay: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.6 Activated Alumina

7.6.1 Overview

7.6.1.1 Activated Alumina: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.6.1.2 Activated Alumina: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.7 Activated Carbon

7.7.1 Overview

7.7.1.1 Activated Carbon: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.7.1.2 Activated Carbon: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.8 Manganese Oxide

7.8.1 Overview

7.8.1.1 Manganese Oxide: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.8.1.2 Manganese Oxide: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.9 Cellulose

7.9.1 Overview

7.9.1.1 Cellulose: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.9.1.2 Cellulose: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.10 Others

7.10.1 Overview

7.10.1.1 Others: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

7.10.1.2 Others: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

8. MEA Drinking Water Adsorbents Market – Country Analysis

8.1 Overview

8.1.1 MEA: Drinking Water Adsorbents Market, by Key Country

8.1.1.1 South Africa: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

8.1.1.1.1 South Africa: Drinking Water Adsorbents Market, by Product

8.1.1.2 Saudi Arabia: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

8.1.1.2.1 Saudi Arabia: Drinking Water Adsorbents Market, by Product

8.1.1.3 UAE: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

8.1.1.3.1 UAE: Drinking Water Adsorbents Market, by Product

8.1.1.4 Rest of MEA: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

8.1.1.4.1 Rest of MEA: Drinking Water Adsorbents Market, by Product

9. SAM Drinking Water Adsorbents Market – Country Analysis

9.1 Overview

9.1.1 SAM: Drinking Water Adsorbents Market, by Key Country

9.1.1.1 Brazil: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.1.1 Brazil: Drinking Water Adsorbents Market, by Product

9.1.1.2 Argentina: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.2.1 Argentina: Drinking Water Adsorbents Market, by Product

9.1.1.3 Rest of SAM: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

9.1.1.3.1 Rest of SAM: Drinking Water Adsorbents Market, by Product

10. Impact of COVID-19 Pandemic on MEA & SAM Drinking Water Adsorbents Market

10.1 MEA: Impact Assessment of COVID-19 Pandemic

10.2 SAM: Impact Assessment of COVID-19 Pandemic

11. Company Profiles

11.1 BASF SE

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.2 Dupont

11.2.1 Key Facts

11.2.2 Products and Services

11.2.3 Financial Overview

11.2.4 SWOT Analysis

11.3 KURARAY CO. LTD

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.4 Lenntech B.V.

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products And Services

11.4.4 Financial Overview

11.4.5 Swot Analysis

11.5 Purolite

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products And Services

11.5.4 Financial Overview

11.5.5 Swot Analysis

12. Appendix

12.1 About The Insight Partners

12.2 Glossary

LIST OF TABLES

Table 1. MEA Drinking Water Adsorbents Market –Revenue and Forecast to 2027 (US$ Million)

Table 2. SAM Drinking Water Adsorbents Market –Revenue and Forecast to 2027 (US$ Million)

Table 3. South Africa Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 4. Saudi Arabia Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 5. UAE Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 6. Rest of MEA Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 7. Brazil Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 8. Argentina Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 9. Rest of South America Drinking Water Adsorbents Market, by Product – Revenue and Forecast to 2027 (USD Million)

Table 10. Glossary of Terms, Global Drinking Water Adsorbents Market

LIST OF FIGURES

Figure 1. MEA & SAM Drinking Water Adsorbents Market Segmentation

Figure 2. SAM & SAM Drinking Water Adsorbents Market Segmentation – By Country

Figure 3. Activated Carbon Segment Held Largest Share of MEA Drinking Water Adsorbents Market

Figure 4. Rest of MEA Held Largest Share of MEA Drinking Water Adsorbents Market

Figure 5. Activated Carbon Segment Held Largest Share of SAM Drinking Water Adsorbents Market

Figure 6. Brazil Held Largest Share of SAM Drinking Water Adsorbents Market

Figure 7. MEA: PEST Analysis

Figure 8. SAM: PEST Analysis

Figure 9. Expert Opinion

Figure 10. MEA & SAM Drinking Water Adsorbents Market Impact Analysis of Drivers and Restraints

Figure 11. MEA: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 12. SAM: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 13. MEA Drinking Water Adsorbents Market Revenue Share, by Product (2019 and 2027)

Figure 14. SAM Drinking Water Adsorbents Market Revenue Share, by Product (2019 and 2027)

Figure 15. MEA Zeolite: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 16. SAM Zeolite: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 17. MEA Clay: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 18. SAM Clay: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 19. MEA Activated Alumina: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 20. SAM Activated Alumina: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 21. MEA Activated Carbon: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 22. SAM Activated Carbon: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 23. MEA Manganese Oxide: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 24. SAM Manganese Oxide: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 25. MEA Cellulose: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 26. SAM Cellulose: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 27. MEA Others: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 28. SAM Others: Drinking Water Adsorbents Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 29. MEA: Drinking Water Adsorbents Market, by Key Country – Revenue (2019) (US$ Million)

Figure 30. MEA: Drinking Water Adsorbents Market Revenue Share, by Key Country (2019 and 2027)

Figure 31. South Africa: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 32. Saudi Arabia: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 33. UAE: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 34. Rest of MEA: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 35. SAM: Drinking Water Adsorbents Market, by Key Country– Revenue (2019) (US$ Million)

Figure 36. SAM: Drinking Water Adsorbents Market Revenue Share, by Key Country (2019 and 2027)

Figure 37. Brazil: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 38. Argentina: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 39. Rest of SAM: Drinking Water Adsorbents Market – Revenue and Forecast to 2027 (US$ Million)

Figure 40. Impact of COVID-19 Pandemic in MEA Country Markets

Figure 41. Impact of COVID-19 Pandemic In SAM Country Markets

- BASF SE

- Dupont

- KURARAY CO. LTD

- Lenntech B.V.

- Purolite

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the MEA & SAM drinking water adsorbents market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the MEA & SAM drinking water adsorbents market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth MEA & SAM market trends and outlook coupled with the factors driving the drinking water adsorbents market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution