Middle East and Africa Aircraft Floor Panel Market Forecast to 2027 - COVID-19 Impact and Regional Analysis by Aircraft Type (Wide Body Aircrafts, Narrow Body Aircrafts, and General Aviation), Material Type (Aluminum Honeycomb and Nomex Honeycomb), Sales Channel (OEM and Aftermarket), and End User (Commercial and Military)

Market Introduction

Aircraft floor panels are a critical component used in various types of aircraft, such as wide–body aircraft, narrow–body, and general aviation. This light-weight component has high durability and strength, which is ideal for aerospace applications. Based on the materials, several core materials, such as nomex and aluminum, are used in developing aerospace floor panels. The positive growth in the aircraft types is anticipated to fuel the demand for aircraft floor panel and offer future growth opportunities to market players operating in the MEA aircraft floor panel market. Moreover, the steady growth in passenger traffic and fluctuations in traffic volumes at individual airports are expected to increase airlines' demand for passenger aircraft which will increase the demand of aircraft floor panels, which will drive the MEA aircraft floor panel market. The technological developments and substantial investments in R & D by OEMs to manufacture aerospace structural parts are also anticipated to accelerate the MEA market growth during the forecast period. Other factor such as mounting emphasis on use of lightweight materials and increasing demand for air freighter fleet are also expected to drive the MEA aircraft floor panel market.

Furthermore, in case of COVID-19, MEA is highly affected specially the UAE and Iran. The MEA aircraft floor panels market is majorly affected by the disruption in the supply chain. Pertaining to the closure of countries' borders, the supply chain of several components and parts has been disturbed. The demand for advanced aircraft components, including aircraft floor panels for line fitting and retrofitting activities on military aircraft fleet and general aviation fleet among the aircraft manufacturers, military forces, and MRO service providers, has weakened over the past couple of months. This has resulted in a loss of business among the aircraft floor panel market players offering their products to respective customers in the MEA region. Additionally, several airlines have postponed or canceled the procurement or orders of scheduled aircraft. South Africa has few aircraft manufacturers, which produce general aviation piston aircraft. The widespread COVID – 19 viruses have led the manufacturers to suspend their operations or operate with a minimal workforce temporarily. This has weakened the demand for aircraft floor panels, thereby hindering the country's aircraft floor panel market

Get more information on this report :

Market Overview and Dynamics

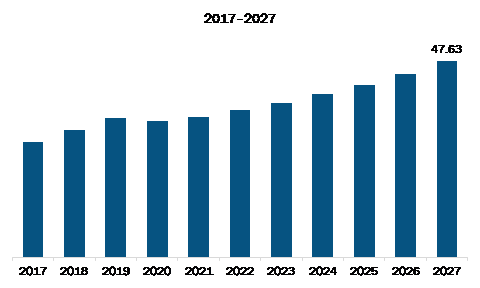

The MEA aircraft floor panel market is expected to grow from US$ 33.96 million in 2019 to US$ 47.63 million by 2027; it is estimated to grow at a CAGR of 5.4 % from 2020 to 2027. Growing aircraft orders and delivery volumes across MEA region is expected to accelerate the MEA aircraft floor panel market. The MEA aviation industry is undergoing expansion at a rapid pace, recording significant production volumes and deliveries of aircraft (commercial and military) fleet. Specifically, the commercial aviation industry has witnessed tremendous growth in the past few years with the emergence of new low cost carriers (LCCs) and fleet expansion strategies adopted by the full service carriers (FSCs). Further, commercial aviation is foreseen to surge in the coming years owing to the mounting number of air travel passengers and aircraft procurement. This surge in aircraft production is boosting the demand for aircraft floor panels across MEA region. Airbus and Boeing are the two aircraft manufacturing giants with significantly greater volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) are continuously encountering orders for various aircraft models from different civil airlines. Owing to the continuously rising production volumes to bridge the gap between demand and supply of aircraft, the OEMs are increasingly procuring large volumes of aircraft floor panels. In the current scenario, the demand for both wide body and narrow body aircraft fleet is high. Growing aircrafts orders and delivery volumes due to increase in the number passengers across MEA region is expected to escalate the demand of aircraft floor panels, which will drive the MEA aircraft floor panel market.

Key Market Segments

In terms of aircraft type, the wide body aircrafts segment accounted for the largest share of the MEA aircraft floor panel market in 2019. In terms of material type, the nomex honeycomb segment held a larger market share of the MEA aircraft floor panel market in 2019. Similarly, in terms of sales channel, the aftermarket segment held a larger market share of the MEA aircraft floor panel market in 2019. Further, the commercial segment held a larger share of the MEA aircraft floor panel market based on end user in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the MEA aircraft floor panel market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aim Altitude UK Ltd.; Collins Aerospace, a Raytheon Technologies Corporation company; Euro Composite S.A.; Safran S.A; Singapore Technologies Engineering Ltd; The Gill Corporation.

Reasons to buy report

- To understand the MEA aircraft floor panel market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for MEA aircraft floor panel market

- Efficiently plan M&A and partnership deals in MEA aircraft floor panel market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form MEA aircraft floor panel market

- Obtain market revenue forecast for market by various segments from 2020-2027 in MEA region.

MEA Aircraft Floor Panel Market Segmentation

MEA Aircraft Floor Panel Market - By Aircraft Type

- Wide Body Aircrafts

- Narrow Body Aircrafts

- General Aviation

MEA Aircraft Floor Panel Market - By Material Type

- Aluminum Honeycomb

- Nomex Honeycomb

MEA Aircraft Floor Panel Market - By Sales Channel

- OEM

- Aftermarket

MEA Aircraft Floor Panel Market - By End User

- Commercial

- Military

MEA Aircraft Floor Panel Market - By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

MEA Aircraft Floor Panel Market - Company Profiles

- Aim Altitude UK Ltd.

- Collins Aerospace, a Raytheon Technologies Corporation company

- Euro Composite S.A.

- Safran S.A

- Singapore Technologies Engineering Ltd

- The Gill Corporation

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Aircraft Floor Panel Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.3 Ecosystem Analysis

5. MEA Aircraft Floor Panel Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Aircraft Orders and Delivery Volumes

5.1.2 Mounting Emphasis on Use of Lightweight Materials

5.2 Market Restraint

5.2.1 Boeing’s Disappointment from B737 Max and Cancellation of A380 Program

5.3 Market Opportunities

5.3.1 Burgeoning Adoption of Wide-Body Jets and Business Jets

5.4 Trend

5.4.1 Increasing Demand for Air Freighter Fleet

5.5 Impact Analysis of Drivers and Restraints

6. Aircraft Floor Panel Market – MEA Analysis

6.1 Overview

6.2 MEA Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ million)

6.3 Market Positioning – Players Ranking

7. MEA Aircraft Floor Panel Market Analysis – By Aircraft Type

7.1 Overview

7.1.1 MEA Aircraft Floor Panel Market Breakdown, by Aircraft Type, 2019 & 2027

7.2 Wide body Aircraft

7.2.1 Overview

7.2.2 Wide body Aircraft Market Revenue and Forecast to 2027 (US$ Million)

7.3 Narrow body Aircraft

7.3.1 Overview

7.3.2 Narrow body Aircrafts Market Revenue and Forecast to 2027 (US$ Million)

7.4 General Aviation

7.4.1 Overview

7.4.2 General Aviation Market Revenue and Forecast to 2027 (US$ Million)

8. MEA Aircraft Floor Panel Market Analysis – By Material Type

8.1 Overview

8.2 MEA Aircraft Floor Panel Market Breakdown, by Material Type, 2019 & 2027

8.3 Aluminum Honeycomb

8.3.1 Overview

8.3.2 Aluminum Honeycomb Market Revenue and Forecast to 2027 (US$ Million)

8.4 Nomex Honeycomb

8.4.1 Overview

8.4.2 Nomex Honeycomb Market Revenue and Forecast to 2027 (US$ Million)

9. MEA Aircraft Floor Panel Market Analysis – By Sales Channel

9.1 Overview

9.2 MEA Aircraft floor panel Market Breakdown, by Sales Channel, 2019 & 2027

9.3 OEM

9.3.1 Overview

9.3.2 OEM Market Revenue and Forecast to 2027 (US$ Million)

9.4 Aftermarket

9.4.1 Overview

9.4.2 Aftermarket Market Revenue and Forecast to 2027 (US$ Million)

10. MEA Aircraft Floor Panel Market Analysis – By End User

10.1 Overview

10.2 MEA Aircraft floor panel Market Breakdown, by End User, 2019 & 2027

10.3 Commercial

10.3.1 Overview

10.3.2 Commercial Market Revenue and Forecast to 2027 (US$ Million)

10.4 Military

10.4.1 Overview

10.4.2 Military Market Revenue and Forecast to 2027 (US$ Million)

11. MEA Aircraft Floor Panel Market – Country Analysis

11.1 Overview

11.1.1 MEA: Aircraft Floor Panel Market, by Key Country

11.1.1.1 South Africa: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

11.1.1.1.1 South Africa: Aircraft Floor Panel Market, by Aircraft Type

11.1.1.1.2 South Africa: Aircraft Floor Panel Market, by Material Type

11.1.1.1.3 South Africa: Aircraft Floor Panel Market, by Sales Channel

11.1.1.1.4 South Africa: Aircraft Floor Panel Market, by End User

11.1.1.2 Saudi Arabia: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

11.1.1.2.1 Saudi Arabia: Aircraft Floor Panel Market, by Aircraft Type

11.1.1.2.2 Saudi Arabia: Aircraft Floor Panel Market, by Material Type

11.1.1.2.3 Saudi Arabia: Aircraft Floor Panel Market, by Sales Channel

11.1.1.2.4 Saudi Arabia: Aircraft Floor Panel Market, by End User

11.1.1.3 UAE: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

11.1.1.3.1 UAE: Aircraft Floor Panel Market, by Aircraft Type

11.1.1.3.2 UAE: Aircraft Floor Panel Market, by Material Type

11.1.1.3.3 UAE: Aircraft Floor Panel Market, by Sales Channel

11.1.1.3.4 UAE: Aircraft Floor Panel Market, by End User

11.1.1.4 Rest of MEA: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

11.1.1.4.1 Rest of MEA: Aircraft Floor Panel Market, by Aircraft Type

11.1.1.4.2 Rest of MEA: Aircraft Floor Panel Market, by Material Type

11.1.1.4.3 Rest of MEA: Aircraft Floor Panel Market, by Sales Channel

11.1.1.4.4 Rest of MEA: Aircraft Floor Panel Market, by End User

12. Impact of COVID-19 Outbreak

12.1 MEA: Impact Assessment of COVID-19 Pandemic

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

14. Company Profiles

14.1 Collins Aerospace, a Raytheon Technologies Corporation company

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Aim Altitude UK Ltd.

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Euro Composite S.A.

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Safran S.A

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 The Gill Corporation

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Singapore Technologies Engineering Ltd

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Word Index

LIST OF TABLES

Table 1. MEA Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ million)

Table 2. South Africa: Aircraft Floor Panel Market, by Aircraft Type – Revenue and Forecast to 2027 (US$ Million)

Table 3. South Africa: Aircraft Floor Panel Market, by Material Type – Revenue and Forecast to 2027 (US$ Million)

Table 4. South Africa: Aircraft Floor Panel Market, by Sales Channel – Revenue and Forecast to 2027 (US$ Million)

Table 5. South Africa: Aircraft Floor Panel Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 6. Saudi Arabia: Aircraft Floor Panel Market, by Aircraft Type – Revenue and Forecast to 2027 (US$ Million)

Table 7. Saudi Arabia: Aircraft Floor Panel Market, by Material Type – Revenue and Forecast to 2027 (US$ Million)

Table 8. Saudi Arabia: Aircraft Floor Panel Market, by Sales Channel – Revenue and Forecast to 2027 (US$ Million)

Table 9. Saudi Arabia: Aircraft Floor Panel Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 10. UAE: Aircraft Floor Panel Market, by Aircraft Type – Revenue and Forecast to 2027 (US$ Million)

Table 11. UAE: Aircraft Floor Panel Market, by Material Type – Revenue and Forecast to 2027 (US$ Million)

Table 12. UAE: Aircraft Floor Panel Market, by Sales Channel – Revenue and Forecast to 2027 (US$ Million)

Table 13. UAE: Aircraft Floor Panel Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 14. Rest of MEA: Aircraft Floor Panel Market, by Aircraft Type – Revenue and Forecast to 2027 (US$ Million)

Table 15. Rest of MEA: Aircraft Floor Panel Market, by Material Type – Revenue and Forecast to 2027 (US$ Million)

Table 16. Rest of MEA: Aircraft Floor Panel Market, by Sales Channel – Revenue and Forecast to 2027 (US$ Million)

Table 17. Rest of MEA: Aircraft Floor Panel Market, by End User – Revenue and Forecast to 2027 (US$ Million)

Table 18. List of Abbreviation

LIST OF FIGURES

Figure 1. MEA Aircraft Floor Panel Market Segmentation

Figure 2. MEA Aircraft Floor Panel Market Segmentation – By Country

Figure 3. MEA Aircraft Floor Panel Market Overview

Figure 4. MEA Aircraft Floor Panel Market, by Country

Figure 5. MEA Aircraft Floor Panel Market, By Aircraft Type

Figure 6. MEA Aircraft Floor Panel Market, By Material Type

Figure 7. MEA Aircraft Floor Panel Market, By Sales Channel

Figure 8. MEA Aircraft Floor Panel Market, By End User

Figure 9. Porter’s Five Forces Analysis

Figure 10. Ecosystem Analysis

Figure 11. MEA Aircraft Floor Panel Market: Impact Analysis of Drivers and Restraints

Figure 12. MEA Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ million)

Figure 13. MEA Aircraft Floor Panel Market Breakdown, by Aircraft Type (2019 and 2027)

Figure 14. MEA Wide body Aircraft Market Revenue and Forecast to 2027(US$ Million)

Figure 15. MEA Narrow body Aircrafts Market Revenue and Forecast to 2027(US$ Million)

Figure 16. MEA General Aviation Market Revenue and Forecast to 2027(US$ Million)

Figure 17. MEA Aircraft Floor Panel Market Breakdown, by Material Type (2019 and 2027)

Figure 18. MEA Aluminum Honeycomb Market Revenue and Forecast to 2027(US$ Million)

Figure 19. MEA Nomex Honeycomb Market Revenue and Forecast to 2027(US$ Million)

Figure 20. MEA Aircraft Floor Panel Market Breakdown, by Sales Channel (2019 and 2027)

Figure 21. MEA OEM Market Revenue and Forecast to 2027(US$ Million)

Figure 22. MEA Aftermarket Market Revenue and Forecast to 2027(US$ Million)

Figure 23. MEA Aircraft Floor Panel Market Breakdown, by End User (2019 and 2027)

Figure 24. MEA Commercial Market Revenue and Forecast to 2027(US$ Million)

Figure 25. MEA Military Market Revenue and Forecast to 2027(US$ Million)

Figure 26. MEA: Aircraft Floor Panel Market Revenue Share, by Key Country (2019 and 2027)

Figure 27. South Africa: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

Figure 28. Saudi Arabia: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

Figure 29. UAE: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

Figure 30. Rest of MEA: Aircraft Floor Panel Market – Revenue and Forecast to 2027 (US$ Million)

Figure 31. Impact of COVID-19 Pandemic in MEA Country Markets

Some of the leading companies are:

- Aim Altitude UK Ltd.

- Collins Aerospace, a Raytheon Technologies Corporation company

- Euro Composite S.A.

- Safran S.A

- Singapore Technologies Engineering Ltd

- The Gill Corporation

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the MEA aircraft floor panel market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the MEA aircraft floor panel market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth MEA market trends and outlook coupled with the factors driving the aircraft floor panel market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution