Middle East & Africa Industrial Wood Adhesives Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Resin Type (Natural and Synthetic), and Technology (Solvent-Based, Water-Based, Solventless, and Others)

Market Introduction

The Middle East & Africa industrial wood adhesives market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Construction industry has been witnessing a boost in the number of new residential and commercial building constructions. The rapid development of metropolitan cities is augmenting the demand for commercial construction projects. Commercial buildings include stores, offices, hotels, resorts, schools, gymnasiums, libraries, museums, hospitals, clinics, and others. The design and construction of commercial buildings impact environmental quality and worker productivity. It is considered that attractive and pleasant working places increase the productivity of the employees. Hence, office spaces are highly using wooden materials to impart an aesthetic appearance. Moreover, the expansion of the tourism sector across Middle East & Africa is further contributing to commercial construction activities. Foodservices and lodging are estimated as the top two spending categories by domestic and international travelers. Therefore, the hotels and resorts construction is witnessing tremendous growth across the Middle East & Africa. To gain customer attraction and provide aesthetic beauty, hotels are constructed with wooden floorings, windows, doors, and furniture. Wood has low thermal conductivity; hence even in a cold climate, it will always be warm inside a wooden building. Thus, the rising construction activities, as well as increased utilization of wooden products in the buildings, is augmenting the growth of the Middle East & Africa industrial wood adhesives market.

In case of COVID-19, in Middle East & Africa, especially South America, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of industrial wood adhesives manufacturing activities. Downfall in other chemical and materials manufacturing sectors has subsequently impacted the demand for industrial wood adhesives during the early months of 2020. Moreover, decline in the overall construction and building materials manufacturing activities has led to discontinuation of industrial wood adhesives manufacturing projects, thereby reducing the demand for industrial wood adhesives. Similar trend was witnessed in other Middle East & Africa countries, i.e., UAE and Saudi Arabia. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Get more information on this report :

Market Overview and Dynamics

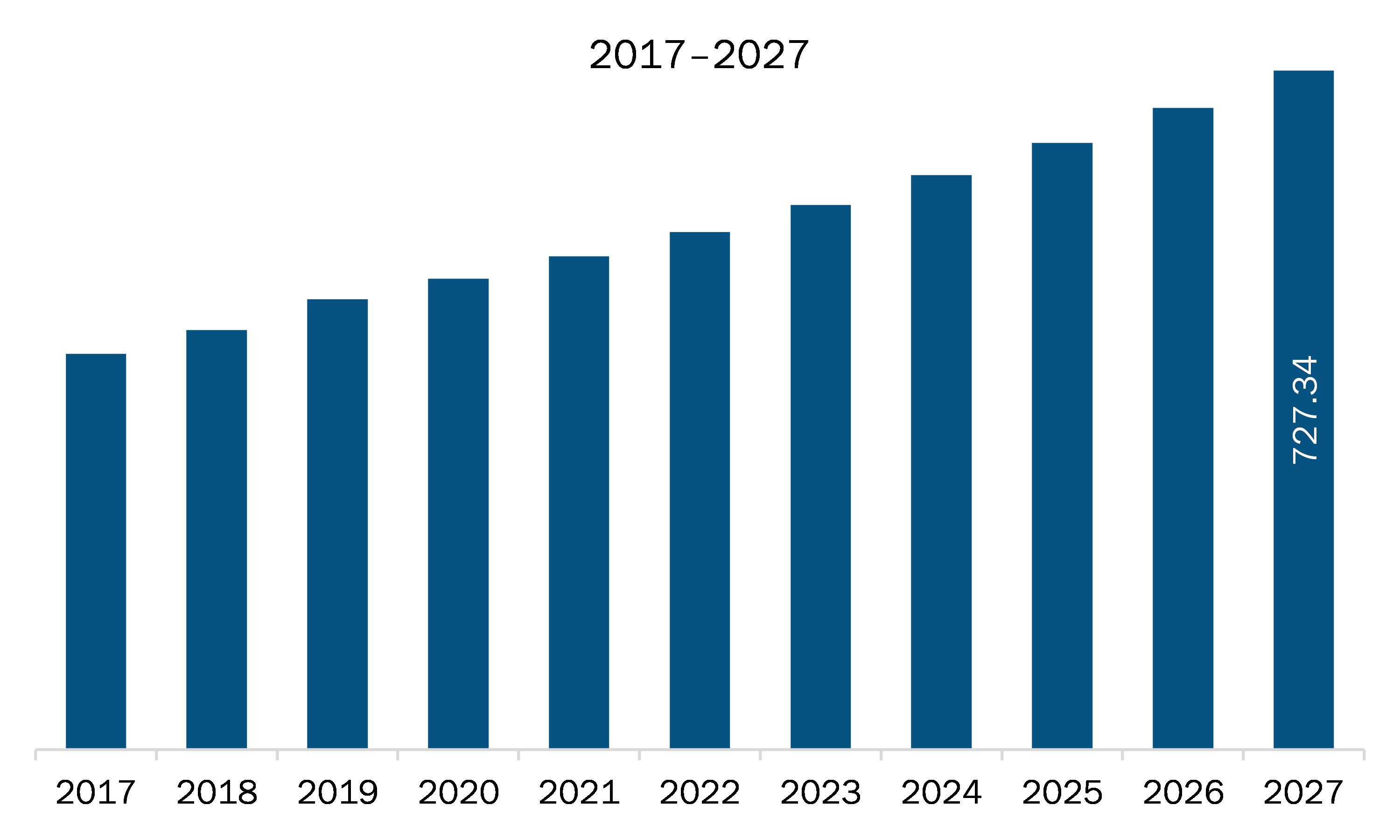

The industrial wood adhesives market in Middle East & Africa is expected to grow from US$ 564.85 million in 2020 to US$ 727.34 million by 2027; it is estimated to grow at a CAGR of 3.7% from 2020 to 2027. There has been a tremendous development in the research and innovation of bio-based adhesives in the engineered wood product industry. Synthetic wood adhesives are majorly derived from depleting petrochemical resources and caused increasing environmental concerns. Bio-based wood adhesives have gained immense momentum in recent years as the customers became aware of the consequences related to the use of petrochemical-derived products. Various biomass resources such as lignin, plant proteins, starch, tannin, bark, and vegetable oils are used as renewable feedstock to synthesize bio-based adhesives. Starch is considered a promising feedstock for the development of bio-adhesives attributed to its accessibility, good adhesion, low cost, easy process, and good film formation properties. Plant protein is another natural resource used to manufacture environmentally friendly wood adhesives. However, it is required to modify the structure of proteins to enhance the water resistance and bonding strength of protein-based adhesives. The National Center for Biotechnology Information estimates that increasing amounts of bio-based adhesives will be employed in the construction of wood composites to decrease the negative environmental impact of current wood adhesives and also to satisfy the societal need of developing sustainable materials and economy. Even though, due to the relatively poor water resistance and bonding strength of the bio-based adhesives, the complete substitution of petroleum-based wood adhesives with bio-based adhesives will be unlikely in the near future. However, technological advancements and R&D aimed at enhancing properties of naturally sourced wood adhesives are intended to create ample growth opportunities for bio-based wood adhesives in the coming years.

Key Market Segments

Based on resin type, the synthetic segment accounted for the largest share of the Middle East & Africa industrial wood adhesives market in 2019. Based on technology, the solvent-based segment held a larger market share of the Middle East & Africa industrial wood adhesives market in 2019. The solvent-based technology is considered to be the root base for any trend line in the development of adhesives. This technology is the oldest in the widest range of chemistries. A solvent-based adhesive is a glue or any adhesion product that is present in the form of a liquid. The solvent-based industrial wood adhesives have been valued through the years as they provide good adhesive properties such as durability along with fast drying conditions. The solvent-based adhesives are produced by blending the adhesive material with a suitable solvent for the creation of adhesive polymer solution. Industrial woods have high amount of resistance which makes it easier to stick them. A solvent-based adhesive is highly suitable to be used for wood due to its strong adhesive qualities. The industrial wood adhesives produced by the employment of this technology, contain an adhesive inside a spreadable or more malleable substance which makes it easier to apply. The solvent-based adhesive covers places where rigid glues would not be able to cover and be effective.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Middle East & Africa industrial wood adhesives market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include H H.B. Fuller Company; Henkel AG & Company KGaA; Ashland; Arkema Group; Sika AG; Pidilite Industries Ltd.; Dow Inc.; 3M, and Akzo Nobel N.V.

Reasons to buy report

- To understand the Middle East & Africa industrial wood adhesives market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for Middle East & Africa industrial wood adhesives market

- Efficiently plan M&A and partnership deals in Middle East & Africa industrial wood adhesives market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form Middle East & Africa industrial wood adhesives market

- Obtain market revenue forecast for market by various segments from 2017-2027 in Middle East & Africa region.

Middle East & Africa Industrial Wood Adhesives Market Segmentation

Middle East & Africa Industrial Wood Adhesives Market -By resin Type

- Natural

- Synthetic

Middle East & Africa Industrial Wood Adhesives Market -By Technology

- Solvent-Based

- Water-Based

- Solventless

- Others

Middle East & Africa Industrial Wood Adhesives Market – By Country

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Middle East & Africa Industrial Wood Adhesives Market – Company Profiles

- H.B.Fuller Company

- Henkel AG & Company KGaA

- Ashland

- Arkema Group

- Sika AG

- Pidilite Industries Ltd.

- Dow Inc.

- 3M

- Akzo Nobel N.V

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Middle East & Africa Industrial Wood Adhesives Market – Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis Formulation:

3.2.4 Macro-Economic Factor Analysis:

3.2.5 Developing Base Number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. Middle East & Africa Industrial Wood Adhesives– Market Landscape

4.1 Overview

4.2 PEST Analysis

4.3 Expert Opinions

5. Middle East & Africa Industrial Wood Adhesives Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Heightening Construction and Infrastructural Activities

5.1.2 Advantages Offered by Wood Adhesives

5.2 Market Restraint

5.2.1 Petroleum or Crude Oil Price Fluctuations

5.3 Future Trends

5.3.1 Rise in the Usage of Bio-Based Wood Adhesives

5.4 Impact Analysis

6. Industrial Wood Adhesives Market – Middle East & Africa Analysis

6.1 Middle East & Africa Industrial Wood Adhesives Market Revenue Forecast and Analysis

7. Middle East & Africa Industrial Wood Adhesives Market Analysis – By Resin Type

7.1 Overview

7.2 Industrial Wood Adhesives Market Revenue Share, by Resin Type (2019 and 2027)

7.3 Natural

7.3.1 Overview

7.3.2 Natural: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

7.4 Synthetic

7.4.1 Overview

7.4.2 Synthetic: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

8. Industrial Wood Adhesives Market Analysis – By Technology

8.1 Overview

8.2 Industrial Wood Adhesives Market Revenue Share, by Technology (2019 and 2027)

8.3 Solvent-Based

8.3.1 Overview

8.3.2 Solvent-Based: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

8.4 Water-Based

8.4.1 Overview

8.4.2 Water-Based: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

8.5 Solventless

8.5.1 Overview

8.5.2 Solventless: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

9. Industrial Wood Adhesives Market – Country Analysis

9.1 Middle East & Africa: Industrial Wood Adhesives Market

9.1.1 Overview

9.1.2 Middle East & Africa: Industrial Wood Adhesives Market Share by Country – 2019 & 2027, (%)

9.1.3 UAE: Industrial Wood Adhesives Market- Revenue and Forecasts to 2027 (US$ Million)

9.1.3.1 UAE: Industrial Wood Adhesives Market- Revenue and Forecasts to 2027 (US$ Million)

9.1.3.2 UAE: Industrial Wood Adhesives Market, by Resin Type, 2017 -2027 (US$ Million)

9.1.3.3 UAE: Industrial Wood Adhesives Market, by Technology, 2017-2027 (US$ Million)

9.1.4 Saudi Arabia: Industrial Wood Adhesives Market- Revenue and Forecasts to 2027 (US$ Million)

9.1.4.1 Saudi Arabia: Industrial Wood Adhesives Market- Revenue and Forecasts to 2027 (US$ Million)

9.1.4.2 Saudi Arabia: Industrial Wood Adhesives Market, by Resin Type, 2017 -2027 (US$ Million)

9.1.4.3 Saudi Arabia: Industrial Wood Adhesives Market, by Technology, 2017-2027 (US$ Million)

9.1.5 South Africa: Industrial Wood Adhesives Market - Revenue and Forecasts to 2027 (US$ Million)

9.1.5.1 South Africa: Industrial Wood Adhesives Market- Revenue and Forecasts to 2027 (US$ Million)

9.1.5.2 South Africa: Industrial Wood Adhesives Market, by Resin Type, 2017 -2027 (US$ Million)

9.1.5.3 South Africa: Industrial Wood Adhesives Market, by Technology, 2017-2027 (US$ Million)

9.1.6 Rest of Middle East and Africa: Industrial Wood Adhesives Market - Revenue and Forecasts to 2027 (US$ Million)

9.1.6.1 Rest of Middle East and Africa: Industrial Wood Adhesives Market- Revenue and Forecasts to 2027 (US$ Million)

9.1.6.2 Rest of Middle East and Africa: Industrial Wood Adhesives Market, by Resin Type, 2018 -2027 (US$ Million)

9.1.6.3 Rest of Middle East and Africa: Industrial Wood Adhesives Market, by Technology, 2018-2027 (US$ Million)

10. Impact of COVID-19 Pandemic on Middle East & Africa Industrial Wood Adhesives Market

10.1 Overview

10.2 Middle East & Africa: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Overview

11.2 Product News

11.3 Merger and Acquisition

12. Company Profiles

12.1 H.B.Fuller Company

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Service

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Henkel AG & Company, KGAA

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.3 Ashland

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.4 Arkema Group

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.5 Sika AG

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.6 Pidilite Industries Ltd.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Dow

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.8 3M

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.9 Akzo Nobel N.V.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. Middle East & Africa Industrial Adhesives Market –Revenue and Forecast to 2027 (US$ Mn)

Table 2. UAE Industrial Wood Adhesives Market, by Resin Type– Revenue and Forecast To 2027 (US$ Million)

Table 3. UAE Industrial Wood Adhesives Market, by Technology – Revenue and Forecast to 2027(US$ Million)

Table 4. Saudi Arabia Industrial Wood Adhesives Market, by Resin Type– Revenue and Forecast To 2027 (US$ Million)

Table 5. Saudi Arabia Industrial Wood Adhesives Market, by Technology – Revenue and Forecast to 2027(US$ Million)

Table 6. South Africa Industrial Wood Adhesives Market, by Resin Type– Revenue and Forecast To 2027 (US$ Million)

Table 7. South Africa Industrial Wood Adhesives Market, by Technology – Revenue and Forecast to 2027(US$ Million)

Table 8. Rest of Middle East and Africa Industrial Wood Adhesives Market, by Resin Type– Revenue And Forecast To 2027 (US$ Million)

Table 9. Rest of Middle East and Africa Industrial Wood Adhesives Market, by Technology – Revenue and Forecast to 2027(US$ Million)

Table 10. Glossary of Terms, Industrial Wood Adhesives Market

LIST OF FIGURES

Figure 1. Industrial Wood Adhesives Market Segmentation

Figure 2. Middle East & Africa Industrial Wood Adhesives Market, By Country

Figure 3. Middle East & Africa Industrial Wood Adhesives Market Overview

Figure 4. Solvent-Based Segment Held Major Share by Technology Segment in Industrial Wood Adhesives Market

Figure 5. UAE to Witness Fastest Growth in the Market During the Forecast Period

Figure 6. Middle East & Africa Industrial Wood Adhesives Market, Industry Landscape

Figure 7. Middle East and Africa - PEST Analysis

Figure 8. Impact Analysis of Drivers and Restraints

Figure 9. Middle East & Africa Industrial Wood Adhesives Market – Revenue Forecast and Analysis – 2017- 2027

Figure 10. Industrial Wood Adhesives Market Revenue Share, by Resin Type (2019 and 2027)

Figure 11. Natural: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

Figure 12. Synthetic: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

Figure 13. Industrial Wood Adhesives Market Share, by Technology (2019 and 2027)

Figure 14. Solvent-Based: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

Figure 15. Water-Based: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

Figure 16. Solventless: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

Figure 17. Others: Industrial Wood Adhesives Market – Revenue and Forecast to 2027 (US$ Million)

Figure 18. Middle East & Africa: Industrial Adhesives Market, by Key Country – Revenue (2019) (USD Million)

Figure 19. Middle East & Africa: Industrial Wood Adhesives Market Share by Country – 2019 & 2027, (%)

Figure 20. UAE: Industrial Wood Adhesives Market- Revenue and Forecasts To 2027 (US$ Million)

Figure 21. Saudi Arabia: Industrial Wood Adhesives Market- Revenue and Forecasts To 2027 (US$ Million)

Figure 22. South Africa: Industrial Wood Adhesives Market- Revenue and Forecasts To 2027 (US$ Million)

Figure 23. Rest of Middle East and Africa: Industrial Wood Adhesives Market- Revenue and Forecasts To 2027 (US$ Million)

Figure 24. Impact of COVID-19 Pandemic in Middle East & African Country Market

- H.B.Fuller Company

- Henkel AG & Company KGaA

- Ashland

- Arkema Group

- Sika AG

- Pidilite Industries Ltd.

- Dow Inc.

- 3M

- Akzo Nobel N.V

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa industrial wood adhesives market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa industrial wood adhesives market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Middle East & Africa industrial wood adhesives market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution