LATAM Fixed-Base Operator Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Service Offered (Hangaring, Fueling, Flight Training, Aircraft Maintenance, and Aircraft Rental) and Application (Business Aviation and Leisure Aviation)

Market Introduction

A fixed-base operator (FBO) is an organization granted the right by an airport to operate at the airport premises and provide various aeronautical services such as hangaring, fueling, tie-down, aircraft rental, aircraft maintenance, and flight instructions. The fixed-base operators provide support services to the general aviation operators. Most fixed-base operators are doing their business at moderate to high-traffic airports. The key drivers for the fixed-base operator market size are development in global airport infrastructures and growth in the business aviation sector.

Owing to the COVID-19 outbreak, LATAM experienced a significant decline in production volumes from the aviation industry. There is a lack of aircraft parking and general aviation (GA) infrastructure throughout the LATAM region. However, with the formation of local flight departments in the region, the fixed-base operator market will strengthen and encourage improvement in infrastructure and general aviation services. Further, the region is experiencing a decline in travel and tourism-related activities, owing to the containment measures imposed by governments, ultimately hindering the adoption of fixed-base operators services. Also, the discontinuation of fixed-base operator projects in Argentina, Colombia, Peru, and Chile, among other Latin American countries, and disruption in the supply chain of the aviation industry in the region are affecting the market growth.

Get more information on this report :

Market Overview and Dynamics

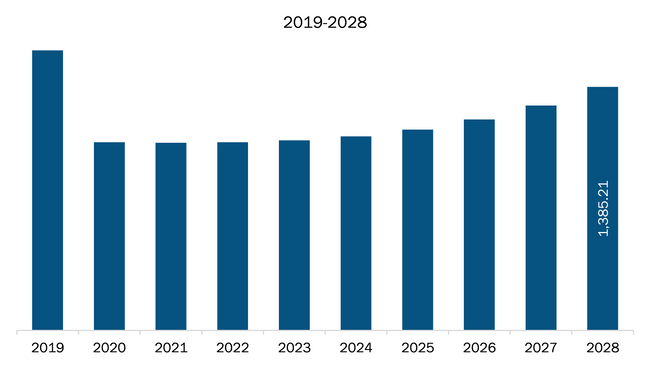

The LATAM fixed-base operator market was valued at US$ 1,067.72 million in 2021 and is projected to reach US$ 1,385.21 million by 2028; it is estimated to register a CAGR of 3.8% from 2021 to 2028.

Mexico is one of the leading countries in the LATAM fixed-base operator market, and it accounts for more than 60% of the fixed-base operator market share. Owing to the low labor cost, many aerospace and aviation players are expected to increase their footprints in this region due to the United States–Mexico–Canada Agreement. Companies that have made expansions in Mexico include LinkedIn, Pinterest, Littler Mendelson P.C., Altimetrik Corp., Eventtia, and ZAG. These factors have increased the business aviation sector across the country. Additionally, the Mexican government is also making high investments in the development of the airport infrastructure across the country. The country focuses on meeting the emerging demand from business class travelers and offering them a better traveling experience with enhanced FBO services. The country houses several international FBO service providers at different locations, with Cancun International Airport being one of the leading airports with a higher number of FBOs. The number of FBOs is expected to grow over the upcoming years as the country is observing steady growth in business and leisure aviation sectors.

Key Market Segments

Based on services offered, the fueling segment dominated the LATAM fixed-base operator market. At airports, the FBOs provide ground handle and fueling services to the commercial airlines operating from the airport. The most important thing that the buyers are looking for is the smaller airfields with a quick response of the FBO, as the purchasing power varies and impacts the margins on each gallon of fuel sold. For instance, Signature Flight Support offers fueling services to corporate and commercial aircraft, by following rules set by airport authorities. The company is engaged in offering, Sustainable Aviation Fuel (SAF) to customers across all its operating airports. The demand for SAF is consistently growing among the aviation companies to reduce carbon footprint, and owing to this, Signature Aviation has strategized to offer SAF. This strategy is expected to boost Signature Aviation’s brand image, customer base, and revenues in the coming years.

The LATAM fixed-base operator market is divided into services offered, application, and geography. Based on services offered, the LATAM fixed-base operator market size is segmented into hangaring, fueling, flight instruction, aircraft maintenance, and aircraft rental. In terms of application, the LATAM fixed-base operator market is segmented into business aviation and leisure aviation. Geographically, the LATAM fixed-base operator market is segmented into Brazil, Argentina, Mexico, and the Rest of LATAM.

Major Sources and Companies Listed

A few major primary and secondary sources referred to while preparing this report on the LATAM fixed-base operator market are company websites, annual reports, financial reports, national government documents, and statistical databases. ICCS; World-Way Aviation; Signature Flight Support; Líder Aviação; South American Jets, LLC; Universal Weather and Aviation, Inc.; Loreto Aviation Services; Jetex; LOBOS HANDLING; and TALMA are among the major companies listed in the LATAM fixed-base operator market report.

Reasons to Buy Report

- To understand the LATAM fixed-base operator market landscape and identify market segments that are most likely to guarantee a strong return

- To stay ahead of the race by comprehending the ever-changing competitive landscape for the market

- To efficiently plan M&A and partnership deals in the market by identifying market segments with the most promising probable sales

- To make business decisions from a perceptive and comprehensive analysis of the performance of various segments in the market

- To obtain LATAM fixed-base operator market size revenue forecast by various segments from 2021–2028

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. LATAM Fixed-Based Operator Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. LATAM Fixed-Base Operator Market –Market Dynamics

5.1 Market Driver

5.1.1 Growth of Business Aviation Sector

5.1.2 Fuelling Services Contribute Significantly to FBO Service Business

5.2 Market Restraint

5.2.1 Staffing Shortages and High Operational Costs

5.3 Market Opportunity

5.3.1 High Potential for FBOs in LATAM Region

5.4 Trends:

5.4.1 Escalating Demand for Hangaring Services for Varied Sized-Aircraft

5.5 Impact Analysis of Drivers and Restraints

6. Fixed-Base Operator Market – LATAM Analysis

6.1 LATAM Fixed-Based Operator Market Overview

6.2 LATAM Fixed-Based Operator Market – Revenue and Forecast to 2028 (US$ Million)

6.3 Market Positioning – Five Key Players

7. LATAM Fixed-Based Operator Market Analysis– By Services Offered

7.1 Overview

7.2 Fixed-Base Operator Market, by Services Offered (2020 and 2028)

7.3 Hangaring

7.3.1 Overview

7.3.2 Hangaring: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Fuelling

7.4.1 Overview

7.4.2 Fuelling: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Flight Instructions

7.5.1 Overview

7.5.2 Flight Instructions: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Aircraft Maintenance

7.6.1 Overview

7.6.2 Aircraft Maintenance: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

7.7 Aircraft Rental

7.7.1 Overview

7.7.2 Aircraft Rental: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

8. LATAM Fixed-Base Operator Market Analysis – By Application

8.1 Overview

8.2 Fixed-Base Operator Market, by Application (2020 and 2028)

8.3 Business Aviation

8.3.1 Overview

8.3.2 Business Aviation: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Leisure Aviation

8.4.1 Overview

8.4.2 Leisure Aviation: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

9. LATAM Fixed-Based Operator Market – Country Analysis

9.1 LATAM: Fixed-Base Operator Market, By Country

9.1.1 Brazil: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1 Brazil: Fixed-Base Operator Market- by Services Offered

9.1.1.2 Brazil: Fixed-Base Operator Market- By Application

9.1.2 Argentina: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.1 Argentina: Fixed-Base Operator Market- by Services Offered

9.1.2.2 Argentina: Fixed-Base Operator Market- By Application

9.1.3 Mexico: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

9.1.3.1 Mexico: Fixed-Base Operator Market- by Services Offered

9.1.3.2 Mexico: Fixed-Base Operator Market- By Application

9.1.4 Rest of LATAM: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.1 Rest of LATAM: Fixed-Base Operator Market- by Services Offered

9.1.4.2 Rest of LATAM: Fixed-Base Operator Market- By Application

10. LATAM Fixed-Base Operator Market- COVID-19 Impact Analysis

10.1 Overview

10.2 LATAM

11. Industry Landscape

11.1 Market Initiatives

12. Company Profiles

12.1 ICCS

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 World-Way Aviation

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Signature Aviation Limited

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Líder Aviação

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 South American Jets, LLC.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Universal Weather and Aviation, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Loreto Aviation Services

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Jetex

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 LOBOS HANDLING

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 TALMA

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. LATAM Fixed-Based Operator Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. Brazil: Fixed-Base Operator Market- by Services Offered –Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil: Fixed-Base Operator Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 4. Argentina: Fixed-Base Operator Market- by Services Offered –Revenue and Forecast to 2028 (US$ Million)

Table 5. Argentina: Fixed-Base Operator Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 6. Mexico: Fixed-Base Operator Market- by Services Offered –Revenue and Forecast to 2028 (US$ Million)

Table 7. Mexico: Fixed-Base Operator Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 8. Rest of LATAM: Fixed-Base Operator Market- by Services Offered–Revenue and Forecast to 2028 (US$ Million)

Table 9. Rest of LATAM: Fixed-Base Operator Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 10. List of Abbreviation

LIST OF FIGURES

Figure 1. LATAM Fixed-Based Operator Market Segmentation

Figure 2. LATAM Fixed-Based Operator Market Segmentation – By Country

Figure 3. LATAM Fixed-Based Operator Market Overview

Figure 4. Fuelling Services held the Largest Share of Market in LATAM

Figure 5. Business Aviation held the Largest Share of Fixed-Base Operator Market in LATAM

Figure 6. Mexico held the Largest Share of Fixed-Base Operator Market in LATAM

Figure 7. Fixed-Base Operator Market – Porter’s Five Forces Analysis

Figure 8. Fixed-Base Operator Market: Ecosystem Analysis

Figure 9. Expert Opinions

Figure 10. Fixed-Base Operator Market Impact Analysis of Drivers and Restraints

Figure 11. LATAM Fixed-Based Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. Fixed-Base Operator Market Revenue Share, by Services Offered (2020 and 2028)

Figure 13. Hangaring: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. Fuelling: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. Flight Instructions: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Aircraft Maintenance: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Aircraft Rental: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Fixed-Base Operator Market Revenue Share, by Application (2020 and 2028)

Figure 19. Business Aviation: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Leisure Aviation: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. LATAM Fixed-Based Operator Market Revenue Share, By Country (2020 and 2028)

Figure 22. Brazil: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Argentina: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Mexico: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Rest of LATAM: Fixed-Base Operator Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Impact of COVID-19 Pandemic in LATAM Country Markets

- ICCS

- World-Way Aviation

- Signature Aviation Limited

- Líder Aviação

- South American Jets, LLC.

- Universal Weather and Aviation, Inc.

- Loreto Aviation Services

- Jetex

- LOBOS HANDLING

- TALMA

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the LATAM fixed-base operator market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the LATAM fixed-base operator market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South America market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution