India Household Insecticides Market to 2027 - Country Analysis and Forecasts by Insect Types (Mosquitoes & Flies, Rats & other Rodents, Termites, Bedbugs & Beetles, Others); Composition (Natural, Synthetic); Packaging (Small, Medium, Large); Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Stores, Others)

The India household insecticides market is accounted to US$ 1,147.5 Mn in 2018 and is expected to grow at a CAGR of 5.4% during the forecast period 2019 - 2027, to account to US$ 1,829.6 Mn by 2027.

Household insecticides are the chemical used to destroy insects from the houses. Insecticides also include the chemicals or substances applied to the surfaces of clothes or houses to control the growth of insects or roaches and to the skin to repel the contact of insects. Household insecticides products are available in different forms, such as gels/creams, aerosols, vaporizers, mats, granules, patches, powdered, and roll-on. The growing emphasis on the control of insect vectors by local and national government bodies has bolstered the growth of the India household insecticides market.

India Household Insecticides Market, Revenue and Forecast, 2018 - 2027

Get more information on this report :

Market Insights

Rising demands from rural markets to boost the household insecticides market

The rising incidences and growing awareness about diseases caused by mosquitoes, flies, cockroaches, rats, and others have created a need for mosquito repellants and insect care products. These products are available in various forms, including lotions, sprays, coils, repellant paints, and repellant pills, and at a lower price, and thus consumers in rural India can afford them. The increasing prevalence of mosquito-borne diseases will bolster the demand for mosquito repellants, consequently fueling the growth of the household insecticide market in the rural region during the forecast period.

New product development provides an opportunity for the household insecticides market growth

Product innovation is the most common market strategy adopted by firms to increase market penetration in rural areas and consumption growth in urban areas. Currently, spray/aerosol insecticides recorded the fastest growth, followed by electric insecticides. Moreover, the use of insecticide coils, which costs less per unit and available in wider options are preferred by low-income Indians. However, Indian companies such as Jyothy Laboratories and Godrej Consumer Products Limited have introduced a range of low priced products such as mosquito repellent cards priced at INR 1 per card mainly to tap the rural consumers. In addition, new players are also investing heavily in R&D activities to develop new and innovative products in order to sustain the competition in the India household insecticides market.

Insect Types Insights

The India household insecticides market by insect types has been categorized in mosquitoes & flies, rats & other rodents, termites, bedbugs & beetles, others. In 2018, the mosquitoes & flies segment accounted for a larger share of the India household insecticides market. Mosquitos and flies are one of the major insects which are perceived to cause diseases. An increase in unhygienic environmental conditions and rapid urbanization are leading to the multiplication of mosquito and flies population. Anopheles and Aedes aegypti species of mosquito-spread several types of diseases such as Malaria, Dengue, Zika, and Chikungunya. Malaria has been a major problem in India for centuries. The rise in populations of insects, along with the growing awareness about insect-borne diseases, is expected to drive the growth of the India household insecticides market.

Composition Insights

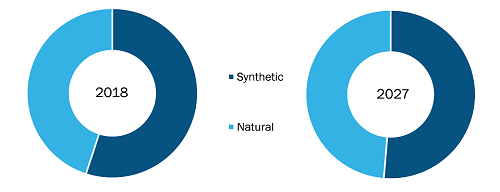

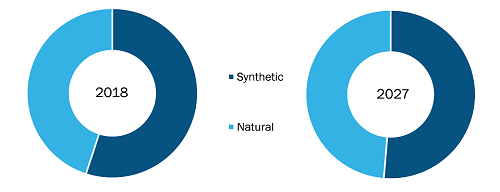

On the basis of composition, the India household insecticides market has been segmented into natural and synthetic. Under the composition segment, synthetic household insecticides are the leading segment in the India household insecticides market. Moreover, the natural household insecticides segment is projected to register for a higher CAGR over the forecast period. Chemicals used in synthetic household insecticides are hazardous for human health. They cause headaches, dizziness, muscular weakness, nausea, and several other health issues. The government of India has also imposed stringent regulations on chemicals that to be used in these products. The rising consumer awareness about the side effects of synthetic household insecticides, coupled with government regulations, has boosted the demand for household insecticides made by natural and organic ingredients. These factors are projected to boost the natural household insecticides market in India.

India Household Insecticides Market by Composition

Get more information on this report :

Strategic Insights

New product development and strategy and business planning strategies were observed as the most adopted strategies in the India household insecticides market. Few of the recent developments in the India household insecticides market are listed below:

2019: Godrej Consumer Products has signed tripartite MOU with the Government of Uttar Pradesh to further its commitment to eliminate malaria in India by 2030.

2019: Godrej Consumer Products unveiled emojis campaign on world malaria day to create awareness of malaria symptoms amongst people

2018: Godrej Consumer Products launches 'Goodknight Naturals Neem Agarbatti.

INDIA HOUSEHOLD INSECTICIDES MARKET SEGMENTATION

By Insect Types

- Mosquitoes & Flies

- Rats & other Rodents

- Termites

- Bedbugs & Beetles

- Others

By Composition

- Natural

- Synthetic

By Packaging

- Small

- Medium

- Large

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Online Stores

- Others

Company Profiles

- Dabur India Ltd

- Godrej Consumer Products Limited

- SC Johnson & Son, Inc.

- Jyothy Laboratories Ltd

- Reckitt Benckiser Group plc.

- Nilgiri Herbals & Agro Industries Pvt. Ltd

- Insecticides India Ltd

- Relaxo Domeswear LLP

- Tainwala Personal Care Products Pvt. Ltd

- HPM Chemicals & Fertilizers Ltd

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 India Household Insecticides Market, by Insect Types

1.3.2 India Household Insecticides Market, by Composition

1.3.3 India Household Insecticides Market, by Packaging

1.3.4 India Household Insecticides Market, by Distribution Channel

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. India Household Insecticides Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 India Pest Analysis

4.3 Expert Opinions

5. India Household Insecticides Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Increased Emphasis On the Control of Insect Vectors by Local and National Government Bodies

5.1.2 Rising demands from rural markets

5.2 Key Market Restraints

5.2.1 Hazardous Health Effects of Synthetic Household Insecticides

5.3 Key Market Opportunity

5.3.1 New Product Development

5.4 Future Trends

5.4.1 Rising acceptance of natural household insecticides

5.5 Impact Analysis of Drivers and Restraints

6. Household Insecticides–Market Analysis

6.1 India Household Insecticides Market Overview

6.2 Household Insecticides Market Forecast and Analysis

6.3 Market Positioning – Key Market Players

7. India Household Insecticides Market Analysis – By Insect types

7.1 Overview

7.2 India Household Insecticides Market Breakdown, By Insect types, 2018 & 2027

7.3 Mosquitoes & Flies

7.3.1 Overview

7.3.2 India Mosquitoes & Flies Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

7.4 Rats & Other Rodents

7.4.1 Overview

7.4.2 India Rats & Other Rodents Household Insecticides Market Revenue Forecasts to 2027 (US$ MN)

7.5 Termites

7.5.1 Overview

7.5.2 India Termites Household insecticides Market Revenue Forecasts to 2027 (US$ MN)

7.6 Bedbugs & Beetles

7.6.1 Overview

7.6.2 India Bedbugs & Beetles Household insecticides Market Revenue Forecasts to 2027 (US$ MN)

7.7 Others

7.7.1 Overview

7.7.2 India Other Insect Types Household insecticides Market Revenue Forecasts to 2027 (US$ MN)

8. India Household Insecticides Market Analysis – By Composition

8.1 Overview

8.2 India Household Insecticides Market Breakdown, by Composition, 2018 & 2027

8.3 Natural

8.3.1 Overview

8.3.2 India Natural Household Insecticides Market Revenue Forecasts to 2027 (US$ Mn)

8.3.3 Citronella Oil

8.3.3.1 Overview

8.3.3.2 India Citronella Oil Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

8.3.4 Geraniol Market

8.3.4.1 Overview

8.3.4.2 India Geraniol Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

8.3.5 Others

8.3.5.1 Overview

8.3.5.2 India Others Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

8.4 Synthetic

8.4.1 Overview

8.4.2 India Synthetic Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

8.4.3 N-Diethyl-Meta-Toluamide (DEET)

8.4.3.1 Overview

8.4.3.2 India N-Diethyl-Meta-Toluamide Household Insecticides Market Revenue Forecasts to 2027 (US$ Mn)

8.4.4 Hydroxyethyl Isobutyl Piperidine Carboxylate (Picaridine) Market

8.4.4.1 Overview

8.4.4.2 India Hydroxyethyl Isobutyl Piperidine Carboxylate Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

8.4.5 Others

8.4.5.1 Overview

8.4.5.2 India Others Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

9. India Household Insecticides Market Analysis – By Packaging

9.1 Overview

9.2 India Household Insecticides Market Breakdown, by Packaging, 2018 & 2027

9.3 Small

9.3.1 Overview

9.3.2 India Small Packaging Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

9.4 Medium

9.4.1 Overview

9.4.2 India Medium Packaging Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

9.5 Large

9.5.1 Overview

9.5.2 India Large Packaging Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

10. Household Insecticides Market Analysis – By Distribution Channel

10.1 Overview

10.2 India Household insecticides Market Breakdown, By Distribution Channel, 2018 & 2027

10.3 Hypermarkets & Supermarkets

10.3.1 India Hypermarkets & Supermarkets Market Revenue Forecasts to 2027 (US$ Mn)

10.4 Convenience Stores

10.4.1 India Convenience Stores Market Revenue Forecasts to 2027 (US$ Mn)

10.5 Online Stores

10.5.1 India Online Stores Market Revenue Forecasts to 2027 (US$ Mn)

10.6 Others

10.6.1 India Others Market Revenue Forecasts to 2027 (US$ Mn)

11. Industry Landscape

11.1 New Development

11.2 Strategy And Business Planning

12. Company Profiles

12.1 Dabur India Ltd.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Godrej Consumer Products Limited

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 SC Johnson & Son, Inc.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.4 Jyothy Laboratories Ltd.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.5 Reckitt Benckiser Group plc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.6 Nilgiri Herbals & Agro Industries Pvt. Ltd.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.7 Insecticides India Ltd.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.8 Relaxo Domeswear LLP

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.9 Tainwala Personal Care Products Pvt. Ltd.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.10 HPM Chemicals & Fertilizers Ltd.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

13. Appendix

13.1 About The Insight Partners

13.2 Glossary

LIST OF TABLES

Table 1. India Household Insecticides Market Revenue Forecast to 2027 (US$ Mn)

Table 2. Glossary of Terms, India Household Insecticides Market

LIST OF FIGURES

Figure 1. India Household Insecticides Market Segmentation

Figure 2. India Household Insecticides Market Overview

Figure 3. Mosquitoes & Flies Held Larger Share of India Household Insecticides Market in 2018

Figure 4. India Household Insecticides Industry Landscape

Figure 5. India – PEST Analysis

Figure 6. Household insecticides Market Impact Analysis Of Driver And Restraints

Figure 7. India Household Insecticides Market Forecast and Analysis, (US$ Mn)

Figure 8. India Household Insecticides Market Breakdown by Insect types, Value, 2018 & 2027 (%)

Figure 9. India Mosquitoes & Flies Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 10. India Rats & Other Rodents Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 11. India Termites Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 12. India Bedbugs & Beetles Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 13. India Other Insect Types Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 14. India Household Insecticides Market Breakdown by Composition, Value, 2018 & 2027 (%)

Figure 15. India Natural Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 16. India Citronella Oil Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 17. India Geraniol Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 18. India Others Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 19. India Synthetic Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 20. India N-Diethyl-Meta-Toluamide Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 21. India Hydroxyethyl Isobutyl Piperidine Carboxylate Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 22. India Others Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 23. India Household Insecticides Market Breakdown by Packaging, Value, 2018 & 2027 (%)

Figure 24. India Small Packaging Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 25. India Medium Packaging Household insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 26. India Large Packaging Household Insecticides Market Revenue Forecasts To 2027 (US$ Mn)

Figure 27. India Household Insecticides Market Breakdown by Distribution Channel, Value, 2018 & 2027 (%)

Figure 28. India Hypermarkets & Supermarkets Market Revenue Forecasts to 2027 (US$ Mn)

Figure 29. India Convenience Stores Market Revenue Forecasts to 2027 (US$ Mn)

Figure 30. India Online stores Market Revenue Forecasts to 2027 (US$ Mn)

Figure 31. India Others Market Revenue Forecasts to 2027 (US$ Mn)

The List of Companies

- Dabur India Ltd.

- Godrej Consumer Products Limited

- SC Johnson & Son, Inc.

- Jyothy Laboratories Ltd.

- Reckitt Benckiser Group plc.

- Nilgiri Herbals & Agro Industries Pvt. Ltd.

- Insecticides India Ltd.

- Relaxo Domeswear LLP

- Tainwala Personal Care Products Pvt. Ltd.

- HPM Chemicals & Fertilizers Ltd.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the India household insecticides market, thereby allowing players to develop effective long term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.