Europe Tax Software Market to 2027 - Regional Analysis and Forecasts By Product (Software, Service); Tax Type (Sales Tax, Income Tax, Corporate Tax, Others); Deployment Type (Cloud, On-premise); End-User (Individual, Commercial Enterprises); Vertical (BFSI, IT& Telecom, Healthcare, Government, Retail, Others)

Market Introduction

Tax software, often known as tax compliance software, is created to assist businesses and individuals in filing income and corporation tax returns. It guarantees that the filing of taxes is streamlined and systematic. This software helps simply the process of submitting income tax returns by guiding the user through forms and automatically calculating the company's or individual's tax liabilities. The software is used to make tax payments and file returns while also reducing human mistakes. The majority of consumer tax software has one of two interfaces: tax software that mimics the layout of various tax documents and forms is known as form-based tax software. It necessitates that the relevant information is entered in the appropriate boxes on the tax paperwork. Tax software based on interviews: the most prevalent sort of tax software is interview-based, and it is usually the easiest to use. Interview-based software uses a question-and-answer structure to streamline the filing process and ensure that the relevant data is in the right places. The tax software is incorporated with other software, such as customer relationship management (CRM), enterprise resource planning (ERP), and reporting applications. Also, the software performs calculations and generates reports. Tax software solutions offer real-time business visibility through its easy to create reports. Wide-ranging tax reporting and analysis across several businesses are increasing swiftly. To manage all the tax-related reports, organizations are embracing tax software. Due to the growing demand for cloud-based technology in various industries, they are widely adopting cloud-based tax software as it mitigates the time to process, and it is also a cost-effective software.

Get more information on this report :

Market Overview and Dynamics

The major stakeholders in the tax software ecosystem comprise hardware providers, service providers, solution providers, network providers, government and regulatory bodies, and end users or verticals. Individuals can file a tax return and make a tax payment remotely owing to the availability of internet and various platforms, such as desktop and smartphone. End users, such as commercial enterprises and individuals, are adopting tax software as it automates tax processes and reduces the manual efforts of computing tax. The software allows registering the information of a taxpayer, and it is then automatically entered into tax returns. It also enables automatic calculation. Various industries use tax software for filing and returns, and they also generate a huge volume of data. In such cases, there is a need for industries to be cautious while transferring tax-related files online. Therefore, tax software vendors provide software with security measures. The data sent by the organizations is encrypted with Secure Socket Layer (SSL) to ensure that the transmitted data is created by the person himself/herself as well as an electronic signature is attached to the data of a tax return. The tax software market operates in a highly fragmented and competitive marketplace. As leading companies in this market continue to broaden their addressable businesses, by expanding current offerings, diversifying client base, all the prominent players face an increasing level of competition, both from start-ups to leading established companies across Europe and globally. Several companies in the value chain are acquiring other players in the market to maintain their position in the market and provide efficient services to their customers. In the current scenario, there are number of key trends prevailing in tax, which would transform the entire tax industry in the future. It includes digitization of tax and compliance, adoption of cloud technologies, development in financial services, and the recovery of SMEs post the COVID-19 pandemic.

Key Market Segments

In terms of tax type, the sales tax segment accounted for the largest share of the Europe tax software market in 2020. In terms of vertical, the retail segment held the largest market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to while preparing the report on the Europe tax software market are company websites, annual reports, financial reports, national government documents, and statistical database. Major companies listed in the report are APEX Analytix; Avalara Inc.; Chetu, Inc.; H & R Block; Intuit Inc.; Sage Group PLC; Thomson Reuters Corporation; Vertex, Inc.; Wolters Kluwer N.V.; Xero Limited; and The Sovos Compliance, LLC.

Reasons to Buy Report

- To understand the Europe tax software market landscape and identify market segments that are most likely to guarantee a strong return

- To stay ahead of the race by comprehending the ever-changing competitive landscape for Europe tax software market

- To efficiently plan M&A and partnership deals in Europe tax software market by identifying market segments with the most promising probable sales

- To make knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment of the Europe tax software market

- To obtain market revenue forecast for market by various segments from 2021–2028 in Europe.

Europe Tax Software Market–Segmentation

Europe Tax Software Market by Type

- Software

- Service

Europe Tax Software Market by Deployment

- On-Premise

- Cloud

Europe Tax Software Market by Tax Type

- Sales Tax

- Income Tax

- Corporate Tax

- Others

Europe Tax Software Market by Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Government

- Retail

- Others

Europe Tax Software Market by Country

- Germany

- France

- Italy

- UK

- Russia

- Rest of Europe

Europe Tax Software Market—Companies Mentioned

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Europe Tax Software Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Europe

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Europe Tax Software Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Digital Transformation Across Various Industries

5.1.2 Growing demand for tax software in retail software

5.2 Market Restraints

5.2.1 Increasing number of cyberattacks

5.3 Market Opportunities

5.3.1 Advent of Blockchain

5.4 Future Trends

5.4.1 Enhancing Business Processes in Various Industries

5.5 Impact Analysis of Drivers and restraints

6. Europe Tax Software Market–Market Analysis

6.1 Tax Software Market Overview

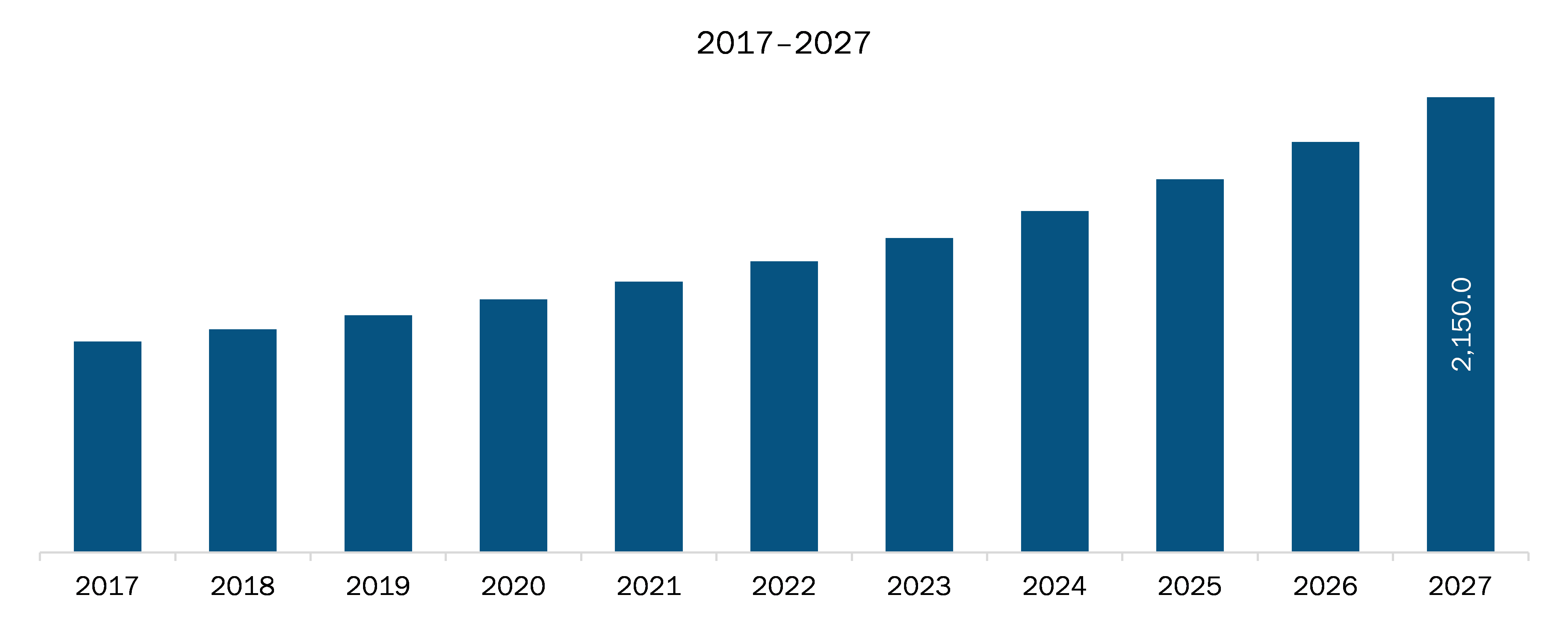

6.2 Europe Tax Software Market –Revenue, and Forecast to 2027 (US$ Million)

7. Europe Tax Software Market Analysis – By Product Type

7.1 Overview

7.2 Tax Software Market Breakdown, by Product Type, 2019 & 2027

7.3 Software

7.3.1 Overview

7.3.2 Software Market Revenue and Forecast to 2027 (US$ Million)

7.4 Service

7.4.1 Overview

7.4.2 Service Market Revenue and Forecast to 2027 (US$ Million)

8. Europe Tax Software Market Analysis – By Deployment Type

8.1 Overview

8.2 Tax Software Market Breakdown, by Deployment Type, 2019 & 2027

8.3 On-Premise

8.3.1 Overview

8.3.2 On-Premise Market Revenue and Forecast to 2027 (US$ Million)

8.4 Cloud

8.4.1 Overview

8.4.2 Cloud Market Revenue and Forecast to 2027 (US$ Million)

9. Europe Tax Software Market Analysis – By Tax Type

9.1 Overview

9.2 Tax Software Market Breakdown, by Tax Type, 2019 & 2027

9.3 Sales Tax

9.3.1 Overview

9.3.2 Sales Tax Market Revenue and Forecast to 2027 (US$ Million)

9.4 Income Tax

9.4.1 Overview

9.4.2 Income Tax Market Revenue and Forecast to 2027 (US$ Million)

9.5 Corporate Tax

9.5.1 Overview

9.5.2 Corporate Tax Market Revenue and Forecast to 2027 (US$ Million)

9.6 Others

9.6.1 Overview

9.6.2 Others Market Revenue and Forecast to 2027 (US$ Million)

10. Europe Tax Software Market Analysis – By End-User

10.1 Overview

10.2 Tax Software Market Breakdown, by End-User, 2019 & 2027

10.3 Individual

10.3.1 Overview

10.3.2 Individual Market Revenue and Forecast to 2027 (US$ Million)

10.4 Commercial Enterprises

10.4.1 Overview

10.4.2 Commercial Enterprises Market Revenue and Forecast to 2027 (US$ Million)

11. Europe Tax Software Market Analysis – By Vertical

11.1 Overview

11.2 Tax Software Market Breakdown, by Vertical, 2019 & 2027

11.3 BFSI

11.3.1 Overview

11.3.2 BFSI Market Revenue and Forecast to 2027 (US$ Million)

11.4 IT and Telecom

11.4.1 Overview

11.4.2 IT and Telecom Market Revenue and Forecast to 2027 (US$ Million)

11.5 Healthcare

11.5.1 Overview

11.5.2 Healthcare Market Revenue and Forecast to 2027 (US$ Million)

11.6 Government

11.6.1 Overview

11.6.2 Government Market Revenue and Forecast to 2027 (US$ Mn)

11.7 Retail

11.7.1 Overview

11.7.2 Retail Market Revenue and Forecast to 2027 (US$ Mn)

11.8 Others

11.8.1 Overview

11.8.2 Others Market Revenue and Forecast to 2027 (US$ Mn)

12. Europe Tax Software Market – Country Analysis

12.1 Europe: Tax Software Market, by Key Country

12.1.1.1 Germany: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

12.1.1.1.1 Germany: Tax Software Market, by Product Type

12.1.1.1.2 Germany: Tax Software Market, by Tax Type

12.1.1.1.3 Germany: Tax Software Market, by Deployment Type

12.1.1.1.4 Germany: Tax Software Market, by End-User

12.1.1.1.5 Germany: Tax Software Market, by Vertical

12.1.1.2 France: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

12.1.1.2.1 France: Tax Software Market, by Product Type

12.1.1.2.2 France: Tax Software Market, by Tax Type

12.1.1.2.3 France: Tax Software Market, by Deployment Type

12.1.1.2.4 France: Tax Software Market, by End-User

12.1.1.2.5 France: Tax Software Market, by Vertical

12.1.1.3 Italy: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

12.1.1.3.1 Italy: Tax Software Market, by Product Type

12.1.1.3.2 Italy: Tax Software Market, by Tax Type

12.1.1.3.3 Italy: Tax Software Market, by Deployment Type

12.1.1.3.4 Italy: Tax Software Market, by End-User

12.1.1.3.5 Italy: Tax Software Market, by Vertical

12.1.1.4 UK: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

12.1.1.4.1 UK: Tax Software Market, by Product Type

12.1.1.4.2 UK: Tax Software Market, by Tax Type

12.1.1.4.3 UK: Tax Software Market, by Deployment Type

12.1.1.4.4 UK: Tax Software Market, by End-User

12.1.1.4.5 UK: Tax Software Market, by Vertical

12.1.1.5 Russia: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

12.1.1.5.1 Russia: Tax Software Market, by Product Type

12.1.1.5.2 Russia: Tax Software Market, by Tax Type

12.1.1.5.3 Russia: Tax Software Market, by Deployment Type

12.1.1.5.4 Russia: Tax Software Market, by End-User

12.1.1.5.5 Russia: Tax Software Market, by Vertical

12.1.1.6 Rest of Europe: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

12.1.1.6.1 Rest of Europe: Tax Software Market, by Product Type

12.1.1.6.2 Rest of Europe: Tax Software Market, by Tax Type

12.1.1.6.3 Rest of Europe: Tax Software Market, by Deployment Type

12.1.1.6.4 Rest of Europe: Tax Software Market, by End-User

12.1.1.6.5 Rest of Europe: Tax Software Market, by Vertical

13. Industry Landscape

13.1 Overview

13.2 Strategy and Business Planning

13.3 Product News

14. Impact of COVID-19 Pandemic On Global Tax Software Market

14.1 North America: Impact assessment of COVID-19 Pandemic

14.2 Europe: Impact assessment of COVID-19 Pandemic

14.3 APAC: Impact assessment of COVID-19 Pandemic

14.4 Middle East & Africa: Impact assessment of COVID-19 Pandemic

14.5 SAM: Impact assessment of COVID-19 Pandemic

15. Company Profiles

15.1 APEX Analytix

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

15.2 Avalara, Inc.

15.2.1 Key Facts

15.2.2 Business Description

15.2.3 Products and Services

15.2.4 Financial Overview

15.2.5 SWOT Analysis

15.2.6 Key Developments

15.3 The Sage Group plc

15.3.1 Key Facts

15.3.2 Business Description

15.3.3 Products and Services

15.3.4 Financial Overview

15.3.5 SWOT Analysis

15.3.6 Key Developments

15.4 Thomson Reuters Corporation

15.4.1 Key Facts

15.4.2 Business Description

15.4.3 Products and Services

15.4.4 Financial Overview

15.4.5 SWOT Analysis

15.4.6 Key Developments

15.5 Vertex, Inc.

15.5.1 Key Facts

15.5.2 Business Description

15.5.3 Products and Services

15.5.4 Financial Overview

15.5.5 SWOT Analysis

15.5.6 Key Developments

15.6 Wolters Kluwer (CCH Incorporated)

15.6.1 Key Facts

15.6.2 Business Description

15.6.3 Products and Services

15.6.4 Financial Overview

15.6.5 SWOT Analysis

15.6.6 Key Developments

15.7 Xero Limited

15.7.1 Key Facts

15.7.2 Business Description

15.7.3 Products and Services

15.7.4 Financial Overview

15.7.5 SWOT Analysis

15.7.6 Key Developments

15.8 Chetu Inc.

15.8.1 Key Facts

15.8.2 Business Description

15.8.3 Products and Services

15.8.4 SWOT Analysis

15.8.5 Key Developments

15.9 H & R Block

15.9.1 Key Facts

15.9.2 Business Description

15.9.3 Products and Services

15.9.4 Financial Overview

15.9.5 SWOT Analysis

15.10 Intuit Inc.

15.10.1 Key Facts

15.10.2 Business Description

15.10.3 Products and Services

15.10.4 Financial Overview

15.10.5 SWOT Analysis

15.10.6 Key Developments

16. Appendix

16.1 About The Insight Partners

16.2 Appendix

LIST OF TABLES

Table 2. Europe: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 3. Europe: Tax Software Market, by Deployment Type– Revenue and Forecast to 2027 (US$ Million)

Table 4. Europe: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 5. Europe: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 6. Europe: Tax Software Market, by Vertical– Revenue and Forecast to 2027 (US$ Million)

Table 7. Germany: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 8. Germany: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 9. Germany: Tax Software Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 10. Germany: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 11. Germany: Tax Software Market, by Vertical – Revenue and Forecast to 2027 (US$ Million)

Table 12. France: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 13. France: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 14. France: Tax Software Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 15. France: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 16. France: Tax Software Market, by Vertical – Revenue and Forecast to 2027 (US$ Million)

Table 17. Italy: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 18. Italy: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 19. Italy: Tax Software Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 20. Italy: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 21. Italy: Tax Software Market, by Vertical – Revenue and Forecast to 2027 (US$ Million)

Table 22. UK: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 23. UK: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 24. UK: Tax Software Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 25. UK: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 26. UK: Tax Software Market, by Vertical – Revenue and Forecast to 2027 (US$ Million)

Table 27. Russia: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 28. Russia: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 29. Russia: Tax Software Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 30. Russia: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 31. Russia: Tax Software Market, by Vertical – Revenue and Forecast to 2027 (US$ Million)

Table 32. Rest of Europe: Tax Software Market, by Product Type – Revenue and Forecast to 2027 (US$ Million)

Table 33. Rest of Europe: Tax Software Market, by Tax Type – Revenue and Forecast to 2027 (US$ Million)

Table 34. Rest of Europe: Tax Software Market, by Deployment Type – Revenue and Forecast to 2027 (US$ Million)

Table 35. Rest of Europe: Tax Software Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 36. Rest of Europe: Tax Software Market, by Vertical – Revenue and Forecast to 2027 (US$ Million)

Table 37. List of Abbreviation

LIST OF FIGURES

Figure 1. Europe Tax Software Market Segmentation

Figure 2. Europe Tax Software Market Segmentation – By Country

Figure 3. Europe Tax Software Market Overview

Figure 4. Software Product Type to Show Remarkable Traction During Forecast Period

Figure 5. Commercial End User to Show Remarkable Traction During Forecast Period

Figure 6. Retail Vertical to Dominate the Tax Software Market

Figure 7. Cloud to Dominate the Tax Software Market

Figure 8. Europe: PEST Analysis

Figure 9. Ecosystem Analysis

Figure 10. Expert Opinion

Figure 11. Europe Tax software Market Impact Analysis of Drivers and Restraints

Figure 13. Europe Tax Software Market Breakdown, by Product Type (2019 and 2027)

Figure 14. Europe Software Market Revenue and Forecast to 2027(US$ Million)

Figure 15. Europe Service Market Revenue and Forecast to 2027(US$ Million)

Figure 16. Europe Tax Software Market Breakdown, by Deployment Type (2019 and 2027)

Figure 17. Europe On-Premise Market Revenue and Forecast to 2027(US$ Million)

Figure 18. Europe Cloud Market Revenue and Forecast to 2027(US$ Million)

Figure 19. Europe Tax Software Market Breakdown, by Tax Type (2019 and 2027)

Figure 20. Europe Sales Tax Market Revenue and Forecast to 2027(US$ Million)

Figure 21. Europe Income Tax Market Revenue and Forecast to 2027(US$ Million)

Figure 22. Europe Corporate Tax Market Revenue and Forecast to 2027(US$ Million)

Figure 23. Europe Others Market Revenue and Forecast to 2027(US$ Million)

Figure 24. Europe Tax Software Market Breakdown, by End-User (2019 and 2027)

Figure 25. Europe Individual Market Revenue and Forecast to 2027(US$ Million)

Figure 26. Europe Commercial Enterprises Market Revenue and Forecast to 2027(US$ Million)

Figure 27. Tax Software Market Breakdown, by Vertical (2019 and 2027)

Figure 28. Europe BFSI Market Revenue and Forecast to 2027(US$ Million)

Figure 29. Europe IT and Telecom Market Revenue and Forecast to 2027(US$ Million)

Figure 30. Europe Healthcare Market Revenue and Forecast to 2027(US$ Million)

Figure 31. Europe Government Market Revenue and Forecast to 2027(US$ Mn)

Figure 32. Europe Retail Market Revenue and Forecast to 2027(US$ Mn)

Figure 33. Europe Others Market Revenue and Forecast to 2027(US$ Mn)

Figure 34. Europe: Tax Software Market Revenue Share, by Key Country (2019 and 2027)

Figure 35. Germany: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

Figure 36. France: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

Figure 37. Italy: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

Figure 38. UK: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

Figure 39. Russia: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

Figure 40. Rest of Europe: Tax Software Market – Revenue and Forecast to 2027 (US$ Million)

Figure 41. Impact of COVID-19 Pandemic In North American Country Markets

Figure 42. Impact of COVID-19 Pandemic in European Country Markets

Figure 43. Impact of COVID-19 Pandemic In APAC Country Markets

Figure 44. Impact of COVID-19 Pandemic in Middle East & African Country Markets

Figure 45. Impact of COVID-19 Pandemic In Sam Country Markets

The List of Companies - Europe Tax Software Market

- Apex Analyticx

- Avalara Inc

- Chetu, Inc

- H & R Block; Intuit Inc.

- Sage Group PLC

- Thomson Reuters Corporation

- Vertex, Inc.

- Wolters Kluwer N.V.

- Xero Limited.

- Intuit Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Europe tax software market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Europe tax software market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution