Europe Synthetic Gypsum Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Type (FGD Gypsum, Flurogypsum, Phosphogypsum, Citrogypsum, and Others), Application (Drywall, Cement, Soil amendment, Dental, Water Treatment, and Others)

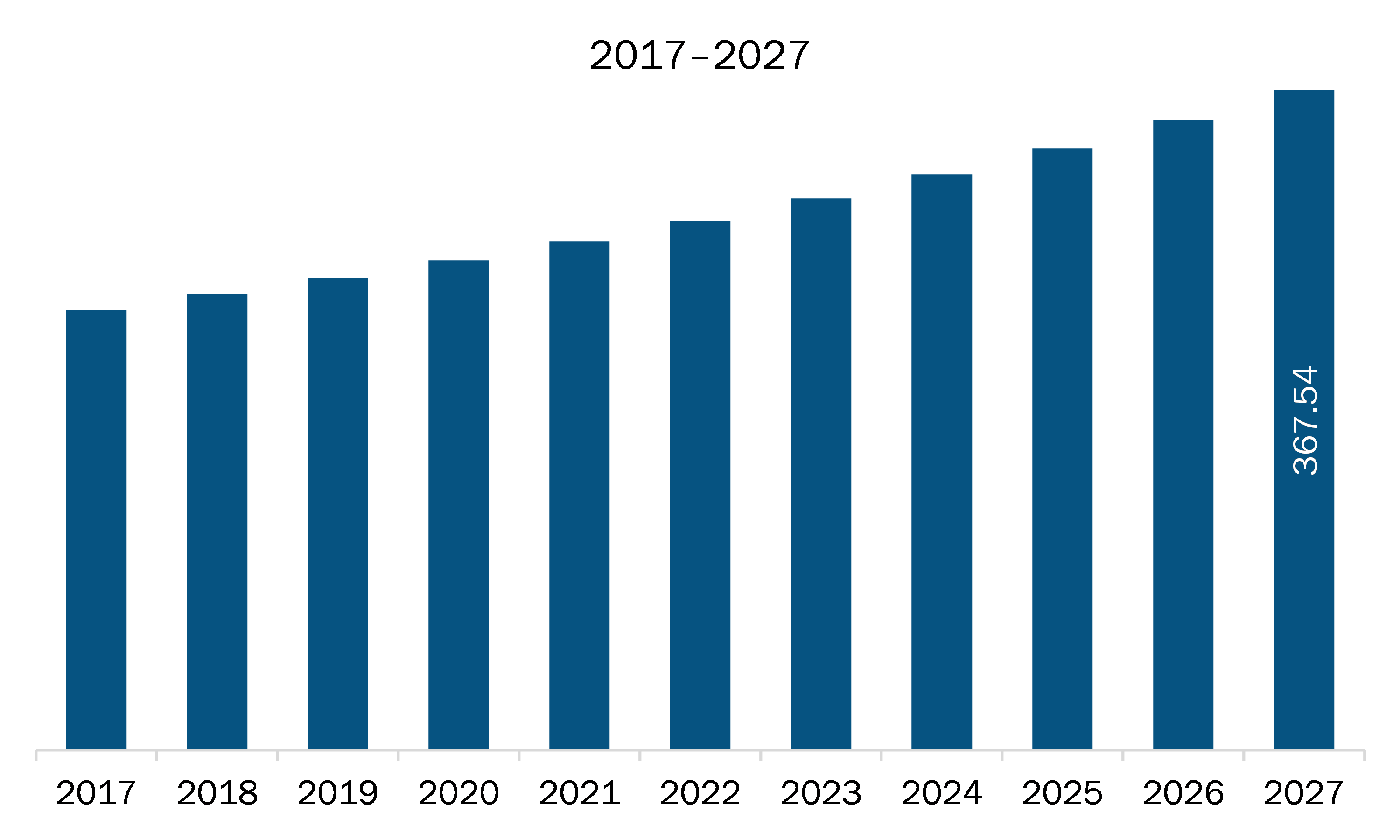

The synthetic gypsum market in Europe is expected to grow from US$ 272.45 million in 2020 to US$ 367.54 million by 2027; it is estimated to grow at a CAGR of 4.4% from 2020 to 2027.

The Europe synthetic gypsum market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Synthetic gypsum is being used increasingly in the agriculture industry as it contains two essential nutrients—calcium and sulfur; thus, it acts as a fertilizer, especially in the treatment of alkaline soil, and improves the crop yield. It is also used as a soil amendment to improve its water retention capacity, permeability, water infiltration, drainage, aeration, and structure, among other physical properties. The synthetic gypsum is also being used in the treatment of alkaline soils. The type FGD gypsum provides other essential micronutrients to the plants, in addition to calcium and sulfur. It can also be used as a soil conditioner for improving the physical and the chemical properties of the soil by providing better aggregation, minimizing subsoil acidity and aluminum toxicity, and lowering the loss of soil and soluble phosphorus from agricultural fields. Thus, the abovementioned benefits have led to the rise in the use of synthetic gypsum in the agricultural industry.

In case of COVID-19, in Europe, especially France, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of synthetic gypsum manufacturing activities. Other chemical and materials manufacturing sector has subsequently impacted the demand for synthetic gypsum during the early months of 2020. Moreover, decline in the overall construction and agricultural materials manufacturing activities has led to discontinuation of synthetic gypsum manufacturing projects, thereby reducing the demand for synthetic gypsum. Similar trend was witnessed in other European countries, i.e., Russia, UK, Italy, Germany and Spain. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Get more information on this report :

Market Overview and Dynamics

The companies which are manufacturing synthetic gypsums are always looking to innovate the products provided by them. The increase in the environmental awareness, concerns and the cost of raw materials has increased the efficient usage of natural reserves. Synthetic gypsum is one of the by-products wastes which is produced from the flue gas desulphurization (FGD) process in order to avoid industrial stack emission of SO2. The adsorption of SO2 through caustic lime produces a final product which is known as synthetic gypsum. Polyethylene is one of the most post-consumer plastics in the world and could be used instead of virgin polyethylene. Nowadays, recycled post-consumer plastics are used as binder and FGD waste was used as filler material for the aluminum composite panels in order to be environmentally friendly. The combination of recycled polyethylene and FGD gypsum are used as filler material for sandwich polymer-metal panels is due to economically and environmental concerns.

Key Market Segments

Based on type, the FGD gypsum segment accounted for the largest share of the Europe synthetic gypsum market in 2019. Based on application, the drywall segment held a larger market share of the Europe synthetic gypsum market in 2019. Drywall is one of the most common form of finish wall sheathing. The drywall is basically made up of gypsum plaster which has been stuck between two thick layers of paper and provides a smooth finish to the wall. Synthetic gypsum was used by the manufacturing companies in order to save the cost, as well as because of the environmental benefits of the by-product. Natural gypsum is mostly obtained from the gypsum mines, whereas the synthetic gypsum will help the companies to save the limited resource as well as help them save energy by constructing a production plant beside a synthetic gypsum producing power plant. The different types of synthetic gypsum that are suitable for the manufacturing of the drywall includes flue gas desulfurization gypsum, citrogypsum, flurorgypsum and titanogypsum.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Europe synthetic gypsum market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Drax Group Plc, USG Corporation, Larargeholcim Ltd., Knauf Gips KG, BauMineral GmbH, and Steag GmbH.

Reasons to buy report

- To understand the Europe synthetic gypsum market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for Europe synthetic gypsum market

- Efficiently plan M&A and partnership deals in Europe synthetic gypsum market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form Europe synthetic gypsum market

- Obtain market revenue forecast for market by various segments from 2017-2027 in Europe region.

Europe Synthetic Gypsum Market Segmentation

Europe Synthetic Gypsum Market -By Type

- FGD Gypsum

- Fluorogypsum

- Phosphogypsum

- Citrogypusm

- Others

Europe Synthetic Gypsum Market -By Application

- Drywall

- Soil Amendment

- Cement

- Dental

- Water Treatment

- Others

Europe Synthetic Gypsum Market – By Country

- Germany

- France

- Italy

- Russia

- UK

- Rest of Europe

Europe Synthetic Gypsum Market – Company Profiles

- Drax Group Plc

- USG Corporation

- BauMineral GmbH

- Larargeholcim Ltd.

- Knauf Gips KG

- Steag GmbH

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. Europe Synthetic gypsum Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.3 Expert Opinion

5. Europe Synthetic Gypsum Market – Key Market Dynamics

5.1 Drivers

5.1.1 Incrementing Demand from the Construction Industry

5.1.2 Rising Application in the Agriculture Industry

5.2 Restraints

5.2.1 Industrial Shift from Coal to Natural Gas

5.3 Opportunities

5.3.1 Escalating Demand in Europe

5.4 Future Trend

5.4.1 Innovations in Environment-Friendly Technologies

5.5 Impact Analysis of Drivers and Restraints

6. Synthetic gypsum – Europe Market Analysis

6.1 Synthetic gypsum Market Overview

6.2 Synthetic Gypsum Market –Revenue and Forecast to 2027 (US$ Million)

7. Europe Synthetic Gypsum Market Analysis – By Type

7.1 Overview

7.2 Europe Synthetic Gypsum Market Breakdown, By Type, 2019 & 2027

7.3 FGD Gypsum

7.3.1 Overview

7.3.2 FGD Gypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

7.4 Fluorogypsum

7.4.1 Overview

7.4.2 Fluorogypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

7.5 Phosphogypsum

7.5.1 Overview

7.5.2 Phosphogypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

7.6 Citrogypsum

7.6.1 Overview

7.6.2 Citrogypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

7.7 Others

7.7.1 Overview

7.7.2 Others: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

8. Europe Synthetic Gypsum Market Analysis – By Applications

8.1 Overview

8.2 Synthetic Gypsum Market Breakdown, By Application, 2019 & 2027

8.3 Drywall

8.3.1 Overview

8.3.2 Drywall: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

8.4 Soil Amendment

8.4.1 Overview

8.4.2 Soil Amendment: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

8.5 Cement

8.5.1 Overview

8.5.2 Cement: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

8.6 Dental

8.6.1 Overview

8.6.2 Dental: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

8.7 Water Treatment

8.7.1 Overview

8.7.2 Water Treatment: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

8.8 Others

8.8.1 Overview

8.8.2 Others: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

9. Europe Synthetic Gypsum Market – Country Analysis

9.1 Overview

9.1.1 Europe: Synthetic gypsum market, by Key Country

9.1.1.1 Germany: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

9.1.1.1.1 Germany: Synthetic gypsum market, Type

9.1.1.1.2 Germany: Synthetic gypsum market, Application

9.1.1.2 France: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

9.1.1.2.1 France: Synthetic gypsum market, Type

9.1.1.2.2 France: Synthetic gypsum market, Application

9.1.1.3 Italy: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

9.1.1.3.1 Italy: Synthetic gypsum market, Type

9.1.1.3.2 Italy: Synthetic gypsum market, Application

9.1.1.4 UK: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

9.1.1.4.1 UK: Synthetic gypsum market, Type

9.1.1.4.2 UK: Synthetic gypsum market, Application

9.1.1.5 Russia: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

9.1.1.5.1 Russia: Synthetic gypsum market, Type

9.1.1.5.2 Russia: Synthetic gypsum market, Application

9.1.1.6 Rest of Europe: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

9.1.1.6.1 Rest of Europe: Synthetic gypsum market, Type

9.1.1.6.2 Rest of Europe: Synthetic gypsum market, Application

10. Overview- Impact of COVID-19 ON Europe Synthetic Gypsum Market

10.1 Europe: Impact Assessment of COVID-19 Pandemic

11. Company Profiles

11.1 USG Corporation

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Lafargeholcim Ltd.

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.3 Knauf Gips KG

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.4 BauMineral GmbH

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.5 Steag GmbH

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.6 Drax Group PLC

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. Europe: Synthetic gypsum Market –Revenue and Forecast to 2027 (US$ Million)

Table 2. Germany Synthetic Gypsum Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 3. Germany Synthetic Gypsum Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 4. France Synthetic Gypsum Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 5. France Synthetic Gypsum Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 6. Italy Synthetic Gypsum Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 7. Italy Synthetic Gypsum Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 8. UK Synthetic Gypsum Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 9. UK Synthetic Gypsum Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 10. Russia Synthetic Gypsum Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 11. Russia Synthetic Gypsum Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 12. Rest of Europe Synthetic Gypsum Market, by Type – Revenue and Forecast to 2027 (USD Million)

Table 13. Rest of Europe Synthetic Gypsum Market, by Application – Revenue and Forecast to 2027 (USD Million)

Table 14. List of Abbreviation

LIST OF FIGURES

Figure 1. Synthetic Gypsum Market Segmentation

Figure 2. Europe Synthetic Gypsum Market Segmentation – By Country

Figure 3. Europe Synthetic Gypsum Market Overview

Figure 4. FGD Segment Held Largest Share of Europe Synthetic gypsum Market

Figure 5. Rest of Europe is Expected to Show Remarkable Traction During the Forecast Period

Figure 6. Europe Synthetic Gypsum Market, Industry Landscape

Figure 7. Europe – PEST Analysis

Figure 8. Expert Opinion

Figure 9. Synthetic Gypsum Market Impact Analysis of Drivers and Restraints

Figure 10. Europe: Synthetic gypsum Market – Revenue and Forecast to 2027 (US$ Million)

Figure 11. Europe Synthetic Gypsum Market Breakdown, By Type, 2019 & 2027

Figure 12. FGD Gypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 13. Fluorogypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 14. Phosphogypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 15. Citrogypsum: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 16. Others: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 17. Synthetic gypsum Market Breakdown, By Application, 2019 & 2027 (%)

Figure 18. Drywall: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 19. Soil Amendment: Synthetic Gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 20. Cement: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 21. Dental: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 22. Water Treatment: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 23. Others: Synthetic gypsum Market – Revenue, and Forecast to 2027 (US$ Million)

Figure 24. Europe: Synthetic Gypsum Market, by Key Country – Revenue (2019) (USD Million)

Figure 25. Europe: Synthetic gypsum market Revenue Share, by Key Country (2019 and 2027)

Figure 26. Germany: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

Figure 27. France: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

Figure 28. Italy: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

Figure 29. UK: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

Figure 30. Russia: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

Figure 31. Rest of Europe: Synthetic gypsum market –Revenue and Forecast to 2027 (US$ Mn)

Figure 32. Impact of COVID-19 Pandemic in Europe Country Markets

- Drax Group Plc

- USG Corporation

- BauMineral GmbH

- Larargeholcim Ltd.

- Knauf Gips KG

- Steag GmbH

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe synthetic gypsum market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Europe synthetic gypsum market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe synthetic gypsum market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution