Europe Surety Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Bond Type (Contract Surety Bond, Commercial Surety Bond, Court Surety Bond, and Fidelity Surety Bond); and Country

Market Introduction

The surety market in European region is posed to surge over the years, owing to the fact that, several countries are showcasing promising outlook towards surety bonds. Italy and Germany has acquired the major market share. A recent trend in the European market is the growing cooperation between banks and Surety companies to develop distribution and to offer cover for risks. Such cooperation is anticipated to develop prosperous opportunities for the Surety market players. Although, Surety market in the European region is propelled by banks, capital regulations are driving them to share some of their uncertainties with Surety companies. This enables banks to mitigate their risks and achieve more cost-effective portfolio management.

Get more information on this report :

Market Overview and Dynamics

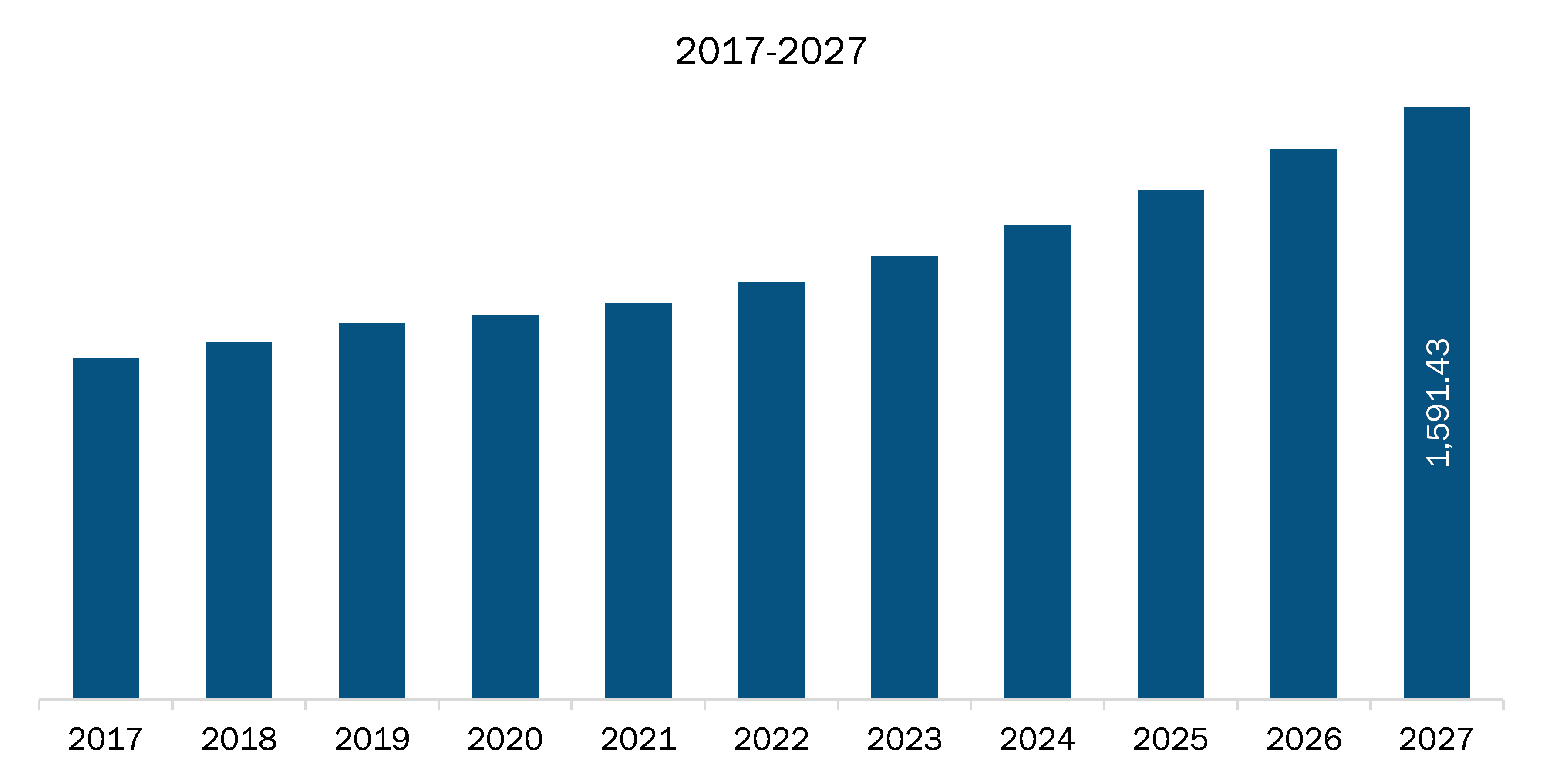

The Europe surety market was valued at US$ 3,608.38 million in 2019 and is projected to reach US$ 5398.33 million by 2027; it is expected to grow at a CAGR of 5.8% from 2020 to 2027. The European region is showcasing tremendous advancements in urbanization in the recent years. The UK, Malta, and the Netherlands have the highest population density living in urban areas. Fast population growth is one of the main reasons for urbanization. With an objective to offer majority of the benefits to live in an urban areas, the governments of the above mentioned countries are investing substantial amounts towards the development respective country’s infrastructure. This is leading to continuous construction of residential and commercial infrastructures. The increase in construction activities in the countries is boosting the surety market, since the contract awarding authorities in the countries demand guarantee for completion of defined task in the stipulated time period.

Key Market Segments

In terms of bond type, the contract surety bond segment accounted for a largest share of the Europe surety market in 2019. Commercial surety bond segment held the second largest share in the market, based on type, in 2019. The court surety bond segment is anticipated to surge at a prime rate during the forecast period from 2020 to 2027.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the surety market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. The major companies listed in the Europe surety market report are CNA Financial Corporation, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Chubb, among others.

Reasons to buy report

- It provides understanding of the Europe surety market landscape and identifies market segments that are most likely to guarantee a strong return.

- It guides stay ahead of the race by comprehending the ever-changing competitive landscape for the Europe surety market.

- It helps efficiently plan merger and acquisition, and partnership deals in the Europe surety market by identifying market segments with the most promising probable sales

- It facilitates knowledgeable business decision-making through perceptive and comprehensive analysis of market performance of various segments pertaining to the Europe surety market.

- It provides market revenue forecast of the market based on various segments for the period from 2020 to 2027.

EUROPE SURETY MARKET SEGMENTATION

Europe Surety Market, by Bond Type

- Contract Surety Bond

- Commercial Surety Bond

- Court Surety Bond

- Fidelity Surety Bond

Europe Surety Market, by Country

- Germany

- France

- Italy

- UK

- Spain

- Rest of Europe

Company Profiles

- CNA Financial Corporation

- The Travelers Indemnity Company

- Liberty Mutual Insurance Company

- Chubb

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Surety Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Europe – PEST Analysis

5. Surety Market – Key Market Dynamics

5.1 KEY MARKET DRIVERS

5.1.1 Ageing Infrastructure in European Economies Creating a need for Massive Investments in its Restoration

5.1.2 Global Acceptance of Public Private Partnership Model Anticipated to Drive the Surety Market Growth

5.2 Market Restraints

5.2.1 Shortage of properly trained underwriter in the Surety Industry

5.3 Key Market Opportunities

5.3.1 Continuous Urbanization is Stimulating the Market Growth

5.4 Future Trends

5.4.1 Adoption of Surety Bond by Diverse End-use Industries

5.5 Impact Analysis of Drivers and Restraints

6. Surety Market – Europe Analysis

6.1 Surety Market Europe Overview

6.2 Surety Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning – Five Key Players

7. Surety Market Analysis – By Bond Type

7.1 Overview

7.2 Surety Market Breakdown, by Bond Type, 2019 & 2027

7.3 Contract Surety Bond

7.3.1 Overview

7.3.2 Contract Surety Bond Market Forecasts and Analysis

7.4 Commercial Surety Bond

7.4.1 Overview

7.4.2 Commercial Surety Bond Market Forecasts and Analysis

7.5 Fidelity Surety Bond

7.5.1 Overview

7.5.2 Fidelity Surety Bond Market Forecasts and Analysis

7.6 Court Surety Bond

7.6.1 Overview

7.6.2 Court Surety Bond Market Forecasts and Analysis

8. Surety Market – By Country

8.1 Overview

8.2 Surety Market, By Country (2019 and 2027)

8.2.1 Europe: Surety Market, by Key Country

8.2.1.1 UK Surety Market Revenue and Forecasts to 2027 (US$ Million)

8.2.1.1.1 UK Surety Market, by Bond Type

8.2.1.2 Germany Surety Market Revenue and Forecast to 2027 (US$ Million)

8.2.1.2.1 Germany Surety Market, by Bond Type

8.2.1.3 France Surety Market Revenue and Forecast to 2027 (US$ Million)

8.2.1.3.1 France Surety Market, by Bond Type

8.2.1.4 Spain Surety Market Revenue and Forecast to 2027 (US$ Million)

8.2.1.4.1 Spain Surety Market, by Bond Type

8.2.1.5 Italy Surety Market Revenue and Forecast to 2027 (US$ Million)

8.2.1.5.1 Italy Surety Market, by Bond Type

8.2.1.6 Rest of Europe Surety Market Revenue and Forecast to 2027 (US$ Million)

8.2.1.6.1 Rest of Europe Surety Market, by Bond Type

9. Impact of COVID-19 Pandemic Outbreak

9.1 Europe: Impact Assessment of COVID-19 Pandemic

10. Industry Landscape

10.1 Market Initiative

11. Company Profiles

11.1 CNA FINANCIAL CORPORATION

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Financial Overview

11.1.4 SWOT Analysis

11.1.5 Key Developments

11.2 THE TRAVELERS INDEMNITY COMPANY

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Financial Overview

11.2.4 SWOT Analysis

11.2.5 Key Developments

11.3 LIBERTY MUTUAL INSURANCE COMPANY

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Financial Overview

11.3.4 SWOT Analysis

11.3.5 Key Developments

11.4 CHUBB

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Financial Overview

11.4.4 SWOT Analysis

11.4.5 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. SURETY MARKET – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 2. EUROPE: SURETY MARKET, BY COUNTRY – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 3. UK SURETY MARKET, BY BOND TYPE – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 4. GERMANY SURETY MARKET, BY BOND TYPE – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 5. FRANCE SURETY MARKET, BY BOND TYPE – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 6. SPAIN SURETY MARKET, BY BOND TYPE – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 7. ITALY SURETY MARKET, BY BOND TYPE – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 8. REST OF EUROPE SURETY MARKET, BY BOND TYPE – REVENUE AND FORECAST TO 2027 (US$ MILLION)

Table 9. LIST OF ABBREVIATION

LIST OF FIGURES

Figure 1. EUROPE SURETY MARKET SEGMENTATION AND COUNTRIES

Figure 2. EUROPE SURETY MARKET OVERVIEW

Figure 3. CONTRACT SECURITY BOND SEGMENT HELD THE LARGEST MARKET SHARE

Figure 4. EUROPE – PEST ANALYSIS

Figure 5. SURETY MARKET IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

Figure 6. GEOGRAPHIC OVERVIEW OF EUROPE SURETY MARKET

Figure 7. Surety Market – Revenue and Forecast to 2027 (US$ Million)

Figure 8. SURETY MARKET BREAKDOWN, BY BOND TYPE (2019 AND 2027)

Figure 9. CONTRACT SURETY BOND MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 10. COMMERCIAL SURETY BOND MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 11. FIDELITY SURETY BOND MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 12. COURT SURETY BOND MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 13. EUROPE: SURETY MARKET REVENUE SHARE, BY KEY COUNTRY (2019 AND 2027)

Figure 14. UK SURETY MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 15. GERMANY SURETY MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 16. FRANCE SURETY MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 17. SPAIN SURETY MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 18. ITALY SURETY MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 19. REST OF EUROPE SURETY MARKET REVENUE AND FORECASTS TO 2027 (US$ MILLION)

Figure 20. Impact of COVID-19 Pandemic in Europe Country Markets

- CNA Financial Company

- The Travelers Indemnity Company

- Liberty Mutual Insurance Company

- Chubb

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Europe surety market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Europe surety market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution