Europe Private LTE Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Solution and Services), Type (FDD and TDD), and End user (Manufacturing, Energy & Utilities, Healthcare, Transportation, Mining, and Others)

Market Introduction

The countries in the European Union (EU) comprises of several key manufacturing industries, such as automotive, aerospace, machinery & equipment, military vehicles, shipbuilding, and others. The automotive industry in these countries is ominously contributing to the country’s GDP. Europe is the prominent producer of motor vehicles, as well as home for several premium automotive manufacturers in the region. 5G wireless networks are on the horizon, and IoT is gaining importance as devices are predicted to form a foremost portion of this 5G network concept. The European market consists of Germany, France, Italy, the UK, Russia, and the rest of Europe. Megacities in Germany, the UK, and France are observed to be the nodes of the growth of 5G and IoT, which are boosting the implementation of these technologies in other developing cities across Europe, includes several cities in Russia. The primary use cases for 5G technology enhances the Fixed Wireless Access (FWA), private LTE, and mobile broadband, though this would vary from market to market. Also, inflated demand for reliable and efficient communications network infrastructure sector is the major factor driving the growth of the Europe private LTE market.

Spain, Italy, Germany, UK, and France are some of the worst affected member states in the European region due to the COVID-19 outbreak. Russia, Germany, Turkey, and the UK are some of the countries with millions of internet users and mobile subscribers. European countries represent a major market for private LTE demand. The Western European countries has witnessed high demand of LTE due to established IT infrastructure. The maturity of IT infrastructure is mainly ascribed to high awareness related to the advanced technologies, strong internet infrastructure, and capital investment capability among companies in the region. As the region houses presence of well-established healthcare and manufacturing industries, the demand for reliable internet connectivity from same industries has increased during COVID-19 spread to keep business activities uninterrupted. The factor of growing demand for reliable connection would gradually catalyze the private LTE demand in Europe amid the COVID-19 pandemic.

Get more information on this report :

Market Overview and Dynamics

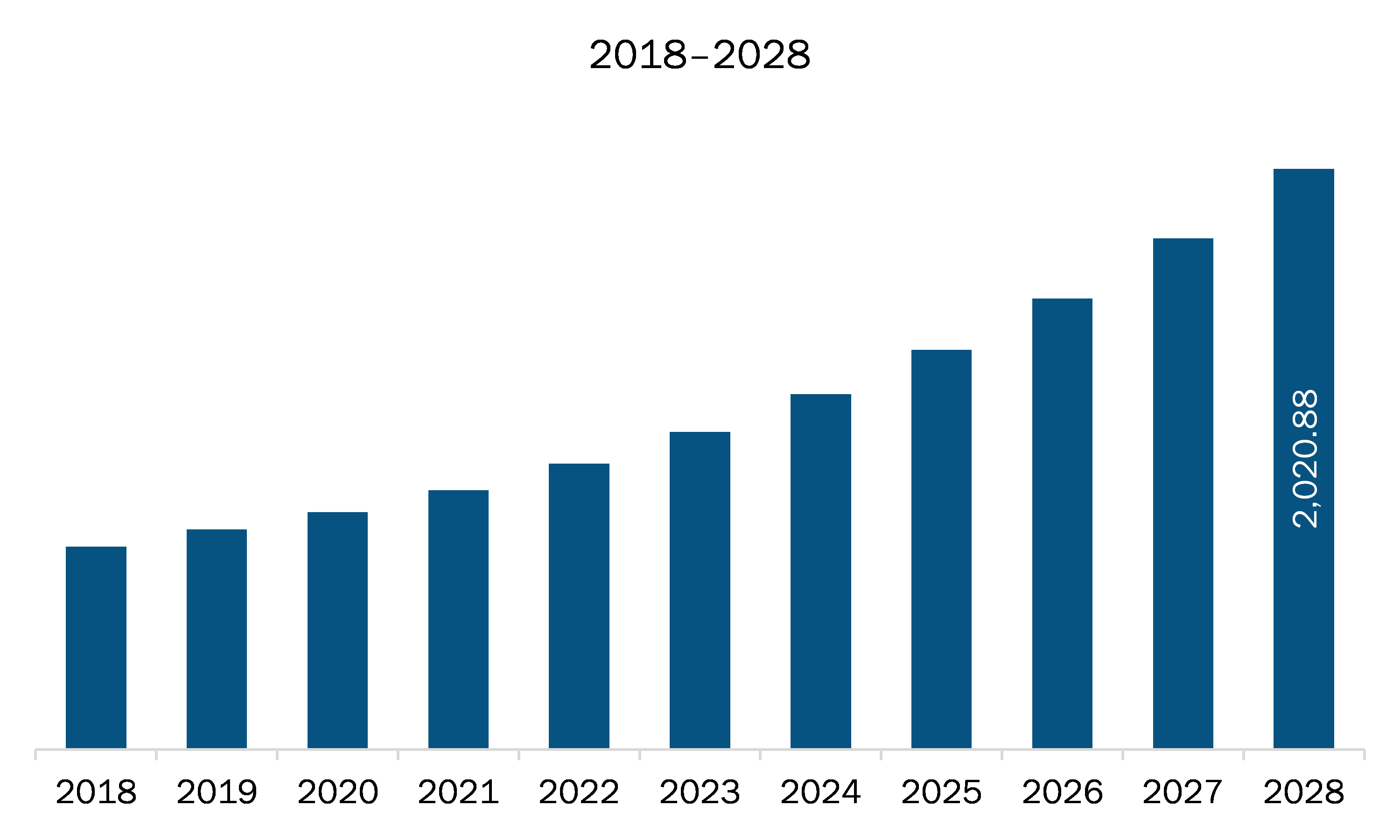

The private LTE market in Europe, is expected to reach US$ 2,020.88 million by 2028 from US$ 902.06 million in 2021. The market is estimated to grow at a CAGR of 12.2% from 2021 to 2028. The advent of private LTE has brought a host of new use cases for industrial and residential uses that are anticipated to be enabled by the evolving networks over the course of years. Fixed Wireless Access (FWA) for residential use and distributed cloud for industries could be examples of these kind. A market competing with fixed broadband access is driving a need for higher bandwidth. The objective is to provide fiber-like speeds that can meet the demand for residential streaming services, such as TV and video. Typical data speed demand ranges from 100 to 4,000 Mbps. However, there is a limited business case to provide fixed broadband alternatives. Typical data speed demand ranges from 50 to 200 Mbps. A market where there are virtually no existing fixed broadband alternatives, and where the dominant way of accessing the internet is through mobile networks on a smartphone.

Key Market Segments

The Europe private LTE market is segmented into component, type, end user, and country. Based on component, the market is segmented into solution and services. The services segment dominated the market in the year 2020 and is also expected to be the fastest growing during forecast period. Based on type, the market is segmented into FDD and TDD. The FDD segment dominated the market in year 2020 and TDD segment is expected to be the fastest growing during the forecast period. Based on end user, the market is segmented into manufacturing, energy & utilities, healthcare, transportation, mining, and others. The manufacturing segment dominated the market in year 2020 and transportation segment is expected to be the fastest growing during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the private LTE market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cisco Systems, Inc, Telefonaktiebolaget LM Ericsson; Huawei Technologies Co., Ltd.; Samsung Group; VERIZON COMMUNICATIONS INC.; CommScope Inc.; NetNumber, Inc.; Star Solutions; and Sierra Wireless, Inc. among others.

Reasons to buy report

- To understand the Europe private LTE market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for Europe private LTE market

- Efficiently plan M&A and partnership deals in Europe private LTE market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form Europe private LTE market

- Obtain market revenue forecast for market by various segments from 2021-2028 in Europe region.

EUROPE PRIVATE LTE MARKET SEGMENTATION

Europe Private LTE Market -By Component

- Solution

- Services

- Professional Services

- Managed Services

Europe Private LTE Market -By Type

- FDD

- TDD

Europe Private LTE Market -By End User

- Manufacturing

- Energy & Utilities

- Healthcare

- Transportation

- Mining

- Others

Europe Private LTE Market -By Country

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

Europe Private LTE Market -Company Profiles

- Cisco Systems, Inc

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Samsung Group

- Verizon Communications, Inc.

- CommScope Inc.

- NetNumber, Inc.

- Star Solutions

- Sierra Wireless, Inc.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Europe Private LTE Market Landscape

4.1 Market Overview

4.2 Ecosystem Analysis

4.3 Expert Opinion

4.4 Europe PEST Analysis

5. Europe Private LTE Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Rising use of IoT in Manufacturing Sector

5.1.2 Inflated Demand for Reliable and Efficient Communications Network Infrastructure

5.2 Market Restraints

5.2.1 Invigorated Exploitation of IoT devices

5.3 Market Opportunities

5.3.1 Launch of 5G network for Vendors Operating in Private LTE Market

5.4 Future Trends

5.4.1 Advent of New Industrial and Residential Use Cases in the Near Future

5.5 Impact Analysis of Drivers and Restraints

6. Private LTE Market – Europe Market Analysis

6.1 Europe Private LTE Market Overview

6.2 Europe Private LTE Market, Revenue and Forecast to 2028 (US$ Million)

7. Europe Private LTE Market – By Component

7.1 Overview

7.2 Private LTE Market Breakdown, by Component (2020 and 2028)

7.3 Solution

7.3.1 Overview

7.3.2 Solution: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Services

7.4.1 Overview

7.4.2 Services: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

7.4.3 Professional Services

7.4.3.1 Overview

7.4.3.2 Professional Services: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

7.4.4 Managed Services

7.4.4.1 Overview

7.4.4.2 Managed Services: Europe LTE Market – Revenue and Forecast to 2028 (US$ Million)

8. Europe Private LTE Market – By Type

8.1 Overview

8.2 Europe Private LTE Market Breakdown, by Type (2020 and 2028)

8.3 FDD

8.3.1 Overview

8.3.2 FDD: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

8.4 TDD

8.4.1 Overview

8.4.2 TDD: Europe LTE Market – Revenue and Forecast to 2028 (US$ Million)

9. Europe Private LTE Market – By End-User

9.1 Overview

9.2 Private LTE Market Breakdown, by End User (2020 and 2028)

9.3 Manufacturing

9.3.1 Overview

9.3.2 Manufacturing: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Energy & Utilities

9.4.1 Overview

9.4.2 Energy & Utilities: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Healthcare

9.5.1 Overview

9.5.2 Healthcare: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Transportation

9.6.1 Overview

9.6.2 Transportation: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Mining

9.7.1 Overview

9.7.2 Mining: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

9.8 Others

9.8.1 Overview

9.8.2 Others: Europe Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

10. Europe Private LTE Market – Country Analysis

10.1 Overview

10.1.1 Europe :Private LTE Market, by Key Country

10.1.1.1 UK: Private LTE market, Revenue and Forecast to 2028

10.1.1.1.1 UK: Private LTE Market, by Component

10.1.1.1.1.1 UK: Private LTE Market, by Services

10.1.1.1.2 UK: Private LTE Market, by Type

10.1.1.1.3 UK: Private LTE Market, by End-User

10.1.1.2 Germany: Private LTE market, Revenue and Forecast to 2028

10.1.1.2.1 Germany: Private LTE Market, by Component

10.1.1.2.1.1 Germany: Private LTE Market, by Services

10.1.1.2.2 Germany: Private LTE Market, by Type

10.1.1.2.3 Germany: Private LTE Market, by End-User

10.1.1.3 Russia: Private LTE market, Revenue and Forecast to 2028

10.1.1.3.1 Russia: Private LTE Market, by Component

10.1.1.3.1.1 Russia: Private LTE Market, by Services

10.1.1.3.2 Russia: Private LTE Market, by Type

10.1.1.3.3 Russia: Private LTE Market, by End-User

10.1.1.4 France: Private LTE market, Revenue and Forecast to 2028

10.1.1.4.1 France: Private LTE Market, by Component

10.1.1.4.1.1 France: Private LTE Market, by Services

10.1.1.4.2 France: Private LTE Market, by Type

10.1.1.4.3 France: Private LTE Market, by End-User

10.1.1.5 Italy: Private LTE market, Revenue and Forecast to 2028

10.1.1.5.1 Italy: Private LTE Market, by Component

10.1.1.5.1.1 Italy: Private LTE Market, by Services

10.1.1.5.2 Italy: Private LTE Market, by Type

10.1.1.5.3 Italy: Private LTE Market, by End-User

10.1.1.6 Rest of Europe: Private LTE market, Revenue and Forecast to 2028

10.1.1.6.1 Rest of Europe: Private LTE Market, by Component

10.1.1.6.1.1 Rest of Europe: Private LTE Market, by Services

10.1.1.6.2 Rest of Europe: Private LTE Market, by Type

10.1.1.6.3 Rest of Europe: Private LTE Market, by End-User

11. Impact of COVID-19 Pandemic on Europe Private LTE Market

11.1.1 Overview

12. Private LTE Market - Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Merger and Acquisition

12.4 New DEvelopment

13. Private LTE Market- Company Profiles

13.1 Cisco Systems, Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Telefonaktiebolaget LM Ericsson

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Huawei Technologies Co., Ltd.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Samsung Group

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 VERIZON COMMUNICATIONS, INC.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 CommScope Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Future Technologies, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 NetNumber, Inc.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Star Solutions

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Sierra Wireless, Inc.

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. Europe Private LTE Market, Revenue and Forecast to 2028 (US$ Million)

Table 2. UK: Private LTE Market, by Component, Revenue and Forecast to 2028 (US$ Million)

Table 3. UK: Private LTE Market, by Services, Revenue and Forecast to 2028 (US$ Million)

Table 4. UK: Private LTE Market, by Type, Revenue and Forecast to 2028 (US$ Million)

Table 5. UK: Private LTE Market, by End-User, Revenue and Forecast to 2028 (US$ Million)

Table 6. Germany: Private LTE Market, by Component, Revenue and Forecast to 2028 (US$ Million)

Table 7. Germany: Private LTE Market, by Services, Revenue and Forecast to 2028 (US$ Million)

Table 8. Germany: Private LTE Market, by Type, Revenue and Forecast to 2028 (US$ Million)

Table 9. Germany: Private LTE Market, by End-User, Revenue and Forecast to 2028 (US$ Million)

Table 10. Russia: Private LTE Market, by Component, Revenue and Forecast to 2028 (US$ Million)

Table 11. Russia: Private LTE Market, by Services, Revenue and Forecast to 2028 (US$ Million)

Table 12. Russia: Private LTE Market, by Type, Revenue and Forecast to 2028 (US$ Million)

Table 13. Russia: Private LTE Market, by End-User, Revenue and Forecast to 2028 (US$ Million)

Table 14. France: Private LTE Market, by Component, Revenue and Forecast to 2028 (US$ Million)

Table 15. France: Private LTE Market, by Services, Revenue and Forecast to 2028 (US$ Million)

Table 16. France: Private LTE Market, by Type, Revenue and Forecast to 2028 (US$ Million)

Table 17. France: Private LTE Market, by End-User, Revenue and Forecast to 2028 (US$ Million)

Table 18. Italy: Private LTE Market, by Component, Revenue and Forecast to 2028 (US$ Million)

Table 19. Italy: Private LTE Market, by Services, Revenue and Forecast to 2028 (US$ Million)

Table 20. Italy: Private LTE Market, by Type, Revenue and Forecast to 2028 (US$ Million)

Table 21. Italy: Private LTE Market, by End-User, Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of Europe: Private LTE Market, by Component, Revenue and Forecast to 2028 (US$ Million)

Table 23. Rest of Europe: Private LTE Market, by Services, Revenue and Forecast to 2028 (US$ Million)

Table 24. Rest of Europe: Private LTE Market, by Type, Revenue and Forecast to 2028 (US$ Million)

Table 25. Rest of Europe: Private LTE Market, by End-User, Revenue and Forecast to 2028 (US$ Million)

Table 26. Glossary of Term: Private LTE Market

LIST OF FIGURES

Figure 1. Europe Private LTE Market Segmentation

Figure 2. Europe Private LTE Market Segmentation – By Country

Figure 3. Services Segment to Dominate the Europe Private LTE Market by Component throughout the Forecast Period

Figure 4. Managed Services Segment to Witness High Growth in the Europe Private LTE Market by Services

Figure 5. TDD Segment Witness High Growth in the Europe Private LTE Market, by Type

Figure 6. Manufacturing Segment Witness High Growth in the Europe Private LTE Market, by End user

Figure 7. Europe Private LTE Market Overview

Figure 8. Germany Holds the Largest Share in the Europe Private LTE Market

Figure 9. Europe Private LTE Market Ecosystem Analysis

Figure 10. Expert Opinion

Figure 11. Europe - PEST Analysis

Figure 12. Europe Private LTE Market Impact Analysis of Drivers and Restraints

Figure 13. Europe Private LTE Market, Revenue and Forecast to 2028 (US$ Million)

Figure 14. Europe Private LTE Market Revenue Share, by Component (2020 and 2028)

Figure 15. Europe Solution: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Europe Services: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Europe Professional Services: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Europe Managed Services: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. Europe Private LTE Market Revenue Share, by Type (2020 and 2028)

Figure 20. Europe FDD: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Europe TDD: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Private LTE Market Revenue Share, by End-User (2020 and 2028)

Figure 23. Europe Manufacturing: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Europe Energy & Utilities: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Europe Healthcare: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Europe Transportation: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Europe Mining: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Europe Others: Private LTE Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. Europe: Private LTE Market, by Key Country-Revenue 2020 (US$ Million)

Figure 30. Europe Private LTE Market Revenue Share, by Key Country(2020 & 2028)

Figure 31. UK Private LTE market, Revenue and Forecast, Revenue and Forecast To 2028 (US$ Million)

Figure 32. Germany Private LTE market, Revenue and Forecast, Revenue and Forecast To 2028 (US$ Million)

Figure 33. Russia Private LTE market, Revenue and Forecast, Revenue and Forecast To 2028 (US$ Million)

Figure 34. France Private LTE market, Revenue and Forecast, Revenue and Forecast To 2028 (US$ Million)

Figure 35. Italy Private LTE market, Revenue and Forecast, Revenue and Forecast To 2028 (US$ Million)

Figure 36. Rest of Europe Private LTE market, Revenue and Forecast, Revenue and Forecast To 2028 (US$ Million)

Figure 37. Impact of COVID-19 Pandemic in Europe Country Markets

- Cisco Systems, Inc

- CommScope Inc.

- Huawei Technologies Co., Ltd.

- NetNumber, Inc.

- Samsung Group

- Sierra Wireless, Inc.

- Star Solutions

- Telefonaktiebolaget LM Ericsson

- VERIZON COMMUNICATIONS, INC.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Europe Private LTE Market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Europe Private LTE market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving Private LTE market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution