Europe Next-generation Antibody Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Therapeutic Area (Oncology, and Autoimmune or Inflammatory) and Technology (Antibody-drug conjugates, Bispecific antibodies, Fc engineered antibodies, Antibody fragments & antibody-like proteins, and Biosimilar antibody products)

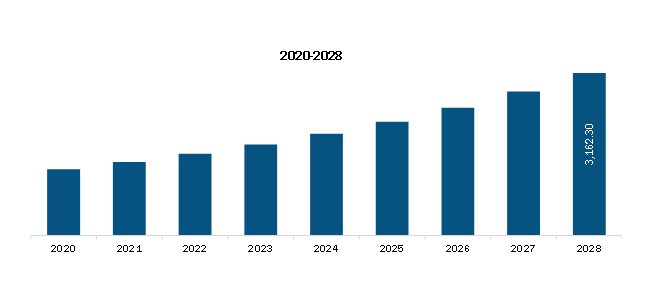

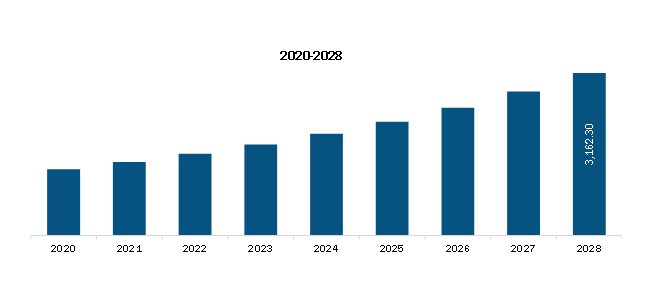

The Europe next-generation antibody market is expected to reach US$ 3,162.30 million by 2028 from US$ 1,455.32 million in 2021. It is estimated to grow at a CAGR of 11.7% from 2021 to 2028.

The increasing prevalence of cancer and growing demand for next-generation antibody therapeutics for its treatment is propelling the Europe next-generation antibody market. However, complications associated with the manufacturing and approvals of next-generation antibodies are expected to restrict the market growth during the forecast period.

Rising developments in biotechnology have led to increasing acceptance for next-generation antibodies therapeutics, which is further driving its use in autoimmune, inflammatory, and chronic treatment diseases. Next-generation antibody treatments have resulted from the application of sophisticated technologies in antibody therapeutics, such as antibody-drug conjugates (ADCs), glycoengineered antibodies, and specific antibodies (BsAbs). Therefore, applications of next-generation antibodies are being widely studied to treat various chronic diseases.

The rising demand for these antibodies has resulted in a rapid increase in the approval of ADCs and other next-generation antibodies therapeutics. For instance, in May 2020, Takeda Pharmaceutical Company Limited announced the FDA approval of ALUNBRIG (brigatinib) for adult patients with anaplastic lymphoma kinase-positive (ALK+) metastatic non-small cell lung cancer (NSCLC) as detected by an FDA-approved test. ALUNBRIG's current indication has been expanded to encompass the first-line setting with its approval. It is a next-generation tyrosine kinase inhibitor (TKI) designed to target ALK molecular abnormalities.

Similarly, in 2019, Genentech announced FDA accelerated approval of Polatuzumab vedotin-piiq, a CD79b-directed antibody-drug conjugate indicated in combination with bendamustine and a rituximab product for adult patients with relapsed or refractory diffuse large B-cell lymphoma.

Moreover, rising investments in next-generation antibodies from biopharmaceutical and pharmaceutical companies to manufacture and develop these next-generation antibodies are driving the market. In addition, contract manufacturing and development organizations (CDMOs) forge a link to next-generation antibody conjugates to offer even more comprehensive ADC capabilities. CDMOs are developing site-specific linker technologies, expanding their payload options, and planning for indications other than cancer. For instance, in September 2020, MilliporeSigma has announced a US$ 65 million expansion of its highly potent active pharmaceutical ingredient (HPAPI) and active pharmaceutical ingredient production capabilities and capacity at its Madison (WI) location.

Similarly, in July 2019, REGENXBIO and Neurimmune AG have signed a licensing, development, and commercialization collaboration to develop innovative AV gene treatments, employing NAV vectors to deliver human antibodies against chronic neurodegenerative disorders, such as tauopathies.

Therefore, the next-generation antibody market is anticipated to proliferate in the forecast period due to the rising clinical trials approvals and high adoption of next-generation antibody therapeutics to treat various diseases.

The European economy is severely affected due to the exponential growth of COVID-19 cases. Spain, Italy, Germany, France, and the UK are among the most affected European countries, and the number of deaths is also high. Several companies experienced severe losses in the last quarter of 2019. They also negatively influenced the first and second quarters of 2020. Hence, the impact of COVID-19 on the European market was immediate and drastic. The next-generation antibody supply chain, which is already logistically complicated, faced new challenges. The next-generation antibody market has also witnessed some shortfall at the beginning of the COVID-19 crisis due to disruption in supply chain and demand due to lockdown announced by most European countries. However, the requirement for next-generation antibodies is expected to increase due to supportive government initiatives over the next few years.

Europe Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Mn)

Get more information on this report :

EUROPE NEXT-GENERATION ANTIBODY MARKET SEGMENTATION

By Therapeutic Area

- Oncology

- Autoimmune/Inflammatory

By Technology

- Antibody-Drug Conjugates (ADC's)

- Bispecific Antibodies

- FC Engineered Antibodies

- Antibody Fragments and Antibody-like Proteins

- Biosimilar Antibody Products

By Country

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Company Profiles

- F. HOFFMANN-LA ROCHE LTD.

- Seagen Inc.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Pfizer Inc.

- Catalent Inc

- AstraZeneca

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Europe Next-generation Antibody Market – By Therapeutic Area

1.3.2 Europe Next-generation Antibody Market – By Technology

1.3.3 Europe Next-generation Antibody Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Next-generation Antibody Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 Europe PEST Analysis

4.3 Experts Opinion

5. Next-generation Antibody Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Prevalence of Cancer

5.1.2 Growing Demand for Next-Generation Antibody Therapeutics

5.2 Market Restraints

5.2.1 Complications Associated with Manufacturing and Approvals

5.3 Future Trends

5.3.1 Developments in Next-Generation Antibodies

5.4 Impact Analysis

6. Next-generation Antibody Market–Europe Analysis

6.1 Europe Next-generation Antibody Market Revenue Forecast and Analysis

7. Europe Next-generation Antibody Market Revenue and Forecasts To 2028– by Therapeutic Area

7.1 Overview

7.2 Europe Next-generation Antibody Market, By Therapeutic Area, 2021 & 2028 (%)

7.3 Oncology

7.3.1 Overview

7.3.2 Oncology: Next-generation Antibody Market Revenue and Forecasts to 2028 (US$ Million)

7.4 Autoimmune or Inflammatory

7.4.1 Overview

7.4.2 Autoimmune or Inflammatory: Next-generation Antibody Market Revenue and Forecasts to 2028 (US$ Million)

8. Europe Next-generation Antibody Market Revenue and Forecasts To 2028 – Technology

8.1 Overview

8.2 Europe Next-generation Antibody Market Share by Segment - 2021 & 2028 (%)

8.3 Antibody-drug conjugates

8.3.1 Overview

8.3.2 Antibody-drug conjugates: Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Million)

8.4 Bispecific antibodies

8.4.1 Overview

8.4.2 Bispecific antibodies: Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Million)

8.5 Fc engineered antibodies

8.5.1 Overview

8.5.2 Fc engineered antibodies: Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Million)

8.6 Antibody fragments and antibody-like proteins

8.6.1 Overview

8.6.2 Antibody fragments and antibody-like proteins: Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Million)

8.7 Biosimilar antibody products

8.7.1 Overview

8.7.2 Biosimilar antibody products: Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Million)

9. Next-generation Antibody Market Revenue and Forecasts to 2028 – Geographical Analysis

9.1 Europe: Next-generation Antibody Market

9.1.1 Overview

9.1.2 Europe: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.3 Europe: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.4 Europe: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

9.1.5 Europe: Next-generation Antibody Market, by Country, 2021 & 2028 (%)

9.1.5.1 Germany: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.1.1 Overview

9.1.5.1.2 Germany: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.1.3 Germany: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.5.1.4 Germany: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

9.1.5.2 France: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.2.1 Overview

9.1.5.2.2 France: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.2.3 France: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.5.2.4 France: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

9.1.5.3 UK: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.3.1 Overview

9.1.5.3.2 UK: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.3.3 UK: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.5.3.4 UK: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

9.1.5.4 Italy: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.4.1 Overview

9.1.5.4.2 Italy: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.4.3 Italy: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.5.4.4 Italy: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

9.1.5.5 Spain: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.5.1 Overview

9.1.5.5.2 Spain: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.5.3 Spain: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.5.5.4 Spain: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

9.1.5.6 Rest of Europe: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.6.1 Overview

9.1.5.6.2 Rest of Europe: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

9.1.5.6.3 Rest of Europe: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

9.1.5.6.4 Rest of Europe: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

10. Impact Of COVID-19 Pandemic on Next-generation Antibody Market

10.1 Europe: Impact Assessment of COVID-19 Pandemic

11. Next-generation Antibody Market–Industry Landscape

11.1 Overview

11.2 Organic Developments

11.2.1 Overview

11.3 Inorganic Developments

11.3.1 Overview

12. Company Profiles

12.1 F. HOFFMANN-LA ROCHE LTD.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Seagen Inc.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Takeda Pharmaceutical Company Limited

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Amgen Inc.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Pfizer Inc.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Catalent Inc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 AstraZeneca

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. New Cancer Cases Registered Worldwide, 2020

Table 2. Europe: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 3. Europe: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 4. Germany: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 5. Germany: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 6. France: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 7. France: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 8. UK: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 9. UK: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 10. Italy: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 11. Italy: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 12. Spain: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 13. Spain: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 14. Rest of Europe: Next-generation Antibody Market, by Therapeutic Area – Revenue and Forecast to 2028 (US$ Million)

Table 15. Rest of Europe: Next-generation Antibody Market, by Technology– Revenue and Forecast to 2028 (US$ Million)

Table 16. Organic Developments in the Next-generation Antibody Market

Table 17. Inorganic Developments in the Next-generation Antibody Market

Table 18. Glossary of Terms

LIST OF FIGURES

Figure 1. Next-generation Antibody Market Segmentation

Figure 2. Next-generation Antibody Market, By Country

Figure 3. Europe Next-generation Antibody Market Overview

Figure 4. Oncology Segment Held Largest Share of Therapeutic Area Segment in Next-generation Antibody Market

Figure 5. Global Next-generation Antibody Market- Leading Country Markets (US$ Million)

Figure 6. Europe: PEST Analysis

Figure 7. Experts Opinion

Figure 8. Next-Generation Antibody Market Impact Analysis of Driver and Restraints

Figure 9. Europe Next-generation Antibody Market– Revenue Forecast and Analysis – 2021 - 2028

Figure 10. Europe Next-generation Antibody Market, by Therapeutic Area, 2021 & 2028 (%)

Figure 11. Oncology: Next-generation Antibody Market Revenue and Forecasts to 2028 (US$ Million)

Figure 12. Autoimmune or Inflammatory: Next-generation Antibody Market Revenue and Forecasts to 2028 (US$ Million)

Figure 13. Europe Next-generation Antibody Market Share by Segment - 2021 & 2028 (%)

Figure 14. Antibody-drug conjugates: Next-generation Antibody Market Revenue and Forecasts To 2028 (US$ Million)

Figure 15. Bispecific antibodies: Next-generation Antibody Market Revenue and Forecasts To 2028 (US$ Million)

Figure 16. Fc engineered antibodies: Next-generation Antibody Market Revenue and Forecasts To 2028 (US$ Million)

Figure 17. Antibody fragments and antibody-like proteins: Next-generation Antibody Market Revenue and Forecasts To 2028 (US$ Million)

Figure 18. Biosimilar antibody products: Next-generation Antibody Market Revenue and Forecasts To 2028 (US$ Million)

Figure 19. Europe: Next-generation Antibody Market, by Key Country – Revenue (2021) (US$ Million)

Figure 20. Europe: Next-generation Antibody Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. Europe: Next-generation Antibody Market, by Country, 2021 & 2028 (%)

Figure 22. Germany: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. France: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. UK: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Italy: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Spain: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Rest of Europe: Next-generation Antibody Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Impact of COVID-19 Pandemic in European Country Markets

- F. HOFFMANN-LA ROCHE LTD.

- Seagen Inc.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Pfizer Inc.

- Catalent Inc

- AstraZeneca

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Europe next-generation antibody market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe next-generation antibody market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.