Europe Automotive Airbags and Seatbelts Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Airbags Type (Front, Knee, Side and Curtain), Seatbelts Type (2-point and 3-point), and Vehicle Class (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles)

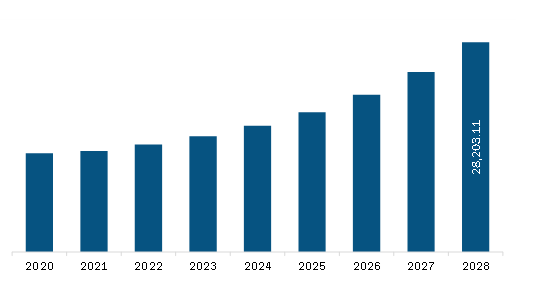

The automotive airbags and seatbelts market in Europe is expected to grow from US$ 14,465.29 million in 2022 to US$ 28,203.11 million by 2028. It is estimated to grow at a CAGR of 11.8% from 2022 to 2028.

Increasing Advancements in Airbag and Seatbelt Technologies

With the rapid expansion of the Europe automotive landscape, manufacturers are primarily focused on enhancing engineering fuel and cost efficiency, improving the driving experience, and working toward the overall safety of passengers and drivers. Airbags and seatbelts remain a key passive safety system in the automotive sector. The growing advancement in airbag and seatbelt technologies is increasing their adoption across passenger vehicles, thereby propelling the market growth. The airbag is best used in combination with wearing a safety belt. It can prevent injuries and fatalities in front-end collisions. Airbag manufacturers have developed an array of airbags, side curtains, and knee bolsters to protect front-seat occupants and are further planning to design a new generation of airbags for rear-seat passengers. For instance, TRW Automotive Holdings Corp. has unveiled two airbags, one mounted on the roof and one in the back of the front seat, which could protect rear-seat passengers during a frontal collision. In addition, the Citroën C4 Cactus is a subcompact crossover SUV, which is equipped with a new roof-mounted passenger airbag technology. The growing advancement in technology for airbags in the automotive industry is fuelling the market growth. For instance, the computer-operated dual deploys, or dual-stage airbags can deploy at two speeds. Airbags deploy at the lower first stage in less severe accidents, usually about 70% of full force. In more severe accidents, both stages are deployed. Further, side airbags are effective in preventing the driver and passengers from head injuries due to the rigid areas of the vehicle in side-impact collisions.

Nylon-based airbags are poised to experience significant demand in the near future. This can be attributed to various benefits of the fabric, including high specific heat capacity, lower density, and better impact resistance. Additionally, airbag manufacturers are focusing on developing nylon-based fabrics coated with organic silicon instead of neoprene, as these coated fabrics have a longer service life, stable performance, high wear resistance, and are lightweight. New developments and innovations are coming up to enhance efficiency and widen the production capabilities of airbags. For instance, in July 2019, ZF Friedrichshafen, a German car parts manufacturer, developed external smart airbags for vehicles that reduce the impact of the crash and decrease damage to the occupants. Moreover, the technological advancements in seatbelts are strengthening the market growth. For instance, in September 2019, Hyundai Mobis announced that it had developed a “Safety Integrated Control Module” that ensures increased efficiency and safety in operating automotive safety devices. This new development combined two separate electronic control units (ECUs) for airbags and electronic seatbelts into a single unit. Thus, such developments in technology for airbags and seatbelts are anticipated to drive the market.

Market Overview

The thriving automotive industry in Europe is supporting the growth of the automotive airbags and seatbelts market. As per OICA 2021 statistics report, the number of motor vehicle produced in Europe was 1,63,30,509; 1,69,42,248; and 2,15,75,118 in 2021, 2020, and 2019, respectively. Also, the total passenger cars produced across the region was 1,38,03,297 in 2021, 1,45,56,548 in 2020, and 1,87,24,208 in 2019, as per the same OICA 2021 statistics report. Germany, France, Spain, the UK, and the Czech Republic are the leading countries in Europe that produced the maximum number of motor vehicles and passenger cars. Further, the national regulatory bodies are taking numerous initiatives to support the development of the automotive industry in the region. For instance, CARS 2020 Action Plan, GEAR 2030, and Horizon 2020 are a few major European government initiatives. The Horizon 2020 Plan focuses on providing funds for research & development (R&D) activities in the automotive industry by launching programs such as the European Green Vehicles Initiative and programs on factories of the future and information and communications technology (ICT) for smart mobility, road transport, and logistics. Therefore, the presence of a robust automotive industry helps boost the demand for automotive airbags and seatbelts due to large-scale motor vehicle production and several European governmental schemes..

Europe Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Europe Automotive Airbags and Seatbelts Market Segmentation

The Europe automotive airbags and seatbelts market is segmented into airbags type , seatbelts type, vehicle class, and country.

- Based on airbag type ,the market is segmented into front, knee, side and curtain. The front segment registered the largest market share in 2022.

- Based on seatbelts type , the market is segmented into 2-point and 3-point. The 3- point segment held the largest market share in 2022.

- Based on vehicle class , the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment held the largest market share in 2022.

- Based on country, the market is segmented into Germany ; France ; Italy ; UK ; Russia and Rest of Europe. Germany dominated the market share in 2022.

Autoliv Inc. ; Continental AG ; Denso Corporation ; INFINEON TECHNOLOGIES AG ; Robert Bosch GmbH ; ZF Friedrichshafen AG ; Hyundai Mobis ; Joyson Safety Systems and Toyoda Gosei Co., Ltd. are the leading companies operating in the automotive airbags and seatbelts market in the region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Europe Automotive Airbags and Seatbelts Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Europe

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Europe Automotive Airbags and Seatbelts Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Growing Initiatives for Introducing Regulatory Standards Related to Vehicle Safety

5.1.2 Increasing Advancements in Airbag and Seatbelt Technologies

5.2 Market Restraints

5.2.1 High Operating and Maintenance Costs

5.3 Market Opportunities

5.3.1 Growing Awareness About Vehicle Safety Features

5.4 Future Trends

5.4.1 Growing Adoption of Electric Vehicles

5.5 Impact Analysis of Drivers and Restraints

6. Automotive Airbags and Seatbelts Market –Market Analysis

6.1 Europe Automotive Airbags and Seatbelts Market Overview

6.2 Europe Automotive Airbags and Seatbelts Market Forecast and Analysis

7. Europe Automotive Airbags and Seatbelts Market Analysis – By Airbags Type

7.1 Overview

7.2 Europe Automotive Airbags and Seatbelts Market, By Airbags Type (2021 And 2028)

7.3 Front

7.3.1 Overview

7.3.2 Europe Front: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

7.4 Knee

7.4.1 Overview

7.4.2 Europe Knee: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

7.5 Side and Curtain

7.5.1 Overview

7.5.2 Europe Side and Curtain: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

8. Europe Automotive Airbags and Seatbelts Market Analysis – By Seatbelts Type

8.1 Overview

8.2 Europe Automotive Airbags and Seatbelts Market, By Seatbelts Type (2021 And 2028)

8.3 2-point

8.3.1 Overview

8.3.2 Europe 2-point: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

8.4 3-point

8.4.1 Overview

8.4.2 Europe 3-point: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

9. Europe Automotive Airbags and Seatbelts Market Analysis – By Vehicle Class

9.1 Overview

9.2 Europe Automotive Airbags and Seatbelts Market, By Vehicle Class (2021 and 2028)

9.3 Passenger Cars

9.3.1 Overview

9.3.2 Europe Passenger Cars: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

9.4 Light Commercial Vehicles

9.4.1 Overview

9.4.2 Europe Light Commercial Vehicles: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

9.5 Heavy Commercial Vehicles

9.5.1 Overview

9.5.2 Europe Heavy Commercial Vehicles: Automotive Airbags and Seatbelts Market Revenue and Forecast To 2028 (US$ Million)

10. Europe Automotive Airbags and Seatbelts Market – Country Analysis

10.1 Europe: Automotive Airbags and Seatbelts Market

10.1.1 Overview

10.1.2 Europe Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ million)

10.1.3 Europe Automotive Airbags and Seatbelts Market Breakdown, by Country

10.1.3.1 Germany Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028

10.1.3.1.1 Germany Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type

10.1.3.1.2 Germany Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type

10.1.3.1.3 Germany Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class

10.1.3.2 France Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028

10.1.3.2.1 France Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type

10.1.3.2.2 France Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type

10.1.3.2.3 France Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class

10.1.3.3 Italy Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028

10.1.3.3.1 Italy Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type

10.1.3.3.2 Italy Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type

10.1.3.3.3 Italy Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class

10.1.3.4 UK Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028

10.1.3.4.1 UK Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type

10.1.3.4.2 UK Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type

10.1.3.4.3 UK Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class

10.1.3.5 Russia Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028

10.1.3.5.1 Russia Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type

10.1.3.5.2 Russia Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type

10.1.3.5.3 Russia Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class

10.1.3.6 Rest of Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028

10.1.3.6.1 Rest of Europe Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type

10.1.3.6.2 Rest of Europe Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type

10.1.3.6.3 Rest of Europe Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class

11. Industry Landscape

11.1 Market Initiative

11.2 New Development

12. Company Profiles

12.1 Autoliv Inc.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Continental AG

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Denso Corporation

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 INFINEON TECHNOLOGIES AG

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Robert Bosch GmbH

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 ZF Friedrichshafen AG

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Hyundai Mobis

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Joyson Safety Systems

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Toyoda Gosei Co., Ltd.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. Europe Automotive Airbags and Seatbelts Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast To 2028 – By Airbags Type (US$ million)

Table 3. Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast To 2028 – By Seatbelts Type (US$ million)

Table 4. Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast To 2028 – By Vehicle Class (US$ million)

Table 5. Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast To 2028 – By Country (US$ million)

Table 6. Germany Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Airbags Type (US$ million)

Table 7. Germany Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Seatbelts Type (US$ million)

Table 8. Germany Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Vehicle Class (US$ million)

Table 9. France Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Airbags Type (US$ million)

Table 10. France Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Seatbelts Type (US$ million)

Table 11. France Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Vehicle Class (US$ million)

Table 12. Italy Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Airbags Type (US$ million)

Table 13. Italy Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Seatbelts Type (US$ million)

Table 14. Italy Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Vehicle Class (US$ million)

Table 15. UK Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Airbags Type (US$ million)

Table 16. UK Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Seatbelts Type (US$ million)

Table 17. UK Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Vehicle Class (US$ million)

Table 18. Russia Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Airbags Type (US$ million)

Table 19. Russia Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Seatbelts Type (US$ million)

Table 20. Russia Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Vehicle Class (US$ million)

Table 21. Rest of Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Airbags Type (US$ million)

Table 22. Rest of Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Seatbelts Type (US$ million)

Table 23. Rest of Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 – By Vehicle Class (US$ million)

Table 24. List of Abbreviation

LIST OF FIGURES

Figure 1. Europe Automotive Airbags and Seatbelts Market Segmentation

Figure 2. Europe Automotive Airbags and Seatbelts Market Segmentation – By Country

Figure 3. Europe Automotive Airbags and Seatbelts Market Overview

Figure 4. Front Segment held the Largest Share of Automotive Airbags and Seatbelts Market

Figure 5. UK to Show Great Traction During Forecast Period

Figure 6. Europe – PEST Analysis

Figure 7. Ecosystem Analysis: Automotive Airbags and Seatbelts Market

Figure 8. Expert Opinion

Figure 9. Europe Automotive Airbags and Seatbelts Market: Impact Analysis of Drivers and Restraints

Figure 10. Europe Automotive Airbags and Seatbelts Market Forecast and Analysis (US$ Million)

Figure 11. Europe Automotive Airbags and Seatbelts Market Breakdown, By Airbags Type, 2021 & 2028 (%)

Figure 12. Europe Front: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. Europe Knee: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. Europe Side and Curtain: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. Europe Automotive Airbags and Seatbelts Market Breakdown, By Seatbelts Type, 2021 & 2028 (%)

Figure 16. Europe 2-point: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. Europe 3-point: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. Europe Automotive Airbags and Seatbelts Market Breakdown, By Vehicle Class, 2021 & 2028 (%)

Figure 19. Europe Passenger Cars: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Europe Light Commercial Vehicles: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. Europe Heavy Commercial Vehicles: Automotive Airbags and Seatbelts Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast To 2028 (US$ million)

Figure 23. Europe Automotive Airbags and Seatbelts Market Breakdown, by Country, 2021 & 2028(%)

Figure 24. Germany Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 (US$ million)

Figure 25. France Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 (US$ million)

Figure 26. Italy Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 (US$ million)

Figure 27. UK Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 (US$ million)

Figure 28. Russia Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 (US$ million)

Figure 29. Rest of Europe Automotive Airbags and Seatbelts Market, Revenue and Forecast to 2028 (US$ million)

- Autoliv Inc.

- Continental AG

- Denso Corporation

- INFINEON TECHNOLOGIES AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Hyundai Mobis

- Joyson Safety Systems

- Toyoda Gosei Co., Ltd.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe Automotive Airbags and Seatbelts Market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Europe Automotive Airbags and Seatbelts Market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.