Asia-Pacific WealthTech Solution Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Solution and Services), End User (Banks, Wealth Management Firms, and Others), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), and Deployment Mode (Cloud-Based and On-Premises)

Market Introduction

Many trends cannot be generalized for all countries in APAC as it is a vast and diverse region. WealthTech services are gaining momentum in Asia and the Pacific Rim of the East. Advanced WealthTech systems are increasingly becoming part of everyday life in fast-growing, developing economies such as China and India, and in developed countries such as Australia and Japan. APAC places with a high rate of smartphone adoption have access to different virtual financial services at a faster rate than people in most other nations.

The use of wealthtech powered services by banks and investment firms across major APAC countries has quadrupled, or tripled, in some cases. wealthtech adoption is 67% in Hong Kong, Singapore, and South Korea; and 58% in Australia. Except India, which has virtually matched the leading digital power in Asia, most countries still lag well behind China, which has 87% adoption of wealthtech in banks and investment firms. Furthermore, a strong FinTech feedback loop continues to benefit the bulk of Asian countries, with higher adoption leading to further innovation and vice versa. Mainland China continues to lead the way in consumer and small-business financial services innovation, while Chinese investments and local entrepreneurs are propelling rapid market penetration and innovation in other Asian nations. Competition between tech giants from China and US for capturing majority shares in huge, fast-growing Indian market is likely to fuel rapid transformation in the financial services and FinTech ecosystem in the region.

APAC is characterized by the presence of developing countries, positive economic outlook, high industrial presence, and huge population. All these factors make APAC a major region for the growth of various markets, including wealthtech solution. The lockdown of various plants and factories in all economies of the region due the COVID-19 pandemic is affecting the global supply chains and negatively impacting the manufacturing, delivery schedules, and sales of various products and services. Disruptions in units have stopped investments in start-ups, thereby negatively impacting the market growth. However, with lockdowns being lifted in several countries, wealthtech start-ups are likely to witness investments.

Get more information on this report :

Market Overview and Dynamics

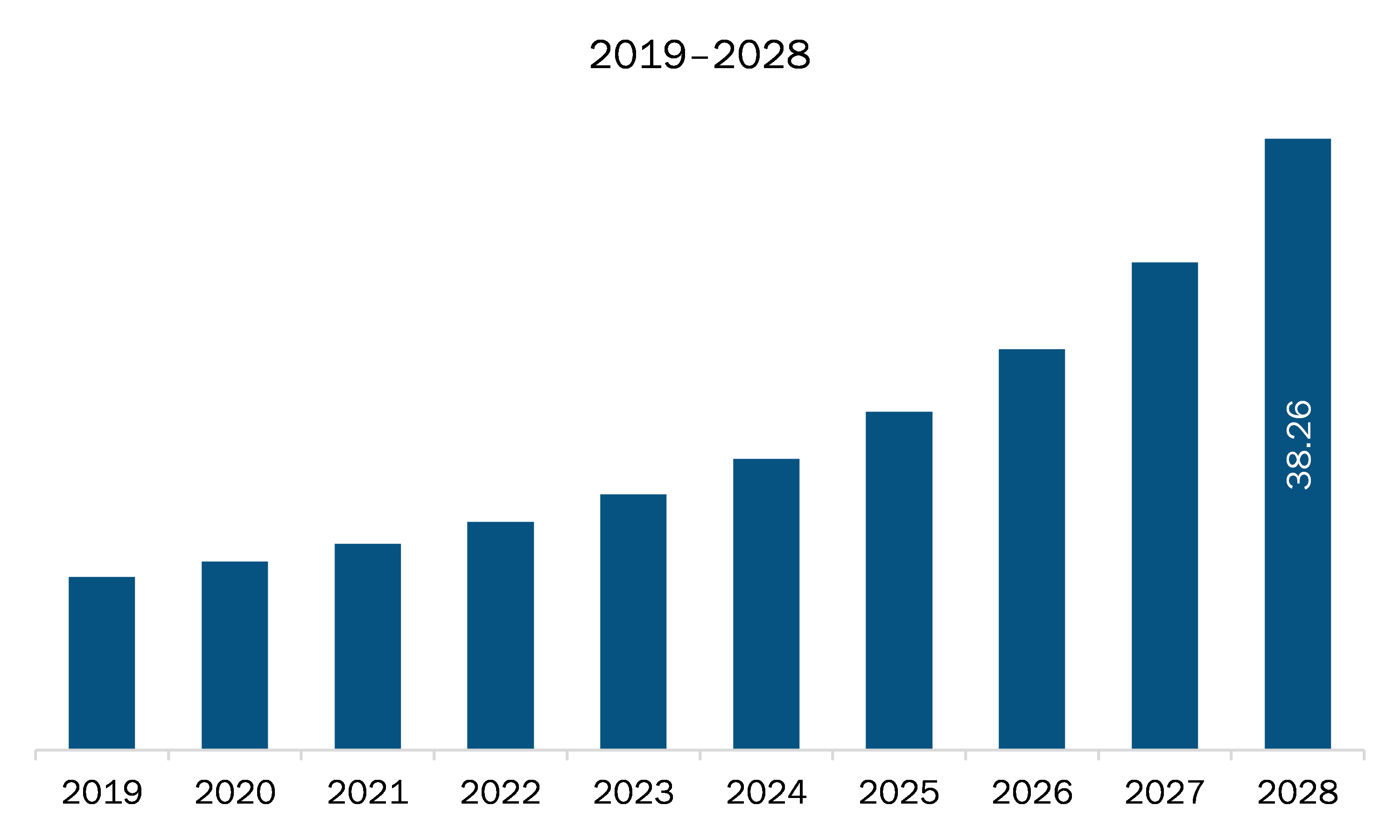

The wealthtech solution market in APAC is expected to grow from US$ 12.89 billion in 2021 to US$ 38.26 billion by 2028; it is estimated to grow at a CAGR of 16.8% from 2021 to 2028. Organizations use financial analytics tools to gain insights into key present and future trends for improving their business performance. Financial analytics services include financial data quality analysis and data layout, client analytics, predictive analytics, principal component analysis, and financial data collection. These analytics require thorough financial and other relevant data to identify patterns; based on these predictions, enterprises may make predictions regarding what their customers would buy, how long their employees' tenures might be, and so on. Thus, financial analytics services help organizations improve the profitability, cash flow, and business value. They may use the insights gained through these analytics to improve their revenues and business processes. Accenture PLC provides the newest data and analytics solutions for financial service providers, along with assisting them in deploying the same. Its services for these firms include cost analytics and enterprise performance analytics. With a prime focus in income statements, balance sheets, and cash flow statements, financial analysis is employed to evaluate economic trends, set financial policies, formulate long-term business plans, and pinpoint projects or companies for investments.

Key Market Segments

APAC wealthtech solution market is segmented into component, end user, organization size, deployment mode, and country. Based on component, the wealthtech solution market is bifurcated into solution and services. In 2020, the solution segment led the market, accounting for a larger market share. Based on end user, the wealthtech solution market is segmented into banks, wealth management firms, and others. In 2020, the wealth management firms segment accounted for the largest market share. Based on organization size, the wealthtech solution market is bifurcated into large enterprises and small and medium-sized enterprises. In 2020, the large enterprises segment accounted for a larger market share. By deployment mode, the wealthtech solution market is bifurcated into cloud-based and on-premises. In 2020, the cloud-based segment accounted for a larger market share. Based on country, the APAC wealthtech solution market is segmented into Australia, China, India, Japan, South Korea, and rest of APAC. In 2020, China led the market, accounting for a larger market share.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the wealthtech solution market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are 3rd-eyes analytics; BlackRock, Inc.; InvestCloud, Inc.; InvestSuite; Synechron; Wealthfront Inc.; Valuefy; and WealthTechs Inc.

Reasons to buy report

- To understand the APAC wealthtech solution market landscape and identify market segments that are most likely to guarantee a strong return.

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC wealthtech solution market.

- Efficiently plan M&A and partnership deals in APAC wealthtech solution market by identifying market segments with the most promising probable sales.

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC wealthtech solution market.

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.

APAC WealthTech Solution Market Segmentation

APAC WealthTech Solution Market - By Component

- Solution

- Services

APAC WealthTech Solution Market - By End User

- Banks

- Wealth Management Firms

- Others

APAC WealthTech Solution Market - By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

APAC WealthTech Solution Market - By Deployment Mode

- Cloud-Based

- On-Premises

APAC WealthTech Solution Market - By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC WealthTech Solution Market - Company Profiles

- 3rd-eyes analytics AG

- BlackRock, Inc.

- InvestCloud, Inc.

- InvestSuite

- Synechron

- Valuefy

- Wealthfront Inc.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 APAC WealthTech Solution Market – By Component

1.3.2 APAC WealthTech Solution Market – By End-User

1.3.3 APAC WealthTech Solution Market – By Organization Size

1.3.4 APAC By Deployment Mode

1.3.5 APAC WealthTech Solution Market- By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. APAC WealthTech Solution Market Landscape

4.1 Market Overview

4.2 APAC PEST Analysis

4.2.1 APAC– PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. APAC WealthTech Solutions Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Significant Demand for Financial Analytics Services

5.1.2 Growing Use of Artificial Intelligence in Wide Industrial Applications

5.2 Market Restraints

5.2.1 Security Concerns Involved with WealthTech Solutions

5.3 Market Opportunities

5.3.1 Constand Rise in Number of Banks

5.4 Future Trends

5.4.1 Cloud-Based Financial Analytics Getting Popular

5.5 Impact Analysis of Drivers and Restraints

6. WealthTech Solution Market – APAC Analysis

6.1 APAC WealthTech Solution Market Overview

6.2 APAC WealthTech Solution Market –Revenue and Forecast to 2028 (US$ Billion)

7. APAC WealthTech Solutions Market Analysis – By Component

7.1 Overview

7.2 APAC WealthTech Solutions Market Breakdown, by Component, 2020 and 2028

7.3 Solution

7.3.1 Overview

7.3.2 Solution: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

7.4 Services

7.4.1 Overview

7.4.2 Services: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

8. APAC WealthTech Solutions Market Analysis – By End User

8.1 Overview

8.2 APAC WealthTech Solutions Market Breakdown, by End User, 2020 and 2028

8.3 Banks

8.3.1 Overview

8.3.2 Banks: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

8.4 Wealth Management Firms

8.4.1 Overview

8.4.2 Wealth Management Firms: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

8.5 Others

8.5.1 Overview

8.5.2 Others: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

9. APAC WealthTech Solutions Market Analysis – By Organization Size

9.1 Overview

9.2 APAC WealthTech Solutions Market Breakdown, by Organization Size, 2020 and 2028

9.3 Large Enterprises

9.3.1 Overview

9.3.2 Large Enterprises: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

9.4 Small and Medium-Sized Enterprises

9.4.1 Overview

9.4.2 Small and Medium-Sized Enterprises: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

10. APAC WealthTech Solutions Market Analysis – By Deployment Mode

10.1 Overview

10.2 APAC WealthTech Solutions Market Breakdown, by Deployment Mode, 2020 and 2028

10.3 Cloud-Based

10.3.1 Overview

10.3.2 Cloud-Based: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

10.4 On-Premises

10.4.1 Overview

10.4.2 On-Premises: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

11. APAC WealthTech Solution Market – Country Analysis

11.1 Overview

11.1.1 APAC: WealthTech Solution Market- by Key Country

11.1.1.1 Australia: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

11.1.1.1.1 Australia: WealthTech Solution Market- by Component

11.1.1.1.2 Australia: WealthTech Solution Market- By End-User

11.1.1.1.3 Australia: WealthTech Solution Market- By Organization Size

11.1.1.1.4 Australia: WealthTech Solution Market- By Deployment Mode

11.1.1.2 China: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

11.1.1.2.1 China: WealthTech Solution Market- by Component

11.1.1.2.2 China: WealthTech Solution Market- By End-User

11.1.1.2.3 China: WealthTech Solution Market- By Organization Size

11.1.1.2.4 China: WealthTech Solution Market- By Deployment Mode

11.1.1.3 India: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

11.1.1.3.1 India: WealthTech Solution Market- by Component

11.1.1.3.2 India: WealthTech Solution Market- By End-User

11.1.1.3.3 India: WealthTech Solution Market- By Organization Size

11.1.1.3.4 India: WealthTech Solution Market- By Deployment Mode

11.1.1.4 Japan: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

11.1.1.4.1 Japan: WealthTech Solution Market- by Component

11.1.1.4.2 Japan: WealthTech Solution Market- By End-User

11.1.1.4.3 Japan: WealthTech Solution Market- By Organization Size

11.1.1.4.4 Japan: WealthTech Solution Market- By Deployment Mode

11.1.1.5 South Korea: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

11.1.1.5.1 South Korea: WealthTech Solution Market- by Component

11.1.1.5.2 South Korea: WealthTech Solution Market- By End-User

11.1.1.5.3 South Korea: WealthTech Solution Market- By Organization Size

11.1.1.5.4 South Korea: WealthTech Solution Market- By Deployment Mode

11.1.1.6 Rest of APAC: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

11.1.1.6.1 Rest of APAC: WealthTech Solution Market- by Component

11.1.1.6.2 Rest of APAC: WealthTech Solution Market- By End-User

11.1.1.6.3 Rest of APAC: WealthTech Solution Market- By Organization Size

11.1.1.6.4 Rest of APAC: WealthTech Solution Market- By Deployment Mode

12. APAC WealthTech Solution Market- COVID-19 Impact Analysis

12.1 APAC

13. Industry Landscape

13.1 Overview

13.2 Market Initiative

13.3 Merger and Acquisition

13.4 New Development

14. Company Profiles

14.1 InvestCloud

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Valuefy

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 BlackRock, Inc.

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Synechron

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Wealthfront Inc.

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 InvestSuite

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 3rd Eyes Analytics

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

15. Appendix

15.1 About The Insight Partners

15.2 Word Index

LIST OF TABLES

Table 1. APAC WealthTech Solution Market – Revenue, and Forecast to 2028 (US$ Billion)

Table 2. Australia: WealthTech Solution Market- by Component –Revenue and Forecast to 2028 (US$ Billion)

Table 3. Australia: WealthTech Solution Market- By End-User –Revenue and Forecast to 2028 (US$ Billion)

Table 4. Australia: WealthTech Solution Market- By Organization Size –Revenue and Forecast to 2028 (US$ Billion)

Table 5. Australia: WealthTech Solution Market- By Deployment Mode –Revenue and Forecast to 2028 (US$ Billion)

Table 6. China: WealthTech Solution Market- by Component –Revenue and Forecast to 2028 (US$ Billion)

Table 7. China: WealthTech Solution Market- By End-User –Revenue and Forecast to 2028 (US$ Billion)

Table 8. China: WealthTech Solution Market- By Organization Size –Revenue and Forecast to 2028 (US$ Billion)

Table 9. China: WealthTech Solution Market- By Deployment Mode –Revenue and Forecast to 2028 (US$ Billion)

Table 10. India: WealthTech Solution Market- by Component –Revenue and Forecast to 2028 (US$ Billion)

Table 11. India: WealthTech Solution Market- By End-User –Revenue and Forecast to 2028 (US$ Billion)

Table 12. India: WealthTech Solution Market- By Organization Size –Revenue and Forecast to 2028 (US$ Billion)

Table 13. India: WealthTech Solution Market- By Deployment Mode –Revenue and Forecast to 2028 (US$ Billion)

Table 14. Japan: WealthTech Solution Market- by Component –Revenue and Forecast to 2028 (US$ Billion)

Table 15. Japan: WealthTech Solution Market- By End-User –Revenue and Forecast to 2028 (US$ Billion)

Table 16. Japan: WealthTech Solution Market- By Organization Size –Revenue and Forecast to 2028 (US$ Billion)

Table 17. Japan: WealthTech Solution Market- By Deployment Mode –Revenue and Forecast to 2028 (US$ Billion)

Table 18. South Korea: WealthTech Solution Market- by Component –Revenue and Forecast to 2028 (US$ Billion)

Table 19. South Korea: WealthTech Solution Market- By End-User –Revenue and Forecast to 2028 (US$ Billion)

Table 20. South Korea: WealthTech Solution Market- By Organization Size –Revenue and Forecast to 2028 (US$ Billion)

Table 21. South Korea: WealthTech Solution Market- By Deployment Mode –Revenue and Forecast to 2028 (US$ Billion)

Table 22. Rest of APAC: WealthTech Solution Market- by Component –Revenue and Forecast to 2028 (US$ Billion)

Table 23. Rest of APAC: WealthTech Solution Market- By End-User –Revenue and Forecast to 2028 (US$ Billion)

Table 24. Rest of APAC: WealthTech Solution Market- By Organization Size –Revenue and Forecast to 2028 (US$ Billion)

Table 25. Rest of APAC: WealthTech Solution Market- By Deployment Mode –Revenue and Forecast to 2028 (US$ Billion)

Table 26. List of Abbreviation

LIST OF FIGURES

Figure 1. APAC WealthTech Solution Market Segmentation

Figure 2. APAC WealthTech Solution Market Segmentation – By Country

Figure 3. APAC WealthTech Solution Market Overview

Figure 4. Solution Segment Held the Largest Market Share in 2020

Figure 5. Wealth Management Firms Held the Largest Market Share in 2020

Figure 6. Large Enterprise Held the Largest Market Share in 2020

Figure 7. Cloud Based Held the Largest Market Share in 2020

Figure 8. China was the Largest Revenue Contributor in 2020

Figure 9. APAC WealthTech Solution Market– Ecosystem Analysis

Figure 10. Expert Opinion

Figure 11. APAC WealthTech Solution Market Impact Analysis of Drivers and Restraints

Figure 12. APAC WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 13. APAC WealthTech Solutions Market Breakdown, by Component (2020 and 2028)

Figure 14. APAC Solution: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 15. APAC Services: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 16. APAC WealthTech Solutions Market Breakdown, by End User (2020 and 2028)

Figure 17. APAC Banks: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 18. APAC Wealth Management Firms: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 19. APAC Others: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 20. APAC WealthTech Solutions Market Breakdown, by Organization Size (2020 and 2028)

Figure 21. APAC Large Enterprises: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 22. APAC Small and Medium-Sized Enterprises: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 23. APAC WealthTech Solutions Market Breakdown, by Deployment Mode (2020 and 2028)

Figure 24. APAC Cloud-Based: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 25. APAC On-Premises: WealthTech Solutions Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 26. APAC: WealthTech Solution Market, by Key Country – Revenue (2020) (US$ Billion)

Figure 27. APAC: WealthTech Solution Market Revenue Share, By Key Country (2020 and 2028)

Figure 28. Australia: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 29. China: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 30. India: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 31. Japan: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 32. South Korea: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 33. Rest of APAC: WealthTech Solution Market – Revenue and Forecast to 2028 (US$ Billion)

Figure 34. Impact of COVID-19 Pandemic in APAC Country Markets

- 3rd-eyes analytics AG

- BlackRock, Inc.

- InvestCloud, Inc.

- InvestSuite

- Synechron

- Valuefy

- Wealthfront Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the APAC wealthtech solution market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the APAC wealthtech solution market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth APAC market trends and outlook coupled with the factors driving the wealthtech solution market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution