Asia Pacific Substrate like PCB Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Line/Space (25/25 and 30/30 µm, and less than 25/25 µm), Inspection Technologies (Automated Optical Inspection, Direct Imaging, and Automated Optical Shaping), Application (Consumer Electronics, Automotive, Medical, Industrial, and Others)

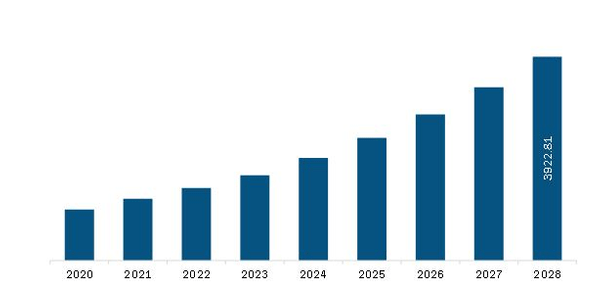

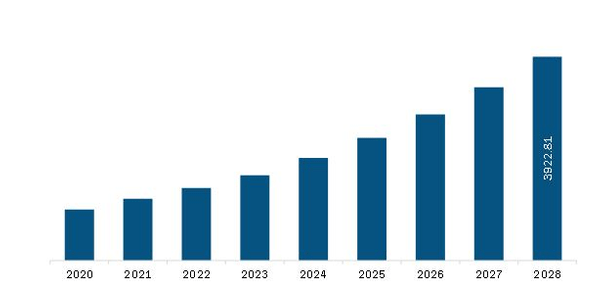

The Asia Pacific substrate like PCB market is expected to reach US$ 3,922.8 million by 2028 from US$ 1,180.2 million in 2021. The market is estimated to grow at a CAGR of 18.7% from 2021–2028.

Smartphones have evolved from 4G LTE to 5G, and the complexity of Massive MIMO antenna configurations has made RF front-ends take up more space in 5G smartphones. In addition, the amount of data processed by the 5G system is expected to grow geometrically shortly, increasing the requirement for high battery capacity, which means that PCBs and other electronic components must be compressed to achieve higher density and smaller form factor, which has pushed substrate-like PCB toward thinner, smaller, and more complex processes. Substrate-like PCB (SLP PCB) is the next generation of high-density PCB, which requires trace/spacing equal to or less than 30/30 μm (now 40/40 μm is the limit for HDI), for further reducing the device size, leaving more space for other components. The rising adoption of SLP by smartphone players due to the transition from 4G to 5G technology provides a massive opportunity to the Asia Pacific substrate-like PCB market. The expansion in 5G infrastructure is expected to increase the demand for PCBs and substrates for mainboards and modules in various end-use industries, such as consumer electronics, automotive, medical, industrial, telecommunication, and others.

APAC is a crucial region in terms of manufacturing and industrial growth and any disruptions may negatively impact the growth of various industries. With the COVID-19 outbreak, the IC substrate production came to an abrupt end in China from February 2020 to March 2020. Thus, this influenced the demand for the product, worldwide, and influenced the price. The governments of various countries of this region are taking drastic measures to reduce the effects of coronavirus outbreaks by announcing lockdowns, travel and trade bans. All these measures hurt the adoption and growth of substrate-like PCB till Mid-2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the substrate like PCB market. The Asia Pacific substrate like PCB market is expected to grow at a good CAGR during the forecast period.

Asia Pacific Substrate like PCB Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

Asia Pacific Substrate like PCB Market Segmentation

By Line/Space

- 25/25 and 30/30 um

- Less than 25/25 um

By Inspection Technology

- Automated Optical Inspection

- Direct Imaging

- Automated Optical Shaping

By Application

- Consumer electronics

- Automotive

- Medical

- Industrial

- Others

By Country

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Rest of APAC

Companies Mentioned

- Compaq Manufacturing Co., Ltd.

- DAEDUCK ELECTRONICS CO., LTD.

- Ibiden Co, Ltd.

- Kinsus Interconnect Technology

- SAMSUNG ELECTRO-MECHANICS CO, Ltd

- AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

- Zhen Ding Tech. Group Technology Holding Limited

- Technologies Inc.

- Korea Circuit

- Unimicron Technology Corp.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Substrate-like PCB Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 Asia Pacific

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Substrate-like PCB Market Key Market Dynamics

5.1 Market Drivers

5.1.1 Surge in Demand for Substrates-like PCB in Consumer Electronics and Automotive Industry

5.1.2 Increasing Demand for Miniaturization and Modularization in Consumer Electronics Industry

5.2 Key Market Restraints

5.2.1 Fluctuating Raw Material Prices

5.3 Key Market Opportunities

5.3.1 Increasing Adoption of 5G Technology by Smartphone Manufacturers

5.4 Future Trends

5.4.1 Growing Adoption of Substrate-like PCB in Medical and Industrial Equipment

5.5 Impact Analysis of Drivers and Restraints

6. Substrate-like PCB Market – Asia Pacific Analysis

6.1 Substrate-like PCB Market Overview

6.2 Substrate-like PCB Market Revenue and Forecast to 2028 (US$ Million)

6.3 Market Positioning – Five Key Players

7. Substrate-Like PCB Market Analysis – By Line/Space

7.1 Overview

7.2 Substrate-Like PCB Market Revenue Breakdown, By Line/Space, 2020 and 2028

7.3/25 and 30/30 µm

7.3.1 Overview

7.3.2/25 and 30/30 µm: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Less than 25/25 µm

7.4.1 Overview

7.4.2 Less than 25/25 µm: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

8. Substrate-Like PCB Market Analysis – By Inspection Technologies

8.1 Overview

8.2 Substrate-Like PCB Market Breakdown, By Inspection Technologies, 2020 & 2028

8.3 Automated Optical Inspection

8.3.1 Overview

8.3.2 Automated Optical Inspection: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Direct Imaging

8.4.1 Overview

8.4.2 Direct Imaging: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Automated Optical Shaping

8.5.1 Overview

8.5.2 Automated Optical Shaping: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

9. Substrate-Like PCB Market Analysis – By Application

9.1 Overview

9.2 Substrate-Like PCB Market Breakdown, By Application, 2020 & 2028

9.3 Consumer Electronics

9.3.1 Overview

9.3.2 Consumer Electronics: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

9.4 Automotive

9.4.1 Overview

9.4.2 Automotive: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

9.5 Medical

9.5.1 Overview

9.5.2 Medical: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

9.6 Industrial

9.6.1 Overview

9.6.2 Industrial: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10. Substrate-Like PCB Market – Geographic Analysis

10.1 APAC: Substrate-Like PCB Market

10.1.1 APAC: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.2 APAC: Substrate-Like PCB Market- By Line/Space

10.1.3 APAC: Substrate-Like PCB Market- By Inspection Technologies

10.1.4 APAC: Substrate-Like PCB Market- By Application

10.1.5 APAC: Substrate-Like PCB Market- by Key Country

10.1.5.1 Australia: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.1.1 Australia: Substrate-Like PCB Market- By Line/Space

10.1.5.1.2 Australia: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.1.3 Australia: Substrate-Like PCB Market- By Application

10.1.5.2 China: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.2.1 China: Substrate-Like PCB Market- By Line/Space

10.1.5.2.2 China: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.2.3 China: Substrate-Like PCB Market- By Application

10.1.5.3 India: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.3.1 India: Substrate-Like PCB Market- By Line/Space

10.1.5.3.2 India: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.3.3 India: Substrate-Like PCB Market- By Application

10.1.5.4 Japan: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.4.1 Japan: Substrate-Like PCB Market- By Line/Space

10.1.5.4.2 Japan: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.4.3 Japan: Substrate-Like PCB Market- By Application

10.1.5.5 South Korea: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.5.1 South Korea: Substrate-Like PCB Market- By Line/Space

10.1.5.5.2 South Korea: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.5.3 South Korea: Substrate-Like PCB Market- By Application

10.1.5.6 Vietnam: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.6.1 Vietnam: Substrate-Like PCB Market- By Line/Space

10.1.5.6.2 Vietnam: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.6.3 Vietnam: Substrate-Like PCB Market- By Application

10.1.5.7 Rest of APAC: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

10.1.5.7.1 Rest of APAC: Substrate-Like PCB Market- By Line/Space

10.1.5.7.2 Rest of APAC: Substrate-Like PCB Market- By Inspection Technologies

10.1.5.7.3 Rest of APAC: Substrate-Like PCB Market- By Application

11. Substrate Like-PCB Market- Impact Analysis of COVID-19

11.1 Asia Pacific

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Development

13. Company Profiles

13.1 Compaq Manufacturing Co., Ltd.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 DAEDUCK ELECTRONICS CO., LTD.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Ibiden Co, Ltd.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Kinsus Interconnect Technology

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 SAMSUNG ELECTRO-MECHANICS CO, Ltd

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Zhen Ding Tech. Group Technology Holding Limited

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Technologies Inc.

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Korea Circuit

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Unimicron Technology Corp.

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

LIST OF TABLES

Table 1. APAC: Substrate-Like PCB Market- By Line/Space – Revenue and Forecast to 2028 (US$ Million)

Table 2. APAC: Substrate-Like PCB Market- By Inspection Technologies – Revenue and Forecast to 2028 (US$ Million)

Table 3. APAC: Substrate-Like PCB Market- By Application – Revenue and Forecast to 2028 (US$ Million)

Table 4. Australia: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 5. Australia: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 6. Australia: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 7. China: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 8. China: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 9. China: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 10. India: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 11. India: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 12. India: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 13. Japan: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 14. Japan: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 15. Japan: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 16. South Korea: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 17. South Korea: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 18. South Korea: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 19. Vietnam: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 20. Vietnam: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 21. Vietnam: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of APAC: Substrate-Like PCB Market- By Line/Space –Revenue and Forecast to 2028 (US$ Million)

Table 23. Rest of APAC: Substrate-Like PCB Market- By Inspection Technologies –Revenue and Forecast to 2028 (US$ Million)

Table 24. Rest of APAC: Substrate-Like PCB Market- By Application –Revenue and Forecast to 2028 (US$ Million)

LIST OF FIGURES

Figure 1. Substrate-like PCB Market Segmentation

Figure 2. Asia Pacific Substrate-Like PCB Market Overview

Figure 3. Less than 25/25um Segment held the largest share in 2020

Figure 4. Vietnam held the highest share in Asia Pacific in 2020

Figure 5. Asia Pacific: PEST Analysis

Figure 6. Substrate-like PCB Market – Ecosystem Analysis

Figure 7. Expert Opinion

Figure 8. Asia Pacific Substrate-Like PCB Market: Impact Analysis of Drivers and Restraints

Figure 9. Substrate-like PCB Market – Geographic Analysis

Figure 10. Substrate-like PCB Market Revenue and Forecast to 2028 (US$ Million)

Figure 11. Substrate-Like PCB Market Revenue Breakdown, By Line/Space, 2020 & 2028 (%)

Figure 12./25 and 30/30 µm: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. Less than 25/25 µm: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. Substrate-Like PCB Market Breakdown, By Inspection Technologies, 2020 & 2028 (%)

Figure 15. Automated Optical Inspection: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Direct Imaging: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Automated Optical Shaping: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. Substrate-Like PCB Market Breakdown, By Application, 2020 & 2028 (%)

Figure 19. Consumer Electronics: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. Automotive: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Medical: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Industrial: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Others: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. APAC: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. APAC: Substrate-Like PCB Market Revenue Share, By Line/Space (2020 and 2028)

Figure 26. APAC: Substrate-Like PCB Market Revenue Share, By Inspection Technologies (2020 and 2028)

Figure 27. APAC: Substrate-Like PCB Market Revenue Share, By Application (2020 and 2028)

Figure 28. APAC: Substrate-Like PCB Market Revenue Share, By Key Country (2020 and 2028)

Figure 29. Australia: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. China: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. India: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. Japan: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. South Korea: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Vietnam: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Rest of APAC: Substrate-Like PCB Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- Compaq Manufacturing Co., Ltd.

- DAEDUCK ELECTRONICS CO., LTD.

- Ibiden Co, Ltd.

- Kinsus Interconnect Technology

- SAMSUNG ELECTRO-MECHANICS CO, Ltd

- AT & S Austria Technologie & Systemtechnik Aktiengesellschaft

- Zhen Ding Tech. Group Technology Holding Limited

- Technologies Inc.

- Korea Circuit

- Unimicron Technology Corp.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific substrate like PCB market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific substrate like PCB market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.