Asia Pacific Refrigerant Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (HCFC, HFC, HFO, Isobutane, Propane, Ammonia, Carbon Dioxide, and Others) and Application (Refrigeration Systems, Chillers, Air-Conditioning Systems, MACs, and Others)

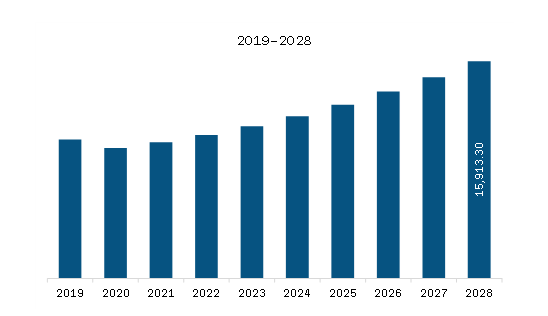

The APAC refrigerant market is expected to grow from US$ 9,954.44 million in 2021 to US$ 15,913.30 million by 2028; it is estimated to grow at a CAGR of 6.9% from 2021 to 2028.

An increase in global warming and the phase-out of fluorocarbon have led to a resurgence in demand for eco-friendly or natural refrigerants. In addition to the growing concerns about the adverse effects of fluorocarbon-based refrigerant exertions on the environment, low deployment costs, wide availability, high thermal conductivity and gas-phase density, a significant heat transfer rate, and reduced harmful effects are the key factors boosting the demand for eco-friendly refrigerants, such as ammonia and carbon dioxide. Moreover, regulations and compliance set by governing bodies mandate the discontinuation of many harmful fluorocarbon-based refrigerants in several Asia Pacific countries. Multinational companies in the field are increasingly investing in research and development to develop novel and eco-friendly offerings to ensure a sustainable business model. The mobile air conditioning directive and the F-gas regulation are the two legislative measures taken by several countries to support eco-friendly refrigerants. The mobile air conditioning directive prohibits the use of fluorinated gases in air conditioning systems. The F-gas regulation focuses on improving the leakage of fluorinated gases, avoiding the use of these gases, and using eco-friendly alternatives. Thus, the growing consumption of eco-friendly refrigerants is expected to fuel the refrigerant market growth across Asia Pacific in the coming years.

With innovative features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC refrigerant market at a significant CAGR during the forecast period.

APAC Refrigerant Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

APAC Refrigerant Market Segmentation

The APAC refrigerant market is segmented based on type, application, and country. Based on type, APAC refrigerant market is segmented into HCFC, HFC, HFO, isobutane, propane, ammonia, carbon dioxide, and others. The HFC segment dominated the market in 2020 and ammonia segment is expected to be fastest growing during forecast period. Based on application, APAC refrigerant market is segmented into refrigeration system, chillers, air-conditioning systems, MACs, and others. The refrigeration system segment dominated the market in 2020 and air-conditioning systems segment is expected to be fastest growing during forecast period. Based on country, the APAC refrigerant market has been segmented into China, India, Japan, South Korea, Australia, and rest of APAC.

AGC Inc.; AIR LIQUIDE SA; Arkema; Daikin Industries, Ltd.; Dongyue Group; Honeywell International Inc.; LINDE; Sinochem Group Co. Ltd.; and The Chemours Company are among the leading companies in the APAC refrigerant market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 APAC Refrigerant Market, by Type

1.3.2 APAC Refrigerant, by Application

1.3.3 APAC Refrigerant Market, by Country

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. APAC Refrigerant Market Landscape

4.1 Market Overview

4.2 Porter's Five Forces Analysis

4.2.1 Threat of New Entrants:

4.2.2 Threat of Substitutes:

4.2.3 Bargaining Power of Buyers:

4.2.4 Bargaining Power of Suppliers:

4.2.5 Competitive Rivalry:

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. APAC Refrigerant Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rise in Demand for Refrigeration System

5.1.2 Increase in Per-capita Income in Developing Economies

5.2 Market Restraints

5.2.1 Stringent Regulation against Fluorocarbon Refrigerants

5.3 Market Opportunities

5.3.1 Growing Consumption of Eco-friendly Refrigerants

5.4 Future Trends

5.4.1 Surging Demand for Energy-efficient Refrigerants

5.5 Impact Analysis

6. Refrigerant Market – APAC Analysis

6.1 APAC Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

7. APAC Refrigerant Market Analysis – By Type

7.1 Overview

7.2 APAC Refrigerant Market, By Type (2020 and 2028)

7.3 HCFC

7.3.1 Overview

7.3.2 HCFC: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.4 HFC

7.4.1 Overview

7.4.2 HFC: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.5 HFO:

7.5.1 Overview

7.5.2 HFO: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.6 Isobutane

7.6.1 Overview

7.6.2 Isobutane: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.7 Propane

7.7.1 Overview

7.7.2 Propane: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.8 Ammonia

7.8.1 Overview

7.8.2 Ammonia: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.9 Carbon Dioxide

7.9.1 Overview

7.9.2 Carbon Dioxide: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

7.10 Others

7.10.1 Overview

7.10.2 Others: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

8. APAC Refrigerant Market Analysis – By Application

8.1 Overview

8.2 APAC Refrigerant Market, By Application (2020 and 2028)

8.3 Refrigeration system

8.3.1 Overview

8.3.2 Refrigeration System: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

8.4 Chillers

8.4.1 Overview

8.4.2 Chillers: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

8.5 Air-conditioning System

8.5.1 Overview

8.5.2 Air-conditioning System: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

8.6 MACs

8.6.1 Overview

8.6.2 MACs: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

8.7 Others:

8.7.1 Overview

8.7.2 Others: Refrigerant Market – Revenue and Forecast to 2028 (US$ Mn)

9. APAC Refrigerant Market – Country Analysis

9.1 Overview

9.1.1 APAC: Refrigerant Market, by Key Country

9.1.1.1 Australia: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 Australia: Refrigerant Market, by Type

9.1.1.1.2 Australia: Refrigerant Market, by Application

9.1.1.2 China: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 China: Refrigerant Market, by Type

9.1.1.2.2 China: Refrigerant Market, by Application

9.1.1.3 India: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 India: Refrigerant Market, by Type

9.1.1.3.2 India: Refrigerant Market, by Application

9.1.1.4 Japan: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

9.1.1.4.1 Japan: Refrigerant Market, by Type

9.1.1.4.2 Japan: Refrigerant Market, by Application

9.1.1.5 South Korea: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

9.1.1.5.1 South Korea: Refrigerant Market, by Type

9.1.1.5.2 South Korea: Refrigerant Market, by Application

9.1.1.6 Rest of APAC: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

9.1.1.6.1 Rest of APAC: Refrigerant Market, by Type

9.1.1.6.2 Rest of APAC: Refrigerant Market, by Application

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 New Product Development

10.4 Merger and Acquisition

11. Company Profiles

11.1 The Chemours Company

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Arkema

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Honeywell International Inc.

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Dongyue Group

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 LINDE

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 AIR LIQUIDE SA

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Sinochem Group Co. Ltd.

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Daikin Industries, Ltd.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 AGC Inc.

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Glossary of Terms

LIST OF TABLES

Table 1. APAC Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. Australia Refrigerant Market, by Type– Revenue and Forecast to 2028 (USD Million)

Table 3. Australia Refrigerant Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 4. China Refrigerant Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 5. China Refrigerant Market, by Application– Revenue and Forecast to 2028 (USD Million)

Table 6. India Refrigerant Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 7. India Refrigerant Market, by Application– Revenue and Forecast to 2028 (USD Million)

Table 8. Japan Refrigerant Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 9. Japan Refrigerant Market, by Application– Revenue and Forecast to 2028 (USD Million)

Table 10. South Korea Refrigerant Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 11. South Korea Refrigerant Market, by Application– Revenue and Forecast to 2028 (USD Million)

Table 12. Rest of APAC Refrigerant Market, by Type – Revenue and Forecast to 2028 (USD Million)

Table 13. Rest of APAC Refrigerant Market, by Application– Revenue and Forecast to 2028 (USD Million)

Table 14. Glossary of Terms

LIST OF FIGURES

Figure 1. APAC Refrigerant Market Segmentation

Figure 2. APAC Refrigerant Market Segmentation – By Country

Figure 3. APAC Refrigerant Market Overview

Figure 4. APAC Refrigerant Market, By Type

Figure 5. APAC Refrigerant Market, by Country

Figure 6. Ecosystem: APAC Refrigerant Market

Figure 7. Expert Opinion

Figure 8. APAC Refrigerant Market Impact Analysis of Drivers and Restraints

Figure 9. APAC Refrigerant Market – Revenue and Forecast to 2028 (US$ Million)

Figure 10. APAC Refrigerant Market Revenue Share, By Type (2020 and 2028)

Figure 11. APAC HCFC: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 12. APAC HFC: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 13. APAC HFO: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 14. APAC Isobutane: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 15. APAC Propane: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 16. APAC Ammonia: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 17. APAC Carbon Dioxide: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 18. APAC Others: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 19. APAC Refrigerant Market Revenue Share, By Application (2020 and 2028)

Figure 20. APAC Refrigeration System: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 21. APAC Chillers: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 22. APAC Air-conditioning System: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 23. APAC MACs: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 24. APAC Others: Refrigerant Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 25. APAC: Refrigerant Market, by Key Country – Revenue (2020) (US$ Million)

Figure 26. APAC: Refrigerant Market Revenue Share, by Key Country (2020 and 2028)

Figure 27. Australia: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

Figure 28. China: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

Figure 29. India: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

Figure 30. Japan: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

Figure 31. South Korea: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

Figure 32. Rest of APAC: Refrigerant Market –Revenue and Forecast to 2028 (US$ Million)

- AGC Inc.

- AIR LIQUIDE SA

- Arkema

- Daikin Industries, Ltd.

- Dongyue Group

- Honeywell International Inc.

- LINDE

- Sinochem Group Co. Ltd.

- The Chemours Company

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the APAC refrigerant market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the APAC refrigerant market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth APAC market trends and outlook coupled with the factors driving the refrigerant market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution