Asia Pacific Recovered Carbon Black Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Application (Tire, Non-Tire Rubber, Plastics, and Others)

Market Introduction

The recovered carbon black market in Asia Pacific comprises several economies such as China, India, Japan, South Korea, Australia, and Rest of Asia Pacific. Asia Pacific (APAC) comprises Australia, China, India, Japan, South Korea, and other Asian countries. Countries such as India and China generate huge numbers of waste tires annually, which is a key factor supporting the growth of the recovered carbon black market in the region. Asia Pacific is characterized by high vehicle production, coupled with strong tire demands. The governments of China and India, among others, are focusing on encouraging the sales of electric vehicles. In India, the National Electric Mobility Mission Plan aims at accelerating the manufacturing and adoption of electric vehicles. Moreover, growing demand for non-tire rubber products is expected to propel the recovered carbon black market growth in the region. Raw material procurement and recycling are the critical activities for industries focusing on reducing the environmental effects of their operations. However, the lack of technological infrastructure required for the production of recovered carbon black limits the market growth in Asia Pacific to some extent. Rise in need for green alternatives with shift towards sustainability is the major factor driving the growth of the APAC recovered carbon black market.

The COVID-19 is anticipated to cause a significant economic loss in the Asia-Pacific. The consequence and impact can be even worse and totally depends on the spread of the virus. The Asian economies have been hit hard due to the pandemic. The emergence of new COVID-19 waves in India, Thailand and other Asian economies have prolonged the effect of pandemic upon GDP. The ongoing COVID-19 pandemic is anticipated to cause huge disruptions in the growth of various industries of Asia-Pacific. However, the uncertainty regarding the future outbreak, especially in countries such as India and few other Asian countries, has altered the status of the industry. The governments of various Asia-Pacific economies are taking possible steps to restrict the spread of the virus by announcing countrywide lockdowns, which have a direct impact upon the growth of industrial sectors. This may impact the demand for recovered carbon black. However, the market is expected to witness an increase in investment by existing players along with penetration of new players to tap the prevailing opportunities as well as cater to soaring demand in post-pandemic times.

Get more information on this report :

Market Overview and Dynamics

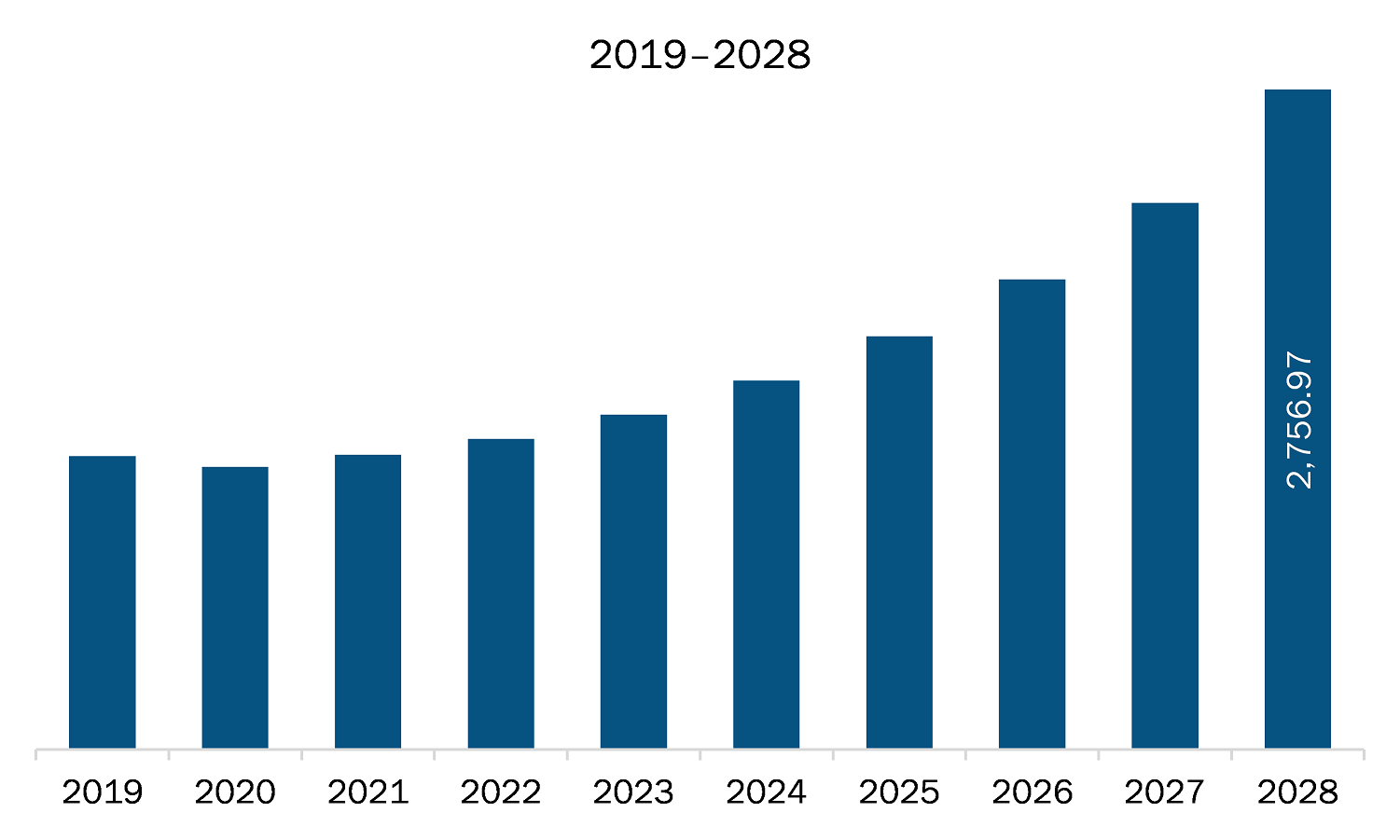

The recovered carbon black market in APAC is expected to grow from US$ 1,231.52 million in 2021 to US$ 2,756.97 million by 2028; it is estimated to grow at a CAGR of 12.2% from 2021 to 2028. Producing recovered carbon black from waste generated by rubber goods, specifically tires is an ecologically beneficial process. Moreover, the outcome is also finer than virgin carbon black, allowing for better cuts in the finished product. To produce 1 kg of virgin carbon black, ~1.5–2 kg of crude oil is required. Moreover, recovering carbon black also entails reusing valuable raw materials, propelling one higher up the recycling hierarchy. Thus, replacing virgin carbon black, produced out of traditional furnace processes, with recovered carbon black considerably reduces the carbon footprint. The use of recovered Carbon Black (rCB) alone can reduce the size of the carbon footprint by 80%, which is why many large tire manufacturers are trying to use significantly more recovered carbon black. Thus, the cost and environmental advantages associated with recovered carbon black are propelling the market growth.

Key Market Segments

Based on application, APAC recovered carbon black market is segmented into tire, non-tire rubber, plastics, and others. The tire segment dominated the market in 2020 and non-tire rubber segment is expected to be the fastest growing during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on recovered carbon black market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bolder Industries; ENRESTEC; Pyrolyx AG; Radhe Group Of Energy; Scandinavian Enviro Systems AB; and SR2O Holdings, LLC are among others.

Reasons to buy report

- To understand the APAC recovered carbon black market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC recovered carbon black market

- Efficiently plan M&A and partnership deals in APAC recovered carbon black market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC recovered carbon black market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.

APAC Recovered Carbon Black Market Segmentation

APAC Recovered Carbon Black Market –By Application

- Tire

- Non-Tire Rubber

- Plastics

- Others

APAC Recovered Carbon Black Market -By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

APAC Recovered Carbon Black Market -Company Profiles

- Bolder Industries

- ENRESTEC

- Pyrolyx AG

- Radhe Group Of Energy

- Scandinavian Enviro Systems AB

- SR2O Holdings, LLC

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

4. APAC Recovered Carbon Black Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of Substitutes

4.2.4 Threat of New Entrants

4.2.5 Intensity of Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. APAC Recovered Carbon Black Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Ecological Advantages of Recovered Carbon Black

5.1.2 Expanding Application Range of Recovered Carbon Black

5.2 Market Restraints

5.2.1 Limited Availability of Recovery Infrastructure and Increasing Production of Crude Oil

5.3 Market Opportunities

5.3.1 Rise in Need for Green Alternatives with Shift Towards Sustainability

5.4 Future Trends

5.4.1 Emphasis on Waste Tire Management

5.5 Impact Analysis

6. Recovered Carbon Black – APAC Market Analysis

6.1 APAC Recovered Carbon Black Market Overview

6.2 APAC Recovered Carbon Black Market –Revenue and Forecast to 2028 (US$ Million)

7. APAC Recovered Carbon Black Market Analysis – By Application

7.1 Overview

7.2 APAC Recovered Carbon Black Market Breakdown, by Application, 2020 & 2028

7.3 Tire

7.3.1 Overview

7.3.2 Tire: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Non-Tire Rubber

7.4.1 Overview

7.4.2 Non-Tire Rubber: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Plastics

7.5.1 Overview

7.5.2 Plastics: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

8. APAC Recovered Carbon Black Market – Country Analysis

8.1 Overview

8.1.1 Asia Pacific: Recovered Carbon Black Market, by Key Country

8.1.1.1 Australia: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.1.1 Australia: Recovered Carbon Black Market, by Application

8.1.1.2 China: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.2.1 China: Recovered Carbon Black Market, by Application

8.1.1.3 Japan: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.3.1 Japan: Recovered Carbon Black Market, by Application

8.1.1.4 India: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.4.1 India: Recovered Carbon Black Market, by Application

8.1.1.5 South Korea: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.5.1 South Korea: Recovered Carbon Black Market, by Application

8.1.1.6 Rest of Asia Pacific: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.6.1 Rest of Asia Pacific: Recovered Carbon Black Market, by Application

9. Impact of COVID-19 on APAC Recovered Carbon Black Market

9.1 Overview

10. Company Profiles

10.1 Bolder Industries

10.1.1 Key Facts

10.1.2 Business Description

10.1.3 Products and Services

10.1.4 Financial Overview

10.1.5 SWOT Analysis

10.1.6 Key Developments

10.2 ENRESTEC

10.2.1 Key Facts

10.2.2 Business Description

10.2.3 Products and Services

10.2.4 Financial Overview

10.2.5 SWOT Analysis

10.2.6 Key Developments

10.3 Klean Carbon

10.3.1 Key Facts

10.3.2 Business Description

10.3.3 Products and Services

10.3.4 Financial Overview

10.3.5 SWOT Analysis

10.3.6 Key Developments

10.4 Radhe Group Of Energy

10.4.1 Key Facts

10.4.2 Business Description

10.4.3 Products and Services

10.4.4 Financial Overview

10.4.5 SWOT Analysis

10.4.6 Key Developments

10.5 SR2O Holdings, LLC

10.5.1 Key Facts

10.5.2 Business Description

10.5.3 Products and Services

10.5.4 Financial Overview

10.5.5 SWOT Analysis

10.5.6 Key Developments

10.6 Pyrolyx AG

10.6.1 Key Facts

10.6.2 Business Description

10.6.3 Products and Services

10.6.4 Financial Overview

10.6.5 SWOT Analysis

10.6.6 Key Developments

11. Appendix

11.1 About The Insight Partners

11.2 Glossary of Terms

LIST OF TABLES

Table 1. APAC Recovered Carbon Black Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. Australia Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 3. China Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 4. Japan Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 5. India Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 6. South Korea Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 7. Rest of Asia Pacific Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 8. Glossary of Terms, Recovered Carbon Black Market

LIST OF FIGURES

Figure 1. APAC Recovered Carbon Black Market Segmentation

Figure 2. APAC Recovered Carbon Black Market Segmentation – By Country

Figure 3. APAC Recovered Carbon Black Market Overview

Figure 4. Tire Segment Held Largest Share of APAC Recovered Carbon Black Market

Figure 5. Japan Held Largest Share of APAC Recovered Carbon Black Market

Figure 6. APAC Recovered Carbon Black Market, Industry Landscape

Figure 7. Porter ‘s Five Forces Analysis for Recovered Carbon Black Market

Figure 8. Recovered Carbon Black Market– Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. APAC Recovered Carbon Black Market Impact Analysis of Drivers and Restraints

Figure 11. APAC: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. APAC Recovered Carbon Black Market Breakdown, by Application, 2020 & 2028

Figure 13. APAC Tire: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. APAC Non-Tire Rubber: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. APAC Plastics: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. APAC Others: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. Asia Pacific: Recovered Carbon Black, by Key Country-Revenue 2020 (US$ Million)

Figure 18. Asia Pacific: Recovered Carbon Black Market Revenue Share, by Key Country (2020 & 2028)

Figure 19. Australia: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 20. China: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 21. Japan: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 22. India: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 23. South Korea: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 24. Rest of Asia Pacific: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 25. Impact of COVID-19 Pandemic in Asia Pacific

- Bolder Industries

- ENRESTEC

- Pyrolyx AG

- Radhe Group Of Energy

- Scandinavian Enviro Systems AB

- SR2O Holdings, LLC

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the APAC Recovered Carbon Black market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the APAC Recovered Carbon Black market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth APAC market trends and outlook coupled with the factors driving the Recovered Carbon Black market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution