Asia Pacific High Throughput Screening Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Product and Service (Consumables, Instruments, Accessories, Software, and Services), Technology (Cell-Based Assays, Lab-On-A-Chip, Ultra-High-Throughput Screening, Bioinformatics, and Label-Free Technology), Application (Drug Discovery, Biochemical Screening, Life Sciences Research, and Other Applications), and End User (Pharmaceutical and Biotechnology Companies, Academic)

Market Introduction

High-throughput screening (HTS) is a drug discovery process that allows automated testing of large numbers of chemical and/or biological compounds for a specific biological target. High-throughput screening methods are extensively used in the pharmaceutical industry, leveraging robotics and automation to quickly test the biological or biochemical activity of many molecules, usually drugs. They accelerate target analysis, as large-scale compound libraries can quickly be screened in a cost-effective way. HTS is a useful tool for assessing for instance pharmacological targets, pharmacologically profiling agonists and antagonists for receptors (such as GPCRs) and enzymes.

Get more information on this report :

Market Overview and Dynamics

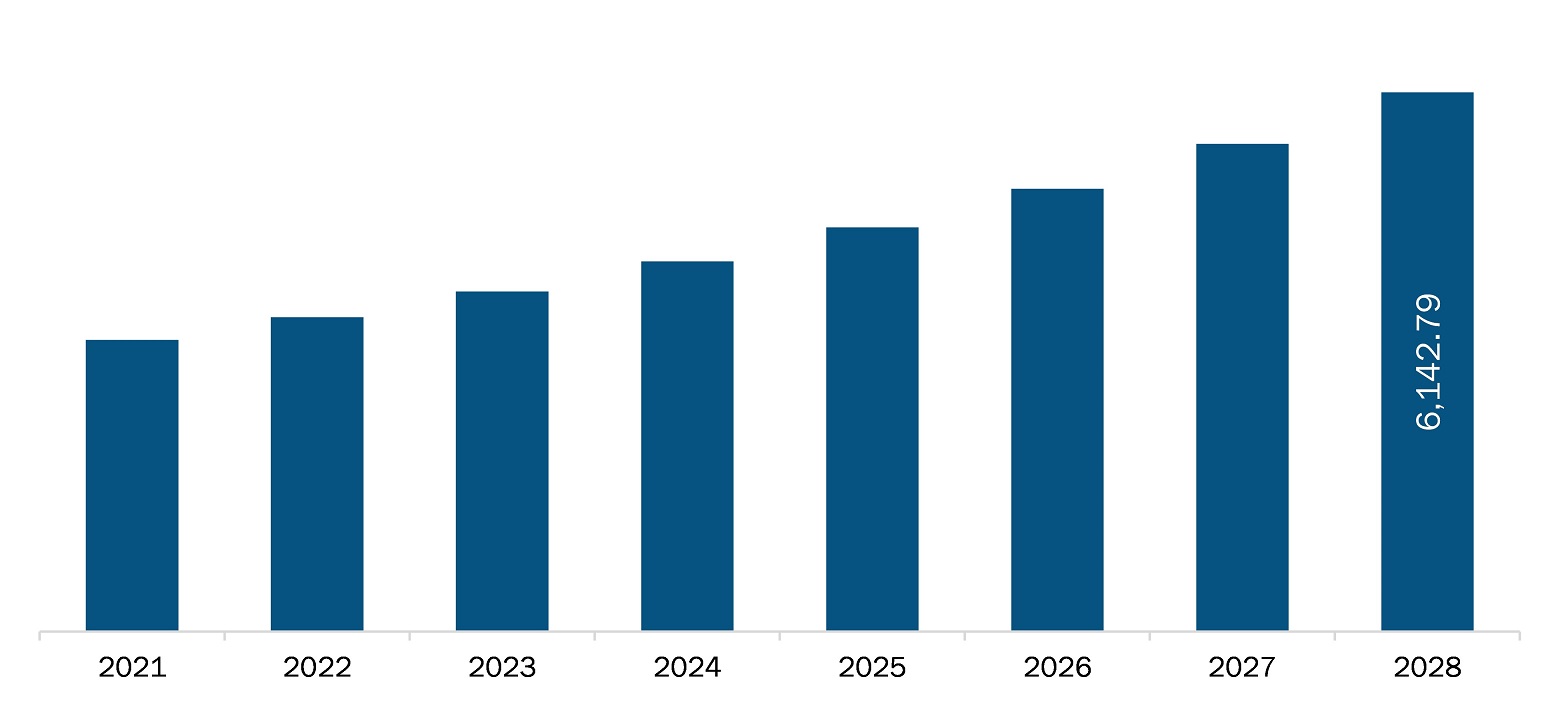

The Asia Pacific high throughput screening market is expected to reach US$ 6,142.79 million by 2028 from US$ 3,321.07 million in 2021; it is estimated to register a CAGR of 9.2% from 2021 to 2028. Driving factors such as an increase in investment in research and development by the pharmaceutical and biotechnology industry and the introduction of technologically advanced products in the high throughput screening market are driving the growth of the market. However, the lack of proper automation methods is obstructing the growth of the market.

Prime vendors have earmarked a few Asia Pacific countries that have huge potential for the drug discovery market. Research and development expenditure in countries such as China and India is growing, which has led to a rise in demand for high throughput screening (HTS) systems for conducting various genetic, chemical, and pharmacological tests that aid the drug discovery process starting from drug design to trials and interactions. Various countries in APAC are capable of adopting advanced HTS technologies; they are engaged in the development of cost-effective and high-performance systems to become advanced drug developers in the world. Governments of these emerging countries have also spent significantly on encouraging research in the life sciences industry. Moreover, the increasing interest of pharmaceutical companies in drug discovery outsourcing due to the ever-increasing demand for better drugs, limited drug pipelines, and rising R&D costs is further fueling the demand for HTS techniques in emerging markets. China and India have many contract research organizations that offer drug discovery services to serve pharmaceutical and biotechnology companies. Furthermore, the increasing incidence of various diseases in Asia Pacific has escalated the demand for novel drug discovery in the region. Governments are also enforcing regulations to encourage the use of high-throughput screening methods for various pharma and biotech companies. Furthermore, there is an increase in demand for high-throughput screening owing to the need for screening new chemical entities with more efficiency and productive optimization of drug molecules. Technological advancements in high-throughput screening techniques and the launch of innovative systems by various market players are expected to propel the market growth.

Countries in Asia Pacific are facing challenges due to increasing incidences of COVID-19 confirmed cases. However, many countries, such as South Korea, Japan, and Singapore, efficiently contained the situation through robust tracking and testing. This has increased the demand for high-throughput screening in the region. India is increasing its testing capacity to control the rising number of COVID-19 cases. New laboratories are being set up to conduct COVID-19 tests. State governments in the country are adopting various strategies to increase the testing capacity. The recent restrictions imposed by many countries in response to the recent COVID-19 outbreak have impacted ongoing clinical research. As these restrictions are now being lifted, the research activities are gaining momentum. The demand for clinical research is on the rise in Asia Pacific. Thus, the above-mentioned factors are positively impacting the market growth.

Key Market Segments

The Asia Pacific high throughput screening market, based on product and service, is subsegmented into consumables, instruments, accessories, software, and services. The consumables segment is further subsegmented into reagents, assay kits, and laboratory equipment. The instruments are further sub-divided into liquid handling systems and detection systems. In 2021, the consumables segment is expected to hold the largest share of the market and is expected to register the highest CAGR during 2021–2028.

The Asia Pacific high throughput screening market, based on technology, was subsegmented into cell-based assays, lab-on-a-chip, ultra-high-throughput screening, bioinformatics, and label-free technology. In 2021, the cell-based assays segment is expected to hold the largest share of the market; however, the lab-on-a-chip segment is expected to register the highest CAGR during the forecast period.

The Asia Pacific high throughput screening market, based on application, is subsegmented into drug discovery, biochemical screening, life sciences research, and other applications. In 2021, the drug discovery segment is expected to hold the largest share of the market and is expected to register the highest CAGR during the forecast period.

The Asia Pacific high throughput screening market, based on end user, is subsegmented into pharmaceutical and biotechnology companies, academic and government institutes, contract research organizations (CRO), and others. In 2021, the pharmaceutical and biotechnology companies segment is expected to hold the largest share of the market; however, the contract research organizations (CRO) segment is expected to register the highest CAGR during the forecast period.

Major Sources and Companies Listed

A few of the primary and secondary sources associated with this report on the Asia Pacific high throughput screening market are the University of Tokyo Edge Capital (UTEC), National Center for Biotechnology Information (NCBI) and Medical Research Future Fund (MRFF).

Reasons to buy the report

- Determine prospective investment areas based on a detailed trend analysis of Asia Pacific high throughput screening market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different addictions therapeutics segments in the top spending countries and identify the opportunities offered by each of them.

- Strengthen your knowledge of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels driving the Asia Pacific high throughput screening market, providing a clear picture of future opportunities that will help analyze, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs undertaken by the different countries within the Asia Pacific high throughput screening market.

ASIA PACIFIC HIGH THROUGHPUT SCREENING MARKET SEGMENTATION

By Product and Services

- Consumables

- Instruments

- Accessories

- Software

- Services

By Technology

- Cell-Based Assays

- Lab-On-A-Chip

- Ultra-High-Throughput Screening

- Bioinformatics

- Label-Free Technology

By Application

- Drug Discovery

- Biochemical Screening

- Life Sciences Research

- Other Applications

By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organizations (CRO)

- Others

By Country

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

Company Profiles

- Agilent Technologies, Inc.

- Axxam S.p.A

- Eurofins Scientific

- Corning Incorporated

- Molecular Devices, LLC.

- Hamilton Company

- Perkin Elmer, Inc.

- THERMO FISHER SCIENTIFIC INC.

- MERCK KGaA

- Tecan Trading AG

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Asia Pacific High Throughput Screening Market – By Product and Service

1.3.2 Asia Pacific High Throughput Screening Market – By Technology

1.3.3 Asia Pacific High Throughput Screening Market – By Application

1.3.4 Asia Pacific High Throughput Screening Market – By End User

1.3.5 Asia Pacific High Throughput Screening Market – By Country

2. High Throughput Screening Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Asia Pacific High Throughput Screening Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 Asia Pacific – PEST Analysis

4.3 Expert Opinions

5. High Throughput Screening Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increase in Investment in Research and Development by Pharmaceutical and Biotechnology Industry

5.1.2 Introduction of Technologically Advanced Products in High Throughput Screening Market

5.2 Market Restraints

5.2.1 High Cost of High Throughput Screening

5.2.2 Lack of Trained Professionals and Complexity in Assay Development

5.3 Market Opportunities

5.3.1 Growing Research and Development Activities in Emerging Economies

5.4 Future Trends

5.4.1 Use of Artificial Intelligence (AI) in High Throughput Screening (HTS)

5.5 Impact analysis

6. High Throughput Screening Market – Asia Pacific Analysis

6.1 Asia Pacific High Throughput Screening Market Revenue Forecast and Analysis

7. High Throughput Screening Market Analysis and Forecasts to 2028 – Product and Service

7.1 Overview

7.2 Asia Pacific High Throughput Screening Market Share by Product and Service 2021 & 2028 (%)

7.3 Consumables

7.3.1 Overview

7.3.2 Consumables Market Revenue and Forecast to 2028 (US$ Mn)

7.3.2.1 Reagents and Assay Kits

7.3.2.1.1 Overview

7.3.2.1.2 Reagents and Assay Kits Market Revenue and Forecast to 2028 (US$ Mn)

7.3.2.2 Laboratory Equipment

7.3.2.2.1 Overview

7.3.2.2.2 Laboratory Equipment Market Revenue and Forecast to 2028 (US$ Mn)

7.4 Instruments

7.4.1 Overview

7.4.2 Instruments Market Revenue and Forecast to 2028 (US$ Mn)

7.4.2.1 Liquid Handling Systems

7.4.2.1.1 Overview

7.4.2.1.2 Liquid Handling Systems Market Revenue and Forecast to 2028 (US$ Mn)

7.4.2.2 Detection Systems

7.4.2.2.1 Overview

7.4.2.2.2 Detection Systems Market Revenue and Forecast to 2028 (US$ Mn)

7.5 Accessories

7.5.1 Overview

7.5.2 Accessories Market Revenue and Forecast to 2028 (US$ Mn)

7.6 Software

7.6.1 Overview

7.6.2 Software Market Revenue and Forecast to 2028 (US$ Mn)

7.7 Service

7.7.1 Overview

7.7.2 Service Market Revenue and Forecast to 2028 (US$ Mn)

8. High Throughput Screening Market Analysis and Forecasts to 2028 – Technology

8.1 Overview

8.2 Asia Pacific High Throughput Screening Market Share by Technology 2021 & 2028 (%)

8.3 Cell-Based Assays

8.3.1 Overview

8.3.2 Cell-Based Assays Market Revenue and Forecast to 2028 (US$ Mn)

8.4 Lab-On-A-Chip

8.4.1 Overview

8.4.2 Lab-On-A-Chip Market Revenue and Forecast to 2028 (US$ Mn)

8.5 Ultra-High-Throughput Screening

8.5.1 Overview

8.5.2 Ultra-High-Throughput Screening Market Revenue and Forecast to 2028 (US$ Mn)

8.6 Bioinformatics

8.6.1 Overview

8.6.2 Bioinformatics Market Revenue and Forecast to 2028 (US$ Mn)

8.7 Label-Free Technology

8.7.1 Overview

8.7.2 Label-Free Technology Market Revenue and Forecast to 2028 (US$ Mn)

9. High Throughput Screening Market Analysis and Forecasts to 2028 – Application

9.1 Overview

9.2 Asia Pacific High Throughput Screening Market Share by Application 2021 & 2028 (%)

9.3 Drug Discovery

9.3.1 Overview

9.3.2 Drug Discovery Market Revenue and Forecast to 2028 (US$ Mn)

9.4 Biochemical Screening

9.4.1 Overview

9.4.2 Biochemical Screening Market Revenue and Forecast to 2028 (US$ Mn)

9.5 Life Sciences Research

9.5.1 Overview

9.5.2 Life Sciences Research Market Revenue and Forecast to 2028 (US$ Mn)

9.6 Other Applications

9.6.1 Overview

9.6.2 Others Applications Market Revenue and Forecast to 2028 (US$ Mn)

10. High Throughput Screening Market Analysis and Forecasts to 2028 – End User

10.1 Overview

10.2 Asia Pacific High Throughput Screening Market Share by End User 2021 & 2028 (%)

10.3 Pharmaceutical and Biotechnology Companies

10.3.1 Overview

10.3.2 Pharmaceutical and Biotechnology Companies Market Revenue and Forecast to 2028 (US$ Mn)

10.4 Contract Research Organization

10.4.1 Overview

10.4.2 Contract Research Organization Market Revenue and Forecast to 2028 (US$ Mn)

10.5 Academic and Government Institutes

10.5.1 Overview

10.5.2 Academic and Government Institutes Market Revenue and Forecast to 2028 (US$ Mn)

10.6 Others

10.6.1 Overview

10.6.2 Others Market Revenue and Forecast to 2028 (US$ Mn)

11. High Throughput Screening Market – Asia Pacific Analysis

11.1 Asia Pacific: High Throughput Screening (HTS) Market

11.1.1 Overview

11.1.2 Asia Pacific: High Throughput Screening (HTS) Market, by Country, 2021 & 2028 (%)

11.1.2.1 China: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.1.1 China: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.1.2 China: High Throughput Screening (HTS) Market, By Product and Service, 2019–2028 (USD Million)

11.1.2.1.2.1 China: High Throughput Screening (HTS) Market, by Consumables, 2019–2028 (USD Million)

11.1.2.1.2.2 China: High Throughput Screening (HTS) Market, by Instruments, 2019–2028 (USD Million)

11.1.2.1.3 China: High Throughput Screening (HTS) Market, by Technology, 2019–2028 (USD Million)

11.1.2.1.4 China: High Throughput Screening (HTS) Market, by Application, 2019–2028 (USD Million)

11.1.2.1.5 China: High Throughput Screening (HTS) Market, by End User, 2019–2028 (USD Million)

11.1.2.2 Japan: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.2.1 Japan: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.2.2 Japan: High Throughput Screening (HTS) Market, By Product and Service, 2019–2028 (USD Million)

11.1.2.2.2.1 Japan: High Throughput Screening (HTS) Market, by Consumables, 2019–2028 (USD Million)

11.1.2.2.2.2 Japan: High Throughput Screening (HTS) Market, by Instruments, 2019–2028 (USD Million)

11.1.2.2.3 Japan: High Throughput Screening (HTS) Market, by Technology, 2019–2028 (USD Million)

11.1.2.2.4 Japan: High Throughput Screening (HTS) Market, by Application, 2019–2028 (USD Million)

11.1.2.2.5 Japan: High Throughput Screening (HTS) Market, by End User, 2019–2028 (USD Million)

11.1.2.3 India: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.3.1 India: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.3.2 India: High Throughput Screening (HTS) Market, By Product and Service, 2019–2028 (USD Million)

11.1.2.3.2.1 India: High Throughput Screening (HTS) Market, by Consumables, 2019–2028 (USD Million)

11.1.2.3.2.2 India: High Throughput Screening (HTS) Market, by Instruments, 2019–2028 (USD Million)

11.1.2.3.3 India: High Throughput Screening (HTS) Market, by Technology, 2019–2028 (USD Million)

11.1.2.3.4 India: High Throughput Screening (HTS) Market, by Application, 2019–2028 (USD Million)

11.1.2.3.5 India: High Throughput Screening (HTS) Market, by End User, 2019–2028 (USD Million)

11.1.2.4 Australia: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.4.1 Australia: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.4.2 Australia: High Throughput Screening (HTS) Market, By Product and Service, 2019–2028 (USD Million)

11.1.2.4.2.1 Australia: High Throughput Screening (HTS) Market, by Consumables, 2019–2028 (USD Million)

11.1.2.4.2.2 Australia: High Throughput Screening (HTS) Market, by Instruments, 2019–2028 (USD Million)

11.1.2.4.3 Australia: High Throughput Screening (HTS) Market, by Technology, 2019–2028 (USD Million)

11.1.2.4.4 Australia: High Throughput Screening (HTS) Market, by Application, 2019–2028 (USD Million)

11.1.2.4.5 Australia: High Throughput Screening (HTS) Market, by End User, 2019–2028 (USD Million)

11.1.2.5 South Korea: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.5.1 South Korea: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.5.2 South Korea: High Throughput Screening (HTS) Market, By Product and Service, 2019–2028 (USD Million)

11.1.2.5.2.1 South Korea: High Throughput Screening (HTS) Market, by Consumables, 2019–2028 (USD Million)

11.1.2.5.2.2 South Korea: High Throughput Screening (HTS) Market, by Instruments, 2019–2028 (USD Million)

11.1.2.5.3 South Korea: High Throughput Screening (HTS) Market, by Technology, 2019–2028 (USD Million)

11.1.2.5.4 South Korea: High Throughput Screening (HTS) Market, by Application, 2019–2028 (USD Million)

11.1.2.5.5 South Korea: High Throughput Screening (HTS) Market, by End User, 2019–2028 (USD Million)

11.1.2.6 Rest of Asia Pacific: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.6.1 Rest of Asia Pacific: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

11.1.2.6.2 Rest of Asia Pacific: High Throughput Screening (HTS) Market, By Product and Service, 2019–2028 (USD Million)

11.1.2.6.2.1 Rest of Asia Pacific: High Throughput Screening (HTS) Market, by Consumables, 2019–2028 (USD Million)

11.1.2.6.2.2 Rest of Asia Pacific: High Throughput Screening (HTS) Market, by Instruments, 2019–2028 (USD Million)

11.1.2.6.3 Rest of Asia Pacific: High Throughput Screening (HTS) Market, by Technology, 2019–2028 (USD Million)

11.1.2.6.4 Rest of Asia Pacific: High Throughput Screening (HTS) Market, by Application, 2019–2028 (USD Million)

11.1.2.6.5 Rest of Asia Pacific: High Throughput Screening (HTS) Market, by End User, 2019–2028 (USD Million)

12. Impact of COVID-19 Pandemic on Asia Pacific High Throughput Screening Market

12.1 Asia Pacific: Impact Assessment of COVID-19 Pandemic

13. Industry Landscape

13.1 Overview

13.2 Organic Developments

13.2.1 Overview

13.3 Inorganic Developments

13.3.1 Overview

14. Company Profiles

14.1 Agilent Technologies, Inc.

14.1.1 Key Facts

14.1.2 Business Description

14.1.3 Products and Services

14.1.4 Financial Overview

14.1.5 SWOT Analysis

14.1.6 Key Developments

14.2 Axxam S.p.A

14.2.1 Key Facts

14.2.2 Business Description

14.2.3 Products and Services

14.2.4 Financial Overview

14.2.5 SWOT Analysis

14.2.6 Key Developments

14.3 Eurofins Scientific

14.3.1 Key Facts

14.3.2 Business Description

14.3.3 Products and Services

14.3.4 Financial Overview

14.3.5 SWOT Analysis

14.3.6 Key Developments

14.4 Corning Incorporated

14.4.1 Key Facts

14.4.2 Business Description

14.4.3 Products and Services

14.4.4 Financial Overview

14.4.5 SWOT Analysis

14.4.6 Key Developments

14.5 Molecular Devices, LLC.

14.5.1 Key Facts

14.5.2 Business Description

14.5.3 Products and Services

14.5.4 Financial Overview

14.5.5 SWOT Analysis

14.5.6 Key Developments

14.6 Hamilton Company

14.6.1 Key Facts

14.6.2 Business Description

14.6.3 Products and Services

14.6.4 Financial Overview

14.6.5 SWOT Analysis

14.6.6 Key Developments

14.7 Perkin Elmer, Inc.

14.7.1 Key Facts

14.7.2 Business Description

14.7.3 Products and Services

14.7.4 Financial Overview

14.7.5 SWOT Analysis

14.7.6 Key Developments

14.8 THERMO FISHER SCIENTIFIC INC.

14.8.1 Key Facts

14.8.2 Business Description

14.8.3 Products and Services

14.8.4 Financial Overview

14.8.5 SWOT Analysis

14.8.6 Key Developments

14.9 MERCK KGaA

14.9.1 Key Facts

14.9.2 Business Description

14.9.3 Products and Services

14.9.4 Financial Overview

14.9.5 SWOT Analysis

14.9.6 Key Developments

14.10 Tecan Trading AG

14.10.1 Key Facts

14.10.2 Business Description

14.10.3 Products and Services

14.10.4 Financial Overview

14.10.5 SWOT Analysis

14.10.6 Key Developments

15. Appendix

15.1 About the Insight Partners

15.2 Glossary of Terms

LIST OF TABLES

Table 1. China: High Throughput Screening (HTS) Market, By Product and Service – Revenue and Forecast to 2028 (USD Million)

Table 2. China High Throughput Screening (HTS) Market, by Consumables – Revenue and Forecast to 2028 (USD Million)

Table 3. China High Throughput Screening (HTS) Market, by Instruments – Revenue and Forecast to 2028 (USD Million)

Table 4. China High Throughput Screening (HTS) Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 5. China High Throughput Screening (HTS) Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 6. China High Throughput Screening (HTS) Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 7. Japan: High Throughput Screening (HTS) Market, By Product and Service– Revenue and Forecast to 2028 (USD Million)

Table 8. Japan High Throughput Screening (HTS) Market, by Consumables – Revenue and Forecast to 2028 (USD Million)

Table 9. Japan High Throughput Screening (HTS) Market, by Instruments – Revenue and Forecast to 2028 (USD Million)

Table 10. Japan High Throughput Screening (HTS) Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 11. Japan High Throughput Screening (HTS) Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 12. Japan High Throughput Screening (HTS) Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 13. India: High Throughput Screening (HTS) Market, By Product and Service– Revenue and Forecast to 2028 (USD Million)

Table 14. India High Throughput Screening (HTS) Market, by Consumables – Revenue and Forecast to 2028 (USD Million)

Table 15. India High Throughput Screening (HTS) Market, by Instruments – Revenue and Forecast to 2028 (USD Million)

Table 16. India High Throughput Screening (HTS) Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 17. India High Throughput Screening (HTS) Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 18. India High Throughput Screening (HTS) Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 19. Australia: High Throughput Screening (HTS) Market, By Product and Service – Revenue and Forecast to 2028 (USD Million)

Table 20. Australia High Throughput Screening (HTS) Market, by Consumables – Revenue and Forecast to 2028 (USD Million)

Table 21. Australia High Throughput Screening (HTS) Market, by Instruments – Revenue and Forecast to 2028 (USD Million)

Table 22. Australia High Throughput Screening (HTS) Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 23. Australia High Throughput Screening (HTS) Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 24. Australia High Throughput Screening (HTS) Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 25. South Korea: High Throughput Screening (HTS) Market, By Product and Service – Revenue and Forecast to 2028 (USD Million)

Table 26. South Korea High Throughput Screening (HTS) Market, by Consumables – Revenue and Forecast to 2028 (USD Million)

Table 27. South Korea High Throughput Screening (HTS) Market, by Instruments – Revenue and Forecast to 2028 (USD Million)

Table 28. South Korea High Throughput Screening (HTS) Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 29. South Korea High Throughput Screening (HTS) Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 30. South Korea High Throughput Screening (HTS) Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 31. Rest of Asia Pacific: High Throughput Screening (HTS) Market, By Product and Service – Revenue and Forecast to 2028 (USD Million)

Table 32. Rest of Asia Pacific High Throughput Screening (HTS) Market, by Consumables – Revenue and Forecast to 2028 (USD Million)

Table 33. Rest of Asia Pacific High Throughput Screening (HTS) Market, by Instruments – Revenue and Forecast to 2028 (USD Million)

Table 34. Rest of Asia Pacific High Throughput Screening (HTS) Market, by Technology – Revenue and Forecast to 2028 (USD Million)

Table 35. Rest of Asia Pacific High Throughput Screening (HTS) Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 36. Rest of Asia Pacific High Throughput Screening (HTS) Market, by End User– Revenue and Forecast to 2028 (USD Million)

Table 37. Organic Developments Done By Companies

Table 38. Inorganic Developments Done By Companies

Table 39. Glossary of Terms, High Throughput Screening Market

LIST OF FIGURES

Figure 1. High Throughput Screening Market Segmentation

Figure 2. High Throughput Screening Market Segmentation, By Country

Figure 3. High Throughput Screening Market Overview

Figure 4. Consumables Segment Held Largest Share of High Throughput Screening Market

Figure 5. Asia Pacific High Throughput Screening Market – Leading Country Markets (US$ Million)

Figure 6. Asia Pacific PEST Analysis

Figure 7. High Throughput Screening Market Impact Analysis of Driver and Restraints

Figure 8. Asia Pacific High Throughput Screening Market – Revenue Forecast and Analysis – 2020- 2028

Figure 9. Asia Pacific High Throughput Screening Market Share by Product and Service 2021 & 2028 (%)

Figure 10. Consumables Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 11. Reagents and Assay Kits Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 12. Laboratory Equipment Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 13. Instruments Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 14. Liquid Handling Systems Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 15. Detection Systems Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 16. Accessories Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 17. Software Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 18. Service Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 19. Asia Pacific High Throughput Screening Market Share by Technology 2021 & 2028 (%)

Figure 20. Cell-Based Assays Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 21. Lab-On-A-Chip Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 22. Ultra-High-Throughput Screening Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 23. Bioinformatics Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 24. Label-Free Technology Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 25. Asia Pacific High Throughput Screening Market Share by Application 2021 & 2028 (%)

Figure 26. Drug Discovery Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 27. Biochemical Screening Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 28. Life Sciences Research Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 29. Others Applications Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 30. Asia Pacific High Throughput Screening Market Share by End User 2021 & 2028 (%)

Figure 31. Pharmaceutical and Biotechnology Companies Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 32. Contract Research Organization Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 33. Academic and Government Institutes Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 34. Others Market Revenue and Forecasts to 2028 (US$ Mn)

Figure 35. Asia Pacific: High Throughput Screening (HTS) Market, by Key Country – Revenue (2021) (USD Million)

Figure 36. Asia Pacific: High Throughput Screening (HTS) Market, by Country, 2021 & 2028 (%)

Figure 37. China: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

Figure 38. Japan: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

Figure 39. India: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

Figure 40. Australia: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million

Figure 41. South Korea: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

Figure 42. Rest of Asia Pacific: High Throughput Screening (HTS) Market – Revenue and Forecast to 2028 (USD Million)

Figure 43. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

- Agilent Technologies, Inc.

- Axxam S.p.A

- Eurofins Scientific

- Corning Incorporated

- Molecular Devices, LLC.

- Hamilton Company

- Perkin Elmer, Inc.

- THERMO FISHER SCIENTIFIC INC.

- MERCK KGaA

- Tecan Trading AG

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Asia Pacific high throughput screening market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific high throughput screening market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.