Asia Pacific General Aviation Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Avionics, Airframe, Landing Gears, Engine, and Others), and Aircraft (Fixed Wing and Rotary Wing)

Market Introduction

All non-scheduled flights, including aircraft that are not operated by the military or commercial airlines, are categorized under general aviation. General aviation is opted for a weekend visit to the desired destination, overnight package delivery, emergency medical evacuation, crop dusting, inspection trips to remote construction sites, etc.

Market Overview and Dynamics

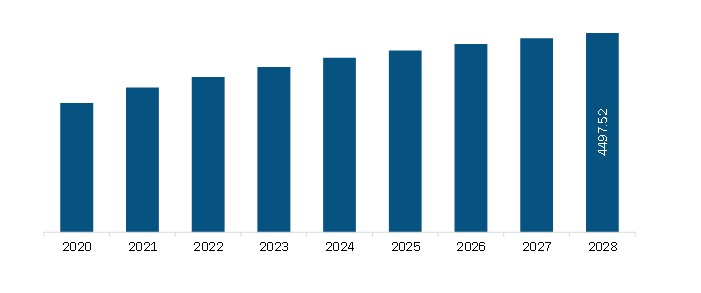

The Asia Pacific general aviation market is expected to reach US$ 4,497.52 million by 2028 from US$ 2,977.89 million in 2021; it is estimated to grow at a CAGR of 6.1% from 2021 to 2028. Factors such as surge in demand for business jets and rise in demand for electrification and overhaul services for existing fleet propel the growth of the general aviation market. However, the predicted onset of the third wave of COVID-19 outbreak by research organizations across Asia Pacific may hamper the market growth.

The popularity and adoption of business jets are expected to increase in the next decade due to the inclusion of new models in the service. In Asia Pacific, countries such as China, Japan, and South Korea together account for more than two-thirds of the regional demand for business jets and helicopters each year. In addition, the demand for business jets, particularly for the large and medium-size jets, is on the rise in Southeast Asia. Gulfstream, Bombardier, and Textron are among the major sellers of business jets in Asia-Pacific. Despite a dip in the sales volumes in the last two years, business jet manufacturers are considering China and India as lucrative markets. Charter flight activities experienced a significant growth in the first half of 2020 due to the travel restrictions enacted by various governments upon the onset of COVID-19 outbreak. Despite these favorable conditions, private buyers were reluctant to buy new jets in that year, which resulted in the limited number of orders in 2020. However, the demand for business jets is expected to increase in the coming years due to the persistent surge in charter activities and business travel in the region. For instance, in the first quarter of 2021, Embraer delivered Phenom 100EV to an undisclosed Australian customer. Further, with the increasing demand from end users, the aircraft OEMs are expanding their customer support and service capabilities, which would contribute to the general aviation market growth during the forecast period. The newly growing interest in aviation electrification is attracting contributions from the manufacturers of aircraft, energy supply equipment, and battery storage. Most of the vendors in the aircraft industry are focusing on the development of advanced electric systems meant for deployments in different aircraft assemblies. With the rapidly growing aviation industry from the past few years, the demand for aircraft overhaul services is also increasing. Emerging economies in APAC are highly focused on extending overhaul services to general aviation aircraft and helicopters. Economic growth, increasing air passenger count, and growing aviation infrastructure spending in APAC countries are among the major factors driving the sales of aircraft overhaul services. A general aviation aircraft engine has a lifespan of ~10–12 years, after which it requires the replacement or overhauling of the whole system, along with its periodic maintenance. Similarly, other components, such as airframe, avionics, and landing gears, need periodic maintenance for efficient flight operations. Thus, the growing focus on electrification of aircraft components and deployment of electronic systems, and escalating demand for periodic maintenance and overhaul services are among the major trends in the general aviation market.

The COVID-19 pandemic has disrupted the APAC’s economy and the region’s aerospace market and changed the customer attitude toward the sector. The region has witnessed a significant decline in the air transportation. As per IATA estimates, Asia-Pacific airlines recorded a revenue decline of US$ 113 billion in 2020 compared to 2019. The reduction in air travel demand, and border restrictions have resulted in the grounding of aircraft at an unprecedented scale. From aircraft manufacturing and assembly viewpoint, China is one of the leading aerospace manufacturing countries in the region and has been one of APAC's most affected countries during Q1 and Q2 of 2020. Therefore, the manufacturing facilities are witnessing severe conditions in general aviation aircraft and component manufacturing facilities. Airbus and Boeing manufacturing facilities in China were shut down for a longer period, which resulted in substantial lesser demand for various components and systems, such as wheels and brakes. Similarly, China’s indigenous aircraft manufacturer COMAC also halted its production of C919 during Q1 of 2020, which hindered the general aviation market. However, the aviation authorities, airlines, and aircraft manufacturers foresee a strong growth in APAC aviation industry. Owing to this, several airlines are ordering and taking deliveries of newer aircraft models. This is expected to drive the demand for general aviation aircraft components among business jets and helicopter manufacturing facilities along with turboprop aircraft manufacturers.

Key Market Segments

Based on component, Asia Pacific the general aviation market is segmented into avionics, airframe, landing gears, engines, and others. The engine segment led the general aviation market with a larger market share of in 2020 and the same segment is estimated to register the higher CAGR in the market during the forecast period.

Based on aircraft type, the Asia Pacific general aviation market is segmented into fixed wing and rotary wing. The fixed wing segment led the general aviation market with a larger market share in 2020. Further, the same segment is expected to witness fastest CAGR during 2021 to 2028.

Major Sources and Companies Listed

A few of the market players associated with this report on the Asia Pacific general aviation market are the Leonardo S.p.A., Boeing and Airbus.

Reasons to buy the report

- Determine prospective investment areas based on a detailed trend analysis of Asia Pacific general aviation market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different addictions therapeutics segments in the top spending countries and identify the opportunities offered by each of them

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

3.4 Data Sources:

4. General Aviation Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

5. General Aviation – Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Demand for Charter Aviation

5.1.2 Surge in Demand for Business Jets

5.2 Market Restraints

5.2.1 Uncertainty in Orders

5.3 Market Opportunities

5.3.1 Introduction of Electric Aircraft

5.4 Future Trends

5.4.1 Demand for Electrification and Overhaul Services for Existing Fleet

5.5 Impact Analysis of Drivers and Restraints

6. General Aviation Market –Asia Pacific Market Analysis

6.1 Global General Aviation Market Overview

6.2 Asia Pacific General Aviation Market Revenue Forecast and Analysis

7. General Aviation Market Analysis – By Component

7.1 Overview

7.2 General Aviation Market, By Component (2020 and 2028)

7.3 Avionics

7.3.1 Overview

7.3.2 Avionics: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.4 Airframe

7.4.1 Overview

7.4.2 Airframe: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.5 Landing Gears

7.5.1 Overview

7.5.2 Landing Gears: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.6 Engines

7.6.1 Overview

7.6.2 Engines: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.6.2.1 Piston Engine

7.6.2.1.1 Overview

7.6.2.1.2 Piston Engine: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.6.2.2 Turboprop

7.6.2.2.1 Overview

7.6.2.2.2 Turboprop: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.6.2.3 Turbofan

7.6.2.3.1 Overview

7.6.2.3.2 Turbofan: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.6.2.4 Turboshaft

7.6.2.4.1 Overview

7.6.2.4.2 Turboshaft: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

7.7 Others

7.7.1 Overview

7.7.2 Others: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

8. General Aviation Market Analysis – By Aircraft Type

8.1 Overview

8.2 General Aviation Market, By Aircraft Type (2020 and 2028)

8.3 Fixed Wing

8.3.1 Overview

8.3.2 Fixed Wing: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

8.4 Rotary Wing

8.4.1 Overview

8.4.2 Rotary Wing: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

9. General Aviation Market – Asia Pacific Analysis

9.1 Asia Pacific: General Aviation Market

9.1.1 Asia Pacific: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2 Asia Pacific: General Aviation Market, by Component

9.1.2.1 Asia Pacific: General Aviation Market, by Component

9.1.3 Asia Pacific: General Aviation Market, by Aircraft Type

9.1.4 Asia Pacific: General Aviation Market, by Key Country

9.1.4.1 Australia: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.1.1 Australia: General Aviation Market, by Component

9.1.4.1.1.1 Australia: General Aviation Market, by Engine

9.1.4.1.2 Australia: General Aviation Market, by Aircraft Type

9.1.4.2 China: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.2.1 China: General Aviation Market, by Component

9.1.4.2.1.1 China: General Aviation Market, by Engine

9.1.4.2.2 China: General Aviation Market, by Aircraft Type

9.1.4.3 India: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.3.1 India: General Aviation Market, by Component

9.1.4.3.1.1 India: General Aviation Market, by Engine

9.1.4.3.2 India: General Aviation Market, by Aircraft Type

9.1.4.4 Japan: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.4.1 Japan: General Aviation Market, by Component

9.1.4.4.1.1 Japan: General Aviation Market, by Engine

9.1.4.4.2 Japan: General Aviation Market, by Aircraft Type

9.1.4.5 South Korea: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.5.1 South Korea: General Aviation Market, by Component

9.1.4.5.1.1 South Korea: General Aviation Market, by Engine

9.1.4.5.2 South Korea: General Aviation Market, by Aircraft Type

9.1.4.6 Rest of APAC: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

9.1.4.6.1 Rest of APAC: General Aviation Market, by Component

9.1.4.6.1.1 Rest of APAC: General Aviation Market, by Engine

9.1.4.6.2 Rest of APAC: General Aviation Market, by Aircraft Type

10. General Aviation Market - COVID-19 Impact Analysis

10.1.1 Asia Pacific: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

11.1 Market Initiative

11.2 Merger and Acquisition

11.3 New Development

12. Company Profiles

12.1 Airbus

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Boeing

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Leonardo S.p.A.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Saab AB

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Dassault Aviation

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 PILATUS AIRCRAFT LTD

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Textron Inc.

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Bombardier

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Gulfstream Aerospace Corporation

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Embraer

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. Asia Pacific: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 2. Asia Pacific: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 3. Asia Pacific: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. Asia Pacific: General Aviation Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 5. Australia: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 6. Australia: General Aviation Market, by Engine – Revenue and Forecast to 2028 (US$ Million)

Table 7. Australia: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 8. China: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 9. China: General Aviation Market, by Engine – Revenue and Forecast to 2028 (US$ Million)

Table 10. China: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 11. India: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 12. India: General Aviation Market, by Engine – Revenue and Forecast to 2028 (US$ Million)

Table 13. India: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 14. Japan: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 15. Japan: General Aviation Market, by Engine – Revenue and Forecast to 2028 (US$ Million)

Table 16. Japan: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 17. South Korea: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 18. South Korea: General Aviation Market, by Engine – Revenue and Forecast to 2028 (US$ Million)

Table 19. South Korea: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 20. Rest of APAC: General Aviation Market, by Component – Revenue and Forecast to 2028 (US$ Million)

Table 21. Rest of APAC: General Aviation Market, by Engine – Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of APAC: General Aviation Market, by Aircraft Type – Revenue and Forecast to 2028 (US$ Million)

Table 23. List of Abbreviation

LIST OF FIGURES

Figure 1. General Aviation Market Segmentation

Figure 2. General Aviation Market Segmentation – By Country

Figure 3. Asia Pacific General Aviation Market Overview

Figure 4. General Aviation Market, by Component

Figure 5. General Aviation Market, by Aircraft Type

Figure 6. General Aviation Market, By Country

Figure 7. General Aviation Market– Porter’s Analysis

Figure 8. Ecosystem Analysis

Figure 9. General Aviation Market: Impact Analysis of Drivers and Restraints

Figure 10. Asia Pacific General Aviation Market Revenue Forecast and Analysis (US$ Million)

Figure 11. General Aviation Market Revenue Share, by Component (2020 and 2028)

Figure 12. Avionics: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 13. Airframe: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 14. Landing Gears: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 15. Engines: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 16. Piston Engine: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 17. Turboprop: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 18. Turbofan: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 19. Turboshaft: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 20. Others: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 21. General Aviation Market Revenue Share, by Aircraft Type (2020 and 2028)

Figure 22. Fixed Wing: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 23. Rotary Wing: General Aviation Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 24. Asia Pacific: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 25. Asia Pacific: General Aviation Market Revenue Share, by Component (2020 & 2028)

Figure 26. Asia Pacific: General Aviation Market Revenue Share, by Aircraft Type (2020 & 2028)

Figure 27. Asia Pacific: General Aviation Market Revenue Share, by Key Country (2020 & 2028)

Figure 28. Australia: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. China: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. India: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. Japan: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. South Korea: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. Rest of APAC: General Aviation Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. Impact of COVID-19 Pandemic in APAC Country Markets

CONTACT US

If you have any queries about this report or would like further information, please contact us:

North America: +1 646 491 9876

Asia Pacific: +91 20 6727 8686

Email: sales@theinsightpartners.com

DISCLAIMER

All Rights Reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publisher, “The Insight Partners”.

- Airbus

- Boeing

- Leonardo S.p.A.

- Saab AB

- Dassault Aviation

- PILATUS AIRCRAFT LTD

- Textron Inc.

- Bombardier

- Gulfstream Aerospace Corporation

- Embraer

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Asia Pacific general aviation market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific general aviation market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.