Asia-Pacific Carbide Tools Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Tool Type (End Mills, Tipped Bores, Burrs, Drills, Cutters, and Other Tools), Configuration (Hand-Based and Machine-Based), and End-User (Automotive and Transportation, Metal Fabrication, Construction, Oil and Gas, Heavy Machinery, and Other End-user)

Market Introduction

The huge population in the region has led to high demand for residential and commercial construction activities. APAC comprises several developing economies such as China and India, as well as many Southeast Asian countries, which generate robust demands for infrastructure projects. The rising population of these countries is the main driver for the region's construction industry. Further, governments of various economies are taking several measures to attract private investments in construction and infrastructure development. For instance, the 2011–2020 Economic Transformation Program (ETP) by the Malaysian government attracts huge FDIs in the country's infrastructure and construction activities. Therefore, the increasing construction sector across the region demands the application of carbide tools in the specific cutting tools for the foundation and piloting machines. Furthermore, government initiatives, rapid technological developments, and digitalization of economies are among other factors propelling the region's overall economic growth, which is driving it from a developing phase to a developed phase. Moreover, the increase in demand for high-speed cutting tools in the manufacturing industries has also been adding to the growth in revenue of the carbide tools market. Due to the carbide tools, the manufacturing industries are highly inclined to use them in varied applications. Surging demand for enhanced carbide cutting tools and growing demand in various industries are the major factor driving the growth of the APAC carbide tools market.

In case of COVID-19, APAC is highly affected specially India. China and India are the most prominent manufacturing hub in the region and have an enhanced focus on industrialization. The growth of the manufacturing industry has been hampered due to lockdown but soon expected to recover the development by enhancing the production capabilities in the second half of the year 2021. The demand for advanced electronics such as a healthcare machines has risen significantly. Also, companies in the Asian region have restructured their capabilities by adopting various strategies such as automation, partnership, and acquisition. The lockdown has been having a severe impact on the automotive sector across the region. China is responsible for more than 80% of the global auto supply chain. Hubei, for example, is one of China's four main car production centers, with over 100 automotive suppliers. Hubei's automotive plants were closed until March 11 and are now slowly reopening. However, China has been able to stabilize its spread of COVID-19, and industries are up and running. This embarks a positive sign towards the stabilization of the carbide tools market.

Get more information on this report :

Market Overview and Dynamics

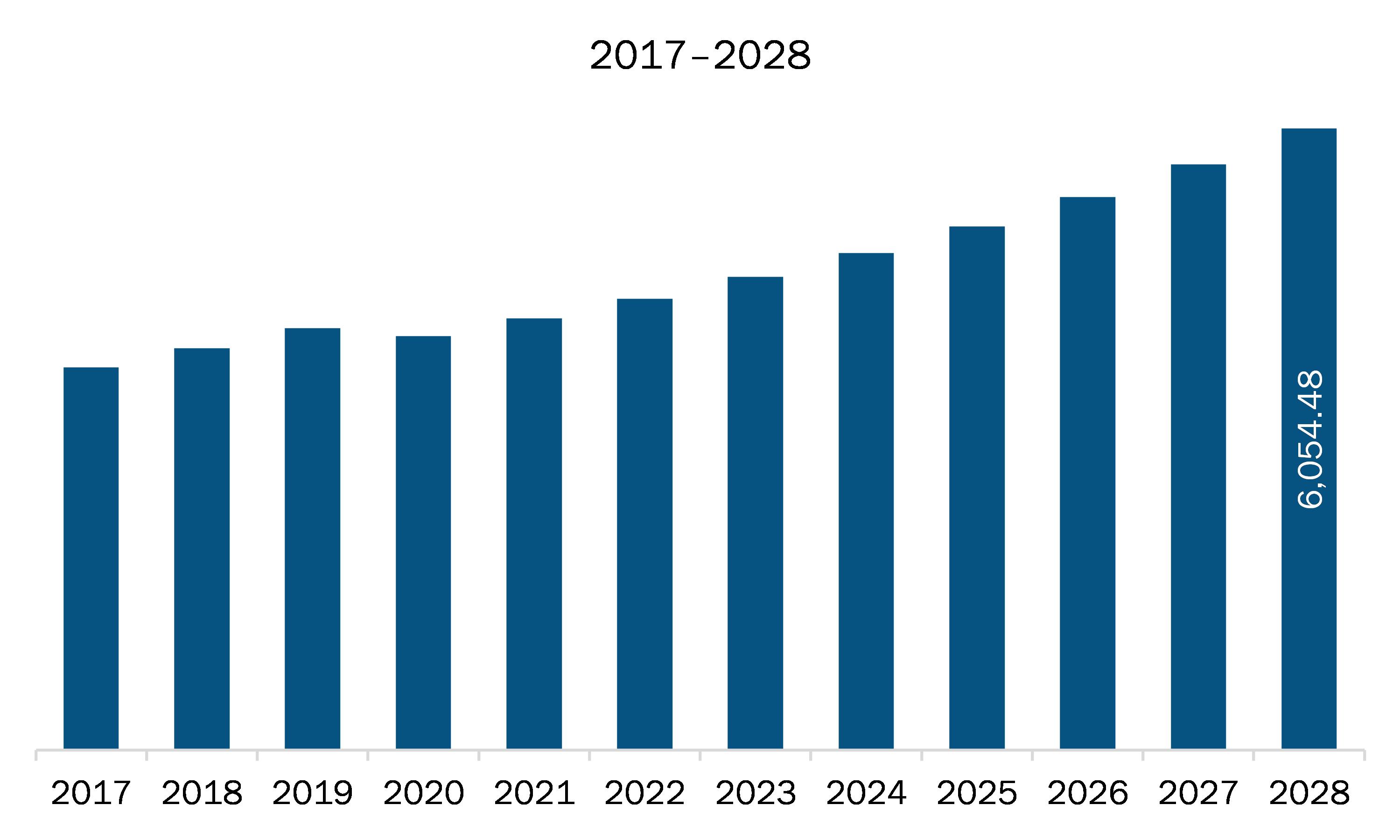

The APAC carbide tools market is expected to grow from US$ 4,205.41 million in 2021 to US$ 6,054.48 million by 2028; it is estimated to grow at a CAGR of 5.3 % from 2021 to 2028. Refined performance of carbide tools than their counterparts is expected to surge the APAC carbide tools market. Carbide tools retain their cutting-edge hardness at high machining temperatures generated by high cutting speeds and feeds that reduce machining cycle time. These tools confer improved surface finish and hold size with better quality for prolonged periods. Along with this, carbide tools last longer due to the carbide chip forming surface resists wear as the chip flows over the tools. This reduces the need for costly changes with increased scrap and rework. Further, carbide tools are used when machining highly abrasive materials. The carbide is also known as tungsten carbide as it comprises half part tungsten and half part carbide. The substance features stiffness thrice that of steel and is commonly used on other types of wood-cutting tools as well. Carbide-tipped wood cutting tools higher cutting speed than standard steel-based woodworking tools. Thus, the better performance capabilities of carbide tools than their counterparts are propelling the growth of the APAC carbide tools market.

Key Market Segments

In terms of tool type, the end mills segment accounted for the largest share of the APAC carbide tools market in 2020. In terms of configuration, the machine-based segment held a larger market share of the APAC carbide tools market in 2020. Further, the automotive and transportation segment held a larger share of the APAC carbide tools market based on end-user in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the APAC carbide tools market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CERATIZIT S.A.; DIMAR GROUP; KYOCERA Precision Tools; Makita Corporation; MITSUBISHI MATERIALS Corporation; Sandvik Coromant; Xinrui Industry Co., Ltd.; and YG-1 Co., Ltd.

Reasons to buy report

- To understand the APAC carbide tools market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for APAC carbide tools market

- Efficiently plan M&A and partnership deals in APAC carbide tools market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form APAC carbide tools market

- Obtain market revenue forecast for market by various segments from 2021-2028 in APAC region.

APAC Carbide Tools Market Segmentation

APAC Carbide Tools Market - By Tool Type

- End Mills

- Tipped Bores

- Burrs

- Drills

- Cutters

- Other Tools

APAC Carbide Tools Market - By Configuration

- Hand-Based

- Machine-Based

APAC Carbide Tools Market - By End-User

- Automotive and Transportation

- Metal Fabrication

- Construction

- Oil and Gas

- Heavy Machinery

- Other End-user

APAC Carbide Tools Market - By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Carbide Tools Market - Company Profiles

- CERATIZIT S.A.

- DIMAR GROUP

- KYOCERA Precision Tools

- Makita Corporation

- MITSUBISHI MATERIALS Corporation

- Sandvik Coromant

- Xinrui Industry Co., Ltd.

- YG-1 Co., Ltd.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 APAC Carbide Tools Market – By Tool Type

1.3.2 APAC Carbide Tools Market – By Configuration

1.3.3 APAC Carbide Tools Market – By End-User

1.3.4 APAC Carbide Tools Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. APAC Carbide Tools Market Landscape

4.1 Market Overview

4.2 APAC PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. APAC Carbide Tools Market – Key Industry Dynamics

5.1 Market Drivers

5.1.1 Burgeoning production in automotive sector

5.1.2 Refined performance of carbide tools than their counterparts

5.2 Market Restraints

5.2.1 Accessibility of better and low-cost alternatives

5.3 Market Opportunities

5.3.1 Surging demand for enhanced carbide cutting tools

5.4 Future Trends

5.4.1 Growing demand in various industries

5.5 Impact Analysis of Drivers and Restraints

6. Carbide Tools Market – APAC Analysis

6.1 APAC Carbide Tools Market Overview

6.2 APAC Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

7. APAC Carbide Tools Market Analysis– By Tool Type

7.1 Overview

7.2 APAC Carbide Tools Market Breakdown, By Tool Type (2020 and 2028)

7.3 End Mills

7.3.1 Overview

7.3.2 End Mills: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

7.4 Tipped Bores

7.4.1 Overview

7.4.2 Tipped Bores: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

7.5 Burrs

7.5.1 Overview

7.5.2 Burrs: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

7.6 Drills

7.6.1 Overview

7.6.2 Drills: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

7.7 Cutters

7.7.1 Overview

7.7.2 Cutters: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

7.8 Other Tools

7.8.1 Overview

7.8.2 Other Tools: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

8. APAC Carbide Tools Market Analysis– By Configuration

8.1 Overview

8.2 APAC Carbide Tools Market Breakdown, By Configuration (2020 and 2028)

8.3 Hand-Based

8.3.1 Overview

8.3.2 Hand-Based: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

8.4 Machine-Based

8.4.1 Overview

8.4.2 Machine-Based: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

9. APAC Carbide Tools Market Analysis – By End-User

9.1 Overview

9.2 APAC Carbide Tools Market, By End-User (2020 and 2028)

9.3 Automotive and Transportation

9.3.1 Overview

9.3.2 Automotive and Transportation: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

9.4 Metal Fabrication

9.4.1 Overview

9.4.2 Metal Fabrication: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

9.5 Construction

9.5.1 Overview

9.5.2 Construction: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

9.6 Oil and Gas

9.6.1 Overview

9.6.2 Oil and Gas: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

9.7 Heavy Machinery

9.7.1 Overview

9.7.2 Heavy Machinery: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

9.8 Other End-User

9.8.1 Overview

9.8.2 Other End-User Industry: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

10. APAC Carbide Tools Market – Country Analysis

10.1 Overview

10.1.1 APAC: Carbide Tools Market, by Key Country

10.1.1.1 Australia: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 Australia: Carbide Tools Market, by Tool Type

10.1.1.1.2 Australia: Carbide Tools Market, by Configuration

10.1.1.1.3 Australia: Carbide Tools Market, by End-User

10.1.1.2 China: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 China: Carbide Tools Market, by Tool Type

10.1.1.2.2 China: Carbide Tools Market, by Configuration

10.1.1.2.3 China: Carbide Tools Market, by End-User

10.1.1.3 India: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 India: Carbide Tools Market, by Tool Type

10.1.1.3.2 India: Carbide Tools Market, by Configuration

10.1.1.3.3 India: Carbide Tools Market, by End-User

10.1.1.4 Japan: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.4.1 Japan: Carbide Tools Market, by Tool Type

10.1.1.4.2 Japan: Carbide Tools Market, by Configuration

10.1.1.4.3 Japan: Carbide Tools Market, by End-User

10.1.1.5 South Korea: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.5.1 South Korea: Carbide Tools Market, by Tool Type

10.1.1.5.2 South Korea: Carbide Tools Market, by Configuration

10.1.1.5.3 South Korea: Carbide Tools Market, by End-User

10.1.1.6 Rest of APAC: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

10.1.1.6.1 Rest of APAC: Carbide Tools Market, by Tool Type

10.1.1.6.2 Rest of APAC: Carbide Tools Market, by Configuration

10.1.1.6.3 Rest of APAC: Carbide Tools Market, by End-User

11. APAC Carbide Tools Market- COVID-19 Impact Analysis

11.1 APAC

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Development

12.4 Merger and Acquisition

13. Company Profiles

13.1 Xinrui Industry Co., Ltd.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 CERATIZIT S.A.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 KYOCERA Precision Tools

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 DIMAR GROUP

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 MITSUBISHI MATERIALS Corporation

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Sandvik Coromant

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 YG-1 Co., Ltd.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Makita Corporation

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. APAC Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. APAC Carbide Tools Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. Australia: Carbide Tools Market, by Tool Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. Australia: Carbide Tools Market, by Configuration – Revenue and Forecast to 2028 (US$ Million)

Table 5. Australia: Carbide Tools Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 6. China: Carbide Tools Market, by Tool Type – Revenue and Forecast to 2028 (US$ Million)

Table 7. China: Carbide Tools Market, by Configuration – Revenue and Forecast to 2028 (US$ Million)

Table 8. China: Carbide Tools Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 9. India: Carbide Tools Market, by Tool Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. India: Carbide Tools Market, by Configuration – Revenue and Forecast to 2028 (US$ Million)

Table 11. India: Carbide Tools Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 12. Japan: Carbide Tools Market, by Tool Type – Revenue and Forecast to 2028 (US$ Million)

Table 13. Japan: Carbide Tools Market, by Configuration – Revenue and Forecast to 2028 (US$ Million)

Table 14. Japan: Carbide Tools Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 15. South Korea: Carbide Tools Market, by Tool Type – Revenue and Forecast to 2028 (US$ Million)

Table 16. South Korea: Carbide Tools Market, by Configuration – Revenue and Forecast to 2028 (US$ Million)

Table 17. South Korea: Carbide Tools Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 18. Rest of APAC: Carbide Tools Market, by Tool Type – Revenue and Forecast to 2028 (US$ Million)

Table 19. Rest of APAC: Carbide Tools Market, by Configuration – Revenue and Forecast to 2028 (US$ Million)

Table 20. Rest of APAC: Carbide Tools Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 21. List of Abbreviation

LIST OF FIGURES

Figure 1. APAC Carbide Tools Market Segmentation

Figure 2. APAC Carbide Tools Market Segmentation – By Country

Figure 3. APAC Carbide Tools Market Overview

Figure 4. End Mills Segment held the Largest Share of APAC Carbide Tools Market

Figure 5. Machine-Based Segment held the Largest Share of APAC Carbide Tools Market

Figure 6. Automotive and Transportation segment held the Largest Share of APAC Carbide Tools Market

Figure 7. China to Show Great Traction During Forecast Period

Figure 8. APAC- PEST Analysis

Figure 9. APAC Carbide Tools Market, Ecosystem

Figure 10. Expert Opinions

Figure 11. APAC Carbide Tools Market Impact Analysis of Drivers and Restraints

Figure 12. APAC Carbide Tools Market Revenue and Forecast to 2028(US$ Million) (US$ Million)

Figure 13. APAC Carbide Tools Market Breakdown, By Tool Type (2020 and 2028)

Figure 14. APAC End Mills: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 15. APAC Tipped Bores: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 16. APAC Burrs: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 17. APAC Drills: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 18. APAC Cutters: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 19. APAC Other Tools: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 20. APAC Carbide Tools Market Breakdown, By Configuration (2020 and 2028)

Figure 21. APAC Hand-Based: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 22. APAC Machine-Based: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 23. APAC Carbide Tools Market Breakdown, By End-User (2020 and 2028)

Figure 24. APAC Automotive and Transportation: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 25. APAC Metal Fabrication: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 26. APAC Construction: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 27. APAC Oil and Gas: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 28. APAC Heavy Machinery Industry: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 29. APAC Other End-User: Carbide Tools Market Revenue and Forecast to 2028(US$ Million)

Figure 30. APAC: Carbide tools Market, by Key Country – Revenue (2020) (USD Million)

Figure 31. APAC: Carbide Tools Market Revenue Share, by Key Country (2020 and 2028)

Figure 32. Australia: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Figure 33. China: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Figure 34. India: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Japan: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. South Korea: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Figure 37. Rest of APAC: Carbide Tools Market – Revenue and Forecast to 2028 (US$ Million)

Figure 38. Impact of COVID-19 Pandemic in APAC Country Markets

- CERATIZIT S.A.

- DIMAR GROUP

- KYOCERA Precision Tools

- Makita Corporation

- MITSUBISHI MATERIALS Corporation

- Sandvik Coromant

- Xinrui Industry Co., Ltd.

- YG-1 Co., Ltd.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the APAC carbide tools market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in APAC carbide tools market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth APAC market trends and outlook coupled with the factors driving the carbide tools market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution